by Calculated Risk on 4/09/2006 03:59:00 PM

Sunday, April 09, 2006

Are Conference Board Leading Indicators Useless?

In a Federal Reserve FOMC transcript released last week, Chairman Greenspan commented that he thought the Conference Board leading indicators were useless in real time:

"As an aside, the probability distribution based on the leading indicators looks remarkably good, but my recollection is that about every three years the Conference Board revises back a series that did not work during a particular time period, so the index is accurate only retrospectively. I’m curious to know whether these are the currently officially published data or the data that were available at the time. I know the answer to the question and it is not good!" [Laughter]Chairman Alan Greenspan, June 28, 2000, emphasis added.

As an example, since the Yield Curve has been signaling a possible recession, the Conference Board responded by changing how they use the Yield Curve: The New Treatment of the Yield Spread in the TCB Composite Index of Leading Indicators

Many researchers also believe Consumer Confidence has no predictive value. See this paper I linked to last year that argued consumer confidence indicators were useless for predicting future spending patterns.

Friday, April 07, 2006

New Mortgage Guidance: "next few months"

by Calculated Risk on 4/07/2006 04:41:00 PM

The comment period for the Interagency Guidance on Nontraditional Mortgage Products ended last week. So now what?

Today the WaPo reports: Regulators To Issue Mortgage Warning

[Speaking to the New York Bankers Association, John M. Reich, director of the Office of Thrift Supervision] noted that regulators are crafting a specific warning to the industry, known as a guidance, that will restrict the use of these loans. It could be issued within the next few months.emphasis added

The Post writeup is an excellent summary for those not following this story closely.

Corrected: Second Homes Graph

by Calculated Risk on 4/07/2006 01:26:00 PM

This is a correction to a previous post. Thanks for the comments!

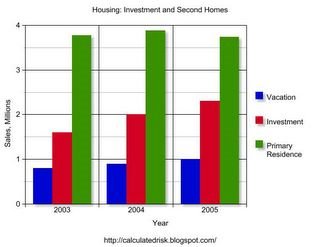

The NAR precentage of investment / vacation homes is correct when New Home Sales are included in the calculation.

Click on graph for larger image.

Using the NAR sales numbers for investment homes, vacation homes, and total existing homes sales, AND the Census Bureau numbers for New Home Sales, this graph shows vacation and second home sales for the last three years. Purchases of primary residences actually fell slightly in 2005, while vacation, and especially investment purchases, rose sharply. This appears to be evidence of significant speculation.

Employment Report

by Calculated Risk on 4/07/2006 12:55:00 PM

Another solid employment report.

Click on graph for larger image.

This graph shows employment growth for Bush's second term. So far job growth has been about as expected.

Kash has more: The Jobs Picture

"... there was good news on the employment front this morning. The US economy continues to enjoy a respectable, though not spectacular, rate of job growth."Barry Ritholtz writes:

"... aggregate hours worked were strong, and revised up, so we would say this report is a slight beat, indicative of a strong economy with more tightening to come."

Thursday, April 06, 2006

Retailers Report Disappointing Sales in March

by Calculated Risk on 4/06/2006 08:24:00 AM

The AP reports: Nation's Retailers Report Disappointing Sales in March on Cooler Weather, Later Easter

Cooler temperatures and a later Easter gave consumers little incentive to shop last month and left retailers with tepid sales for the second month in a row.

...

"So far, it looks like consumers didn't shop in the month of March," said Jharonne Martis, an analyst at Thomson Financial. "Basically, the results were mixed to disappointing."

Wednesday, April 05, 2006

More on Second Homes

by Calculated Risk on 4/05/2006 04:03:00 PM

CORRECTION: see here for corrections. Thanks for the comments. The vacation / investment homes is a share of all homes (existing and new), not just existing homes.

The NAR reported that second home sales accounted for 39.9% of all sales in 2005. The percentage seems incorrect.

NAR reported 7.075 million sales in 2005. NAR reported 1.02 million vacation homes and 2.32 million investment homes. That gives 3.34 million second homes or 47.2%.

Click on graph for larger image.

Using the NAR sales numbers, this graph shows vacation and second home sales for the last three years. Purchases of primary residences actually fell slightly in 2005, while vacation, and especially investment purchases, rose sharply. This appears to be evidence of significant speculation.

NAR: Second Home Sales Hit Another Record in 2005

by Calculated Risk on 4/05/2006 03:06:00 PM

The National Association of Realtors reports: Second Home Sales Hit Another Record in 2005; Market Share Rises

Vacation- and investment-home sales both set records in 2005, with the combined total of second home sales accounting for four out of 10 residential transactions, according to the National Association of Realtors®.(hat tip to Peterbob)

The annual report, based on two surveys, shows that 27.7 percent of all homes purchased in 2005 were for investment and another 12.2 percent were vacation homes. All together, there were 3.34 million second-home sales in 2005, up 16.0 percent from an upwardly revised total of 2.88 million in 2004. The market share of second homes rose from 36.0 percent of transactions in 2004 to 39.9 percent in 2005.

Vacation-home sales increased 16.9 percent last year to a record 1.02 million from a downwardly revised 872,000 in 2004, while investment-home sales rose 15.7 percent to a record 2.32 million in 2005 from an upwardly revised 2.00 million in 2004.

MBA: Mortgage Volume and Rates Rises

by Calculated Risk on 4/05/2006 10:36:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Up While Refinance Share Drops (update: add Link)

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 612.8, an increase of 7.2 percent on a seasonally adjusted basis from 571.7 one week earlier. On an unadjusted basis, the Index increased 7.2 percent compared with the previous week but was down 4.6 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 8.4 percent to 438.2 from 404.1 the previous week whereas the Refinance Index increased by 5.3 percent to 1640.8 from 1558.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.49 percent from 6.36 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 5.96 percent from 5.83 percent ...

| Total | -4.6% |

| Purchase | -1.9% |

| Refi | -8.8% |

| Fixed-Rate | 5.4% |

| ARM | -22.8% |

Purchase activity is off only 1.9% from last year. This is a rebound in activity from recent weakness.

Tuesday, April 04, 2006

WaPo: Is Economy too Reliant on Real Estate?

by Calculated Risk on 4/04/2006 11:31:00 PM

Neil Irwin writes in the WaPo: Is Reliance on Real Estate a Crack in the Foundation? Some Excerpts:

The U.S. economy is more dependent on housing than it has been in a half-century ...Overall a very good summary article, however I think the following sentence is a little misleading:

... economists worry that the housing slowdown that began late last year could hurt the broader economy more than past real estate downturns, although other parts of the economy appear to be accelerating.

What makes the real estate boom of the past decade unusual is that its effects have reverberated far beyond closely related sectors such as construction, driving sales in places as varied as furniture stores and motorcycle showrooms ...

...

By almost any measure, the U.S. economy is built on housing more than in the past. In 2005, investment in housing constituted a higher proportion of the goods and services the nation produced than it has since 1950, when the nation was experiencing a massive postwar housing boom. The proportion of jobs in real-estate-related fields is the highest it has been since at least 1970.

Nationally, real-estate-related industries accounted for 74 percent of new jobs over the past five years.The economy has added 2.2 million jobs over the last 5 years and the U.S. economy has probably added 1.6 million real estate related jobs during that period (74%). However, from the low in employment (Summer 2003), the economy has added almost 5 million jobs - so real estate would only be about 30% of those jobs - still extremely high, but not the 74% number mentioned in the article.

I definitely agree with the thrust of the article: a real estate slowdown will impact many seemingly unrelated industries.

Dr. Leamer says: Expect Slow, Gradual, Painful House Price Declines

by Calculated Risk on 4/04/2006 02:38:00 PM

In this Mercury News article, UCLA's Dr. Leamer makes some interesting comments:

If history is any guide ... home prices won't peak for a while, said Edward E. Leamer, director of the UCLA Anderson Forecast. When the end of the Cold War caused consolidation of the defense industry, the number of home sales in the Los Angeles area peaked in November 1988 -- but home prices didn't top out for nearly 2 1/2 years. "Then the prices began this gradual, painful, slow deterioration" of about 5 percent a year, Leamer said.

"Don't watch the prices," he said. "Watch the volume."

In Santa Clara County, sales of new and existing houses and condos dropped 14 percent from the record mark set the previous February. It was the slowest February since 2001, according to DataQuick Information Systems.

If sales have peaked, Leamer predicts homeowners are likely to endure a test of their patience and financial mettle.

"It's really slow, not enough to drive you totally crazy," Leamer said. "It's a little bit of pain every year. If you try to sell, you can't find anybody to buy, and the price is eating into your equity little by little. That's the kind of adjustment we expect to see."