by Calculated Risk on 4/10/2006 11:58:00 AM

Monday, April 10, 2006

FED Governor Bies on Recent Regulatory Proposals

FED Governor Susan Schmidt Bies spoke today at the America’s Community Bankers Risk Management and Finance Forum, Naples, Florida. Her speech was an overview of risk management and the recent regulatory proposals.

On Commercial Real Estate:

It is perhaps an understatement to say that those gathered here today are aware of the proposed commercial real estate (CRE) guidance recently issued by the U.S. banking agencies. Indeed, we have received hundreds of comment letters on the proposed guidance so far: the comment period ends April 13.On Nontraditional Residential Mortgages:

...

Commercial real estate lending played a central role in the banking problems of the late 1980s and early 1990s and has historically been a highly volatile asset class. Past problems in CRE have generally come at times when the broader market encounters difficulties. Therefore, banks should not be surprised by the emphasis of the proposed CRE guidance on the importance of portfolio risk management and concentrations. One reason why supervisors are proposing CRE guidance at this point is that we are seeing high and rising concentrations of CRE loans relative to capital. For certain groups of banks, such as those with assets between $100 million and $1 billion, average CRE concentrations are about 300 percent of total capital. This compares to a concentration level of about 150 percent in the late 1980s and early 1990s for this same bank group.

You are probably also aware that the U.S. banking agencies recently issued proposed supervisory guidance on nontraditional mortgages, for which the comment period ended March 29. We appreciate the extensive feedback from the industry and others. The agencies are now in the process of reviewing the comment letters and deciding on a way forward. While the main focus of the proposed guidance is on banks' ability to adequately identify, measure, monitor, and control the risk associated with these products, the proposed guidance also addresses consumer protection ...She didn't address when the nontraditional mortgage guidance would be released.

More on the FED's Year 2000 Transcripts

by Calculated Risk on 4/10/2006 01:07:00 AM

My post is up on Angry Bear: The FED's Year 2000 Transcripts. The transcripts make for some interesting reading, especially if you are suffering from insomnia! But they do help understand what the FED was thinking in a transition year (from boom to recession).

These transcripts may be relevant to today if the US economy slows because of the slowdown in the housing market.

Best to all.

Sunday, April 09, 2006

Are Conference Board Leading Indicators Useless?

by Calculated Risk on 4/09/2006 03:59:00 PM

In a Federal Reserve FOMC transcript released last week, Chairman Greenspan commented that he thought the Conference Board leading indicators were useless in real time:

"As an aside, the probability distribution based on the leading indicators looks remarkably good, but my recollection is that about every three years the Conference Board revises back a series that did not work during a particular time period, so the index is accurate only retrospectively. I’m curious to know whether these are the currently officially published data or the data that were available at the time. I know the answer to the question and it is not good!" [Laughter]Chairman Alan Greenspan, June 28, 2000, emphasis added.

As an example, since the Yield Curve has been signaling a possible recession, the Conference Board responded by changing how they use the Yield Curve: The New Treatment of the Yield Spread in the TCB Composite Index of Leading Indicators

Many researchers also believe Consumer Confidence has no predictive value. See this paper I linked to last year that argued consumer confidence indicators were useless for predicting future spending patterns.

Friday, April 07, 2006

New Mortgage Guidance: "next few months"

by Calculated Risk on 4/07/2006 04:41:00 PM

The comment period for the Interagency Guidance on Nontraditional Mortgage Products ended last week. So now what?

Today the WaPo reports: Regulators To Issue Mortgage Warning

[Speaking to the New York Bankers Association, John M. Reich, director of the Office of Thrift Supervision] noted that regulators are crafting a specific warning to the industry, known as a guidance, that will restrict the use of these loans. It could be issued within the next few months.emphasis added

The Post writeup is an excellent summary for those not following this story closely.

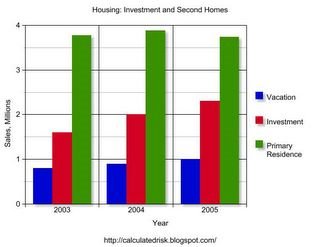

Corrected: Second Homes Graph

by Calculated Risk on 4/07/2006 01:26:00 PM

This is a correction to a previous post. Thanks for the comments!

The NAR precentage of investment / vacation homes is correct when New Home Sales are included in the calculation.

Click on graph for larger image.

Using the NAR sales numbers for investment homes, vacation homes, and total existing homes sales, AND the Census Bureau numbers for New Home Sales, this graph shows vacation and second home sales for the last three years. Purchases of primary residences actually fell slightly in 2005, while vacation, and especially investment purchases, rose sharply. This appears to be evidence of significant speculation.

Employment Report

by Calculated Risk on 4/07/2006 12:55:00 PM

Another solid employment report.

Click on graph for larger image.

This graph shows employment growth for Bush's second term. So far job growth has been about as expected.

Kash has more: The Jobs Picture

"... there was good news on the employment front this morning. The US economy continues to enjoy a respectable, though not spectacular, rate of job growth."Barry Ritholtz writes:

"... aggregate hours worked were strong, and revised up, so we would say this report is a slight beat, indicative of a strong economy with more tightening to come."

Thursday, April 06, 2006

Retailers Report Disappointing Sales in March

by Calculated Risk on 4/06/2006 08:24:00 AM

The AP reports: Nation's Retailers Report Disappointing Sales in March on Cooler Weather, Later Easter

Cooler temperatures and a later Easter gave consumers little incentive to shop last month and left retailers with tepid sales for the second month in a row.

...

"So far, it looks like consumers didn't shop in the month of March," said Jharonne Martis, an analyst at Thomson Financial. "Basically, the results were mixed to disappointing."

Wednesday, April 05, 2006

More on Second Homes

by Calculated Risk on 4/05/2006 04:03:00 PM

CORRECTION: see here for corrections. Thanks for the comments. The vacation / investment homes is a share of all homes (existing and new), not just existing homes.

The NAR reported that second home sales accounted for 39.9% of all sales in 2005. The percentage seems incorrect.

NAR reported 7.075 million sales in 2005. NAR reported 1.02 million vacation homes and 2.32 million investment homes. That gives 3.34 million second homes or 47.2%.

Click on graph for larger image.

Using the NAR sales numbers, this graph shows vacation and second home sales for the last three years. Purchases of primary residences actually fell slightly in 2005, while vacation, and especially investment purchases, rose sharply. This appears to be evidence of significant speculation.

NAR: Second Home Sales Hit Another Record in 2005

by Calculated Risk on 4/05/2006 03:06:00 PM

The National Association of Realtors reports: Second Home Sales Hit Another Record in 2005; Market Share Rises

Vacation- and investment-home sales both set records in 2005, with the combined total of second home sales accounting for four out of 10 residential transactions, according to the National Association of Realtors®.(hat tip to Peterbob)

The annual report, based on two surveys, shows that 27.7 percent of all homes purchased in 2005 were for investment and another 12.2 percent were vacation homes. All together, there were 3.34 million second-home sales in 2005, up 16.0 percent from an upwardly revised total of 2.88 million in 2004. The market share of second homes rose from 36.0 percent of transactions in 2004 to 39.9 percent in 2005.

Vacation-home sales increased 16.9 percent last year to a record 1.02 million from a downwardly revised 872,000 in 2004, while investment-home sales rose 15.7 percent to a record 2.32 million in 2005 from an upwardly revised 2.00 million in 2004.

MBA: Mortgage Volume and Rates Rises

by Calculated Risk on 4/05/2006 10:36:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Up While Refinance Share Drops (update: add Link)

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 612.8, an increase of 7.2 percent on a seasonally adjusted basis from 571.7 one week earlier. On an unadjusted basis, the Index increased 7.2 percent compared with the previous week but was down 4.6 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 8.4 percent to 438.2 from 404.1 the previous week whereas the Refinance Index increased by 5.3 percent to 1640.8 from 1558.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.49 percent from 6.36 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 5.96 percent from 5.83 percent ...

| Total | -4.6% |

| Purchase | -1.9% |

| Refi | -8.8% |

| Fixed-Rate | 5.4% |

| ARM | -22.8% |

Purchase activity is off only 1.9% from last year. This is a rebound in activity from recent weakness.