by Calculated Risk on 4/13/2006 08:15:00 PM

Thursday, April 13, 2006

Kudos to Real Estate Broker Gary Watts

One year ago, Gary Watts predicted:

Watts expressed his enthusiasm this way: The recent $100 increase in monthly payments - or $1,200 a year - is nothing compared to what he predicts is Orange County home-price appreciation potential: as much as $70,000 a year.At that time (March 2005), the median Orange County home was selling for $555K according to DataQuick.

"There's too much emphasis on interest rates in the marketplace," Watts said. "Who wouldn't trade $1,200 for $70,000?"

DataQuick announced today that the median Orange County house is selling for $625K.

That is an increase of $70K in one year.

Watts prediction for 2006:

"Fifteen percent is pretty much in the bag for Orange County in 2006," [Gary Watts] says. "It's impossible for prices to go down this year."

FED's Kohn: "great uncertainties" Due to Housing Market

by Calculated Risk on 4/13/2006 02:51:00 PM

At the Bankers and Business Leaders Luncheon in Kansas City, Federal Reserve Governor Donald L. Kohn spoke on the economic outlook today. Overall Kohn was very positive on the economy, but expressed some concern about the housing market:

"If the past is any guide, the effect of rising interest rates is likely to be felt most visibly in housing markets. The rate for a thirty-year, fixed-rate mortgage is up 70 basis points from its level in the middle of last year, and one-year adjustable-rate mortgages have risen more than 100 basis points over the same period. In addition, house prices have increased considerably relative to rents, incomes, and returns on alternative assets. Already there have been signs that housing demand has begun to moderate. Sales of both new and existing homes are down substantially from their levels last summer, and information on mortgage applications and pending home sales point to further softening in the next few months. With demand slowing, house prices also seem likely to decelerate. Indeed, we are beginning to see hints of moderation in some of the data on housing prices.

As a consequence, spending for new housing construction, after contributing nearly 1/2 percentage point to overall GDP growth last year, may not increase much this year. Moreover, the slowdown in house price increases could well hold back growth in consumption spending on a wide variety of goods and services. The rapid run-up in prices over the past few years and hence in household wealth, perhaps combined with the increasing ease of tapping that wealth, probably has been a major reason that households have been saving so little of their current flow of income. As house-price appreciation slows, the personal saving rate likely should begin a gradual ascent.

To be candid, however, the behavior of the housing market and the response of spending are among the great uncertainties about the economic outlook. I have sketched a benign scenario of gradual adjustment that lines up very nicely with the Federal Reserve's assessment that overall growth should slow to a sustainable pace. But our ability to predict asset prices is very limited, especially when the trajectory of those prices is shifting, as that of house prices appears to be doing right now. Moreover, we have particular difficulty in assessing how consumers will respond to changes in their perceptions of future capital gains and actual home prices. The housing market and its effects on spending will be among the areas that Tom and I and our colleagues on the FOMC will be monitoring most closely as we try to discern the emerging pattern of economic activity and inflation."

Wells Fargo: Housing Market "noticeably deteriorated"

by Calculated Risk on 4/13/2006 02:17:00 PM

From the Contra Costa Times: State's housing market retreats. The Contra Costa Times excerpts from a new Wells Fargo report on the California economy.

Click on graph for larger image.

Wells Fargo provides this graphic of unsold inventory in California by county. The caption reads:

California housing inventories can no longer be considered lean. Orange County and San Diego appear most at risk for near-term home price deceleration.From the Times article:

The housing market in California has fallen into a visible slump, and the downturn could erode economic expansion in fast-growing regions such as the East Bay, economists warned Wednesday.

Existing home sales have skidded, houses now languish on the market for longer periods, and the rate of home building has slowed, according to the report issued by Wells Fargo Bank.

...the Wells Fargo economic study warned of a chill for real estate.

"California housing market conditions have noticeably deteriorated since September," Scott Anderson, Wells Fargo senior economist, wrote in his report.

...

"The California housing market may have skipped a beat, but the patient is not dead yet," Anderson stated in his study. "The decline so far appears manageable for the industry as well as for the California economy."

Still, some of the recent trends in housing portray a sector in retreat from the white-hot levels of the last years:

• Existing home sales statewide "plunged" in November, with an 11.2 percent decline; in December, with a 17.6 percent drop; and in January, with a 5.9 percent setback, Wells Fargo reported, citing data released by the California Association of Realtors.

• Unsold inventories of detached houses rose to 6months in January, far above the 3.2 months that houses remained unsold in January 2005.

• Statewide housing permits have drooped 11 percent below last year's pace.

• Median prices have been "nearly flat" in the last six months, although they remain 13.8 percent above the levels of a year ago.

Wednesday, April 12, 2006

Housing: Quote of the Day

by Calculated Risk on 4/12/2006 07:42:00 PM

Barry Ritholtz (The Big Picture) provides this quote:

"Home sales are in the process of reversing all the gains of the past two years and reverting to 2003 levels."

- Robert Mellman, economist, J.P. Morgan

MBA: Mortgage Application Volume Drops

by Calculated Risk on 4/12/2006 09:35:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Drops in Latest Survey

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 579.4, a decrease of 5.5 percent on a seasonally adjusted basis from 612.8 one week earlier. On an unadjusted basis, the Index decreased 5.1 percent compared with the previous week and was down 14.7 percent compared with the same week one year earlier.Mortgage rates increased slightly:

The seasonally-adjusted Purchase Index decreased by 4.7 percent to 417.7 from 438.2 the previous week whereas the Refinance Index decreased by 6.6 percent to 1532.4 from 1640.8 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.50 percent from 6.49 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 5.97 percent from 5.96 percent ...

| Total | -14.7% |

| Purchase | -11.9% |

| Refi | -19.3% |

| Fixed-Rate | -5.2% |

| ARM | -31.8% |

Purchase activity is off 11.9% from last year. This provides further evidence that housing is slowing.

Tuesday, April 11, 2006

Toll Bros CEO: Speculators Impacting Supply

by Calculated Risk on 4/11/2006 06:44:00 PM

Dow Jones reports: Toll Bros CEO: Housing Comparisons Difficult Over Last Year

Toll Brothers Inc. Chief Executive Robert Toll said comparisons in the housing market continue to be difficult over last year ...How Speculation impacts supply:

...

As demand declined, Toll said speculators left the market.

"What's more you get the speculator putting their product back on the market - so you've got a little excess supply," Toll said.

A recent report by the National Association of Realtors (NAR) reported that 39.9% of all homes nationwide bought in 2005 were purchased as second homes. NAR reported 12.2% were purchased as vacation homes and 27.7% for investments. This is clear evidence of speculation.

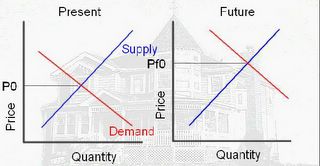

The following supply demand diagrams illustrate this type of speculation.

Click on diagram for larger image.

The above diagram shows the motive for the speculator. If he buys today, at price P0, he believes he can sell in the future at price Pf0 (price future zero), because of higher future demand. The speculation would return: Profit = Pf0-P0-storage costs (the storage costs are mortgage, property tax, maintenance, and other expenses minus any rents).

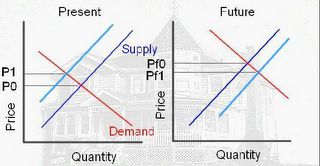

In this model, speculation is viewed as storage; it removes the asset from the supply. The following diagram shows the impact on price due to the speculation:

Since speculation removes the asset from the supply, the Present supply curve shifts to the left (light blue) and the price increases from P0 to P1. In the second diagram, when the speculator sells, the supply increases (shifts to the right). The future price will fall from PF0 to PF1. As long as (PF1 – storage costs) is greater than P1 the speculator makes a profit.

However, if the price does not rise, the speculator must either hold onto the asset or sell for a loss. If the speculator chooses to sell, this will add to the supply and put additional downward pressure on the price.

This is the type of speculation that Robert Toll is describing.

For more on speculation, especially leverage (using nontraditional mortgages), see my post on Angry Bear: Speculation is the Key. (Some of this post is a duplicate of that post).

DiMartino: Housing as Leading Indicator

by Calculated Risk on 4/11/2006 11:37:00 AM

Danielle DiMartino writes in the Dallas Morning News: Real estate indicator gets notice

One of those data points in particular is troubling and telling to Merrill chief economist David Rosenberg.

"Over the past three decades, there were eight episodes where new-home sales decelerated into an environment of double-digit decline," he wrote in a recent report. "In seven of the eight, the economy slowed sharply in the ensuing four quarters."

On average, annualized economic growth slowed by 3 percentage points. The single exception, which trailed an early 1987 downturn in sales, was offset by the post-stock-crash explosion in share prices. And we're not just talking a quick slowdown, so to speak – in six of the eight instances, recessions followed within five quarters' time.

This fresh analysis rendered new-home sales an instant classic leading indicator, at least in Mr. Rosenberg's book.

...

Mr. Kasriel takes the Rosenberg analysis one step further by plotting the quarterly average observations of the year-over-year change in economic growth against the year-over-year change in new-home sales, which he then advanced by three quarters. This three-quarter advance yielded the strongest correlation to gross domestic economic growth.

"In other words, as pointed out by Mr. Rosenberg, the behavior of new-home sales is a powerful leading indicator of overall economic growth," Mr. Kasriel wrote.

Of course, a blowout March could throw the fancy predictive models out the window.

Barring that, first-quarter sales will be down about 16 percent from the prior year, the biggest decline since the first quarter of 1991, when the economy was in recession.

Click on graph for larger image.

New Home Sales is one of my favorite leading indicators of future economic activity. The one exception, the 2001 recession, was due to a dearth of business investment after the burst of the stock market bubble. For the consumer led recessions, New Home Sales has been an excellent leading indicator.

Monday, April 10, 2006

Caroline Baum: Economy Springs Ahead, May Fall Back

by Calculated Risk on 4/10/2006 10:23:00 PM

Caroline Baum writes for Bloomberg: Economy Springs Ahead, May Fall Back

...the gap in the housing market between demand (sales) and production (starts). ...If demand slows and production doesn't, inventories pile up. Unless builders want to run their business into the ground, they build fewer houses.The article has some positive quotes from Michael Carliner at the National Association of Home Builders:

Something's Gotta Give

The difference between new home sales and single-family starts has reached extremes seen only a handful of times, according to Joe Carson, director of global economic research at Alliance Bernstein. In all three previous instances -- 1972, 1978 and 1984 -- starts took a tumble.

Carliner says the bulging inventory of unsold homes -- up 23 percent in the past year to 548,000 -- isn't as burdensome as it looks. "Excluding homes that haven't been started, the months' supply is historically low," he says.Lets check Carliner's claim that "excluding homes that haven't been started, the months' supply is historically low":

However, "there are things that we don't measure that are worrisome," Carliner says, referring to sales cancellations. "Cancellations appear to be up," based on net sales numbers reported by large builders.

If housing starts don't begin to decline soon, there will be a problem of too much inventory, he says.

Click on graph for larger image.

The Census bureau is the source of all data. Note that the For Sale data by stage of construction is NSA - that makes a small difference.

There is nothing unusual about the number of houses For Sale, Not Started. In fact, both measures of supply are at highs since the end of the last housing bust. When comparing to the late '80s and early '90s, the months of supply is low - by both measures. But Carliner's argument concerning Not Started houses in inventory falls flat.

FED Governor Bies on Recent Regulatory Proposals

by Calculated Risk on 4/10/2006 11:58:00 AM

FED Governor Susan Schmidt Bies spoke today at the America’s Community Bankers Risk Management and Finance Forum, Naples, Florida. Her speech was an overview of risk management and the recent regulatory proposals.

On Commercial Real Estate:

It is perhaps an understatement to say that those gathered here today are aware of the proposed commercial real estate (CRE) guidance recently issued by the U.S. banking agencies. Indeed, we have received hundreds of comment letters on the proposed guidance so far: the comment period ends April 13.On Nontraditional Residential Mortgages:

...

Commercial real estate lending played a central role in the banking problems of the late 1980s and early 1990s and has historically been a highly volatile asset class. Past problems in CRE have generally come at times when the broader market encounters difficulties. Therefore, banks should not be surprised by the emphasis of the proposed CRE guidance on the importance of portfolio risk management and concentrations. One reason why supervisors are proposing CRE guidance at this point is that we are seeing high and rising concentrations of CRE loans relative to capital. For certain groups of banks, such as those with assets between $100 million and $1 billion, average CRE concentrations are about 300 percent of total capital. This compares to a concentration level of about 150 percent in the late 1980s and early 1990s for this same bank group.

You are probably also aware that the U.S. banking agencies recently issued proposed supervisory guidance on nontraditional mortgages, for which the comment period ended March 29. We appreciate the extensive feedback from the industry and others. The agencies are now in the process of reviewing the comment letters and deciding on a way forward. While the main focus of the proposed guidance is on banks' ability to adequately identify, measure, monitor, and control the risk associated with these products, the proposed guidance also addresses consumer protection ...She didn't address when the nontraditional mortgage guidance would be released.

More on the FED's Year 2000 Transcripts

by Calculated Risk on 4/10/2006 01:07:00 AM

My post is up on Angry Bear: The FED's Year 2000 Transcripts. The transcripts make for some interesting reading, especially if you are suffering from insomnia! But they do help understand what the FED was thinking in a transition year (from boom to recession).

These transcripts may be relevant to today if the US economy slows because of the slowdown in the housing market.

Best to all.