by Calculated Risk on 4/20/2006 11:22:00 AM

Thursday, April 20, 2006

Rising Rents and Inflation

As the housing market slows, rents are starting to rise. The OC Register reports: No slowdown in O.C. rents

Apartment rents spiked 7 percent in the first quarter to $1,441 a month, compared to the year-ago quarter, said apartment tracker RealFacts in a report expected today.

...

Landlords say they are making up for the years after the '01 dot.com bust when a slowing economy flattened rates.

Rental growth slowed to under 5 percent from late 2001 to early 2005 ...

Click on graph for larger image.

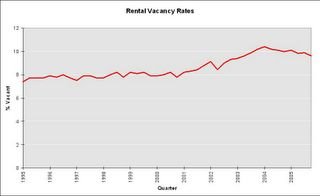

Vacancy rates are declining, but are still above normal for recent years according to the Census Bureau. In regions with higher than normal vacancy rates, vacancies will probably keep rents from rising too quickly. However another concern is that a slowing housing market will lead to higher CPI due to rising Owners' Equivalent Rent. Dr. Altig touched on this yesterday.

"Mike [Bryan] notes that owners equivalent rent accelerated in March, something many folks have been concerned about for some time."

Here is a graph of the monthly changes for Owners' Equivalent Rent (OER). OER is the largest single component of CPI and many people have argued that OER was understated as house prices rose, and that OER would start rising as housing slowed - leading to higher reported inflation.

For those interested in how OER is calculated, here is a description from the BLS: Consumer Price Indexes for Rent and Rental Equivalence

A higher reported CPI might lead to higher rates and further impact the housing market.

UPDATE: Here is a writeup from Asha Bangalore and Paul Kasriel at Northern Trust: The FOMC Finds Itself in a Tight Spot. Excerpt:

"We need to watch the owner’s equivalent rent and rent of primary residence components of shelter costs which are showing an upward trend. Owner’s equivalent rent rose 0.4% in March, after a 0.3% increase in February and a 0.2% gain in January. Adjustments for utilities play a role in the computation of this component in addition to rental prices. The value of landlord provided utilities is subtracted from rent to obtain the “pure rent” measure of owner’s equivalent rent. In situations of rising natural gas prices a larger amount is subtracted to estimate pure rent vs. situations when natural gas prices are falling. The recent decline in natural gas prices could explain to some degree the upward trend of owner’s equivalent rent. In addition, the upward trend of the rent component of shelter costs also contributed to higher owner’s equivalent rent. Higher rents reflect demand pressures on rental property as rising mortgage rates could have priced out otherwise eligible potential home owners. The rent index moved up 0.4% in March after a 0.3% gain in February and a 0.1% increase in January."

Wednesday, April 19, 2006

MBA Purchase Index

by Calculated Risk on 4/19/2006 11:13:00 PM

Thanks to Anon in the comments of the previous post, here is a longer term graph for the MBA Purchase Index.

Click on graph for larger image.

Note: This slide is from the MBA Economic Presentation on Feb 22, 2006.

The Purchase Index YTD average is 420.0, compared to the 2005 YTD of 444.3. That is a decline of just over 5%. However, over the last 6 to 7 weeks, the MBA Purchase Index has averaged about 11% less than the comparable period one year ago.

This is about the decline that David Berson, Fannie Mae Economist, is projecting in his April Forecast for the rest of the year:

Home sales are projected to fall by nearly 10 percent in 2006 in reaction to investor pullbacks and lower affordability."A home sales decline of 10% would probably not have a serious impact on the overall economy in 2006. I think a sales decline of 20% or more would have significant economic consequences - but we haven't seen that yet in the MBA numbers.

Since Feb 22, the Purchase Index has been around 400. Here is the data not included on the chart:

| Date | Purchase Index | 4-Week Average |

| Feb 24, 2006 | 400.8 | 406.6 |

| Mar 3, 2006 | 399.0 | 400.1 |

| Mar 10, 2006 | 403.0 | 402.9 |

| Mar 17, 2006 | 393.6 | 399.1 |

| Mar 24, 2006 | 404.1 | 399.9 |

| Mar 31, 2006 | 438.2 | 409.7 |

| Apr 7, 2006 | 417.7 | 413.4 |

| Apr 14, 2006 | 407.4 | 416.9 |

UPDATE: DoctorWho points to this chart from Fannie Mae:

UPDATE: DoctorWho points to this chart from Fannie Mae:The first chart is mislabeled by the MBA - it starts in 2000. The second chart provides the MBA index since 1990 and shows how the Purchase Index tracks home sales.

MBA: Mortgage Application Volume Down Slightly

by Calculated Risk on 4/19/2006 10:06:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Drops Slightly

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 569.6, a decrease of 1.7 percent on a seasonally adjusted basis from 579.4 one week earlier. On an unadjusted basis, the Index decreased 1.4 percent compared with the previous week and was down 14.9 percent compared with the same week one year earlier.Mortgage rates increased slightly:

The seasonally-adjusted Purchase Index decreased by 2.5 percent to 407.4 from 417.7 the previous week whereas the Refinance Index decreased by 0.4 percent to 1526.1 from 1532.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.56 percent from 6.50 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.00 percent from 5.97 percent ...

| Total | -14.9% |

| Purchase | -12.7% |

| Refi | -18.4% |

| Fixed-Rate | -6.2% |

| ARM | -30.5% |

Purchase activity is off 12.7% from last year. This provides further evidence that housing is slowing.

Tuesday, April 18, 2006

San Diego Home Prices Decline in Q1

by Calculated Risk on 4/18/2006 03:01:00 PM

This morning, DataQuick released their March report on the Southern California housing market: Southland passes half million mark

The median price paid for a Southern California home passed $500,000 for the first time last month as sales continued to decline, the result of higher mortgage interest rates and a real estate cycle that has passed its frenzy phase, a real estate information service reported.On San Diego, DataQuick noted:

"San Diego County is still the market furthest along in this cycle."DataQuick reported that prices in San Diego increased 5.7% on a YoY basis. However, for the first quarter, prices declined 2.3% in San Diego.

So far, DataQuick is only showing quarterly price declines in San Diego and Ventura counties in Southern California.

Monday, April 17, 2006

West Coast Ports: March imports up, Record Exports

by Calculated Risk on 4/17/2006 08:09:00 PM

The Ports of Long Beach and Los Angeles reported record exports for March and very strong imports.

Import traffic at the Port of Long Beach increased 11.9% compared to February and was 34.4% higher than March 2005. A total of 282 thousand loaded cargo containers came into the Port of Long Beach, compared to 252 thousand in February.

For the Port of Los Angeles, import traffic increased 37.6% in March compared to February, and imports were up 33% from March 2005. March imports were 341 thousand containers.

For both ports, exports traffic set all time records. For Long Beach, outbound traffic was up 8% to 118.7 thousand containers. At Los Angeles, outbound traffic was up 19% to 128 thousand containers.

The previous export record for Long Beach was 110.7 thousand containers set in August 2005. For Los Angeles, the record was 115 thousand containers set in March 2005.

The quantity of containers says nothing about the content value, but provides a rough guide on imports from China and the rest of Asia. Given these numbers, I expect record exports to Asia for March and even stronger imports.

Are we looking at the first $70 Billion monthly trade deficit (for March)? Maybe.

NAHB: Builder Confidence Declines In April

by Calculated Risk on 4/17/2006 02:30:00 PM

The National Association of Home Builders reports: Builder Confidence Declines In April

Click on graph for larger image.

Excluding the brief impact of 9/11/2001 on the housing market, the Housing Market Index is at the lowest level since February 1996 - the end of the previous housing down cycle. From the NAHB:

Rising mortgage rates, continued affordability issues and subsiding demand from investors/speculators are prompting single-family home builders to adjust their perspectives on the new-home market, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for April, released today. The HMI declined four points from a downwardly revised reading in the previous month to hit 50 for the latest report.

...

"With mortgage rates back up to the 6.5 percent range and serious affordability issues in the highest-priced markets, today’s HMI numbers are neither surprising nor alarming," noted NAHB Chief Economist David Seiders. "Indeed, a reported reduction in home buying by investors/speculators in the market for new single-family homes is a positive development.

Furthermore, we expect solid growth in employment and household income to essentially offset the minor increases in the interest-rate structure that we’re projecting for the balance of this year."

...

All three component indexes slipped this month, with the largest decline registered for current single-family sales. That component declined five points to 54 in April, while the component for sales expectations in the next six months was down four points to 58 and the component gauging traffic of prospective buyers declined a single point to 39.

Caroline Baum: Banks Have No Exposure to Mortgages?

by Calculated Risk on 4/17/2006 01:50:00 AM

Carolina Baum writes: Banks Have No Exposure to Mortgages? Think Again.

Every time the subject of banks making risky home loans to bad credit risks -- no money down, no questions asked -- the usual retort is that banks sell the mortgages. They aren't at risk. It doesn't matter if the loan stops performing because they don't own it.However the data doesn't tell which loans the banks have kept. Most banks claim they have kept the better quality loans (low LTV).

That's not exactly true. According to the Federal Reserve's Flow of Funds report for the fourth quarter of 2005, mortgages accounted for 32 percent of commercial banks' financial assets. Throw in agency- and mortgage-backed securities, and the exposure to outright and securitized mortgage loans is 44 percent.

A few statistics:

-- 43 percent of first-time home buyers made no down payment last year, according to a study by First American Corp.

-- 22 percent of the borrowers with initial interest payments of 2.5 percent or less have negative equity in their homes (the principal balance is greater than the size of the initial loan); 40 percent have less than 40 percent equity.

-- About one-quarter of the jobs created since the 2001 recession have been in construction, real estate and mortgage finance.

Sunday, April 16, 2006

$70 Oil and Gasoline

by Calculated Risk on 4/16/2006 11:57:00 PM

My post on Angry Bear: $70 Oil.

The spot price for wholesale unleaded gasoline just hit $2.12 per gallon, up almost 15 cents in the last week. The gasoline balance in charts from the DOE's This Week In Petroleum.

Domestic gasoline production is still below 2005 levels for the same period. Falling production is a typical pattern for this time of year as refineries shift blends. Also, according to the DOE, there has been "unusually high refinery maintenance in the U.S. ... this spring".

Luckily gasoline imports are still higher than last year. Of course this adds to the trade deficit.

Meanwhile the demand for gasoline keeps rising.

And the end result is falling stocks. However stocks are still in the normal range for this time of year, and domestic production should increase over the next few weeks. Still a 15 cent rise in the wholesale price should lead to higher prices at the pump in the next couple of weeks. Gasoline is already close to $3.00 per gallon for regular unleaded in my town.

Friday, April 14, 2006

House Prices and Sales Volumes: California and Arizona

by Calculated Risk on 4/14/2006 11:14:00 AM

Here are three articles on house prices and sales volumes:

From the San Diego Union: San Diego housing market continues cooling trend

... the San Diego region's housing market continued its slow cooling trend in March, which marked the 11th month in a row of single-digit price gains.From the LA Times: Housing Prices in L.A. Aren't Letting Up

The end of the first quarter also marked the 21st consecutive month in which sales volumes were down on a year-over-year basis, DataQuick Information Systems reported Thursday.

...

Last month's overall sales count was 4,146, a decline of 17 percent from March 2005. That was the lowest count for March since March 1998, when 4,016 homes sold.

The pace of resale condo sales fell by nearly 30 percent to 841 units, compared to the same month last year. That was a gain over February's resale condo tally of 657 units, however.

The overall median price for all homes sold was $504,000, a 5.7 increase over March 2005 and a slight rise over February's median of $502,000. The county hit a record overall median price of $518,000 in November 2005.

In March, the median hit $506,000, up 15% from a year earlier and 3% above the prior month, according to DataQuick Information Systems, a La Jolla-based research firm that analyzes property transactions.From the Arizona Republic: Median resale housing prices still dropping

Los Angeles County thus joined Orange, Ventura and San Diego counties in crossing the half-million-dollar mark, keeping Southern California's place among the nation's priciest housing markets. Orange and Ventura counties' medians sailed through the $600,000 level in the middle of last year, and San Diego's broke through the $500,000 point last fall.

...

Sales volumes are slowing while more homes are coming on the market. In March, 9,755 homes changed hands in L.A. County, a 10.3% decline from a year earlier, and the fifth straight month of falling sales.

...

Today's combination of prices rising more slowly, fewer sales and growing supply are typical of the first phase of a slowdown, UCLA economist Christopher Thornberg says.

"Prices are still going up, because they always go up even when the market starts to cool," he says. "It will take six to nine months for a cooling market to start to see lower prices. It happens time after time."

Median resale housing prices kept falling through most of the Southeast Valley in March, mainly because there are so many more homes on the market. But it's still too early to say if this will continue for the rest of the year.

The main exception was Ahwatukee Foothills, where prices jumped 6 percent from February to March, to $364,250. But that is still below its December median of $386,250. Median home prices from February to March fell 5 percent in Gilbert to $322,500, and almost 4 percent in Tempe to $288,400.

Prices in Mesa, meanwhile, fell less than 1 percent to $243,500, and 1.6 percent in Chandler to $295,000.

Thursday, April 13, 2006

Dr. Duy: Fed Policy in Transition

by Calculated Risk on 4/13/2006 10:47:00 PM

Dr. Tim Duy presents another Fed Watch: Policy in Transition. Excerpt:

"... recent data reveals that the economy enjoys enough momentum to justify another rate hike in May. That is something of a given at this point; the real question is the June meeting. I continue to feel that the Fed would like to take a pass at that meeting on the expectation of slowing economic growth, but make it clear that the odds of tightening beyond that remain about 50%. The question is whether the data will continue to support such a move, especially since policymakers would likely risk somewhat higher interest rates now to avoid even more aggressive hikes later. Particularly important is the relative impact of possible higher commodity prices versus expectations of slowing demand growth.Interesting speculation! And just a reminder, every Monday, Dr. Dave Altig presents the market based probablities on Fed Funds rates.

Another possible path comes to mind. As the play on housing becomes less stimulative, will market participants find yet another asset play to maintain household wealth? ..."