by Calculated Risk on 4/21/2006 06:58:00 PM

Friday, April 21, 2006

California Construction Jobs

The previous post provided excerpts from an LA Times article indicating the number of construction jobs may be decreasing in California.

Click on graph for larger image.

This graph show the number of construction jobs in California since 1990. The housing slump of the early '90s is very clear. Following the business investment driven recession in 2001, construction employment was fairly stable for a couple of years and then started increasing again.

If the small drop in March construction employment is the beginning of a prolonged housing slump, I'd expect employment to fall by a couple hundred thousand jobs over the next few years - similar to the early '90s slump.

LA Times: Construction Decline Means Loss of Jobs

by Calculated Risk on 4/21/2006 05:56:00 PM

The LA Times reports: Construction Decline Means Loss of Jobs

California employment fell in March for the first time since last spring, the state reported today, a drop due almost entirely to a decline in the construction sector as the housing boom comes to a close.From the California Labor Market Information Division:

And the first ripples of the housing slowdown are beginning to be felt in the larger economy.

Over the last four years, soaring house prices generated widespread benefits. Flush homeowners tapped into their newfound equity to pay for new cars, remodeling jobs and lavish vacations, all of which spread the wealth around.

Now, fewer homes are selling, which means builders aren't working overtime to make more of them. That means they need fewer workers — 9,400 fewer in March.

That's one explanation for the overall net drop of 10,800 payroll jobs in March. Another is more modest: it rained a lot in March. This might have worked to keep construction employment down, said state finance chief Howard Roth.

Sectors with increased employment, in order of job gain, were:

Leisure and hospitality (6,500);

Information (3,300);

Financial activities (1,500); and

Natural resources and mining (100).

Sectors with decreased employment included:

Construction (9,400);

Trade, transportation and utilities (4,100);

Professional and business services (3,100);

Government (2,200); other services (2,100);

Manufacturing (900); and

Educational and health services (400).

UCLA on Housing

by Calculated Risk on 4/21/2006 11:48:00 AM

Several economists from the UCLA Anderson Forecast (One of the top rated forecasters) will present at a San Diego conference on May 3rd. Here are some previews:

Christopher Thornberg, a senior economist at Anderson Forecast, said the forecast will be focusing on San Diego because its housing market is the first to follow a nationwide trend of depreciation and a cooling of the real estate bubble.

"A bubble is a function of a period of time where there is expectation in the marketplace and, as a result, people cash in and it feeds up the price," Thornberg said.

He said forecasters are worried about how the housing market will affect the economy.

"We see depreciation starting to flow and overall sales starting to decline, and when real estate markets cool, construction jobs are lost, and real estate and mortgage brokers lose their jobs," he said.

...

Edward Leamer, the director of Anderson Forecast, said the term real estate bubble refers to the extremely high and unsustainable prices for certain assets.

"When the market is hot you get a lot of sales. When the market is cold, the result is that there is a lot of withholding and people don't sell. We're at the initial early warning signs," Leamer said.

He said the housing bubble is 20 to 30 percent off its absolute peak, and with another three to four months of sales volume drops, it will be absolutely clear that the housing bubble has peaked.

"Sales volumes will drop substantially. The popping will be more in terms of sales volumes than with real estate prices," Leamer said.

Thursday, April 20, 2006

$3 Gasoline

by Calculated Risk on 4/20/2006 04:52:00 PM

Rising Rents and Inflation

by Calculated Risk on 4/20/2006 11:22:00 AM

As the housing market slows, rents are starting to rise. The OC Register reports: No slowdown in O.C. rents

Apartment rents spiked 7 percent in the first quarter to $1,441 a month, compared to the year-ago quarter, said apartment tracker RealFacts in a report expected today.

...

Landlords say they are making up for the years after the '01 dot.com bust when a slowing economy flattened rates.

Rental growth slowed to under 5 percent from late 2001 to early 2005 ...

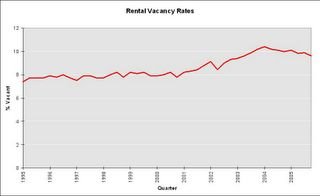

Click on graph for larger image.

Vacancy rates are declining, but are still above normal for recent years according to the Census Bureau. In regions with higher than normal vacancy rates, vacancies will probably keep rents from rising too quickly. However another concern is that a slowing housing market will lead to higher CPI due to rising Owners' Equivalent Rent. Dr. Altig touched on this yesterday.

"Mike [Bryan] notes that owners equivalent rent accelerated in March, something many folks have been concerned about for some time."

Here is a graph of the monthly changes for Owners' Equivalent Rent (OER). OER is the largest single component of CPI and many people have argued that OER was understated as house prices rose, and that OER would start rising as housing slowed - leading to higher reported inflation.

For those interested in how OER is calculated, here is a description from the BLS: Consumer Price Indexes for Rent and Rental Equivalence

A higher reported CPI might lead to higher rates and further impact the housing market.

UPDATE: Here is a writeup from Asha Bangalore and Paul Kasriel at Northern Trust: The FOMC Finds Itself in a Tight Spot. Excerpt:

"We need to watch the owner’s equivalent rent and rent of primary residence components of shelter costs which are showing an upward trend. Owner’s equivalent rent rose 0.4% in March, after a 0.3% increase in February and a 0.2% gain in January. Adjustments for utilities play a role in the computation of this component in addition to rental prices. The value of landlord provided utilities is subtracted from rent to obtain the “pure rent” measure of owner’s equivalent rent. In situations of rising natural gas prices a larger amount is subtracted to estimate pure rent vs. situations when natural gas prices are falling. The recent decline in natural gas prices could explain to some degree the upward trend of owner’s equivalent rent. In addition, the upward trend of the rent component of shelter costs also contributed to higher owner’s equivalent rent. Higher rents reflect demand pressures on rental property as rising mortgage rates could have priced out otherwise eligible potential home owners. The rent index moved up 0.4% in March after a 0.3% gain in February and a 0.1% increase in January."

Wednesday, April 19, 2006

MBA Purchase Index

by Calculated Risk on 4/19/2006 11:13:00 PM

Thanks to Anon in the comments of the previous post, here is a longer term graph for the MBA Purchase Index.

Click on graph for larger image.

Note: This slide is from the MBA Economic Presentation on Feb 22, 2006.

The Purchase Index YTD average is 420.0, compared to the 2005 YTD of 444.3. That is a decline of just over 5%. However, over the last 6 to 7 weeks, the MBA Purchase Index has averaged about 11% less than the comparable period one year ago.

This is about the decline that David Berson, Fannie Mae Economist, is projecting in his April Forecast for the rest of the year:

Home sales are projected to fall by nearly 10 percent in 2006 in reaction to investor pullbacks and lower affordability."A home sales decline of 10% would probably not have a serious impact on the overall economy in 2006. I think a sales decline of 20% or more would have significant economic consequences - but we haven't seen that yet in the MBA numbers.

Since Feb 22, the Purchase Index has been around 400. Here is the data not included on the chart:

| Date | Purchase Index | 4-Week Average |

| Feb 24, 2006 | 400.8 | 406.6 |

| Mar 3, 2006 | 399.0 | 400.1 |

| Mar 10, 2006 | 403.0 | 402.9 |

| Mar 17, 2006 | 393.6 | 399.1 |

| Mar 24, 2006 | 404.1 | 399.9 |

| Mar 31, 2006 | 438.2 | 409.7 |

| Apr 7, 2006 | 417.7 | 413.4 |

| Apr 14, 2006 | 407.4 | 416.9 |

UPDATE: DoctorWho points to this chart from Fannie Mae:

UPDATE: DoctorWho points to this chart from Fannie Mae:The first chart is mislabeled by the MBA - it starts in 2000. The second chart provides the MBA index since 1990 and shows how the Purchase Index tracks home sales.

MBA: Mortgage Application Volume Down Slightly

by Calculated Risk on 4/19/2006 10:06:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Drops Slightly

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 569.6, a decrease of 1.7 percent on a seasonally adjusted basis from 579.4 one week earlier. On an unadjusted basis, the Index decreased 1.4 percent compared with the previous week and was down 14.9 percent compared with the same week one year earlier.Mortgage rates increased slightly:

The seasonally-adjusted Purchase Index decreased by 2.5 percent to 407.4 from 417.7 the previous week whereas the Refinance Index decreased by 0.4 percent to 1526.1 from 1532.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.56 percent from 6.50 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.00 percent from 5.97 percent ...

| Total | -14.9% |

| Purchase | -12.7% |

| Refi | -18.4% |

| Fixed-Rate | -6.2% |

| ARM | -30.5% |

Purchase activity is off 12.7% from last year. This provides further evidence that housing is slowing.

Tuesday, April 18, 2006

San Diego Home Prices Decline in Q1

by Calculated Risk on 4/18/2006 03:01:00 PM

This morning, DataQuick released their March report on the Southern California housing market: Southland passes half million mark

The median price paid for a Southern California home passed $500,000 for the first time last month as sales continued to decline, the result of higher mortgage interest rates and a real estate cycle that has passed its frenzy phase, a real estate information service reported.On San Diego, DataQuick noted:

"San Diego County is still the market furthest along in this cycle."DataQuick reported that prices in San Diego increased 5.7% on a YoY basis. However, for the first quarter, prices declined 2.3% in San Diego.

So far, DataQuick is only showing quarterly price declines in San Diego and Ventura counties in Southern California.

Monday, April 17, 2006

West Coast Ports: March imports up, Record Exports

by Calculated Risk on 4/17/2006 08:09:00 PM

The Ports of Long Beach and Los Angeles reported record exports for March and very strong imports.

Import traffic at the Port of Long Beach increased 11.9% compared to February and was 34.4% higher than March 2005. A total of 282 thousand loaded cargo containers came into the Port of Long Beach, compared to 252 thousand in February.

For the Port of Los Angeles, import traffic increased 37.6% in March compared to February, and imports were up 33% from March 2005. March imports were 341 thousand containers.

For both ports, exports traffic set all time records. For Long Beach, outbound traffic was up 8% to 118.7 thousand containers. At Los Angeles, outbound traffic was up 19% to 128 thousand containers.

The previous export record for Long Beach was 110.7 thousand containers set in August 2005. For Los Angeles, the record was 115 thousand containers set in March 2005.

The quantity of containers says nothing about the content value, but provides a rough guide on imports from China and the rest of Asia. Given these numbers, I expect record exports to Asia for March and even stronger imports.

Are we looking at the first $70 Billion monthly trade deficit (for March)? Maybe.

NAHB: Builder Confidence Declines In April

by Calculated Risk on 4/17/2006 02:30:00 PM

The National Association of Home Builders reports: Builder Confidence Declines In April

Click on graph for larger image.

Excluding the brief impact of 9/11/2001 on the housing market, the Housing Market Index is at the lowest level since February 1996 - the end of the previous housing down cycle. From the NAHB:

Rising mortgage rates, continued affordability issues and subsiding demand from investors/speculators are prompting single-family home builders to adjust their perspectives on the new-home market, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for April, released today. The HMI declined four points from a downwardly revised reading in the previous month to hit 50 for the latest report.

...

"With mortgage rates back up to the 6.5 percent range and serious affordability issues in the highest-priced markets, today’s HMI numbers are neither surprising nor alarming," noted NAHB Chief Economist David Seiders. "Indeed, a reported reduction in home buying by investors/speculators in the market for new single-family homes is a positive development.

Furthermore, we expect solid growth in employment and household income to essentially offset the minor increases in the interest-rate structure that we’re projecting for the balance of this year."

...

All three component indexes slipped this month, with the largest decline registered for current single-family sales. That component declined five points to 54 in April, while the component for sales expectations in the next six months was down four points to 58 and the component gauging traffic of prospective buyers declined a single point to 39.