by Calculated Risk on 4/28/2006 03:55:00 PM

Friday, April 28, 2006

Q1 GDP, Trade and Residential Investment

Here are a couple of succinct reviews of the Q1 GDP report:

From Professor Polley: Strong 1st quarter growth and tame PCE deflator growth

"Today's figures on durables make up what was lost in the 4th quarter, but taken together the last 6 months have been pretty bad for durables. If that continues through the rest of the year, it will be a drag on GDP."Professor Samwick: The End of Personal Saving?

"I wonder how it can be that with the Baby Boom generation in the high-income and presumably high-saving part of its economic life cycle, we can possibly have negative saving rates for the population as a whole ..."I think the BEA might have underestimated the trade deficit for March. The BEA is estimating a surge in Goods exported in Q1, and this appears likely. However I think the BEA might be underestimating the increase in Goods imported. I'm basing this mostly on the record export / import traffic at West Coast ports in March. If I am correct, the March trade deficit might be close to $70 Billion (a new record) and Q1 GDP would then be revised down to 4.5% or so (still solid).

Click on graph for larger image.

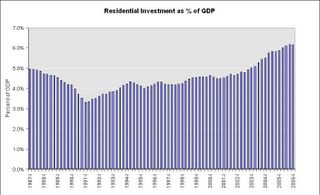

Also Real Residential Investment (RI) increased 2.6% from Q4 (SA annualized). So RI grew slower than GDP in Q1 2006 and RI as a % of GDP decreased slightly. I suspect we will start seeing decreases in RI over the next few quarters and that will be a drag on GDP.

Overall this is a solid report.

Thursday, April 27, 2006

Housing and Employment

by Calculated Risk on 4/27/2006 03:13:00 PM

Here is another story on housing and employment, this one from the Contra Costa Times: 'Housing is king in East Bay employment market'

Housing has become a crucial pillar of an increasingly robust and strongly expanding East Bay economy.

Whether that's good or bad is another thing altogether.

What is clear is that the residential boom in the Alameda-Contra Costa region has fueled remarkable job gains on a number of fronts ...

Construction, finance, insurance and real estate have become the most dynamic industries in the East Bay.

"We are in a construction-driven economy, top to bottom," said Christopher Thornberg, an economist with the UCLA Anderson Forecast. "Things are being driven in large part by real estate, and housing is going to leave the economy in a big way over the next year.

"What's unclear is how much oomph will leave the East Bay economy," Thornberg said.

...

Housing generates jobs

Three industries that are directly or indirectly linked to the housing market have accounted for a significant number of jobs in the East Bay over the past year. No one can say definitively how many jobs resulted specifically because of housing, but the numbers are striking nonetheless.

Construction, real estate and finance/insurance combined to generate about 12,000 new East Bay jobs over the last 12 months -- that's 52 percent of the 23,000 new jobs in the two-county region over the same time period.

"Jobs are jobs, and that's good, and that produces income," Thornberg said. "But you hope that some of the other industries will replace any losses when housing slows down. Professional services, transportation, maybe even a little manufacturing, will start to pick up the slack."

...

In the past year, construction was the champ of employment generation with 8,200 added jobs. But other East Bay industries unrelated to housing also created plenty of jobs:

• Leisure and hospitality, 3,400 jobs

• Retail, 2,900 jobs

• Professional and business services, 2,900 jobs

• Finance and insurance, 2,600 jobs

• Health care, 2,200 jobs.

Bernanke on Housing

by Calculated Risk on 4/27/2006 10:15:00 AM

Bernanke is testifying this morning before the Joint Economic Committee. Here are his prepared remarks on the Outlook for the U.S. economy. Excerpts on housing:

Based on the information in hand, it seems reasonable to expect that economic growth will moderate toward a more sustainable pace as the year progresses. In particular, one sector that is showing signs of softening is the residential housing market. Both new and existing home sales have dropped back, on net, from their peaks of last summer and early fall. And, while unusually mild weather gave a lift to new housing starts earlier this year, the reading for March points to a slowing in the pace of homebuilding as well. House prices, which have increased rapidly during the past several years, appear to be in the process of decelerating, which will imply slower additions to household wealth and, thereby, less impetus to consumer spending. At this point, the available data on the housing market, together with ongoing support for housing demand from factors such as strong job creation and still-low mortgage rates, suggest that this sector will most likely experience a gradual cooling rather than a sharp slowdown. However, significant uncertainty attends the outlook for housing, and the risk exists that a slowdown more pronounced than we currently expect could prove a drag on growth this year and next. The Federal Reserve will continue to monitor housing markets closely.

Wednesday, April 26, 2006

New Home Sales YTD

by Calculated Risk on 4/26/2006 11:50:00 AM

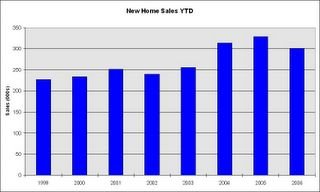

Is housing slowing? Looking at New Home Sales, the answer is unequivocally yes.

Click on graph for larger image.

New Home Sales for 2006 are below both 2004 and 2005. In February I cautioned "One month does not make a trend, but New Home Sales have fallen in six of the last seven months."

That same caution applies to the March numbers. New Home Sales have now fallen six of the last eight months - a definite down trend. But 2006 is still the third best year so far.

This graph (from the previous post) shows the reported sales (NSA) by month for the last four year. For each month, sales for 2006 have been below 2005.

The reason I follow housing so closely is I expect a slowing housing market to impact the economy.

However, as I wrote last month, "I'd be very concerned if New Home Sales fall below about 1.05 million units annual rate for several months." That hasn't happened for even one month yet.

March New Home Sales: 1.213 Million

by Calculated Risk on 4/26/2006 10:01:00 AM

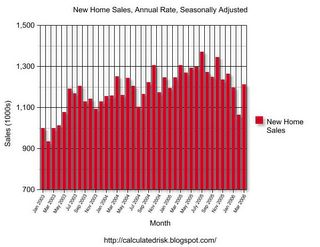

According to the Census Bureau report, New Home Sales in March were at a seasonally adjusted annual rate of 1.213 million. February's sales were revised down slightly to 1.066 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

The Not Seasonally Adjusted monthly rate was 119,000 New Homes sold. There were 127,000 New Homes sold in March 2005.

On a year over year basis, March 2006 sales were 7.2% lower than March 2005.

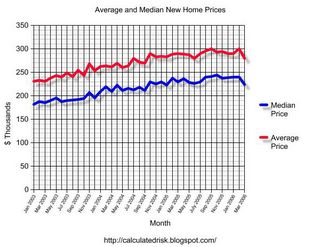

The median and average sales prices declined.

The median sales price of new houses sold in March 2006 was $224,200; the average sales price was $279,100.

The seasonally adjusted estimate of new houses for sale at the end of March was 555,000. This represents a supply of 5.5 months at the current sales rate.

The 555,000 units of inventory is another all time record for new houses for sale. On a months of supply basis, inventory is significantly above the level of recent years.

Although sales bounced back in March from the February lows, this report shows that the housing market continues to slow down.

MBA: Mortgage Application Volume Down

by Calculated Risk on 4/26/2006 09:44:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Down

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 548.6, a decrease of 3.7 percent on a seasonally adjusted basis from 569.6 one week earlier. On an unadjusted basis, the Index decreased 3.2 percent compared with the previous week and was down 22.4 percent compared with the same week one year earlier. There were no holiday adjustments made for the Easter holiday.Mortgage rates were steady:

The seasonally-adjusted Purchase Index decreased by 4.4 percent to 389.4 from 407.4 the previous week whereas the Refinance Index decreased by 2.4 percent to 1489.4 from 1526.1 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.53 percent from 6.56 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 5.96 percent from 6.00 percent ...

| Total | -22.4% |

| Purchase | -19.1% |

| Refi | -27.4% |

| Fixed-Rate | -14.7% |

| ARM | -36.9% |

Purchase activity is off 22.4% from last year. This is a significant decline from last year and provides further evidence that housing is slowing.

Tuesday, April 25, 2006

Bush Blunders on Gasoline

by Calculated Risk on 4/25/2006 01:27:00 PM

The AP reports: Bush Eases Environmental Rules on Gasoline

President Bush on Tuesday ordered a temporary suspension of environmental rules for gasoline, making it easier for refiners to meet demand and possibly dampen prices at the pump. He also halted for the summer the purchase of crude oil for the government's emergency reserve.Halting the purchase of crude oil for the SPR is reasonable, but the suspension of environmental rules is not. Last year I supported the temporary suspension of environmental rules as a response to the impact of Hurricanes Katrina and Rita. Does the Bush Administration believe the recent increase in gasoline prices is temporary? Or will the suspension of environmental rules become permanent?

NOTE: It makes sense to reduce the number of different blends used around the country to avoid spot shortages, but not to return to the air quality standards of 30+ years ago.

Existing Home Sales

by Calculated Risk on 4/25/2006 10:03:00 AM

UPDATE: The National Association of Realtors (NAR) released their data for Existing Home Sales in March. NAR reported:

Sales of existing homes edged up in March following a strong rebound in February, according to the National Association of Realtors®.Existing Home Sales are a trailing indicator. The sales are reported at close of escrow, so March sales reflects agreements reached in January and February.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 0.3 percent to a seasonally adjusted annual rate1 of 6.92 million units in March from a pace of 6.90 million in February, but were 0.7 percent below a 6.97 million-unit level in March 2005.

David Lereah, NAR’s chief economist, said sales are leveling out. “It’s a good sign to see home sales holding close to the level of a strong rebound in the month before,” he said. “This is additional evidence that we’re experiencing a soft landing. We may see some minor slowing in home sales as interest rates rise, but the market clearly is stabilizing.” Lereah expects 2006 to be the third strongest year on record for home sales.”

Also note that mortgage applications fell about 10% in February and March (compared to January). This probably indicates that existing home sales will fall in the coming months on a seasonally adjusted (SA) basis.

Click on graph for larger image.

Existing Home inventories rose to 3.19 million units in March. This is the start of the listing season, and I expect inventories to continue to rise.

If sales fall about 10% (as indicated by the MBA purchase index) and inventories continues to rise at the current pace, the months of supply could be over 6 months by Summer. Usually 6 to 8 months of inventory starts causing pricing problem - and over 8 months a significant problem.

New Home sales (released tomorrow) is usually a better indicator of the housing market.

Monday, April 24, 2006

Builders Fret Over Immigrant Debate

by Calculated Risk on 4/24/2006 03:46:00 PM

From BuilderOnline: Builders Fret Over Immigrant Debate: Construction Would Halt Under Stricter Laws, the Industry Warns

In the debate over how to fix the nation's immigration laws, few sectors have more at stake than the construction industry, one of the country's economic bright spots.There is a new home being built right next door to me. The work crews all speak Spanish, although I have no idea if they are legal or illegal immigrants. But it makes me wonder if there are far more people employed in construction than are reported by the Bureau of Labor Statistics.

One of every four workers in construction is an immigrant, according to government statistics.

And as orders for new housing have soared over the last decade, the industry's future has become increasingly intertwined with that of the immigrant workforce.

On any given day, 117,600 mostly immigrant workers around the country either work as day laborers or are looking for such work, according to a recent survey.If the immigrant workforce is underreported, then as the housing market slows, some of the lost jobs might not show up in the BLS data. Just something to keep in mind as we track construction employment in the US and California.

"The immigrant workforce is still keeping the housing market afloat to some extent," said Jerry Howard, chief executive of the National Association of Homebuilders.

UBS: Housing Demand Falling "More Quickly than Expected"

by Calculated Risk on 4/24/2006 02:55:00 PM

From MarketWatch: UBS tempers view on home builders

"The long-anticipated housing slowdown appears to be finally upon us," wrote analyst Margaret Whelan in a research note, citing new-home sales down 21% from their July high, while new-mortgage applications are off 23% from their peak in June.

Yet she noted that markets vary by geography, reflected in the disparity in home-order growth being reported by the building companies.

Whelan's long-standing expectation was a "soft-landing" scenario, reminiscent of the corrections in 1994 and 1995, and also between 1998 and 2000, where new-home sales dipped 20% over a 20-month period.

"Of late, however, the more rapid rate of decline in demand -- down 21% in eight months -- has led us to rethink our thesis for the near term," she said. "Given tough comparisons and a proliferation in for sale listings in some of the hotter markets, demand has fallen more quickly than we expected."