by Calculated Risk on 5/04/2006 01:40:00 PM

Thursday, May 04, 2006

Fed's Bies: "Housing has ... Peaked"

Reuters reports: Rising rents may push CPI higher, Fed's Bies says

The U.S. consumer price index may move higher as the U.S. housing market slows and the rental market strengthens, Federal Reserve Board Governor Susan Bies said on Thursday.This is a topic we've discussed before; as housing slows, rents increase and the largest component of CPI is "Owners Equivalent Rent". So, as housing slows, reported CPI could increase.

Noting that the CPI's gauge of housing costs is based on rents, Bies told a banking conference in answer to a question: "We've come through a period of weaker rents. Now, housing has really sort of peaked ... that may rejuvenate rents and so you may see may see that, in turn, higher (CPI) inflation going forward."

More from Susan Schmidt Bies on Nontraditional Mortgage Products:

Over the past few years, the agencies have observed an increase in the number of residential mortgage loans that allow borrowers to defer repayment of principal and, sometimes, interest. These loans, often referred to as nontraditional mortgage loans, include "interest-only" (IO) mortgage loans, on which the borrower pays no loan principal for the first few years of the loan, and "payment-option" adjustable-rate mortgages (option ARMs), for which the borrower has flexible payment options--and which could also result in negative amortization.

IOs and option ARMs are estimated to have accounted for almost one-third of all U.S. mortgage originations in 2005, compared with less than 10 percent in 2003. Despite their recent growth, however, these products, it is estimated, still account for less than 20 percent of aggregate domestic mortgages outstanding of $8 trillion. While the credit quality of residential mortgages generally remains strong, the Federal Reserve and other banking supervisors are concerned that current risk-management techniques may not fully address the level of risk inherent in nontraditional mortgages, a risk that would be heightened by a downturn in the housing market.

Mortgages with some of the characteristics of nontraditional mortgage products have been available for many years; however, they have historically been offered to higher-income borrowers. More recently, they have been offered to a wider spectrum of consumers, including subprime borrowers, who may be less suited for these types of mortgages and may not fully recognize the embedded risks. These borrowers are more likely to experience an unmanageable payment shock during the life of the loan, meaning that they may be more likely to default on the loan. Further, nontraditional mortgage loans are becoming more prevalent in the subprime market at the same time risk tolerances in the capital markets have increased. Banks need to be prepared for the resulting impact on liquidity and pricing if and when risk spreads return to more "normal" levels and competition in the mortgage banking industry intensifies.

Supervisors have also observed that lenders are increasingly combining nontraditional mortgage loans with weaker mitigating controls on credit exposures--for example, by accepting less documentation in evaluating an applicant's creditworthiness and not evaluating the borrower's ability to meet increasing monthly payments when amortization begins or when interest rates rise. These "risk layering" practices have become more and more prevalent in mortgage originations. Thus, while some banks may have used elements of the product structure successfully in the past, the easing of traditional underwriting controls and sales of products to subprime borrowers may have unforeseen effects on losses realized in these products.

In view of these industry trends, the Federal Reserve and the other banking agencies decided to issue the draft guidance on nontraditional mortgage products. The proposed guidance emphasizes that an institution's risk-management processes should allow it to adequately identify, measure, monitor, and control the risk associated with these products. It reminds lenders of the importance of assessing a borrower's ability to repay the loan including when amortization begins and interest rates rise. These products warrant strong risk-management standards as well as appropriate capital and loan-loss reserves. Further, bankers should consider the impact of prepayment penalties for ARMs. Lenders should provide borrowers with enough information to clearly understand, before choosing a product or payment option, the terms of and risks associated with these loans, particularly the extent to which monthly payments may rise and that negative amortization may increase the amount owed above the amount originally borrowed. Lenders should recognize that certain nontraditional mortgage loans are untested in a stressed environment; for instance, nontraditional mortgage loans to investors that rely on collateral values could be particularly affected by a housing price decline. Investors have represented an unusually large share of home purchases in the last two years. Past loan performance indicated that investors are more likely to default on a loan when housing prices decline, than owner occupants.

Wednesday, May 03, 2006

Housing Indicators

by Calculated Risk on 5/03/2006 11:15:00 PM

This graph displays the year-over-year percentage change for three housing indicators: New Home Sales, Existing Home Sales and the MBA Purchase Index. Only the Purchase Index has data for April.

Click on graph for larger image.

First, the monthly MBA Purchase Index shows the housing market is continuing to slide - even though the numbers rebounded somewhat in the most recent week.

Second, there is significant variability in the New Home Sales data. However, looking at a long term chart, the trend is definitely down.

Existing Home Sales are a trailing indicator because the sales are reported when escrow closes - about 30 to 60 days after the contract is signed.

Given this data, I expect further declines in the reported New and Existing Home sales for April.

MBA: Mortgage Application Volume Rebounds

by Calculated Risk on 5/03/2006 10:25:00 AM

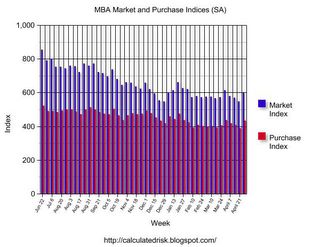

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Rebounds

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 596.8, an increase of 8.8 percent on a seasonally adjusted basis from 548.6 one week earlier. On an unadjusted basis, the Index increased 9.6 percent compared with the previous week and was down 15.6 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 11.3 percent to 433.3 from 389.4 the previous week whereas the Refinance Index increased by 5.1 percent to 1565.6 from 1489.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.57 percent from 6.53 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.08 percent from 5.96 percent ...

| Total | -15.6% |

| Purchase | -10.1% |

| Refi | -24.0% |

| Fixed-Rate | -9.1% |

| ARM | -28.3% |

Even with the small rebound in mortgage activity, purchase applications are still off 10.1% from last year.

California Foreclosure Activity Up

by Calculated Risk on 5/03/2006 01:45:00 AM

DataQuick reports: California Foreclosure Activity Up

First-quarter foreclosure activity in California increased to the highest level in more than two years, the result of slower home price increases, a real estate information service reported.Foreclosure activity is still low, but rising.

Lending institutions sent 18,668 default notices to California homeowners during the January-to-March period.

...

Foreclosure activity hit a low during the third quarter of 2004 when 12,145 default notices were recorded. Defaults peaked in 1996's first quarter at 59,897. DataQuick's default statistics go back to 1992.

"A number of factors are driving defaults higher," said Marshall Prentice, DataQuick's president. "The main one right now is that home values are rising more slowly than they have been the past couple of years, which makes it more difficult for homeowners to sell their homes and pay off the lender. Other factors that influence default activity include the amount of equity people have in their property, the type of mortgage they used and how long they've had that mortgage."

...

Only about five percent of homeowners who find themselves in default actually lose their homes to foreclosure. Most are able to stop the foreclosure process by bringing their mortgage payments current, or by selling their home and paying the home loan(s) off.

Tuesday, May 02, 2006

Housing and Jobs

by Calculated Risk on 5/02/2006 06:20:00 PM

From CNNMoney: Working on the housing boom. The sector is cooling, finally. Now, a debate is raging over whether the employment market will prevent a implosion.

Experts who say the housing market is cooling, but won't implode, argue that solid job growth should be enough to prevent a collapse in home prices. But others who see a housing "bubble" ready to pop say a developing slowdown in home building itself could hurt job growth enough to put a big dent in housing.And as if on cue, Ameriquest Parent to Lay Off 3,800 Workers. Back to the CNNMoney article:

Recent government figures show that about 1.5 million homes were vacant in the first quarter, most of those presumably up for sale, a 17 percent increase from a year earlier. ...

"When you see it increasing quarter after quarter, there seems to be something going on here," [Dean] Baker said. "We're building more homes than are being filled."

Among those most worried about the real estate market are home builders themselves. The National Association of Home Builders saw its index of builder confidence sink last month to the lowest level since 1995, save for two months right after Sept. 11.

...

But some economists say that while housing will cool as mortgages continue to rise, home sales and prices won't collapse, due mostly to strength in the job market.

...

"Our experience says prices do not go down when there's job creation in the local economy," said [Lawrence Yun, senior economist for the National Association of Realtors] "In local markets where they are flat on jobs, they could see prices decline. But we're projecting 2.3 million new jobs this year. The job market is providing a buffer. It's a counter force to rising rates."

So far job growth is cooperating.

...

But the experts who see a possible meltdown say strong employment isn't enough to support an overinflated housing market.

...

Past housing downturns have seen builders slash their work forces by up to 40 percent, said Baker, the housing market bear, and with an estimated 3.5 million people working in residential construction, the loss of more than 1 million jobs would obviously cause problems for the labor market.

Add job losses at mortgage firms, building supply retailers and real estate agencies and the downturn in home building could itself further weaken one of the key supports for real estate.

One of those worried about just that is James McShirley, owner of Sulphur Lumber near Indianapolis. He's already laying off staff and not filling open positions due to a slowdown in orders from his builder clients.

...

McShirley said when he sees his clients cutting staff, and a local mortgage broker with 100 employees go out of business, he grows more worried.

"Those people losing their jobs are the classic home owners. This could be a vicious circle," he said.

2006: Record Real Gasoline Prices?

by Calculated Risk on 5/02/2006 05:37:00 PM

Click on photo for larger image.

Photo taken May 2, 2006 at the gas station nearest my home.

And here is a photo of the same station taken way back on April 20, 2006.

The EIA provides historical data on oil and gasoline prices.

Using the EIA data, this graph shows the annual average real and nominal gasoline prices since 1919. Real gasoline prices have declined steadily for the last 85 years, with a few exceptions: real prices rose during the Depression and during the two supply driven oil shocks in the 1970s.

And real prices have been rising for the last few years. If the average price for gasoline is just over $3.00 per gallon this year, 2006 will set a new record for real gasoline prices.

Monday, May 01, 2006

GDP and Mortgage Interest

by Calculated Risk on 5/01/2006 11:59:00 PM

Homeowners continued to borrow substantially against their homes in Q1 2006 according to the BEA. Hence the strong increase in Personal Consumption Expenditures (PCE) and GDP in Q1 ... and the negative savings rate.

For some graphs, see my post on Angry Bear: GDP and Mortgage Interest

I will calculate Mortgage Equity Withdrawal (MEW) when the FED's Flow of Funds reports is released in June.

Energy Secretary Bodman: 'Demand Exceeds Supply'

by Calculated Risk on 5/01/2006 01:41:00 AM

UPDATE: on the same theme, see pgl's Gasoline Prices: Russert Tries Demand & Supply, and Dr. Hamilton's More political pandering and Mish's humorous take: Panic Over Oil

MarketWatch quotes Energy Secretary Samuel Bodman saying "Demand exceeds supply" in the market for gasoline. Here is the excerpt:

"Suppliers have lost control of the market," Bodman told NBC's Tim Russert, when asked what the reason for the latest spike in U.S. gas prices. "Therefore demand exceeds supply."I don't think 'demand exceeds supply'. Too funny.

For some reason, relatively high gasoline prices bring out the silly comments and dumb proposals. Senator Frist has proposed sending most Americans a check for $100 - he is thinking small - why not $1 million?

And some Senate Democrats have proposed a 60-day Moratorium on gasoline taxes. Wouldn't that encourage demand?

And Condoleezza Rice proclaimed:

"... if anything has surprised me as secretary of state, it is the degree to which the kind of search for hydrocarbons is distorting international politics."This was a surprise?

Both the supply and demand curves for oil and gasoline are very steep. Demand is fairly inelastic over a wide range of prices and supply is essentially fixed in the short term (it takes time and significant investment to bring new product to market). Any short term proposal has to be aimed at reducing demand - like increasing the gasoline tax, not decreasing it.

But raising the gasoline tax has political ramifications - remember this Bush Ad?

In the 30-second spot that harkens to the bumbling Keystone cops of the black-and-white silent movie era, an announcer says, "Some people have wacky ideas. Like taxing gasoline more so people drive less. That's John Kerry." The ad's image is of 1920s-vintage cars going around in circles.Also the impact of high gasoline prices falls disproportionately on lower income Americans. That is the problem with a short sighted energy strategies - like giving tax credits to companies that buy large SUVs. On this point, Josh Bolten is correct:

"This is a very large problem ... It's not going to be solved in the short run by some silver bullet."So lets get started. And remember the goal is to significantly reduce total oil consumption. This will reduce the price of oil and gasoline, help with Global Warming, and as the Secretary of State just realized, positively impact international politics.

Hurricanes: Sea Surface Temperatures

by Calculated Risk on 5/01/2006 01:07:00 AM

Hurricane season officially starts June 1st. NOAA offers this resource page to track Sea Surface Temperatures (SST) around the World.

UPDATE: April 28, 2005 vs. April 28, 2006 (sorry for leaving off dates!)

Here are two animations comparing 2005 (land in pink) to 2006 (land in green). The first image shows that most of the Atlantic and the Caribbean are slightly cooler this year.

The second image shows the Gulf of Mexico. The GOM is clearly warmer in 2006.

Friday, April 28, 2006

NAHB: Economists Predict Soft Landing For Housing

by Calculated Risk on 4/28/2006 08:09:00 PM

From the National Association of Home Builders (NAHB): Economists Predict Soft Landing For Housing

After soaring to record levels for three consecutive years, the single-family housing market is gliding toward a “soft landing” in 2006, as rising interest rates, affordability issues and a reduced role for investors/speculators contribute to a softening in demand, according to economists at the National Association of Home Builders (NAHB) Construction Forecast Conference in Washington, D.C. on April 27.The forecast: Sales down 12% in 2006.

"After topping out in the third quarter of last year, it is pretty clear that the housing sector is in a period of transition. Sales and starts are trending lower toward more sustainable levels," said NAHB Chief Economist David Seiders. Even so, the slowing housing market is not likely to derail the expansion as housing yields its position as the economy’s major growth engine to other sectors, he added.

Expressing a similar assessment, Michael Moran, chief economist at Daiwa Securities America Inc., said: "The housing sector is going through an adjustment, not a collapse."

Taking a bullish view on the current economic and inflation outlook, Jim Glassman, managing director and senior policy strategist with JP Morgan Chase & Co., said these factors will bode well for housing.

"Real estate is pricing itself back to reality and in the long-run it is reasonable to expect starts in the 1.8 million to 2 million range," said Glassman. "Housing won't continue to make the same contribution to the economy that it has. But when I think about where the economy is, I think we're in the fifth inning with a good chance of going into extra innings. This expansion may prove to be the longest one ever seen."

Looking to the future, Seiders said that new home sales in the first quarter of this year were down 10 percent from the fourth quarter in 2005, and that he expects them to ease further in the coming months before leveling off in 2007.And on the "Housing Bubble":

NAHB is forecasting that new home sales will hit 1.13 million units in 2006, down 12 percent from last year’s all-time high of 1.28 million units, and then move down slightly in 2007 to 1.09 million.

"Hopefully, most of this decline will be due to investors and speculators stepping out of the market. What we don’t want to see is investors dumping homes on the market," said Seiders.

After posting a record 1.716 million single-family starts in 2005, NAHB is predicting that new home construction will level off to 1.595 million units in 2006 and 1.488 million in 2007, which would still rank high by historical standards.

Commenting on the dramatic home price increases in many markets in recent years, Seiders said home price appreciation is expected to fall from an average 12 percent in 2005 to about 4 percent in 2007 and that mortgage rates should move up to 6.7 percent later this year.

Addressing a question that has generated endless speculation in recent years, Thomas Lawler, a housing and mortgage market consultant who worked for Fannie Mae for 22 years, said “Was there a national bubble? Nationwide, no, but in some regions, absolutely."

Lawler, who spoke on house prices and local dynamics, noted that in some areas, "all of the signs of a bubble were present: a surge in speculative investing; a surge in innovative financing; easy credit and loose underwriting; home inspection waivers; and home purchases sight unseen. You had to be ‘on something’ not to see a bubble in some areas," he said.