by Calculated Risk on 5/09/2006 02:15:00 PM

Tuesday, May 09, 2006

Citigroup Remains Bullish

I've just read the Citigroup May 9th Consumer Update. To say Citigroup remains bullish on the US economy (and homebuilders too) is an understatement.

I must be missing the fun with the "recreational debt creation", but lets check a few numbers. Real residential construction grew 5.8% over the last year, from $584.1 Billion in Q1 2005 (annualized) to $618.2 Billion in Q1 2006 (in 2000 dollars). GDP grew 3.5% over the same period ($10.999 Trillion to $11,381.40 Trillion in 2000 dollars).

If residential construction had been flat, GDP would have been around 3.1%. So Citigroup's number is technically correct (less than 0.5 percentage points of GDP growth came from growth in residential construction), but that is still a substantial contribution to GDP growth.

And what if residential construction falls 10% this year (a common estimate)? All else being equal that would put real GDP growth at around 2.6%. And that is excluding any impact from the loss of the "wealth effect" and the loss of housing related employment.

It is true that personal interest income has been rising almost as fast as mortgage interest payments. The general idea is simple: as strapped homeowners reduce their personal consumption expenditures, other consumers will take up the slack with their additional interest income.

However, it seems likely that consumers receiving substantial interest income tend to save more - and as interest rates rise, the savings rate will increase - so its not a one for one substitution for consumption. Besides, the primary concern for housing is the marginal homeowner with an ARM. As rates rise, these homeowners might be forced to sell, increasing the supply of houses for sale and eventually putting pressure on prices - and reversing the wealth effect.

There is much more in the Citigroup report, but suffice to say Citigroup didn't convince me. I remain concerned about the impact of the housing slowdown on the general economy.

Monday, May 08, 2006

FOMC Rate Hike Odds

by Calculated Risk on 5/08/2006 10:48:00 PM

Every week Dr. Altig calculates the market expectations of future federal funds rate hikes based on the options on federal funds futures. This weeks post is especially interesting. Expectations are for another 25 bps this Wednesday and then for a pause, at least through the August meeting.

Click on graph for larger image.

This graph shows the daily odds of various Fed Funds rates after the August 8th meeting.

An extended pause is somewhat surprising since most of the recent economic data has been fairly positive. Even the data for the housing market hasn't been terrible - and the housing slowdown hasn't impacted employment significantly yet.

Inflation also appears to be moving higher - as an example the Dallas Fed's trimmed mean PCE inflation rate was an annualized 3.7% in March and 2.4% over the last 6 months - above the high end of the Fed's informal target of 2.0%.

For the FED to pause, they must expect housing will weaken further in the near future. There were a couple of commentaries today suggesting that the housing slowdown is spreading: see Dimartino: Bubble's bursting on all fronts and Housing slowdown appears to be spreading nationwide. Further evidence of a housing slowdown was provided after market hours by Dominion Homes, when they reported a Q1 loss:

Douglas Borror, chief executive officer of the company, said, "Based on the level of sales we are currently experiencing, we do not expect that 2006 will be a profitable year."I think there might be another rate hike in June unless inflationary pressures ease.

Harper's: The New Road to Serfdom

by Calculated Risk on 5/08/2006 11:39:00 AM

Here is the cover from this month's Harper's Magazine:

THE NEW ROAD TO SERFDOM

An Illustrated Guide to the Coming Real Estate Collapse

UPDATE: Professor Thoma posted a cartoon from the China Daily last week that is very similar to the Harper's Magazine cover.

Saturday, May 06, 2006

Buffett: Real estate slowdown ahead

by Calculated Risk on 5/06/2006 09:19:00 PM

CNNMoney reports: Buffett: Real estate slowdown ahead

On the real estate bubble

Buffett: "What we see in our residential brokerage business [HomeServices of America, the nation's second-largest realtor] is a slowdown everyplace, most dramatically in the formerly hottest markets. ... The day traders of the Internet moved into trading condos, and that kind a speculation can produce a market that can move in a big way. You can get real discontinuities. We've had a real bubble to some degree. I would be surprised if there aren't some significant downward adjustments, especially in the higher end of the housing market."

On mortgage financing

Munger: "There is a lot of ridiculous credit being extended in the U.S. housing sector."

Buffett: "Dumb lending always has its consequences. It's like a disease that doesn't manifest itself for a few weeks, like an epidemic that doesn't show up until it's too late to stop it Any developer will build anything he can borrow against. If you look at the 10Ks that are getting filed [by banks] and compare them just against last year's 10Ks, and look at their balances of 'interest accrued but not paid,' you'll see some very interesting statistics [implying that many homeowners are no longer able to service their current debt]."

Friday, May 05, 2006

'Risky ARM mortgages come due'

by Calculated Risk on 5/05/2006 01:51:00 PM

Catherine Reagor writes in The Arizona Republic: Risky ARM mortgages come due

Thousands of people used the non-traditional mortgages last year to afford a house in the Valley, where home prices increased nearly 50 percent from 2004. They're paying for that decision today.Lured? No, homeowners were just taking then Fed Chairman Alan Greenspan's advice:

...

Arizona incomes aren't climbing at the same rate, meaning many of those already struggling to pay their mortgages could wind up losing their homes in the months ahead.

Arizona's housing market could be hurt more than other areas of the country by a fallout from rapidly rising rates on ARMs.

Economists say nearly 40 percent of all home loans in metropolitan Phoenix are adjustable. Nationally, about 30 percent of all mortgages are ARMs.

...

"Record numbers of people lured by low initial teaser rates have taken out adjustable-rate mortgages that are putting them in vulnerable positions as rates rise," said Jay Luber, a vice president with First Horizon Home Loans in Phoenix.

"... many homeowners might have saved tens of thousands of dollars had they held adjustable-rate mortgages rather than fixed-rate mortgages during the past decade.In the Arizona Republic article, Ms. Reagor notes:

...

American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage. To the degree that households are driven by fears of payment shocks but are willing to manage their own interest rate risks, the traditional fixed-rate mortgage may be an expensive method of financing a home."

Alan Greenspan, Feb 23, 2004

The number of people making late payments on ARMs in Arizona climbed during the second half of 2005.

At the end of the year, almost 10,000 homeowners across the state were behind on their payments for adjustable mortgages. That is almost double the rate from last summer, according to the Mortgage Bankers Association of America.

...

Last year, strapped homeowners were able to sell quickly for hefty profits or refinance into ARMs with artificially low teaser rates. As a result, foreclosures were at nearly record lows.

But now, a growing number of people are so stretched they are spending more than they earn.

First American Real Estate estimates that $297 billion worth of adjustable-rate mortgages issued nationally in 2005 and 2004 could end up in foreclosure.

...

"If interest rates continue to go up and housing prices don't, more people will be squeezed," said Elliott Pollack, an Arizona economist and real estate investor.

"When the next recession rolls around, many people are going to be set up for a very bad situation."

Thursday, May 04, 2006

Dr. Thornberg: Housing will get "Chilly"

by Calculated Risk on 5/04/2006 11:52:00 PM

From the San Francisco Chronicle: 30-year mortgages at 6.59%, approaching a 4-year high

Chris Thornberg, senior economist at the UCLA Anderson Forecast, thinks the housing market will decline no matter what happens with interest rates.

"The overall cooling bubble will far and away dominate any kind of interest-rate effects," Thornberg said. Rising interest rates "are just one tiny little (impact), like a guy standing in the middle of a hurricane throwing a bucket of water."

His predictions for the housing market are pessimistic.

"The market's already cooling. It's going to continue to cool and will get downright chilly by the end of the year," Thornberg said. "Appreciation will come to a stop and you'll continue to see overall unit sales falling."

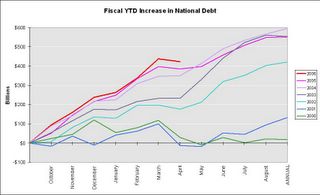

National Debt: Record Annual Increase through April

by Calculated Risk on 5/04/2006 03:22:00 PM

For the first seven months of the 2006 fiscal year (starts Oct 1st), the National Debt has increased $423 Billion. The previous nominal record was $385 Billion for the first seven months of fiscal 2005.

Click on graph for larger image.

April was a strong revenue month for obvious reasons. As a percent of GDP, the deficit has improved slightly over the last few years.

The annual increase in the debt is running around 4.5% to 5.0% of GDP. This is a classic "structural budget deficit" or "high employment deficit" - something most economists believe should be avoided.

Meanwhile, from Bloomberg: U.S. Budget Deficit Will Be `Well Below' Forecast, Adams Says

"We think that this year's number will actually come in well below the estimate," Tim Adams, undersecretary for international affairs, told reporters today in Hyderabad, India. "Revenues are sufficiently strong. We think the actual number for 2006 will be closer to what we saw last year."Anyone else experiencing a little déjà vu?

"The U.S. budget deficit is falling, and it is falling fast."Joshua Bolten, July 14, 2005

Same speech. Different year. New record annual increase in the National Debt.

Fed's Bies: "Housing has ... Peaked"

by Calculated Risk on 5/04/2006 01:40:00 PM

Reuters reports: Rising rents may push CPI higher, Fed's Bies says

The U.S. consumer price index may move higher as the U.S. housing market slows and the rental market strengthens, Federal Reserve Board Governor Susan Bies said on Thursday.This is a topic we've discussed before; as housing slows, rents increase and the largest component of CPI is "Owners Equivalent Rent". So, as housing slows, reported CPI could increase.

Noting that the CPI's gauge of housing costs is based on rents, Bies told a banking conference in answer to a question: "We've come through a period of weaker rents. Now, housing has really sort of peaked ... that may rejuvenate rents and so you may see may see that, in turn, higher (CPI) inflation going forward."

More from Susan Schmidt Bies on Nontraditional Mortgage Products:

Over the past few years, the agencies have observed an increase in the number of residential mortgage loans that allow borrowers to defer repayment of principal and, sometimes, interest. These loans, often referred to as nontraditional mortgage loans, include "interest-only" (IO) mortgage loans, on which the borrower pays no loan principal for the first few years of the loan, and "payment-option" adjustable-rate mortgages (option ARMs), for which the borrower has flexible payment options--and which could also result in negative amortization.

IOs and option ARMs are estimated to have accounted for almost one-third of all U.S. mortgage originations in 2005, compared with less than 10 percent in 2003. Despite their recent growth, however, these products, it is estimated, still account for less than 20 percent of aggregate domestic mortgages outstanding of $8 trillion. While the credit quality of residential mortgages generally remains strong, the Federal Reserve and other banking supervisors are concerned that current risk-management techniques may not fully address the level of risk inherent in nontraditional mortgages, a risk that would be heightened by a downturn in the housing market.

Mortgages with some of the characteristics of nontraditional mortgage products have been available for many years; however, they have historically been offered to higher-income borrowers. More recently, they have been offered to a wider spectrum of consumers, including subprime borrowers, who may be less suited for these types of mortgages and may not fully recognize the embedded risks. These borrowers are more likely to experience an unmanageable payment shock during the life of the loan, meaning that they may be more likely to default on the loan. Further, nontraditional mortgage loans are becoming more prevalent in the subprime market at the same time risk tolerances in the capital markets have increased. Banks need to be prepared for the resulting impact on liquidity and pricing if and when risk spreads return to more "normal" levels and competition in the mortgage banking industry intensifies.

Supervisors have also observed that lenders are increasingly combining nontraditional mortgage loans with weaker mitigating controls on credit exposures--for example, by accepting less documentation in evaluating an applicant's creditworthiness and not evaluating the borrower's ability to meet increasing monthly payments when amortization begins or when interest rates rise. These "risk layering" practices have become more and more prevalent in mortgage originations. Thus, while some banks may have used elements of the product structure successfully in the past, the easing of traditional underwriting controls and sales of products to subprime borrowers may have unforeseen effects on losses realized in these products.

In view of these industry trends, the Federal Reserve and the other banking agencies decided to issue the draft guidance on nontraditional mortgage products. The proposed guidance emphasizes that an institution's risk-management processes should allow it to adequately identify, measure, monitor, and control the risk associated with these products. It reminds lenders of the importance of assessing a borrower's ability to repay the loan including when amortization begins and interest rates rise. These products warrant strong risk-management standards as well as appropriate capital and loan-loss reserves. Further, bankers should consider the impact of prepayment penalties for ARMs. Lenders should provide borrowers with enough information to clearly understand, before choosing a product or payment option, the terms of and risks associated with these loans, particularly the extent to which monthly payments may rise and that negative amortization may increase the amount owed above the amount originally borrowed. Lenders should recognize that certain nontraditional mortgage loans are untested in a stressed environment; for instance, nontraditional mortgage loans to investors that rely on collateral values could be particularly affected by a housing price decline. Investors have represented an unusually large share of home purchases in the last two years. Past loan performance indicated that investors are more likely to default on a loan when housing prices decline, than owner occupants.

Wednesday, May 03, 2006

Housing Indicators

by Calculated Risk on 5/03/2006 11:15:00 PM

This graph displays the year-over-year percentage change for three housing indicators: New Home Sales, Existing Home Sales and the MBA Purchase Index. Only the Purchase Index has data for April.

Click on graph for larger image.

First, the monthly MBA Purchase Index shows the housing market is continuing to slide - even though the numbers rebounded somewhat in the most recent week.

Second, there is significant variability in the New Home Sales data. However, looking at a long term chart, the trend is definitely down.

Existing Home Sales are a trailing indicator because the sales are reported when escrow closes - about 30 to 60 days after the contract is signed.

Given this data, I expect further declines in the reported New and Existing Home sales for April.

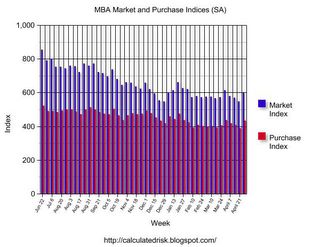

MBA: Mortgage Application Volume Rebounds

by Calculated Risk on 5/03/2006 10:25:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Rebounds

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 596.8, an increase of 8.8 percent on a seasonally adjusted basis from 548.6 one week earlier. On an unadjusted basis, the Index increased 9.6 percent compared with the previous week and was down 15.6 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 11.3 percent to 433.3 from 389.4 the previous week whereas the Refinance Index increased by 5.1 percent to 1565.6 from 1489.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.57 percent from 6.53 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.08 percent from 5.96 percent ...

| Total | -15.6% |

| Purchase | -10.1% |

| Refi | -24.0% |

| Fixed-Rate | -9.1% |

| ARM | -28.3% |

Even with the small rebound in mortgage activity, purchase applications are still off 10.1% from last year.