by Calculated Risk on 5/31/2006 02:11:00 PM

Wednesday, May 31, 2006

Fed Minutes: Inflation Risk Rising, Growth Slowing

Here are the minutes for the May 10th FOMC meeting. The members were worried about rising inflation and slowing growth:

Core inflation recently had been a bit higher than had been expected, and several members remarked that core inflation was now around the upper end of what they viewed as an acceptable range. Moreover, a number of factors were augmenting the upside risks to inflation: the surge in energy and commodity prices, some recent weakness in the foreign exchange value of the dollar, and the possibility that the apparent increase in inflation expectations could, if it persisted, impart momentum to inflation.And on housing:

...

At the same time, members also saw downside risks to economic activity. For example, the cumulative effect of past monetary policy actions and the recent rise in longer-term interest rates on housing activity and prices could turn out to be larger than expected.

The underlying pace of residential activity seemed to moderate in the first quarter. After unseasonably warm weather allowed a high level of single-family housing starts in January and February, starts fell in March to their lowest level in a year. New permit issuance for single-family homes also fell in March, continuing its downward trend. Multifamily starts recovered a bit in March from their low rate in February but remained well within their historical range. Home sales also declined, on net, in recent months. Although sales of existing single-family homes edged up in February and March, the level of sales for the first quarter as a whole was notably below the record high in the second quarter of last year. Sales of new homes also moved up in March, but their average in the first quarter was down substantially from the peak in the third quarter of last year. House price appreciation appeared to have slowed from the elevated rates seen over the past summer. Growth in the average sales price of existing homes in March, versus a year earlier, decelerated sharply, and the average price for new homes in March fell compared to a year earlier. In addition, other indicators, such as months' supply of both new and existing homes for sale and the index of pending home sales, supported the view that housing markets had cooled in recent months.

...

In their discussion of major sectors of the economy, some participants noted that growth of household spending was likely to slow over the remainder of the year. Anecdotal information pointed to some cooling of housing markets. That cooling was especially noticeable for high-end homes and for houses in markets that previously had experienced the steepest appreciation. Data on home sales, permits, and starts on the whole likewise suggested that activity was gradually diminishing. Some reports indicated that speculative building of homes had dropped off considerably, but inventories of unsold homes still seemed to be expanding. Although fresh comprehensive data were not available, home prices on average appeared still to be rising, but at a slower pace than over the past few years.

MBA: Mortgage Application Volume Declines

by Calculated Risk on 5/31/2006 10:44:00 AM

UPDATE: Also see Barry Ritholtz' Recent Housing Data: Charts & Analysis (with graphs from Northern Trust). This graph from NT's Asha Bangalore shows a longer term view of the MBA Purchase Index.

ORIGINAL POST: The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Declines

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 541.9, a decrease of 1.9 percent on a seasonally adjusted basis from 552.6 one week earlier. On an unadjusted basis, the Index decreased 2.6 percent compared with the previous week and was down 22.4 percent compared with the same week one year earlier.Mortgage rates increased slightly:

The seasonally-adjusted Purchase Index decreased by 0.2 percent to 395.5 from 396.4 the previous week whereas the Refinance Index decreased by 4.8 percent to 1409.0 from 1480.5 one week earlier....

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.66 percent from 6.61 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.09 percent from 6.02 percent ...

| Total | -22.4% |

| Purchase | -14.2% |

| Refi | -34.2% |

| Fixed-Rate | -19.4% |

| ARM | -28.5% |

Using the MBA weekly data, it appears purchase activity in May '06 will be about 15% below May '05.

Tuesday, May 30, 2006

NAR: Rents Expected to Rise 5%

by Calculated Risk on 5/30/2006 06:08:00 PM

The USA Today reports: Apartment rents expected to rise 5%

Apartment rents are expected to increase 5.3% this year - about double last year's increase - the National Association of Realtors says. That's the highest jump since 2000 ...The article offers these reasons:

"This is going to be the highest rental increase year since 2000, and it's going to be a broad-based increase in rents, not just limited to a few markets," said Hessam Nadji, who manages research for Marcus & Millichap, a real estate firm in Northern California.

• Job growth. U.S. businesses have generated 4 million new jobs in the past two years. New hires typically look for rental property.The first two reasons are weak. There is nothing special about 4 million new jobs over two years. This would only matter if the new supply of housing units didn't keep up with growth.

• Rising home prices. From 1980 to 2000, the median price of a home was 12 times higher than the annual average rent. By this spring, it was 21 times higher, Nadji said.

• Condo conversions. When the housing market was at its blazing peak, many investors who owned apartment buildings kicked out tenants and sold the units as condos. One out of three apartment buildings sold last year were converted into condos for sale. That took 191,400 apartments off the market, according to the NAR. In addition, the number of new apartment buildings under construction is down this year.

• Hurricane Katrina. About half the 100,000 displaced families in the New Orleans area haven't returned. Most of them were renters, says Lawrence Yun, an NAR economist, and "that's putting additional pressure on rental units throughout the country."

And the ratio of Price to Rent could fall without rents increasing; house prices could fall instead. For some reason the Realtors didn't mention this alternative!

The last two reasons make sense: there is less supply due to condo conversions and the destruction caused by Hurricane Katrina.

Fannie Mae's Berson on Housing

by Calculated Risk on 5/30/2006 09:44:00 AM

Fannie Mae Economist David Berson writes: Housing continues to weaken, although it's not collapsing.

Most of the latest data on housing activity show that this sector continues to weaken ... With mortgage rates edging upward, economic growth moderating, and home price appreciation slowing (and in some areas falling, thus reducing investor demand), the prospects of a bounce-back for the housing market this year appear to be dim.Here is a chart of New Home Sales through April:

...

Even with these declines in housing activity ... we continue to project the third strongest year ever for 2006 -- even with sales down by 7-10 percent. In fact, total home sales would have to decline by more than 20 percent in 2006 for sales this year to fall out of the top-three years -- highly unlikely in a non-recession year.

Click on graph for larger image.

As Berson noted, 2006 is on track to be the third strongest year ever behind 2005 and 2004. New Home Sales are off 11.2% YTD compared to 2005.

Berson's numbers are slightly different because he includes Existing Home Sales.

Monday, May 29, 2006

Barron's: The Big Glut

by Calculated Risk on 5/29/2006 12:24:00 PM

Barron's cover story is about the second home glut: The Big Glut

A couple of quotes:

"If you want to sell, you've got to go back to '04 prices," says Chip Harris of Coldwell Banker Previews International

"People don't believe in the laws of supply and demand anymore," says Alan Skrainka, chief market strategist at Edward Jones. "We're not saying it's a bubble, but we're saying prices are overstated and will likely correct 20% to 25% over four or five years."

Sunday, May 28, 2006

OFHEO: House Price Index

by Calculated Risk on 5/28/2006 04:49:00 PM

The Q1 OFHEO House Price Index will be released on Thursday, 10 A.M. EST. The headline number is the year over year price increase - and that will still be positive.

However, I expect the US and many Metropolitan Statistical Area's (MSA) might see negative Q1 appreciation declining prices. Those will be the interesting numbers.

Here are the last 3 quarters:

2005 Q2 3.65%So even if Q1 2006 shows

2005 Q3 3.14%

2005 Q4 2.86%

Click on graph for larger image.

"We've never had a decline in housing prices on a nationwide basis."

Ben Bernanke, July 29, 2005

The US hasn't seen

Housing: More Inventory

by Calculated Risk on 5/28/2006 01:00:00 AM

The Virginia MLS provides several charts of existing home inventory. The following chart is for Fairfax County:

Click on graph for larger image.

For other markets, see: Bubble Markets Inventory Tracking. Here are the number of listings for San Diego:

2/05: 8,500 (SD Union Tribune)

7/05: 14,176___7/05 sold: 4,765___7/04 sold: 5,658

8/05: 15,240___8/05 sold: 5,379___8/04 sold: 5,580

9/05: 16,081___9/05 sold: 4,935___9/04 sold: 5,177

10/05: 16,490__10/05 sold: 4,155___10/04 sold: 4,758

11/05: 16,072__11/05 sold: 3,937___11/04 sold: 4,350

12/05: 14,591__12/05 sold: 4,262___12/04 sold: 4,807

2006

1/1: 13,916

1/10: 14,840

1/20: 15,643

1/30: 16,161___1/06 sold: 2,763___1/05 sold: 3,324

2/10: 16,601

2/20: 16,981

2/28: 17,262___2/06 sold: 2,865__2/05 sold: 3,442

3/10: 17,648

3/20: 18,003

3/31: 18,261___3/06 sold: 4,146__3/05 sold: 5,018

4/10: 18,531

4/20: 19,069

4/22: 19,260

4/30: 19,480___4/06 sold: 3,705__4/05 sold: 5,345

5/10: 20,009

5/20: 20,617

5/23: 20,788

5/24: 20,836

5/25: 20,901

5/27: 21,106

Thursday, May 25, 2006

Core PCE

by Calculated Risk on 5/25/2006 06:05:00 PM

UPDATE: Dr. Altig has a great summary PCE Inflation: Not Horrible, Not Good. His take:

Which means, I think, that everyone walked away from the report believing just about what they believed before the report.

Since I will not be here tomorrow AM, and we are now "data dependent", here is the place to look for the core PCE:

News Release: Personal Income and Outlays. Right now this directs you to the release for March, but it take you to the April report after 8:30 AM ET on May 26th.

Check Table 9 for "PCE excluding food and energy". No matter what you think about reported inflation, this is one of the key numbers for the FED. According to Rex Nutting at MarketWatch, the market expectation is 0.2%.

Economists surveyed by MarketWatch are forecasting a 0.2% increase in core inflation after a 0.3% gain in March.A higher number will probably mean the FED is leaning towards another rate hike in June.

But even 0.2% has a pretty wide range. If its closer to 0.25% that is about 3% annualized (0.15% is about 1.8% annualized).

You can calculate the actual number using the Chain-type price indexes, also in Table 9. The math is simple: divide April by March and subtract 1. For March, the reported increase was .3%. The actual increase for March was 110.941 divided by 110.586 = 0.32% or 3.9% annualized.

Table 11 presents the annual increase (YoY) of core PCE.

There is one more CPI release (Jun 14, 2006) before the June 28/29 Fed meeting.

Finally, the Dallas Fed provides a slightly different measure: Trimmed-Mean PCE Inflation Rate. This will also be interesting to check (I'm not sure when they will release the data for April - but probably some time on Friday).

Best to all.

Slowing Job Market?

by Calculated Risk on 5/25/2006 12:13:00 PM

In addition to revised GDP and Existing Home Sales, there were a couple of employment related indicators released this morning.

For Initial Claims:

In the week ending May 20, the advance figure for seasonally adjusted initial claims was 329,000, a decrease of 40,000 from the previous week's revised figure of 369,000. The 4-week moving average was 337,000, an increase of 3,250 from the previous week's revised average of 333,750.The number to watch is the 4-week moving average, and this has been moving up for several weeks.

From the Conference Board: Help-Wanted Advertising Index

The Conference Board Help-Wanted Advertising Index – a key measure of job offerings in major newspapers across America – dipped two points in April. The Index now stands at 35. It was 39 one year ago.I think the recent economic data is fairly weak, so I'm leaning towards the FOMC pausing in June. Unless, of course, inflation keeps rising. And that brings us to tomorrow's key number - the FED's favorite inflation indicator - the core PCE price index.

The Conference Board, the global business research and membership organization, examines each month help-wanted ads in 51 newspapers and online.

In the last three months, help-wanted advertising declined in all nine U.S. regions. Steepest declines occurred in the West South Central (-16.0%), South Atlantic (-12.9%) and East North Central (-8.9%) regions.

Says Ken Goldstein, labor economist at The Conference Board: "The latest data shows that job advertising softened in April, both in print and online. ... If the labor market experiences some softening, it could be due to a slowing in pace in the overall economy."

Existing-Home Sales Slip

by Calculated Risk on 5/25/2006 11:31:00 AM

The National Association for Realtors (NAR) reports: Existing-Home Sales Slip in April

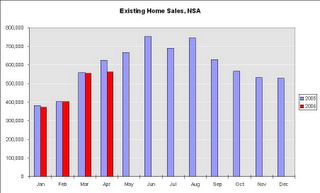

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – slipped 2.0 percent to a seasonally adjusted annual rate1 of 6.76 million units in April from a downwardly revised level of 6.90 million in March, and were 5.7 percent below the 7.17 million-unit pace in April 2005.

Click on graph for larger image.

This is the first month of 2006 that is significantly below the same month in 2005. April 2006 sales (NSA) were 10.1% below April 2005.

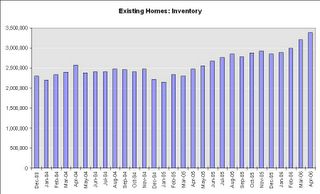

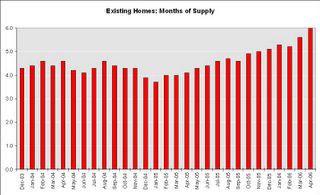

Total housing inventory levels rose 5.8 percent at the end of April to 3.38 million existing homes available for sale, which represents a 6.0-month supply at the current sales pace.

The months of supply continues to rise. Many agents feel 6 months of supply is the danger zone - any additional supply and prices will start to fall. Some areas, like Boston, have significantly more than 6 months supply, and prices are already starting to fall.

As a reminder: Existing Home Sales is a trailing indicator. The weakness in New Home Sales, the NAHB index, and the MBA Purchase Index all suggest fewer existing home sales in the coming months.

And now from the always optimistic Lereah:

"... our forecast model is showing a modest decline for the second quarter with sales leveling out before rising in the fourth quarter."

David Lereah, NAR’s chief economist