by Calculated Risk on 6/05/2006 10:49:00 AM

Monday, June 05, 2006

Expectations of a FED Pause Rise

From the Cleveland FED: Fed Funds Rate Predictions

Click on graph for larger image.

After the jobs report on Friday, market expectations are split almost evenly between a pause and one more 25 bps hike.

These are the same graphs that Dr. Altig used to present Monday (See Dr. Altig: Hawk Killer). Now the Cleveland Fed is updating these graphs daily.

Saturday, June 03, 2006

UCLA's Leamer: Housing a "Sick Sector"

by Calculated Risk on 6/03/2006 08:54:00 AM

From Lisa Girion at the LA Times: Weak Job Growth Raises Concerns

UCLA Anderson Forecast Director Edward Leamer said all the speculation about what the central bank and its new chairman, Ben S. Bernanke, should do about rates was folly because of a real estate slowdown that was well underway.A few more comments on the economy from the article:

"I don't think the Fed, at this point, has much control," Leamer said.

"We have a sick sector, the housing sector, and there's not a whole lot of medicine the Fed can provide."

Leamer's group sees declining home sales contributing to a broad economic slowdown that bottoms out at 2% growth and stays there for at least a couple of years.

"It's been a drunken party for several years," he said. "Now, we have to deal with the hangover."

"The slowdown is in place," wrote John Silvia, an economist at Wachovia Corp. "How much and how rapid remains an issue."

"There is now a growing body of evidence — especially among leading indicators — that a meaningful economic slowdown is underway and this will finally cause the Fed to hold" its benchmark short-term rate at 5%, said Bernard Baumohl, executive director of Economic Outlook Group.

"The economy is slowing fast," said Ian Shepherdson, chief U.S. economist at High Frequency Economics Ltd.

Friday, June 02, 2006

Standard Pacific Corp. Warns

by Calculated Risk on 6/02/2006 07:38:00 PM

Yawn ... another homebuilder warns: Standard Pacific Corp.

Net new home orders for the first two months of the 2006 second quarter were down 41% from the year earlier period, driven in large part by an increase in the Company's cancellation rate and continued softening of demand in many of the Company's larger markets. Orders were off in Southern California, Northern California, Florida and Arizona, up in Texas and Colorado and off slightly in the Carolinas. The Company's gross orders for the first two months of the 2006 second quarter were off 22% versus the year ago period.

In light of the decreased order levels for the first two months of the 2006 second quarter, the Company expects to lower its earnings and delivery guidance for the full year and will provide the updated guidance in conjunction with its regularly scheduled earnings release at the end of July.

Pulte Homes Warns

by Calculated Risk on 6/02/2006 05:35:00 PM

There are some interesting comments in this Reuters report: Pulte Homes cuts outlook on cooling housing market

Pulte Homes Inc. [No. 2 U.S. home builder] on Friday slashed its second-quarter and full-year profit outlook ...Blame the messenger is apparently wrong; a new survey today showed most homeowners are still optimistic about the housing market:

"There's a lot of inventory and the market's slowing," said Thomas Leritz, Argent Capital Management portfolio manager ... "Consumer sentiment is negative on housing," he added. "Every day you look at the newspaper, you read a magazine or watch TV, you see some comment about how the housing market is a bubble. People are scared."

...

Analysts expect the current quarter's results for home builders will be much weaker than last year's, when the U.S. housing boom peaked.

Despite signs of a real estate slowdown, American homeowners aren’t expecting a steep drop in the value of their properties, according to a survey released today by ING Direct...

• Nearly three-quarters of ... homeowners surveyed ... weren’t worried that there will be a downturn in the housing market ... Homeowners, on average, are anticipating a 4 percent increase in the value of their homes over the next 12 months...

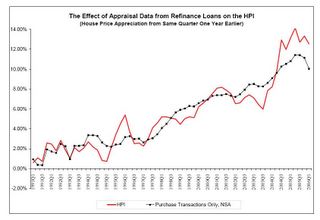

House Price Index: Effect of Appraisal Data

by Calculated Risk on 6/02/2006 03:43:00 PM

Reader ac suggests in the comments:

"[Could you] post an image of the graph (The Effect of Appraisal Data from Refinance Loans on the HPI) from page 4 of the 2006 Q1 OFHEO HPI data on your site?Here is the graph from the OFHEO HPI:

Seems like there's a lot of misinterpretation and misuse of the HPI data showing up in some media reports... an image of that graph might help with "educating" people.

I think it's clear now that the Q1 HPI numbers were pumped up by appraisals which apparently lag actual sales prices."

Click on graph for larger image.

From OFHEO:

"An important factor that has affected the HPI in some recent quarters is the influence of refinancings on the overall index. The figure below shows percent changes in the HPI for the United States as a whole over the prior four quarters compared with changes in an index constructed using only house prices associated with mortgages used for house purchases. The upward trend is the same, but the purchase-only index has accelerated much more smoothly. Over the past year, while the U.S. HPI has risen 12.54 percent, the purchase-only index has risen 10.04 percent."

And from the OC Register:

The report showed that Orange County home values increased by 2.95 percent in the first quarter of 2006 ... But numbers from other sources place Orange County's appreciation rate at much lower levels...As ac suggests, the HPI appears to be overstating appreciation in the most recent quarters due to the impact of cash-out refis.

Officials compiling the federal index agree their numbers may be overly optimistic. They cited a growing incidence of homeowners extracting cash from loans against their homes' increased value. That's something that may occur more often in homes that have appreciated the most, the agency said.

"Evidence suggests that the growing prevalence of cash-out refinances over the last year has had the effect of increasing measured appreciation rates for the HPI," the [OFHEO] said.

emphasis added.

Employment Report

by Calculated Risk on 6/02/2006 12:24:00 PM

Click on graph for larger image.

This graph shows employment growth for Bush's second term. So far job growth has been about as expected.

Kash has more: Employment Update

"Those who were employed actually worked fewer hours in May, and nominal earnings were stagnant after rising at a reasonable pace for the past several months (this means that real earnings fell, of course). All in all, this is a pretty lousy jobs report.And from Barry Ritholtz: NFP stinks -- and Some People Still Don't Get It

Does this provide evidence of a slowing economy? We'll need a few more months of weak job readings to tell for sure, but it's definitely starting to look like a real possibility."

"As unemployment starts ticking up, it will not be pretty. It suggests the next recession will be more severe than the last one."From Brad DeLong: A Non-High Pressure Labor Market

"Three percent productivity growth. Zero percent real wage growth. Not an economy near full employment feeling rising inflationary pressures from labor."

Housing: IRS Raps DAPs

by Calculated Risk on 6/02/2006 02:11:00 AM

Last year I wrote about the proliferation of DAPs (Downpayment Assistance Programs). Now the IRS has ruled that these are "scams".

From the WaPo: IRS Ruling Imperils 'Gift Fund' Charities For Home Buyers

A ruling by the Internal Revenue Service threatens to extinguish a fast-growing -- but controversial -- charitable industry that has funneled hundreds of millions of dollars in cash to first-time home buyers for their down payments.Lets do the math: If $500 Million is 3% of the purchase price, then this represented downpayments on about $16 Billion in transactions last year. OK, about 7 million existing homes were sold in 2005 at an average price of around $270K. So less than 1% of the total value of transactions last year used DAPs (even less when we add in New Homes) - but these are still marginal deals.

...

Under the system, sellers provide cash to the charities, which then give it to home buyers for their down payments. The sellers, who pay the charities a service fee, often recoup their money by charging a higher price for the homes -- usually 2 or 3 percent more, or an amount equal to the down payment, says a Government Accountability Office study.

...

The IRS called the programs "scams" in its ruling last month and said that by providing down payments, the charities actually inflated home prices, making it more likely that homeowners would default on their loans.

...

The charities say they move $500 million a year from sellers to buyers -- money that would disappear if many down payment assistance charities were put out of business.

"Almost anybody building for the first-time home buyer is using these programs," said David Ledford, staff vice president for housing finance and housing policy with the National Association of Home Builders. "Builders are concerned about what would happen not just in the future but for buyers who have already qualified and are going through a sale but who have not closed yet."

Thursday, June 01, 2006

May: Record YTD Increase in National Debt

by Calculated Risk on 6/01/2006 02:09:00 PM

For the first eight months of the 2006 fiscal year (starts Oct 1st), the National Debt has increased $424.1 Billion. The previous record was $413.2 Billion for the first eight months of fiscal 2004.

Click on graph for larger image.

As a percent of GDP, the deficit has improved slightly over the last few years.

The annual increase in the debt is running around 4.5% to 5.0% of GDP. This is a classic "structural budget deficit" or "high employment deficit" - something most economists believe should be avoided.

If someone says the deficit is falling - laugh (or cry). Its not true. Here are some recent delusional comments:

"[Hank Paulson] will work closely with Congress to help restrain the spending appetite of the federal government and keep us on track to meet our goal of cutting the deficit in half by 2009."

George W. Bush, May 30, 2006

"That surge in government receipts, along with the strict control on spending that you've advocated, are putting us on a path to not only meet your deficit-reduction target but to do so ahead of schedule."

Treasury Secretary John Snow, May 30, 2006

OFEHO: House Price Increases Continue; Some Deceleration Evident

by Calculated Risk on 6/01/2006 10:02:00 AM

The Office of Federal Housing Enterprise Oversight (OFHEO) released the Q1 2006 House Price Index.

House Price Increases Continue; Some Deceleration Evident

OFHEO House Price Index Shows Annual Rise of 12.5 Percent

WASHINGTON, D.C. – U.S. home prices were 12.54 percent higher in the first quarter of 2006 than they were one year earlier. Appreciation for the most recent quarter was 2.03 percent, or an annualized rate of 8.12 percent. The quarterly rate is about one percentage point below the rate from the previous quarter and is the lowest rate since the first quarter of 2004. The figures were released today by OFHEO Acting Director James Lockhart, as part of the House Price Index (HPI), a quarterly report analyzing housing price appreciation trends.

“These data show average housing prices still growing stronger than some might have expected,” said Lockhart. “They do indicate, however, that price growth is moderating in some parts of the country, particularly in areas where prices have been rising the most.”

House prices continued to grow considerably faster over the past year than did prices of non-housing goods and services reflected in the Consumer Price Index. House prices rose 12.5 percent, while prices of other goods and services rose

only 4.2 percent.

“Increasing sales inventories are apparently giving buyers greater bargaining power, while increasing interest rates are dampening demand," said OFHEO Chief Economist Patrick Lawler.

Click on graph for larger image.

As noted, the quarterly appreciation slowed - but not as much as I had expected.

From a bubble perspective, three of the most closely watched cities have been Boston, Sacramento and San Diego - all three have shown signs of a housing slowdown.

Boston prices increased 0.51% in Q1 2006 and 5.6% for the year.

Sacramento prices increased -0.24% for the quarter, and 13.2% for the year.

San Diego prices increased 0.23% for the quarter, and 8% for the year.

The housing slowdown is starting to show up in the prices for these areas.

Wednesday, May 31, 2006

Reuters on Housing Slowdown

by Calculated Risk on 5/31/2006 03:26:00 PM

Reuters reports: US housing slowdown well under way, set to drag on

America's booming housing market has clearly slowed ...

...

"I think that the housing market actually crested in the fall of 2005 and we've been in a gradual cool-down," said Frank Nothaft, chief economist at mortgage finance company Freddie Mac.

...

So far this year, total home sales are 3.9 percent below the first four months of 2005. And despite surprising gains in March and April, sales of newly built homes are down too versus a year ago, according to the Mortgage Bankers Association.

That trade group's data also show fewer people are applying for mortgages. In fact, purchase applications year to date are down 10 percent from the comparable period in 2005.

"We're running at about 2003 levels," said Mike Fratantoni, senior economist at the Mortgage Bankers Association. "It's still a pretty strong purchase market, but not nearly as strong as it was in '04 or '05."

The number of houses up for sale offers a telling sign too, said Jeff Taylor, the National Association of Federal Credit Unions' senior economist.

Indeed, inventories are soaring. The number of new homes and existing houses on the market both hit records in April, according to the National Association of Realtors and the U.S. Commerce Department.

At the current sales pace, the number of homes up for resale amounted to a six-month supply -- the largest in more than eight years.