by Calculated Risk on 6/22/2006 10:21:00 PM

Thursday, June 22, 2006

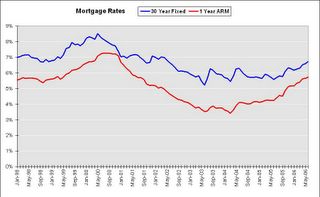

Mortgage Rates

Freddie Mac reported: One-Year ARM At Highest Level In Almost Five Years

Freddie Mac [reported] the 30-year fixed-rate mortgage averaged 6.71 percent ... The 30-year FRM has not been higher since May 31, 2002, when it averaged 6.76 percent.

...

One-year Treasury-indexed ARMs averaged 5.75 percent this week ... The 1-year ARM has not been higher since August 3, 2001, when it averaged 5.77 percent.

Click on graph for larger image.

Rates are now back to 1998 levels.

Will we see 7% for the 30-year fixed this summer?

Popular Internet Properties

by Calculated Risk on 6/22/2006 11:10:00 AM

I found this interesting: Social Networking Sites Continue to Attract Record Numbers. The press release also has some statistics on the top internet properties (in addition to Social Networking).

Its not really surprising that Yahoo! is the top property for internet users. I was surprised (see table 4) at how many unique visitors use Monster.com (#14 Overall) and CareerBuilder (#27) every month. Were 30 million Americans really looking for a new job in May? I suppose it is free to look, and the opportunity costs are negligible.

And I'm not familiar with Myspace, Facebook, Classmates, etc. I'm probably not in the right demographic!

When I checked out YouTube, my first search was for the Columbia Business School Spring 2006 Follies spoof of Ben Bernanke (probably says something about me).

Then I searched for Volcker - nothing. Hmmm ... maybe this will give me an opportunity to to post a video on Youtube. It is always fun to try out a new free service.

So I wrote to Stanford for permission to post the video of Volcker's speech of February 2005 at the Stanford Institute for Economic Policy Research. The answer was "Thank you for the inquiry. However, at this time we are unable to authorize use of this material outside SIEPR." I wasn't surprised by the answer, but I think it is a mistake for Stanford not to allow the video to be posted on Youtube. NOTE: If you haven't seen Volcker's speech, it is worth watching.

So I had another idea. Sasha has just filmed a new commercial for Simply Saline, so I wrote the company asking for permission to post the commercial. (The mpg file is here) No response yet. This does raise some interesting compensation and quality issues - and probably other issues I haven't considered.

Since I haven't posted any videos yet, I'll leave you with this:

FED Study: Price of Residential Land

by Calculated Risk on 6/22/2006 10:24:00 AM

From FED economists Dr. Morris A. Davis and Dr. Michael G. Palumbo: The Price of Residential Land in Large U.S. Cities

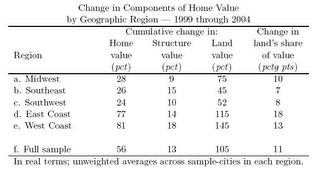

"[A] striking result is just how widespread the strength of land prices has been in the current housing boom — taken to have begun at the end of 1998. We show that in 43 of the 46 large metropolitan areas in our sample, a rapid pace of land price appreciation has pushed up land’s share of home value markedly in just the past six years."

Click on table for larger image.

This table from the Fed study shows that land values have increased significantly more than the value of the structure over the last few years. This has been especially evident along the East and West coasts.

But with land prices, what goes up, can also go down:

"... though residential land has appreciated significantly, on net, over the past past twenty years, for most large metro areas the path has been more of a roller coaster ride than a steady upward march. Indeed, we show that 39 of the 46 cities in our sample have experienced a clear peak in the real residential land price index, and in many of these cities it has taken 10 years or more for land prices to fully recover from their previous troughs."The implication is that home prices may be more volatile in the future:

"... the implication of our data and analysis that, with residential land having appreciated so significantly over the past twenty years around the country, the future course of land prices is expected to play an even more prominent role in governing home prices — in terms of average appreciation rates and volatility — in the next two decades."

Wednesday, June 21, 2006

DQNews: Bay Area home sales continue to drop, prices reach new peak

by Calculated Risk on 6/21/2006 05:39:00 PM

DataQuick reports: Bay Area home sales continue to drop, prices reach new peak

Sales of Bay Area homes declined for the fourteenth month in a row in May as prices continued to slowly edge up ...

A total of 9,064 new and resale houses and condos were sold in the nine-county region last month. That was up 8.4 percent from 8,358 for April, and down 19.8 percent from 11,308 for May last year, according to DataQuick Information Systems.

Last month was the slowest May since 2001 when 7,864 homes were sold. The strongest months of May since 1988 were May 2004 with 12,028 sales, and last year. May sales hit bottom in 1995 with 5,779.

...

The median price paid for a Bay Area home was $631,000 last month, another record. That was up 0.5 percent from April's $628,000, and up 6.1 percent from $595,000 for May a year ago.

UCLA on Housing

by Calculated Risk on 6/21/2006 11:53:00 AM

UCLA Anderson Forecast Calls for Real Estate Slowdown in California; No Statewide or National Recession Seen

In its second quarterly report of 2006, the UCLA Anderson Forecast anticipates a slowdown in real estate across the United States and in California. But absent other factors that historically precede recessionary conditions nationally and in the state, no recession is foreseen.

The national forecast

In the latest report, released to the public today, UCLA Anderson Forecast Director Edward Leamer frames his forecast in an essential question: "(Will) housing difficulties be amplified by problems elsewhere in the economy, producing a nasty recession, or will the pathology be mostly contained in the real estate sector (including construction, real estate brokers and mortgage brokers)?"

He concludes that the problems will likely be confined to the real estate sector and will not produce a national recession.

Leamer, who does not expect real estate prices to fall significantly, notes that sales volume is what typically drops, and drops more precipitously than prices, as the price cycle lags behind the volume cycle. The number of homes sold will drop as owners decline to sell in a weak housing market. Prices, however, should hold. The real decline in the housing market, Leamer says, will come in "residential investment," which includes construction of new homes, repair and remodeling, and brokerage commissions on the sale of new and existing homes.

But according to Leamer, the decline in residential investment and the associated decline in construction employment will not be matched by a decline in manufacturing employment, as the latter has not yet recovered from the recession of 2001. Unless there is a decline in manufacturing employment, the national economy will avoid recession in what Leamer calls "a close call."

The California forecast

The California forecast, by economist Ryan Ratcliff, takes note of the state's slowing real estate markets. Ratcliff concludes that the real estate slowdown will lead to a flat housing market and a slower economy.

"We do not predict a recession, nor do we predict a substantial decline in average nominal home prices," Ratcliff says. "This forecast it based on two arguments. There is not enough vulnerability in the usual sources of employment loss to create a recession, and the historical record suggests that average home prices do not usually fall without this kind of job loss."

As in the national forecast, Ratcliff is acknowledging declines in real estate and associated job losses in real estate-sensitive sectors. But absent job losses in manufacturing or other sectors, there will be no recession, he says.

Ratcliff does note the possibility of some downside risk to the forecast, however, due to the potential impact of exotic real estate financing and uncertainties about the effects of home prices on consumption.

About the UCLA Anderson Forecast

The UCLA Anderson Forecast is one of the most widely watched and often-cited economic outlooks for California and the nation, and was unique in predicting both the seriousness of the early-1990s downturn in California, and the strength of the state's rebound since 1993. Most recently, the forecast is credited as the first major U.S. economic forecasting group to declare the recession of 2001.

MBA: Mortgage Rates Increase, Application Volume Steady

by Calculated Risk on 6/21/2006 10:17:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Increase, Application Volume Steady

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 567.6, a decrease of 0.8 percent on a seasonally adjusted basis from 571.9 one week earlier. On an unadjusted basis, the Index decreased 1.6 percent compared with the previous week and was down 26.8 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index increased by 0.1 percent to 414.8 from 414.6 the previous week and the Refinance Index decreased by 2.2 percent to 1466.1 from 1499.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.73 percent from 6.61 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.22 percent from 6.09 percent ...

| Total | -26.8% |

| Purchase | -13.2% |

| Refi | -43.1% |

| Fixed-Rate | -25.6% |

| ARM | -29.5% |

Although mortgage activity is above its recent lows, purchase activity remains significantly below 2005 levels.

Tuesday, June 20, 2006

DataQuick: SoCal Housing Sales at '99 Pace

by Calculated Risk on 6/20/2006 03:22:00 PM

DataQuick reports: Southland home sales slow to 1999 pace, prices leveling off

Home sales in Southern California slowed for the sixth month in a row, making last month the slowest May since 1999. Homes are appreciating in value at their slowest pace in almost six years ...According to DataQuick, prices for Southern California remained unchanged from last month, and up 6.4% from May 2005.

...

While last month was the slowest May since 1999 when 25,404 homes were sold, sales were still above the May "average" May of 24,857 (going back to 1988). The strongest May was in 2002 when 32,391 homes were sold, the slowest was in 1993 when 15,001 were sold.

UPDATE: LA Times on DataQuick report: SoCal Home Sales Decline

Monday, June 19, 2006

Budget Lies

by Calculated Risk on 6/19/2006 04:42:00 PM

I just added a post to Angry Bear: Budget Metrics and the Cheating Clotheshorse

The bottom line: Bush has made no progress on the budget deficit.

NAHB: Builder Confidence Falls to 11 Year Low

by Calculated Risk on 6/19/2006 01:27:00 PM

The National Association of Home Builders (NAHB) reports: Builder Confidence Declines In June (update: add graph)

Click on graph for larger image.

The [Housing Market Index] HMI declined four points from an upwardly revised reading in the previous month to hit 42 for the latest report, its lowest mark since April 1995.

"Based on historical experience, particularly the 1994-95 episode, the pronounced pattern of movement in the HMI is not inconsistent with the reasonably orderly cooling-down process we’re projecting for home sales and single-family housing starts in 2006,” said NAHB Chief Economist David Seiders. “We now expect new-home sales to be off by 13 percent from the record posted in 2005. Single-family starts, supported by large builder backlogs of unfilled orders and some continuing reconstruction in the wake of last year’s hurricanes, should be down by about 9 percent from the 2005 record."

"These forecasts naturally are subject to a considerable degree of risk," added Seiders. "The downside risks include the potential for large numbers of sales cancellations and re-sales by the investor/speculator group as well as more aggressive tightening of monetary policy than we’re assuming in our baseline forecast."

...

All three component indexes declined in June, falling to their lowest levels since early 1995. The index gauging current sales was down three points to 47, while the index gauging sales expectations for the next six months fell five points to 50 and the index gauging traffic of prospective buyers declined four points, to 29.

The decline in builder confidence was broad-based and registered in every region this month. The HMI fell seven points to 40 in the Northeast, four points to 25 in the Midwest, two points to 49 in the South and one point to 61 in the West. These regional indexes are all down by similar amounts from their 1995 highs, and the relatively low levels for the Midwest and Northeast reflect relatively weak economic conditions in those parts of the country.

Sunday, June 18, 2006

Housing: "Fear" Grips Arizona

by Calculated Risk on 6/18/2006 10:38:00 PM

The Arizona Republic reports: How low will it go?

Greed drove metropolitan Phoenix's home prices and sales to new records in 2005. Fear is driving the market this year.An excellent article.

...

"There's a psychological umbrella of fear in Phoenix's housing market now," said Tim Sullivan, a national housing analyst with San Diego-based Sullivan Group. "Buyers are uncertain."

...

With the housing industry accounting for at least one of every three dollars generated in the Valley's economy, any slowdown will hurt. Consumers will be particularly vulnerable: Analysts say the demand for Valley homes and housing prices both were hyperinflated by 25 to 30 percent last year, mostly because of investors.

"My sense is the worst is behind us, and the housing market will have stabilized with smaller jumps in listings and more steady sales by October," said John Foltz, president of Realty Executives.Maybe. But I think this is just the beginning ...