by Calculated Risk on 7/12/2006 11:08:00 AM

Wednesday, July 12, 2006

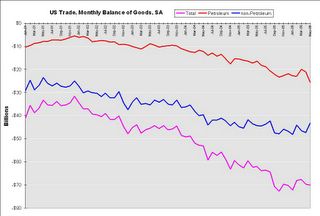

May Trade Deficit: $63.8 Billion

The Census Bureau reports:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that total May exports of $118.7 billion and imports of $182.5 billion resulted in a goods and services deficit of $63.8 billion, $0.5 billion more than the $63.3 billion in April, revised. May exports were $2.7 billion more than April exports of $115.9 billion. May imports were $3.2 billion more than April imports of $179.3 billion.For an excellent analysis See Dr. Setser's: How long can non-oil imports remain flat if the US economy continues to grow?

Click on graph for larger image.

The non-Petroleum goods balance has stabilized since the end of last year. This might suggest that US economic growth is slowing. From a post in March:

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."

Alan Greenspan, Current account, Feb 4, 2005

I expect the annual increase in mortgage debt to decline in 2006. This is because I expect new and existing home purchases to decline, and homeowners to extract less equity from their homes in 2006.

The drop in mortgage activity is is one of the reasons I expect the trade deficit to stabilize in 2006.

MBA: Mortgage Application Volume Steady

by Calculated Risk on 7/12/2006 10:21:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Steady

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 566.8, an increase of 1.0 percent on a seasonally adjusted basis from 561.0 one week earlier. On an unadjusted basis, the Index decreased 29.1 percent compared with the previous week and was down 36.3 percent compared with the same week one year earlier.Mortgage rates increased slightly:

The seasonally-adjusted Purchase Index increased by 2.6 percent to 425.0 from 414.2 the previous week and the Refinance Index decreased by 1.6 percent to 1400.5 from 1423.9 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.81 percent from 6.80 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.41 percent from 6.39 percent ...

| Total | -36.3% |

| Purchase | -23.4% |

| Refi | -52.0% |

| Fixed-Rate | -37.0% |

| ARM | -34.5% |

Purchase activity is off 23.4% compared to the same week last year. The MBA Purchase Index is indicating that the housing market is continuing to slow compared to 2005.

Tuesday, July 11, 2006

The Press and the Budget Deficit

by Calculated Risk on 7/11/2006 06:24:00 PM

With the White House announcement today that the deficit will be smaller than they expected, it is worth looking at how the story is being reported.

Joel Havemann, at the LA Times, does a solid job: Bush Credits Tax Cuts for Deficit Shrinkage

President Bush today delivered what he called "some good news for the American taxpayer" — a budget update that shows the deficit for this year shrinking from the $423 billion forecast five months ago to $296 billion now.Notice how Havemann correctly notes this is an improvement in the "forecast". The Bush Administration routinely overestimates the deficit and then touts their "improvement". Havemann offers the opposing view:

Rep. John Spratt of South Carolina, the top Democrat on the House Budget Committee, pointed out that when Bush came into office in January 2001, the official White House budget projection showed a $305-billion surplus. So the new projected deficit of $296 billion represents a swing of $600 billion, Spratt said.Although I'd prefer a comparison of the General Fund deficit for '01 and '06 (it would be a larger swing since annual Social Security revenues have been increasing), this still shows the damage done to the US fiscal position by the Bush tax cuts.

And Havemann pulls up some old Bush projections:

In 2002, the White House estimated that revenues would reach $2.5 trillion in 2006 under the tax laws then in effect. The revenue re-estimate issued today was $2.4 trillion. ...Spending in 2006 was projected in 2002, based on laws then in effect, to reach about $2.2 trillion; it is now estimated at $2.7 trillion.Well done. An excellent article.

From the WaPo: Budget Deficit Estimate Drops to $296B. After quoting Mr. Bush, the article offers the opposite view:

Congressional Democrats blasted Bush's speech, saying that the deficit remains too large and charging that the administration put out a gloomy early forecast in order to claim better-than-expected results later on.And they properly note:

... the White House acknowledges that in the long run, the nation's fiscal outlook remains bleak. ... "The projections are that the Social Security surplus will peak in 2010, and diminish every year thereafter, so ultimately, instead of collecting 5 cents on the national dollar and paying out 4 1/2 cents, we will continue to collect 5 cents and pay out 7 cents," [Douglas Holtz-Eakin, a former CBO director and Bush White House economist.] said. "And that's the good news. The bad news is Medicare. The demands on the Treasury go from 4 cents on the national dollar to 22 cents in the next 50 years."The outlook is bleak, primarily because of General Fund issues: the structural General Fund deficit and Medicare. In comparison, Social Security is a minor problem. But at least the former Bush economist is being honest about the outlook: bleak.

The WaPo also notes some of the reasons for the improvement:

Among the fastest-growing types of revenue were corporate income taxes, which rose 26 percent in the nine months ending June 30, according to the CBO. ... Another major source of revenue growth were taxes that are not withheld from paychecks, typically capital gains and year-end bonuses for Wall Streeters and other upper-income people. Revenue from those types of taxes has risen 20 percent, compared with 8 percent for taxes withheld from the paychecks of salaried employees.Since the authors are discussing the Unified Budget deficit, they should note that the annual Social Security surplus has been increasing significantly, contributing to the improvement. They should also note the improvement in the legally mandated budget deficit (the General Fund) has been minor.

The bad news is profit growth appears to be slowing, and the housing bubble is starting to unwind (impacting not withheld tax revenues next year). In my yearly projections, I noted: "Although I expect the General Fund deficit to grow to around $600 Billion in 2006, I don't think it will become a huge story until '07 or '08." My reasoning was the impact of a slowing economy would impact next year's corporate profits and 'not withheld' tax revenues.

Overall these stories are pretty good. I'd prefer switching to the General Fund (as required by law), but that is going to take some work.

Stiglitz: A New Agenda for Global Warming

by Calculated Risk on 7/11/2006 04:16:00 PM

Dr. Stiglitz proposes in the Economists’ Voice: A New Agenda for Global Warming. Dr. Stiglitz proposes a global environmental tax:

There is a second problem with Kyoto: how to bring the developing countries within the fold. The Kyoto protocol is based on national emission reductions relative to each nation’s level in 1990. The developing countries ask, why should the developed countries be allowed to pollute more now simply because they polluted more in the past? In fact, because the developed countries have already contributed so much, they should be forced to reduce more. The world seems at an impasse: the United States refuses to go along unless developing countries are brought into the fold; and the developing countries see no reason why they should not be allowed to pollute as much per capita as the United States or Europe. Indeed, given their poverty and the costs associated with reducing emissions, one might give them even more leeway. But, given their low levels of income, that would imply that no restraints would be imposed on them for decades.Now that the scientific debate concerning Global Warming is over (it is over except for the industry shills), it is now time to consider policies to reduce pollutants. This proposal seems like an excellent alternative to Kyoto.

There is a way out, and that is through a common (global) environmental tax on emissions. There is a social cost to emissions, and the common environmental tax would simply make everyone pay the social cost. This is in accord with the most basic of economic principles, that individuals and firms should pay their full (marginal) costs. The world would, of course, have to agree on assessing the magnitude of the social cost of emissions; the tax could, for instance, be set so that the level of (global) reductions is the same as that set by the Kyoto targets.

As technologies evolve, and the nature of the threat of global warming becomes clearer, the tax rate could adjust, perhaps up, perhaps down. ... each country could keep its own revenues and use them to replace taxes on capital and labor: it makes much more sense to tax "bads" (pollution,like greenhouse gas emissions) than to tax "goods," like work and saving. (Economists refer to these taxes as corrective taxes.) Hence, overall economic efficiency would be increased by this proposal. The big advantage of taxation over the Kyoto approach is that it avoids most of the distributional debate. Under Kyoto, getting the right to pollute more is, in effect, receiving an enormous gift. (Now that pollution rights are tradeable, we can even put a market value on them.) The United States might claim that because it is a larger country, it “needs” more pollution rights. Norway might claim that because it uses hydroelectric power, the scope for reducing emissions is lower. France might claim that because it has already made the effort to go into nuclear energy, it should not be forced to reduce more. Under the common tax approach, these debates are sidestepped. All that is asked is that everyone pay the social cost of their emissions, and that the tax be set high enough that the reductions in emissions is large enough to meet the required targets. The economic cost to each country is small—in some cases, actually negative.

Monday, July 10, 2006

Record Household Debt Service

by Calculated Risk on 7/10/2006 07:43:00 PM

Please see my post on Angry Bear: Record Household Debt Service

Growing Concern: Default rate of 'piggyback' loans

by Calculated Risk on 7/10/2006 12:38:00 PM

From the LA Times: Default rate of 'piggyback' loans spurs Wall Street to action

Wall Street is sounding the alarm on one of the most popular ways to buy a house in many high-cost areas around the country — so-called "piggyback" programs that mesh first mortgages with second-lien credit lines or mortgages.And a mention of the new nontraditional mortgage guidance:

As of July 1, the most influential ratings agency in the mortgage arena, Standard & Poor's Corp., has upped the ante for lenders who fund piggyback deals. The move is likely to raise interest rates and fees for some home purchasers this summer, say mortgage experts, and could reduce the volume and availability of piggyback programs overall.

The reason for the change, according to Standard & Poor's credit analyst Kyle Beauchamp, is that an exhaustive study of piggyback loans found them anywhere from 43% to 50% more likely to go into default than comparable stand-alone first-lien purchase transactions.

More ominous still for the piggyback market: Federal financial regulators are expected to issue guidelines for lenders within the next few months that will force them to throttle back on piggybacks, payment-option loans and interest-only loans to borrowers with marginal credit scores and incomes.The regulatory agencies will eventually close the barn door; too bad the cow is long gone. I'm surprisd it has taken so long for the rating agencies (like S&P) to catch on.

Friday, July 07, 2006

Housing: Ohio and Kentucky

by Calculated Risk on 7/07/2006 07:13:00 PM

The AP reports: Dominion Homes 2nd-Quarter Sales Slip 46 Percent on Cooling Real Estate Climate

Dominion Homes Inc., which sells homes and offers mortgage financing services, said revenue from home sales dropped 46.2 percent in the second quarter, compared with the same period last year.This would be no surprise in Florida, Boston, Phoenix or SoCal, but ...

The homebuilder said the decline in sales, deliveries and backlog reflects the cooling residential real estate climate in the company's markets, primarily central Ohio and the Louisville, Ky., area.I believe the housing slowdown is geographically widespread; not just on the coasts.

General Fund Deficit

by Calculated Risk on 7/07/2006 04:26:00 PM

Reader Steve points out that according to the Monthly Treasury Statement for May (June will be released soon), the YTD General Fund deficit has fallen slightly from fiscal year '05. He takes exception to my comment: "If someone says the deficit is falling - laugh (or cry). Its not true."

Of course I'm tracking the annual increase in the National Debt, and that is not falling. For the National Debt, the YTD annual increase in '06 is greater than in '05. See: June: Near Record Increase in National Debt

Last year on Angry Bear I pointed out the difference between the different methods of tracking the deficit: Another Budget, Another Disaster

Click on graph for larger image.

Note: Graph from last year.

There are at least three methods of presenting the deficit; the first is the “Unified Budget” that includes the annual surplus from Social Security Insurance (and the miniscule Postal Service Fund) in the total. The second is the “General Fund Budget” (the most used) that excludes the SS Insurance surplus, but includes surpluses from Military Retirement, Federal Employee Retirement and many other smaller trust funds. The third approach (my favorite) is to use the annual increase in the National Debt as the annual deficit.As noted, the Unified Budget is worthless as a measuring tool. I'll stick to my favorite measure, but I'll also include the MTS report on the General Fund deficit.

Employment Report

by Calculated Risk on 7/07/2006 12:11:00 PM

Click on graph for larger image.

This graph shows cumulative employment growth for Bush's second term. So far job growth has been about as expected.

Construction employment showed a slight decline in June. The construction declines were in 'Residential building' and 'Residential specialty trade contractors', finally showing a slight impact from the housing slowdown.

Rex Nutting reported for MarketWatch: Jobs report not as weak as it looks

The U.S. labor market was stronger in June than indicated by the tepid 121,000 growth in nonfarm payrolls.

The data from the Labor Department released Friday paint a muddled picture. While job growth of 121,000 was less than the 175,000 expected by economists and far less than the 390,000 projected by the ADP index, other aspects of the report show a healthier labor market. See full story.

"Everything else in the report showed strength," said David Greenlaw, an economist for Morgan Stanley.

In contrast to the weak payroll survey, the household survey showed robust job growth of 387,000 in June, keeping the unemployment rate at a very low 4.6%. The number of hours worked rose smartly, and average pay increased. The number of people who've been out of work longer than six months dropped by 217,000 to 1.1 million. The labor force participation rate rose by a tenth of a percentage point to 66.2%

Thursday, July 06, 2006

San Diego Housing Market

by Calculated Risk on 7/06/2006 10:58:00 PM

Some anecdotal info on the San Diego housing market:

I spoke to a top real estate agent in San Diego this evening. She has been selling Real Estate since the mid-'80s. She told me the last couple of months have been the slowest of her career; even slower than the early '90s.

She said Standard Pacific called her and offered a 5% commission on any new home. Usually SPF just offers a small finders fee. She also said the builder offered substantial upgrades to any buyer. Last year these homes would have sold immediately - now they can't find buyers.

Finally she said there is heavy discounting in the existing home market and she is surprised the price declines have not shown up in the official numbers yet.