by Calculated Risk on 7/21/2006 11:38:00 AM

Friday, July 21, 2006

California Assn. of Realtors: Not 'Soft Landing'

David Streitfeld writes in the LA Times: Housing Expert: 'Soft Landing' Off Mark. Excerpts:

The chief economist of the California Assn. of Realtors has stopped using the term "soft landing" to describe the state's real estate market, saying she no longer feels comfortable with that mild label.On Real Estate agents, just see my previous post!

...

For real estate optimists, the phrase "soft landing" conveyed the soothing notion that the run-up in values over the last few years would be permanent. It wasn't a bubble, it was a new plateau.

The Realtors association last month lowered its 2006 sales prediction from a 2% slip to a 16.8% drop. That was when Appleton-Young first told the San Diego Union-Tribune that she didn't feel comfortable any longer using "soft landing."

...

If there's one group in California still unreservedly bullish on real estate, it might be the throngs lining up to take the licensing exams.

The state Department of Real Estate recently reported that the total number of agents in the state passed 500,000 in May for the first time. That's one agent for every 55 adults in the state.

Appleton-Young had no qualms about predicting a hard landing here: "We're expecting a fairly significant shakeout."

Thursday, July 20, 2006

California: Real Estate Licensees Surpasses 500,000

by Calculated Risk on 7/20/2006 11:55:00 PM

The California Department of Real Estate reports the total number of Real Estate licensees reached 504 thousand in the state at the end of June 2006. This is an increase of 55,000 agents / brokers over the last 12 months.

Click on graph for larger image in new window.

The number of Salesperson licensees has reached 336.7 thousand, a 14% increase over one year ago.

The number of Broker licensees is 137.4 thousand; 8% higher than last year.

The second graph shows the annual growth rate for the number of salesperson and broker licensees.

In California, the number of real estate transactions peaked last year, but the number of licensees continues to grow.

Husing: Soft Landing for Inland Empire Housing

by Calculated Risk on 7/20/2006 07:48:00 PM

Private economist Dr. John Husing is quoted in the San Bernardino Sun: Husing still optimistic

There's just too strong an economy and too much job growth for much other than the "soft landing'' Husing and other economists have been predicting for the end of the five-year housing boom.

"We are right on the cusp of a very powerful period in job growth,'' Husing said. "Local [Inland Empire, San Bernardino/Riverside area] unemployment in May was 4.2 percent, and that's the lowest I have seen for May in 42 years of studying the local economy.

...

Senior economist Christopher Thornberg of UCLA's Anderson School of Management had called the soft-landing theory "nonsense'' on Tuesday and said we are in a "classic bubble.''

"If we are lucky, prices will go flat,'' he said, suggesting that we could see five years without price appreciation.

That may be true elsewhere, Husing said, but it won't happen here.

"Is the housing market vulnerable?'' he asked. "Yes, it is. But is a bubble likely to happen? No, it is not. The underlying strength of our economy is too great.''

Click on graph for larger image.

I disagree with Dr. Husing. I think the Inland Empire is one of the most vulnerable areas to a housing slowdown. Construction is far more important to the San Bernardino/Riverside economy than most other areas of the state.

As the homebuilders start to layoff workers, a larger percentage of workers in the San Bernardino and Riverside area are at risk. During the previous housing bust, the Inland Empire unemployment rate rose from 4.9% to over 12% (NSA) in just three years.

With regards to timing, I noted earlier:

Historically Construction Employment continued to rise for a year or more after the peak in housing transactions.So I expect construction employment in the Inland Empire to start to fall during the next couple of quarters.

UPDATE: DoD Employment as Percent of Nonfarm Employment.

A common question is: how much did the aerospace / DoD spending slowdown in the early '90s impact employment? Although I don't have aerospace data (I'll look), this graph shows DoD employment was far more important for San Diego than the Inland Empire.

DoD and aerospace were probably most important for LA and San Diego in the '90s

Note that DoD employment was far less than construction employment. Also, DoD employment only fell slightly faster than total employment in the early '90s. Construction employment fell sharply. DoD employment was fairly flat during the mid-90s, so the percentage of total employment continued to fall as the California economy added jobs.

Although the aerospace slowdown probably precipitated the general economic slowdown in California during the early '90s, the housing slowdown had a larger impact. This time, many of us are suggesting that the housing slowdown will most likely be the precipitating event.

Thornberg: Housing a "Classic Bubble"

by Calculated Risk on 7/20/2006 01:32:00 AM

UCLA Economist Christopher Thornberg is quoted in the San Bernardino Sun: Region's home sales looking like 'classic bubble'

"The soft-landing people are full of nonsense," said Christopher Thornberg, senior economist at UCLA. "This is a classic bubble. And unit sales are falling faster than in past bubbles."I think Thornberg is optimistic.

"We are in the middle of this decline. If we are lucky, prices will go flat. But we are not going to have prices fall like the stock market. You won't see declines of 10 percent or 15 percent per year. What will happen is that prices will flatten out," he said, adding that there might not be housing appreciation until 2011.

Next year will be critical from the standpoint of how the consumer will react to not having "a house cash machine" that can be tapped for spending thanks to rapidly appreciating value.

"A major pullback in consumer spending could get ugly very quickly," he said.

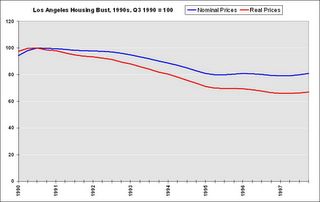

Click on graph for larger image.

This graph shows the price of Los Angeles housing based on the OFHEO housing index. For the real price, the nominal price is adjusted by CPI, less Shelter, from the BLS.

Although I agree prices will probably not fall 10%+ per year, I think the bust will last longer than 5 years and prices will fall steadily in real terms. In the previous California housing bust, prices declined for 6 1/2 years and the median house lost almost 34% in real terms.

Here is a chart of the year to year price declines in Los Angeles according OFHEO.

| Year of Housing Bust | Nominal Annual Price Decline | Cumulative Nominal Price Decline | Real Annual Price Decline | Cumulative Real Price Decline |

| 1 | -1.9% | -1.9% | -5.1% | -5.1% |

| 2 | -1.0% | -2.9% | -3.8% | -8.7% |

| 3 | -5.5% | -8.2% | -7.9% | -15.9% |

| 4 | -7.3% | -14.9% | -9.8% | -24.2% |

| 5 | -6.1% | -20.1% | -8.2% | -30.4% |

| 6 | +0.2% | -19.9% | -2.6% | -32.3% |

| 6.5 | -1.2% | -20.9% | -2.4% | -33.9% |

The worst annual declines occurred in the 3rd, 4th and 5th years of the housing bust.

Wednesday, July 19, 2006

MarketWatch: Bernanke overstates wage growth

by Calculated Risk on 7/19/2006 10:31:00 PM

Rex Nutting writes at MarketWatch: Bernanke overstates wage growth

Fed Chairman Ben Bernanke told senators Wednesday that he sees "some evidence" that wages are finally beginning to catch up with productivity growth ... "It's been slow coming. I want to be clear about that," Bernanke said of wage growth.And on real compensation, Nutting correctly notes:

But the figures Bernanke used in his testimony were not accurate. At several points in his testimony, Bernanke overstated the growth of wages over the past few years.

...

To his credit, Bernanke told Sen. Elizabeth Dole, R-N.C., that the evidence for wages catching up "is not very overwhelming." He noted that "the average hourly earnings number is up about a percentage point this last year versus the previous year."

But even that underwhelming figure is wrong.

According to the Bureau of Labor Statistics, average hourly earnings are up about 3.9% in the past year. Once adjusted for the 4.3% rise in inflation, however, real average hourly earnings are down 0.5% in the past year. The wage figures cover about 80% of U.S. workers.

If you look at nonfarm business compensation per hour, you have real increases about 2.5% over the past few years," Bernanke said. "And if you look at real average hourly earnings, it's much closer to zero."Kudos to Nutting.

The first part of that is true, according to BLS statistics. Real compensation has risen 2.5% cumulatively in the past two years.

The second part of Bernanke's statement is misleading but also technically true: Real average hourly earnings are down 1.6% in the past two years, which is "much closer to zero" than 2.5%.

While real compensation has risen 2.5% in the past two years, productivity is up a cumulative 5.5% over that period.

By that measure, compensation is not catching up with productivity; it is still falling behind.

Bernanke and Disposable Personal Income

by Calculated Risk on 7/19/2006 03:46:00 PM

Professor Hamilton covers some of Chairman Bernanke's positive comments today: Bernanke's latest testimony

This sentence, from Dr. Bernanke's statement leapt off the page (as least for me):

"... favorable fundamentals, including relatively low unemployment and rising disposable incomes, should provide support for consumer spending."Rising disposable incomes?

Click on graph for larger image.

SOURCE: BEA Personal Income and Its Disposition, Monthly

One of my concerns has been that real disposable personal income has been fairly flat for the last 6 months. Consumers have increased their consumption, as measured by real PCE, by borrowing, not from any increase in real DPI.

Perhaps Chairman Bernanke believes that nominal disposable incomes will continue to rise at the about the current pace, even as inflation subsides, thereby increasing real disposable incomes. In that case, rising DPI "should provide support for consumer spending". Maybe.

DataQuick: Bay Area home sales continue to drop

by Calculated Risk on 7/19/2006 02:40:00 PM

DataQuick reports: Bay Area home sales continue to drop, prices reach new peak

Home sales in the Bay Area continued to slow last month as prices reached new highs. Prices increased at their slowest pace in more than three years ...

| Median Home Price | June-04 | June-05 | June-06 | Pct.Chg |

| Alameda | $489K | $581K | $593K | 2.1% |

| Contra Costa | $458K | $558K | $592K | 6.1% |

| Marin | $690K | $815K | $829K | 1.7% |

| Napa | $501K | $608K | $638K | 4.9% |

| San Francisco | $653K | $760K | $778K | 2.4% |

| San Mateo | $646K | $752K | $759K | 0.9% |

| Santa Clara | $549K | $645K | $684K | 6.0% |

| Solano | $358K | $449K | $482K | 7.3% |

| Sonoma | $449K | $557K | $587K | 5.4% |

| TOTAL Bay Area | $516K | $610K | $644K | 5.6% |

I added the June 2004 median prices to give a two year perspective on prices.

"The market is definitely slowing but can only be considered "slow" when compared to the hot market of 2004 and 2005. In reality, today's market is pretty normal and balanced, right between the grim times of 1993 to 1995 and the frenzies of 1999 and 2004-2005. The Bay Area's market is reaching the end of a real estate cycle, it looks like prices could flatten out sometime this fall. What happens after that is anyone's guess," said Marshall Prentice, DataQuick president.

| Homes Sold | June-04 | June-05 | June-06 | Pct.Chg |

| Alameda | 2,922 | 2,730 | 1,991 | -27.1% |

| Contra Costa | 2,772 | 2,640 | 1,900 | -28.0% |

| Marin | 544 | 454 | 435 | -4.2% |

| Napa | 233 | 209 | 189 | -9.6% |

| San Francisco | 847 | 723 | 652 | -9.8% |

| San Mateo | 1,122 | 917 | 765 | -16.6% |

| Santa Clara | 3,543 | 3,220 | 2,562 | -20.4% |

| Solano | 1,055 | 1,147 | 732 | -36.2% |

| Sonoma | 1,066 | 974 | 666 | -31.6% |

| TOTAL Bay Area | 14,104 | 13,014 | 9,892 | -24.0% |

Sales have been falling for two years in the Bay Area. Since DataQuick's President says what happens next is "anyone's guess" - I'll guess we will see falling prices later this year.

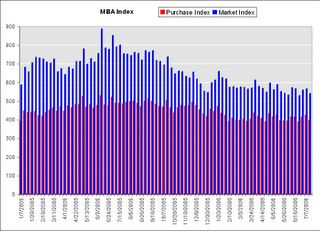

MBA: Mortgage Application Volume Declines

by Calculated Risk on 7/19/2006 10:42:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Declines

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 540.8, a decrease of 4.6 percent on a seasonally adjusted basis from 566.8 one week earlier. On an unadjusted basis, the Index increased 36.4 percent compared with the previous week but was down 31.3 percent compared with the same week one year earlier.Mortgage rates decreased:

The seasonally-adjusted Purchase Index decreased by 6.2 percent to 398.5 from 425.0 the previous week and the Refinance Index decreased by 1.6 percent to 1377.6 from 1400.5 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.73 percent from 6.81 percent...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 6.28 percent from 6.41 percent ...

| Total | -31.3% |

| Purchase | -17.8% |

| Refi | -47.4% |

| Fixed-Rate | -31.8% |

| ARM | -30.0% |

Purchase activity is off 17.8% compared to the same week last year. The MBA purchase index has been fairly flat for several months. I expect another drop in the seasonally adjusted purchase activity in the coming months.

Tuesday, July 18, 2006

Fed Funds Rate Predictions

by Calculated Risk on 7/18/2006 09:06:00 PM

Update: Check out Dr. Tim Duy's Fed Watch: Living on a Knife Edge

The Cleveland FED presents the Fed Funds Rate probabilities based on options on federal funds futures. For the next two meetings (August and September), the current probabilities are interesting:

Click on graph for larger image (new window).

For the August meeting, the highest probability is 5.50%; another 25 bps hike.

For the September meeting, the highest probability is 5.25%.

This implies either a pause at both meetings, or a rate increase in August followed by a rate decrease in September.

I think this is the first time in this cycle that we've seen the highest probability FED Funds rate be lower for the further out meeting.

DataQuick: SoCal Appreciation / Sales Weaken

by Calculated Risk on 7/18/2006 02:44:00 PM

DataQuick reports: Southland home prices set record, appreciation/sales weaken

Southern California home prices climbed to a new peak last month but at the slowest pace in more than six years. Prices edged higher even as June sales fell to a seven- year low, the result of higher borrowing costs, more inventory and less urgency among buyers.

| Median Home Price | June-04 | June-05 | June-06 | Pct.Chg |

| Los Angeles | $414K | $475K | $517K | 8.8% |

| Orange County | $540K | $603K | $646K | 7.1% |

| San Diego | $464K | $493K | 488K | -1.0% |

| Riverside | $319K | $393K | $422K | 7.4% |

| San Bernardino | $246K | $322K | $367K | 14.0% |

| Ventura | $500K | $584K | $627K | 7.4% |

| TOTAL SoCal | $406K | $465K | $493K | 6.0% |

I added the June 2004 median prices to give a two year perspective on prices.

DataQuick addessed the apparently price puzzle with rising inventories and falling sales:

"Many view this as a great conundrum: Prices continue to rise, even set records, as sales continue to slow. It happened for two years in San Diego before prices last month finally fell slightly below year-ago levels. We view this as the normal winding down of a real estate cycle, where declining demand gradually erodes price growth until it halts or reverses. We expect more markets to see prices flatten or decline a bit in the second half of this year," said Marshall Prentice, DataQuick president.

| Homes Sold | June-04 | June-05 | June-06 | Pct.Chg |

| Los Angeles | 11,673 | 12,001 | 10,248 | -14.6% |

| Orange County | 4,749 | 4,898 | 3,608 | -26.3% |

| San Diego | 6,208 | 5,663 | 4,301 | -24.1% |

| Riverside | 6,343 | 6,485 | 5.927 | -8.6% |

| San Bernardino | 4,292 | 4,700 | 3.998 | -14.9% |

| Ventura | 1,466 | 1,707 | 1,155 | -32.3% |

| TOTAL SoCal | 34,731 | 35,454 | 29,237 | -17.5% |

Notice that San Diego had declining sales in 2005 compared to 2004. As LA Times writer David Streitfeld noted about the San Diego housing market:

San Diego had the wildest run-up among major California cities, with prices tripling since the mid-1990s. ... The market also began to fade first in San Diego. ...It does appear that San Diego is leading the way, and I think that means declining prices soon in all of SoCal.

Whatever happens [in San Diego], optimists and pessimists agree, will happen later in the rest of the state.