by Calculated Risk on 8/03/2006 03:33:00 PM

Thursday, August 03, 2006

Recession Predictions

Last week, Professor Roubini predicted a recession later this year or early in '07:

"There will be no soft landing; it will be as hard a landing as it gets."And models using the yield curve are estimating about a 41% chance of recession in the next six months: See Political Calculations.

Now comes Dr. Delong: The odds of economic meltdown

Forecasting recessions is a fool's game. If there is enough solid economic information to make it appear highly likely that a recession is coming -- that production, employment and consumer demand will actually fall -- then it is highly likely that there already is a recession. Businesses are not stupid, and they don't have to wait for economists to tell them what they already know. By the time a gloomy forecast has been issued they've probably already noticed a drop in consumer demand and responded by firing workers and reducing production.And Professor DeLong concludes:

So: Never say that a recession is coming. Say only that a recession is here, or that there might be a recession on the way. Which, in fact, is what I'm saying today. As of the beginning of August 2006, a recession is not here, and I'm not going to violate my own rule by saying one is coming. But there is a good chance -- for the first time since 2003 -- that there might be a recession in progress six months from now.

Why? Three factors: 1) A Federal Reserve that finds itself with less inflation-fighting credibility than it thought it had; 2) upward pressure on inflation from rising energy and, perhaps, import prices; and 3) millions of middle-class homeowners who for too long have treated their houses as gigantic ATMs, using home equity loans and refinancing to generate extra spending money.

Make no mistake about it: The U.S. economy is close to the edge. Retail sales in the second quarter were rising at only a 2.1 percent annual pace. Business investment in equipment and software was falling. Residential construction was falling. Either households will continue spending beyond all reason, or businesses will start boosting investment, or exports will start booming, or there will be a recession sometime in the next year. Figure the odds at 3 out of 10.

California Housing: Default Notices vs. Price

by Calculated Risk on 8/03/2006 11:08:00 AM

In the previous post, DataQuick reported that default notices for Q2 2006 had reached a three year high in California. The following graph compares the annual number of default notices sent in California since 1992 (start of DataQuick data series) and house prices.

Notes: Price is from the OFHEO series for California (100 = Q1 1990). This is the price peak for the previous bust. 2006 is estimated for both series: Price is estimated at a 4% annual increase and default notices are double the reported notices sent for the first two quarters of 2006.

Click on graph for larger image.

During the previous bust, as prices slowly fell over 6+ years, the number of default notices continued to rise. Finally, in 1997, as housing prices started to rise and the number of default notices declined.

There is probably a vicious cycle that lasts several years during a housing bust: as prices fall, homeowners in distress can't sell and find themselves in default. And, as more homes go into foreclosure, prices fall some more.

It appears this vicious cycle is just starting for the current housing bust.

California Foreclosure Activity Hits Three-Year High

by Calculated Risk on 8/03/2006 01:41:00 AM

DataQuick reports: California Foreclosure Activity Hits Three-Year High

Lenders sent 20,752 default notices to homeowners statewide during the April-through-June period. That was up 10.5 percent from 18,778 the previous quarter and up 67.2 percent from 12,408 in the second quarter of last year, DataQuick Information Systems reported. Last quarter's year-over-year increase was the highest for any quarter since DataQuick began tracking defaults in 1992.

...

Despite the second quarter surge, defaults remained below historically normal levels. On average, lenders filed 32,762 notices of default each quarter over the past 14 years. Last quarter's 20,752 total was the highest since 25,511 were filed in first quarter 2003.

"This is an important trend to watch but doesn't strike us as ominous," said Marshall Prentice, DataQuick's president. "The increase was a statistical certainty because the number of defaults had fallen to such extreme lows. We would have to see defaults roughly double from today's level before they would begin to impact home values much."

"We hear a lot of talk about rising payments on adjustable-rate loans triggering borrower distress," Prentice continued. "While there's no doubt some of that is going on, as far as we can tell the spike in defaults is mainly the result of slowing price appreciation. It makes it harder for people behind on their mortgage to sell their homes and pay off the lender."

...

Foreclosure activity hit a low during the third quarter of 2004, when lenders filed 12,145 default notices. That year California home prices rose at an annual rate exceeding 20 percent. This year annual price gains have slipped into single digits in many of the state's larger housing markets. Last month San Diego and Sacramento counties saw their median home prices dip about 1 percent compared with a year ago. Second quarter defaults shot up about 99 percent in San Diego County and 109 percent in Sacramento County from last year.

Still, today's statewide foreclosure activity amounts to about one-third of the peak level in the first quarter of 1996, when 59,897 defaults were filed. The state was in a housing slump back then and foreclosure activity tugged home values down by about 10 percent in some areas.

Wednesday, August 02, 2006

Freddie Mac: Q2 Refi Activity Slips, But Remains Strong

by Calculated Risk on 8/02/2006 06:46:00 PM

From Freddie Mac: Refinance Activity Slips, But Still Remains Stronger than Expected in Second Quarter

In the second quarter of 2006, 88 percent of Freddie Mac-owned loans that were refinanced resulted in new mortgages with loan amounts that were at least five percent higher than the original mortgage balances, according to Freddie Mac's quarterly refinance review. This percentage is up from the first quarter of 2006, when the share of refinanced loans that took cash out was a revised 86 percent, and is the highest since the second quarter of 1990.Homeowners are still using the Home ATM.

"The staying power of refinance activity has been much stronger than we initially thought," said Frank Nothaft, Freddie Mac vice president and chief economist. "But borrowers are reacting to both incentives to cash out home equity through refinance and incentives to change their mortgage as they hit an interest rate adjustment. Freddie Mac estimates that $500 billion in first lien mortgages will adjust this year and another $650 billion in second liens will see at least one rate change this year.

...

"The incentive to take cash out of home equity is partially driven by the rapid rise in short-term interest rates like the prime rate. Many borrowers have seen their rates on home equity lines of credit – which are tied to the prime rate – rise. Now they are consolidating those HELOC loans into a new first lien mortgage to reduce their mortgage payments," said Amy Crews Cutts, Freddie Mac deputy chief economist. "This quarter we saw $81.0 billion cashed out, up from a revised $74.1 billion cashed out in the first quarter of 2006. Cash out activity should remain strong throughout the rest of the year as interest rates are expected to continue to gently climb.

"Because rates on home equity lines of credit have risen to 8.25 percent or higher, borrowers who are looking for an inexpensive way to finance home improvements or business investments, or to consolidate high cost debt, are turning to cash-out refinance. These borrowers are often willing to refinance into higher rates on their first lien mortgages. As previously noted, we saw the median ratio of new mortgage rates to rates on the loan being refinanced rise by eight percent. This is second consecutive quarter in which the median refinance borrower increased the rate on their first lien mortgage. For the 20 quarters prior to 2006, the median refinance borrower was reducing his or her first lien mortgage rate."

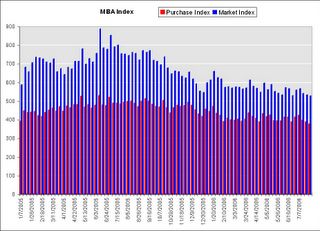

MBA: Market Index Falls to May 2002 Levels

by Calculated Risk on 8/02/2006 12:21:00 AM

The Mortgage Bankers Association (MBA) reports: Application Volume Declines

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 527.6, a decrease of 1.2 percent on a seasonally adjusted basis from 533.8 one week earlier. This is the lowest that the index has been since May 2002. On an unadjusted basis, the Index decreased 1.4 percent compared with the previous week but was down 29.0 percent compared with the same week one year earlier.Mortgage rates decreased:

The seasonally-adjusted Purchase Index decreased by 3.3 percent to 376.2 from 389.0 the previous week and the Refinance Index increased by 2.3 percent to 1417.2 from 1385.2 one week earlier. The Purchase Index is at its lowest since November 2003. emphasis added

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.62 percent from 6.69 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for 15-year fixed-rate mortgages decreased to 6.28 percent from 6.31 percent ...

| Total | -29.0% |

| Purchase | -23.2% |

| Refi | -37.0% |

| Fixed-Rate | -28.2% |

| ARM | -30.7% |

Last week I wrote: "This may be the beginning of another decline in purchase activity." With the Purchase Index off another 3.3%, this does appears to be the start of another leg down for the housing market.

Tuesday, August 01, 2006

YTD Increase in National Debt: $511.6 Billion

by Calculated Risk on 8/01/2006 07:58:00 PM

UPDATE: pgl discusses The Structural Deficit

For the first ten months of the 2006 fiscal year (starts Oct 1st), the National Debt has increased $511.6 Billion. The record is $533.6 Billion for the first ten months of fiscal 2004. This represents an improvement of $21.7 Billion, or about 4%, as compared to fiscal 2004.

The debt increase for fiscal 2006 YTD is slightly worse than fiscal 2005 for the comparable period.

Click on graph for larger image.

As a percent of GDP, the deficit has improved slightly over the last few years.

The annual increase in the debt is running around 4.5% of GDP. This is a classic "structural budget deficit" or "high employment deficit" - something most economists believe should be avoided.

In my predictions for 2006, I wrote that the budget deficit would probably not be a big story this year:

The Budget Deficit: Although I expect the General Fund deficit to grow to around $600 Billion in 2006, I don't think it will become a huge story until '07 or '08.With the slowing economy that prediction still makes sense.

Construction Spending

by Calculated Risk on 8/01/2006 02:42:00 PM

The Census Bureau reported:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2006 was estimated at a seasonally adjusted annual rate of $1,217.3 billion, 0.3 percent above the revised May estimate of $1,213.8 billion. The June figure is 6.8 percent above the June 2005 estimate of $1,139.9 billion.I'd like to focus on the longer term trend.

During the first 6 months of this year, construction spending amounted to $569.3 billion, 8.5 percent above the $524.8 billion for the same period in 2005.

Click on graph for larger image.

This graph shows construction spending, in Billions of dollars (SA, annual rate) for the three main categories of spending: Private Residential and Nonresidential, and Public spending since 1993.

Private Nonresidential and Public spending have picked up recently, as Private Residential Spending has decreased. Some analysts are hoping that increased Nonresidential spending will mostly offset the decrease in residential spending going forward. This seems unlikely.

The second graph presents the same data as a percent of GDP. Private Nonresidential spending, as a percent of GDP, is off from the highs of the late '90s, but spending is already near the pace of the mid-90s. Perhaps Private Nonresidential will increase some more, but if Residential spending falls back to 3.5% - 4.0% of GDP, Nonresidential spending will only offset a small portion of this decrease.

The second graph presents the same data as a percent of GDP. Private Nonresidential spending, as a percent of GDP, is off from the highs of the late '90s, but spending is already near the pace of the mid-90s. Perhaps Private Nonresidential will increase some more, but if Residential spending falls back to 3.5% - 4.0% of GDP, Nonresidential spending will only offset a small portion of this decrease.Public construction spending, as a percent of GDP, is already near the highs of the last 13 years (data collection started in 1993), and any further increase will be minor in comparison to the probable decrease in future residential spending.

Paulson: "No Recession"

by Calculated Risk on 8/01/2006 12:18:00 PM

From MarketWatch:

Asked if the economy faces a recession in the near term, [Treasury Secretary Henry] Paulson declared, "Absolutely not."I agree with Paulson's approach:

"I have always tried to live by the philosophy that when there is a big problem that needs fixing, you should run toward it, rather than away from it,"Of course the major fiscal problems facing the U.S. are the structural general fund budget deficit and Medicare, not Social Security. So Paulson might be running towards the wrong problem.

June: core PCE and Savings Rate

by Calculated Risk on 8/01/2006 10:01:00 AM

From the BEA report for June:

Core PCE increased 0.2 percent in June (2.9% annualized). Core PCE for June was slightly above the May rate (2.8% annualized), and still above the high end of the FED's assumed target range (2%).

MarketWatch sums it up: Core inflation rising at 11-year high in June

Real consumer spending tepid for fourth straight month

U.S. core consumer inflation matched an 11-year high in June, keeping the pressure on the Federal Reserve to fight inflation, the Commerce Department reported Tuesday.

The core personal consumption expenditure price index, excluding food and energy, increased 0.2% for the third straight month in June, and has risen 2.4% in the past 12 months, matching the largest year-over-year gain since April 1995's 2.5% increase.

...

Meanwhile, personal incomes rose 0.6% in June, outpacing the 0.4% increase in consumer spending.

The personal savings rate rose to negative 1.5% from negative 1.6%, the 15th consecutive month of negative savings. Consumers can have negative savings by spending previous savings, or by borrowing or selling assets to support their consumption.

After adjusting for inflation, real consumer spending rose 0.2% in June, the fourth straight month of tepid spending. Factoring out taxes and inflation, real take-home pay rose 0.4%, the biggest increase in disposable income since December.

Click on graph for larger image.

The savings rate continued its downward trend. The savings rate, as a percent of DPI, was a negative 1.5%. The Microsoft special dividend (Dec '04) and the impact of hurricane Katrina (Aug '05) are evident in the monthly chart.

Bottomline: Slowing growth, negative savings and too much inflation.

Monday, July 31, 2006

Roubini: Landing "Hard as it gets"

by Calculated Risk on 7/31/2006 07:01:00 PM

Nouriel Roubini writes: Dismal GDP Report: U.S. Is on Its Way to a Recession by Year End

... once the signals of this recession build up, the slowing demand, sales, profits, earnings will severely batter the stock market. Expect 10-15% losses on the major equity indexes between now and year end as the bearish reality of a recession sinks in delusional investors still hoping for a soft landing of the economy. There will be no soft landing; it will be as hard a landing as it gets. So, as Bette Davis said in All About Eve: Fasten your seat belts...it's gonna be a bumpy ride! A very bumpy one for the economy and for all risky assets. In 2006 cash is king and all risky assets (equities, EM bonds, currencies and equities, commodities, credit risks and premia) will be battered once the markets finally comes to the realization that a U.S. recession followed by a serious global slowdown is coming.Brad Setser writes: Growth slowing, oil rising ... not good

[T]he global economy [is at risk] as well. Like Dr. Roubini, I am not convinced that Chinese growth is entirely independent of US growth.And more on the US consumer:

Reuters reports: Whole Foods profit up but sales trail estimates

Whole Foods, based in Austin, Texas, has seen explosive growth in recent years as it added stores and profited from a desire among consumers for healthy food and lifestyles. But the latest quarterly report pointed to slower growth as shoppers wrestle with rising energy prices.AP reports: Tyson Foods Shares Drop on 3rd-Qtr. Loss

Shares of Tyson Foods Inc. shed 3 percent on Monday, after the world's largest meat processor reported a fiscal third-quarter loss and predicted only modest improvement in the fourth quarter.It appears consumers are moving away from the higher priced food stuff (natural and organic foods and chicken) to inferior goods. This is similar to the problem with casual dining that I mentioned last week.

Tyson said a persistent glut of chicken, in particular, led to lower sales prices.

...

"The chicken glut continues. The export demand still is not there yet," Warren said. "It's definitely not a Tyson specific problem."