by Calculated Risk on 8/24/2006 10:31:00 AM

Thursday, August 24, 2006

July New Home Sales: 1.072 Million Annual Rate

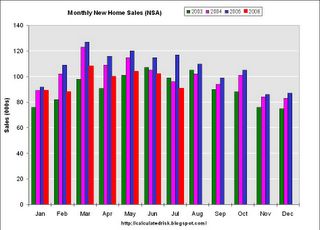

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 1.072 million. Sales for June were revised down to 1.120 million, from 1.131 million. Numbers for April and May were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in July 2006 were at a seasonally adjusted annual rate of 1,072,000 ... This is 4.3 percent below the revised June rate of 1,120,000 and is 21.6 percent below the July 2005 estimate of 1,367,000.

The Not Seasonally Adjusted monthly rate was 91,000 New Homes sold. There were 117,000 New Homes sold in July 2005.

On a year over year NSA basis, July 2006 sales were 22.2% lower than July 2005. Also, July '06 sales were below July 2004 (96,000) and July 2003 (99,000) sales. This is the lowest July since 2002 when 82,000 new homes were sold.

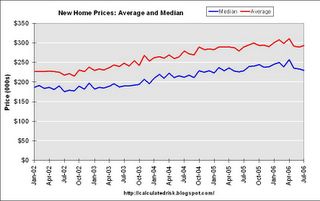

The median and average sales prices were down slightly. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in July 2006 was $230,000; the average sales price was $293,500.

The seasonally adjusted estimate of new houses for sale at the end of July was 568,000. This represents a supply of 6.5 months at the current sales rate.

The 568,000 units of inventory is another record for new houses for sale.

On a months of supply basis, inventory is above the level of recent years.

This report is weaker than expected by Wall Street, but is in line with recent reports from home builders. More later today on New Home Sales and Recessions.

Wednesday, August 23, 2006

AutoNation chief warns of recession

by Calculated Risk on 8/23/2006 07:03:00 PM

The Orange Country Register reports: AutoNation chief warns of recession

The chief executive of the nation's largest auto-dealing company said Tuesday the economy is "at a tipping point," threatened with recession as rising interest rates undermine consumer confidence.

"The question is how bad a recession," said Mike Jackson, CEO of AutoNation, which owns 338 auto franchises, including House of Imports in Buena Park, Power Toyota Cerritos, Lexus Cerritos and Power Toyota Irvine.

During the first six months of this year, auto sales fell 0.3 percent nationwide and 6.8 percent in Orange County. Sales of autos and gasoline account for almost one-third of retail spending in Orange County...

TIPPING POINT: "Sales of pickup trucks are down because construction activity is backing off," says, Mike Jackson, CEO of AutoNation. "Pickups are the backbone of construction."

Photo: Jeff Kowalsky, Bloomberg

And from the AP: Slowing Pickup Truck Sales Hurt Profits

Much to the detriment of Detroit's Big Three, people like [carpenter Tom] Wright are delaying truck purchases, cutting into profits and forcing Ford Motor Co., General Motors Corp. and DaimlerChrysler AG's Chrysler Group to idle some assembly lines.This is a secondary effect from the housing bust; slower auto sales, especially slower truck sales as construction workers find less work.

Pickup sales overall are off 15.7 percent in the first seven months of the year from the same time last year.

Sales of Ford's F-series pickups, the highest-selling vehicles in the nation, are down 12.3 percent. The No. 2 seller, the Chevrolet Silverado, is off 20.1 percent as the company changes production to a new model. Dodge's Ram line is down 11.7 percent.

More from the Archetypical Eeyore

by Calculated Risk on 8/23/2006 02:06:00 PM

From Professor Duy: Fed Watch: Finally – Some FedSpeak

Last week Dallas Fed President Richard Fisher stepped up to the podium, but revealed little new in Fed thinking, simply noting the tight spot between accelerating inflation and slower growth. The only new information one could glean from his speech was when he described recession-minded analysts as “Eeyores.” Such a dismissive remark can only suggest that the idea of a rate cut is furthest from his mind. That said, Fisher’s “eighth inning” remark lingers in everyone’s minds – perhaps the best strategy is to bet against Fisher, and side with the “Eeyores.”

'Eeyore is a fictional character from the book series and cartoon Winnie-the-Pooh. ... He is a pessimistic, gloomy, old donkey who is a friend of Winnie the Pooh. Eeyore is hardly ever happy and when he is, he is still sardonic and a bit cynical.'And who is the archetypical Eeyore? More from Tim Duy:

To be sure, policymakers have an eye on the housing slowdown, but I just doubt they feel much urgency. Certainly, not as much urgency as the current archetypical Eeyore, Nouriel Roubini, whose recent writing leaves me thinking about liquidating all my assets and rebalancing into a “diversified” portfolio of dry goods, gold, guns, and ammunition (which in Oregon would not be considered out of the ordinary).Very funny! Duy's commentaries are always enlightening and frequently amusing.

And now from the archetypical eeyore himself, Professor Roubini writes: "The Biggest Slump in US Housing in the Last 40 Years"…or 53 Years?

"At this point there no doubt on whether the housing sector is contracting ... I have also argued before that the effects of housing on US economic growth and the role of housing in tipping the US economy into a recession in early 2007 are more significant than the role that the tech sector bust in 2000 played in tipping the economy into a recession in 2001."Read Nouriel's piece for his analysis, but here is his conclusion:

"... the simple conclusion from the analysis above is that this is indeed the biggest housing slump in the last four or five decades: every housing indictor is in free fall, including now housing prices. By itself this slump is enough to trigger a US recession: its effects on real residential investment, wealth and consumption, and employment will be more severe than the tech bust that triggered the 2001 recession. And on top of the housing bust, US consumers are facing oil above $70, the delayed effects of rising Fed Fund and long term rates, falling real wages, negative savings, high debt ratios and higher and higher debt servicing ratios. This is the tipping point for the US consumer and the effects will be ugly. Expect the great recession of 2007 to be much nastier, deeper and more protracted than the 2001 recession."Eeyore indeed. Did I mention Eeyore is also a very intelligent animal?

NAR: Existing-Home Sales Down With Softening Prices

by Calculated Risk on 8/23/2006 10:42:00 AM

The AP reports:

"Sales of previously owned homes plunged in July to the lowest level in 2 1/2 years and the inventory of unsold homes climbed to a new record high, fresh signs that the housing market has lost steam."The National Association of Realtors (NAR) reports: Existing-Home Sales Down With Softening Prices

Click on graph for larger image.

Existing-home sales were down in July, while home prices in many areas are slightly below year-ago levels, according to the National Association of Realtors®.

Total existing home sales – including single-family, townhomes, condominiums and co-ops – dropped 4.1 percent to a seasonally adjusted annual rate1 of 6.33 million units in July from a downwardly revised pace of 6.60 million June, and were 11.2 percent below the 7.13 million-unit level in July 2005.

David Lereah, NAR’s chief economist, said higher interest rates dampened sales but that price softening is good news for the housing market because it is drawing buyers. “Many potential home buyers have been on the sidelines, some ‘kicking the tires,’ but mostly waiting for sellers to compromise on prices and terms,” he said. “Now sellers in many areas of the country are pricing to reflect current market realities. As a result, there could be some lift to home sales, but it’ll likely take some months for price appreciation to rise.”

The national median existing-home price for all housing types was $230,000 in July, up 0.9 percent from July 2005 when the median was $228,000. The median is a typical market price where half of the homes sold for more and half sold for less.

Total housing inventory levels rose 3.2 percent at the end of July to 3.86 million existing homes available for sale, which represents a 7.3-month supply at the current sales pace.Existing Home Sales are a trailing indicator. The sales are reported at close of escrow, so July sales reflects agreements reached in May and June.

As I've noted before, usually 6 to 8 months of inventory starts causing pricing problem - and over 8 months a significant problem. With current inventory levels at 7.3 months of supply, inventories are now in the danger zone and prices are falling in many areas.

MBA: Mortgage Rates Decline

by Calculated Risk on 8/23/2006 12:22:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Decline

Click on graph for larger image.

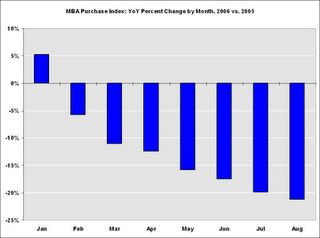

The Market Composite Index, a measure of mortgage loan application volume, was 561.5, an increase of 0.1 percent on a seasonally adjusted basis from 561.2 one week earlier. On an unadjusted basis, the Index decreased 1.2 percent compared with the previous week and was down 25.1 percent compared with the same week one year earlier.Mortgage rates declined:

The seasonally-adjusted Purchase Index decreased by 1 percent to 382.2 from 385.9 the previous week and the Refinance Index increased by 1.3 percent to 1608.5 from 1587.5 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.38 percent from 6.54 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 5.91 percent from 5.97 percent ...

| Total | -25.1% |

| Purchase | -20.9% |

| Refi | -30.5% |

| Fixed-Rate | -23.3% |

| ARM | -29.5% |

Purchase activity continues to fall and is about at 2003 levels. So far, August 2006 purchase activity is off 21.2% from August 2005.

Purchase activity continues to fall and is about at 2003 levels. So far, August 2006 purchase activity is off 21.2% from August 2005.Purchase activity was especially strong in the Summer and early Fall of 2005, and that makes the comparisons look ugly. Still, year-to-date purchase activity is off 12.7% compared to 2005 and appears to be getting worse.

Interest rates on a 30 year mortgage have fallen from a peak of 6.86%, just two months ago, to 6.38% last week. These declining rates have probably helped boost refinance activity.

Tuesday, August 22, 2006

Fed's Moskow: Inflation Risk Greater than Slow Growth

by Calculated Risk on 8/22/2006 01:39:00 PM

From Reuters: Fed's Moskow-More rate increases could be needed

This month's pause to the Federal Reserve's string of interest rate hikes was "constructive," but more rate increases could still be needed to cut inflation, Chicago Federal Reserve President Michael Moskow said on Tuesday.Here is Moskow's speech: U.S. Economic Outlook. Here are his comments on housing:

"The risk of inflation remaining too high is greater than the risk of growth being too low. Thus some additional firming of policy may yet be necessary to bring inflation back into the comfort zone within a reasonable period of time," Moskow said in remarks prepared for a speech to the McLean County Chamber of Commerce.

...

"We need to balance the benefits of gaining new information against the costs of waiting too long. If inflation stays stubbornly high while we wait to see the effects of earlier policy actions, inflation expectations could increase -- and that would be very costly," said Moskow.

Current levels of job creation -- while below Wall Street expectations of the past few months -- were roughly consistent with potential growth, and the jobs market is solid, he said.

"Higher energy prices, the slowing in housing markets, and other factors should push near-term growth a bit below potential for a short period. However, I don't see evidence of a more worrisome downshift in activity," he said.

Of course, there are some risks. One relates to housing. The orderly declines that we've been expecting could become more significant. Housing had been an area of strength for an extended period during this business cycle. The large increases in home values added an indirect boost to household spending growth by increasing homeowners' wealth.Did I read that right? House prices won't decline nationally, but if they do, the impact on consumer spending would be "modest". That is a fairly optimistic outlook!

Some analysts say that housing is overvalued and that prices are going to decline nationwide. To be sure, we currently are seeing a good deal of softening in housing markets, and home prices are increasing at a slower rate. Looking ahead, most forecasts for GDP growth factor in slow home price appreciation and marked declines in residential investment. But it seems unlikely that prices will actually decline for the nation overall. Housing markets are local in nature. Home prices have risen only modestly in Chicago, Bloomington, and most Midwestern cities; the largest increases have occurred in cities such as Miami, Phoenix, and Las Vegas. Even if there were large price declines in some cities, there probably would be little spillover to a more general drop in prices nationwide. And even if prices did decline nationally, history suggests that the impact on consumer spending would be modest and gradual.

NAHB: Builder Confidence in Condo Market Falls

by Calculated Risk on 8/22/2006 12:23:00 PM

The National Association of Homebuilders (NAHB) reports: Builder's Confidence in Condo Market Dips Again.

Builder confidence in the condominium housing market weakened significantly in the second quarter of 2006, as sales continued to retreat from the record-high levels seen last yearBut confidence in rental apartments is soaring.

...

"Investors and speculators had been a big factor driving sales and production at the height of the condo boom and they have been pulling out of the market," said NAHB Chief Economist David Seiders, "What we are currently seeing is a level of condo production that is probably more sustainable in the long run, although builders are worried that affordability has also become a factor for buyers, now that the overall economy appears to be slowing."

The component of the MCMI that tracks current condo supply conditions fell to an index value of 32.0, compared to a value of 61.3 during the second quarter of last year. It was the third time since NAHB began tracking this data that the for-sale index has fallen below 50. A rating of 50 generally indicates that the number of positive responses is about the same as the number of negative responses.

...

In a set of special questions for condo developers, 82 percent said they had noticed buyer resistance to current prices and, of these, more than one-fourth reported that they have reduced prices. The average price cut was 9 percent.

About three-fourths of the respondents said they are using non-price incentives to boost sales and limit cancellations. Two-thirds of those builders who reported using incentives are including optional items at no cost, a third are absorbing financing points, and two-thirds are paying closing costs or fees to bolster sales. Half the developers are using agents or brokers to help sell, up from about 20% a year ago.

"We are in the midst of a solid comeback on the rental apartment side of the multifamily housing market," said NAHB Chief Economist David Seiders, who noted that during the last three years, condos have made up a rising share of multifamily housing production.This rental demand is somewhat local. Apartment vacancy rates, at 9.6% nationwide, are near all time highs according to the Census Bureau. And the Homeowner vacancy rate is at 2.2% - an all time high.

"At the same time, thousands of existing rental units had been converted to for-sale units to meet what seemed an insatiable appetite for condos," said Seiders. "As a result, the supply of rental units is very tight at a time when the demand pendulum is swinging back to rentals," said Seiders.

Retailer Watch

by Calculated Risk on 8/22/2006 12:28:00 AM

The most immediate impacts from the housing slowdown, on the general economy, will be the loss of housing related jobs, and the slowing of personal consumption expenditures due to less equity extraction.

As of July, residential construction employment was only off about 1% from the most recent peak. And mortgage equity extraction (MEW) was apparently still strong in Q2.

But recently there have been signs of a retail slowdown. First with casual dining (a discretionary expense) and now with the major retailers:

From the WSJ: Lowe's Net Rises, but Outlook Is Cut, Dim View for Year Suggests Wider Toll of Energy Costs And Home-Price Slowdown

Lowe's Cos. cut its outlook for the year ... underscoring that the economic malaise created by high energy prices and flattening home prices is spreading to more retailers.

The nation's second-largest home-improvement retailer, after Home Depot Inc... said that sales at stores open at least a year -- a key retailing measure often called "same-store sales" -- rose just 3.3%, near the bottom of Lowe's 3% to 5% forecast. The 3.3% quarterly gain was the smallest since 2003. And Lowe's said the weakness could last through the first quarter of next year.

The weaker same-store sales trend "is primarily the macroeconomic" environment coupled with shifts in its quarterly calendar, which includes one less week among other changes, said Robert Niblock, Lowe's chairman and chief executive. "Consumers are taking a bit of a breather," he said.

Long a retailing standout, the warning by Lowe's of weaker-than-expected gains for the rest of the year comes as higher gasoline, electricity and consumer-borrowing costs continue to pinch spending. Last week, Wal-Mart Stores Inc. and Home Depot offered mixed outlooks as U.S. consumers held tighter to their pocketbooks.

Even retailers appealing to more-affluent customers are now reporting a damping effect on sales of everything from lattes to home décor.

Monday, August 21, 2006

"Jingle Mail" and More

by Calculated Risk on 8/21/2006 07:27:00 PM

Phrase of the day from Fleck: Jingle Mail.

Jingle Mail: where homeowners have mailed in the keys because they can't make the payments and no longer have any equity in their homes.However, with the new bankruptcy law, some homeowners will still owe money on their homes even after they mail in the keys.

That phrase was a prominent feature of the S&L bust and ensuing real-estate debacle in 1990-1991 -- and something we'll be hearing lots more about in the future.

From Roubini: Recent Macro Indicators Strongly Reinforce My Recession Call...

The macroeconomic indicators published in the last week or so have strongly reinforced my out-of-consensus view that the US economy will fall into a recession by early 2007: quite simply most of them are headed sharply south, consistent with a sharp deceleration in growth in H2 that will lead to a recession by 2007.And a much more positive view on housing from two Fed economists - The great turn-of-the-century housing boom, Jonas D. M. Fisher and Saad Quayyum. Here are their conclusions:

This article has attempted to explain two features of the turn of the twenty-first century U.S. economy: high levels of residential investment and homeownership rates. Our main findings are as follows. First, it appears that the housing boom has not been driven by unusually loose monetary policy. This is not to say the monetary policy has not been unusually loose, but that to the extent it has been loose, this is not what has been driving spending on housing. Second, the current levels of spending on new housing are largely explained by technology-driven wealth creation over the previousI'm amazed by their conclusion. The authors clearly understood that the surge in residential investment was related to new mortgage products, but I believe they missed that excessive leverage can be considered speculation.

decade. Third, changes in the demographic, income, educational, and regional structure of the population account for about one-half of the increase in homeownership. That is, without any other developments, the homeownership rate is likely to have gone up anyway, but not by as much as it has done. The last finding is that substitution away from rental housing made possible by developments in the mortgage market, such as subprime lending, could account for a significant fraction of the increase in residential investment and homeownership.

We view our findings as supporting the view that the current housing boom may be a temporary transition toward an era with higher homeownership rates in which spending is temporarily higher than historical norms but will eventually return to such norms. While we have so far mostly avoided discussing housing prices, our findings do suggest that to the extent that house prices have grown considerably in recent years, this is not due to unusually excessive speculation in the housing market, such as would occur in a bubble. Instead, our findings point toward the high prices being driven by fundamentals.

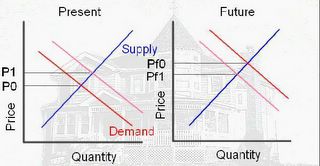

"... substitution away from rental housing made possible by developments in the mortgage market, such as subprime lending, could account for a significant fraction of the increase in residential investment and homeownership."This type of leveraged activity pulls demand from future periods.

Starting with the first diagram on the left, these leveraged financing programs shift the demand curve to the right (light red) and increase the price from P0 to P1. In the future, the demand will be shifted to the left and the future price will be Pf1.

If Pf1 is less than P1, and the homeowner cannot make the mortgage payment, then the homeowner might resort to "jingle mail", and the supply will increase further - and depress prices even more.

Sunday, August 20, 2006

Investment and Recessions

by Calculated Risk on 8/20/2006 11:49:00 PM

This post will try to explain my focus on residential investment, the usefulness of New Home Sales as a leading indicator, and the current situation.

Note: these graphs may appear cluttered, and for larger versions of each graph, see the links at the end of this post. Click on graph for larger image (see end of post for even larger images)

Click on graph for larger image (see end of post for even larger images)

Figure 1 shows the change in real GDP and Private Fixed Investment over the preceding four quarters, shaded areas are recessions. (Source: BEA Table 1.1.1)

A couple of observations:

1) Since 1948, private fixed investment has fallen during every economic recession.

2) Private fixed investment has fallen 13 times since 1948, with only 10 recessions.

So what happened during the periods around 1951, 1967 and 1986 to keep the economy out of recession? These are the periods when private investment fell, but the economy didn't slide into recession. The answer is generally the same for all three periods: a surge in defense spending. The defense spending in the early '50s was due to the Korean war, in the mid '60s the Vietnam war, and in the mid '80s a general defense build-up helped offset a small decline in private investment. The mid '80s also saw a surge in MEW (mortgage equity withdrawal) that also contributed to GDP growth. Figure 2 shows the separation of private fixed investment into residential and nonresidential components.

Figure 2 shows the separation of private fixed investment into residential and nonresidential components.

This graphs shows something very interesting: in general, residential investment leads nonresidential investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential investment remained strong.

Another interesting period was 2001 when nonresidential investment fell significantly more than residential investment. Obviously the fall in nonresidential investment was related to the bursting of the stock market bubble.

But the most useful information is that typically recessions are preceded by declines in residential investment. Maybe we can use that information.

Figure 3 is the YoY change in New Home Sales from the Census Bureau.

Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. The one exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As noted earlier, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Conclusions:

1) New Home Sales appears to be an excellent leading indicator. However the series is heavily revised and that might limit it's usefulness. I believe the revisions problem can be mitigated using mortgage data from the MBA and builder sentiment from the NAHB to estimate New Home sales (this is for another post).

2) If New Home sales falls to around the 1.05 million level (20% decline), a recession is very likely.

What can offset the decline in New Home sales? Possibilities mentioned earlier are: a surge in defense spending, an increase in consumer borrowing especially MEW, and strong nonresidential investment spending.

An increase in consumer borrowing and MEW seems extremely remote, especially since household debt service is already at record levels. It is far more likely that MEW will fall over the next few years, also acting as a drag on GDP. (A future post will review the contribution from MEW to GDP over the last few years).

Most bullish analysts are forecasting strong nonresidential investment to offset the decrease in residential investment. Maybe. But usually nonresidential investment follows residential investment. Here is a previous post discussing nonresidential investment: Will Business Investment Rescue the Economy?

And defense spending has already increased significantly over the last few years. The implications of a further surge in defense spending, from the current levels, are too scary to contemplate.

NOTE: Click on the links below for 1200x800 graphs in new windows.

Figure 1: Private Fixed Investment vs. Recessions

Figure 2: Residential and Nonresidential Investment

Figure 3: YoY Change in New Home Sales vs. Recessions