by Calculated Risk on 9/08/2006 12:05:00 AM

Friday, September 08, 2006

Krugman: Housing Prices "Long way to fall"

On Bloomberg Video: Krugman of Princeton Says Home Prices Have a `Long Way to Fall'.

Click image for video.

September 7 (Bloomberg) -- Paul Krugman, an economics professor at Princeton University, talks with Bloomberg's Rhonda Schaffler in New York about the outlook for the U.S. housing market, prospects for a recession and concern about the country's trade deficit. (Source: Bloomberg)

"I think we are looking at a housing cycle that we've never seen.

...

If history is any guide, housing prices have got a long way to fall and the housing industry is going to go through a long drought."

Thursday, September 07, 2006

Homebuilder Exits Home State

by Calculated Risk on 9/07/2006 06:14:00 PM

MarketWatch reports: St. Joe to exit Florida homebuilding

[Jacksonville, Fla.-based] St. Joe Co. after Thursday's closing bell said it plans to exit homebuilding in Florida, resulting a reduction in its workforce.It's getting ugly out there.

Another Homebuilder "Giveaway"

by Calculated Risk on 9/07/2006 05:03:00 PM

Homebuilder Pulte just sent out an email advertising a "$99,000 Giveaway and Getaway." Click on Ad for larger image.

Click on Ad for larger image.

This is the Pulte Giveaway and Getaway site. (Warning: annoying music).

Here are some details:

Must buy through September 30th.

The $99,000 can be used to roll back the price or ...

Terrific incentives like rolled back pricing, 100% financing, free pool* and so much more.Close before Christmas and receive a free vacation:

Those purchasing a home closing before 12/24/06 will receive a free vacation.This appears to be limited to certain communities in Northern California. The asking prices range from $300K+ to $700K+.

Fed's Yellen on Housing and Economy

by Calculated Risk on 9/07/2006 03:09:00 PM

Janet L. Yellen, President and CEO of the Federal Reserve Bank of San Francisco spoke today in Boise, Idaho: Prospects for the U.S. Economy. Here are her conclusions on future Fed policy:

The bottom line is this. With inflation too high, policy must have a bias toward further firming. However, our past actions have already put a lot of firming in the pipeline. With the lags in policy we haven't yet seen the full effect of our past actions. These will unfold gradually over time. By pausing, we allowed ourselves more time to observe the data and more time to gauge how much, if any, additional firming is needed to pursue our dual mandate.And here are her comments on housing:

... we already have seen clear evidence of cooling in the housing sector. Nationally, housing permits are down noticeably—by more than 20 percent—from a year ago. In addition, inventories of unsold houses are up significantly, sales of new and existing homes are off their peaks, and surveys of homebuyers and builders are showing much more pessimistic attitudes. Even in a market that has been as hot as Boise's, some recent evidence points to cooling in the pace of home sales and residential construction activity.

The national data on residential investment reflect all of these developments and enter directly into the calculation of real GDP growth. After adjusting for inflation, (real) residential investment dropped at nearly a 10 percent annual rate in the second quarter following two small declines in the prior two quarters.

The effects of the housing slowdown go beyond their direct contribution to GDP. In particular, what happens to house prices could have important effects on consumer spending, which is a very big part of the economy—roughly 70 percent. As we all know, the pace of house-price appreciation has definitely moderated, after rising at heart-stopping rates in recent years. And there are signs that it may continue. For example, rents are finally moving up more vigorously after a long period of stagnation. This may reflect, in part, expectations that house-price appreciation will continue to slow, as landlords raise rents to try to maintain the total rate of return on rental properties and as those in the market for housing grow more inclined to rent than to buy.

Slower increases in house prices could weaken consumer spending in a couple of ways. Both of them have to do with what I'm going to call the "piggy bank" phenomenon. To be honest, I've stolen this term from some news stories I've seen, but I think the crime is worth it because the description is apt. Back when house prices were rising so fast, people saw that more and more equity was being built up in their house values; in other words, they saw their houses as piggy banks that got fuller and fuller, faster and faster, by just sitting there. Insofar as the piggybank of house value makes up a good chunk of many households' portfolios, they might well have felt that they could afford to spend pretty freely. In economic terms, this is called the "wealth effect." A second factor stimulating spending relates to the ease with which households can now pull money out of the piggy bank. With home equity loans, refinancings, and so on, the piggy bank is now pretty simple to access. So it's no surprise that homeowners seized the opportunity and drew some of the money out to support their spending. Now, with the pace of house-price appreciation slowing, of course, the piggy bank is not getting so full so fast anymore, which may weaken the growth in consumer spending.

While it's likely that the slowdown in the housing sector will have only moderating effects on economic activity and will continue to unfold in an orderly way, I should note that we can't ignore the risk that a more unpleasant scenario might develop. In particular, we have heard a lot in recent years about the possibility that there is a house-price "bubble," implying that prices got out of line with the fundamental value of houses and that the current softening could be just the beginning of a steep fall. While I doubt that we'll see anything like a "popping of the bubble"—in part because I'm not convinced there is a bubble, at least on a national level—it is a risk we have to watch out for.

Homebuilders Lower Forecasts

by Calculated Risk on 9/07/2006 09:52:00 AM

From MarketWatch: Beazer trims 2006 outlook

Beazer Homes USA Inc. again cut its earnings forecast for 2006, blaming higher cancellation rates and weakening sales as the deluge of negative news from the home-building group continues.

The Atlanta-based company said net home sales for the two months ended Aug. 31 fell 49% from the year earlier as the cancellation rate rose to 50% from 26%.

"As compared to prior years, a higher percentage of home closings are being deferred or cancelled, immediately prior to closing in many cases, due to worsening buyer sentiment and the inability of buyers to sell their existing homes," the company said in a statement.

...

Beazer said its revised 2006 outlook "also contemplates potential charges to exit non-strategic land positions currently under review." ... The builder said it is reviewing its operating plan for 2007 "in light of the ongoing deterioration in business conditions."

Click on Ad for larger image.

Click on Ad for larger image.Incentives gone "berserk"! These non-price concessions are masking the actually drop in New Home prices.

Ryland Homes offers 40% off mortgage payments, plus more.

From CNNMoney:

David Seiders, chief economist for the National Association of Home Builders says 75 percent of the nation's builders and developers are offering incentives.The AP reports: Homebuilder Hovnanian's Profits Down As Housing Market Slows

...

"Incentives are all over the place," says Salli Kirkpatrick, founder of SK Associates, a Sacramento-area advertising agency that works with homebuilders. "No closing costs, no payments for six months, $10,000 toward a built-in swimming pool. Things have gone berserk."

Homebuilder Hovnanian Enterprises Inc. reported Wednesday that its profit sank 36 percent for the third quarter as the company struggled with higher costs, slower-paced orders and increased cancellations in a slowing real-estate market.From Reuters: KB Home cuts profit forecast again as orders drop

...

The company said it booked $11.4 million in write-offs for walkaway costs and another $800,000 in land write-downs in the latest quarter.

For the past year, the single-family homebuilder has "experienced a deteriorating environment for new home sales in many of our more regulated markets," President and Chief Executive Ara K. Hovnanian said in a written statement.

...

Ara K. Hovnanian said the housing slowdown is unusual because the economy as a whole is strong -- and that makes it difficult to forecast.

"Thus, we are making decisions today with the assumption that current conditions will persist for the foreseeable future," he said.

KB Home, one of the largest U.S. homebuilders, on Wednesday cut its full-year profit forecast for the second time in three months, saying a more difficult housing market is causing orders to decline.

...

Chief Executive Bruce Karatz said KB Home is being hurt by "weaker-than-expected demand for new homes" and growing inventories in markets that have experienced rapid price appreciation and substantial investor activity.

Wednesday, September 06, 2006

Housing: "Third Best Year Ever"

by Calculated Risk on 9/06/2006 06:07:00 PM

I've heard several commentators mention that this will be the third best year ever for New Home sales.  Click on graph for larger image.

Click on graph for larger image.

Right now 2006 sales are in third place, through July, behind 2004 and 2005. But if the recent sales rate continues, annual sales for 2006 will probably fall into fourth place behind 2003.

With regards to employment, residential construction employment is significantly higher than in 2003. In 2003, builders were ramping up employment to meet growing demand. So all else being equal, I'd expect residential construction employment to drop below 2003 levels, even if sales plateau at this level (something I think is unlikely).

| Residential Construction Employment, Monthly Average, Thousands | |||

| Year | Residential building | Residential specialty trade contractors | Total |

| 2001 | 781 | 1849 | 2630 |

| 2002 | 803 | 1887 | 2690 |

| 2003 | 837 | 1965 | 2802 |

| 2004 | 896 | 2123 | 3019 |

| 2005 | 949 | 2278 | 3227 |

| 2006 | 979 | 2346 | 3325 |

This table shows the average residential construction employment for each of the last six years. If employment falls to 2003 levels that will result in the loss of over 500 thousand residential construction jobs.

There is little evidence that these construction layoffs have started: via MarketWatch, Layoff announcements bounce back in August

"There are some signs that the housing slowdown is taking a toll on jobs," said the firm's CEO, John Challenger [Challenger Gray & Christmas]. "Job cutting in real estate this year is nearly double last year's pace." But job cutting in other housing-related sectors, such as finance or consumer durable goods, has not risen, he said.Last week I noted that I heard through a company insider, about significant layoffs at one of the major (top ten) homebuilders. I still haven't seen any public announcement, but I expect layoffs soon at all the homebuilders.

"The housing slowdown has not had a major impact on the job market, yet," said Challenger.

So even though 2006 might be the "third best year ever", the impact on the economy will still be significant - and the impact from the loss of jobs hasn't really started yet.

Beige Book on Housing

by Calculated Risk on 9/06/2006 03:45:00 PM

The Federal Reserve has released the Beige Book. Here are a few excerpts on housing:

Housing markets and home construction activity weakened throughout the nation, but commercial real estate and construction strengthened in most Districts. Virtually all Districts reported declines in home sales, as well as in residential construction activity. Moreover, most Districts indicated substantial increases in the inventory of unsold homes; Kansas City attributed some of this increase to "sizable numbers of foreclosures" in some areas. In general, residential real estate contacts expected that housing markets would remain weak, if not weaken further, in the months ahead; such concerns were specified in the reports from Philadelphia, Cleveland, Atlanta, and Kansas City.Declines in home sales, increases in inventory, rising foreclosures, flat or declining prices ... a bleak picture for housing at the end of August.

Relatively flat or declining home prices were noted in the New York, Richmond, and Kansas City Districts, and decelerating prices were reported in the Philadelphia and San Francisco Districts. The high end of the market was described as particularly weak in the Richmond, Chicago, and Kansas City Districts, as well as parts of the Minneapolis District. In contrast, the high ends of both the Dallas District's housing market and the New York District's co-op and condo market were reported to have experienced less softening than the more moderately priced segments. One area of relative strength in residential real estate has been the apartment market--of the three Districts reporting on this, New York and Chicago both indicate fairly strong demand for apartment rentals since the last report, while Dallas noted continued strong demand for condominiums.

MBA: Home Purchase Applications Rise

by Calculated Risk on 9/06/2006 12:16:00 AM

The Mortgage Bankers Association (MBA) reports: Home Purchase Applications Rise

NOTE: I usually post the MBA headline - this headline compares to the previous week - and that week was the lowest level of activity since November 2003. Another headline could have been "Purchase Activity off 26% from comparable week last year." Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 566.3, an increase of 1.8 percent on a seasonally adjusted basis from 556.5 one week earlier. On an unadjusted basis, the Index increased 0.4 percent compared with the previous week but was down 26.1 percent compared with the same week one year earlier.Mortgage rates decreased:

The seasonally-adjusted Purchase Index increased by 3.7 percent to 389.7 from 375.9 the previous week and the Refinance Index decreased by 0.9 percent to 1594.7 from 1609.2 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.31 percent from 6.39 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.97 percent from 6.06 percent ...

| Percent Change in Number of Applications | |||

| Applications | Change from one year ago | ||

| Total | -26.1% | ||

| Purchase | -21.1% | ||

| Refi | -32.3% | ||

| Fixed Rate | -25.8% | ||

| ARM | -26.9% | ||

Purchase activity is off 26.1% from the comparable week last year. The slight increase in purchase activity this week, was from the lowest level since November 2003.

Purchase activity is off 26.1% from the comparable week last year. The slight increase in purchase activity this week, was from the lowest level since November 2003.This graph shows the Purchase Index and the 4 and 12 week moving averages.

Note: Scale does not start at zero to better show changes.

Purchase activity has clearly moved lower again in recent weeks.

Tuesday, September 05, 2006

OFHEO: House Price Appreciation Slows

by Calculated Risk on 9/05/2006 10:15:00 AM

The Office of Federal Housing Enterprise Oversight (OFHEO) released the Q2 2006 House Price Index.

House Price Appreciation Slows; OFHEO House Price Index Shows Largest Deceleration in Three DecadesFrom a bubble perspective, three of the most closely watched cities have been Boston, Sacramento and San Diego - all three have shown signs of a housing slowdown.

WASHINGTON, D.C. – U.S. home prices continued to rise in the second quarter of this year but the rate of increase fell sharply. Home prices were 10.06 percent higher in the second quarter of 2006 than they were one year earlier. Appreciation for the most recent quarter was 1.17 percent, or an annualized rate of 4.68 percent. The quarterly rate reflects a sharp decline of more than one percentage point from the previous quarter and is the lowest rate of appreciation since the fourth quarter of 1999. The decline in the quarterly rate over the past year is the sharpest since the beginning of OFHEO’s House Price Index (HPI) in 1975. The figures were released today by OFHEO Director James B. Lockhart, as part of the HPI, a quarterly report analyzing housing price appreciation trends.

“These data are a strong indication that the housing market is cooling in a very significant way,” said Lockhart. “Indeed, the deceleration appears in almost every region of the country.”

Possible causes of the decrease in appreciation rates include higher interest rates, a drop in speculative activity, and rising inventories of homes. “The very high appreciation rates we’ve seen in recent years spurred increased construction,” said OFHEO Chief Economist Patrick Lawler. “That coupled with slower sales has led to higher inventories and these inventories will continue to constrain future appreciation rates,” Lawler said.

House prices grew faster over the past year than did prices of non-housing goods and services reflected in the Consumer Price Index. While house prices rose 10.06 percent, prices of other goods and services rose only 4.41 percent. The pace of house price appreciation in the most recent quarter more closely resembles the non-housing inflation rate.

Boston: -0.61% in Q1 2006 and 2.92% for the year.

Sacramento: -0.38% for the quarter, and 6.51% for the year.

San Diego: 0.15% for the quarter, and 5.61% for the year.

The housing slowdown is starting to show up in the prices for these areas.

Monday, September 04, 2006

Demographics and Housing Demand

by Calculated Risk on 9/04/2006 06:27:00 PM

I'm trying to answer one of the key housing questions: How far will New Home sales fall? This is a complicated question and, of course, the quantity demanded depends on the price - and homebuilders are already responding to the sluggish market by lowering their prices and / or offering incentives. So how quickly prices fall is a key determinate on how far New Home Sales decline.

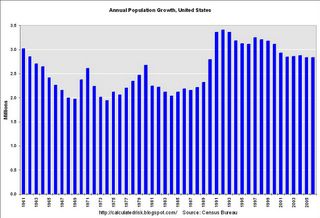

This post is more modest; this is an overview of some of the demographic drivers of housing demand. This is a look at the national market. Note that demographic drivers in local markets will differ considerable from the national trends. As an example the population in Detroit is declining, and since housing is very durable, prices for existing homes are below replacement costs. (See Profile of Edward L. Glaeser) Click on graph for larger image.

Click on graph for larger image.

The first key demographic for housing is population growth. This chart show the annual U.S. population growth according to the Census Bureau. The surge in the early '90s was probably a combination of the Baby Boom echo and perhaps immigration. But the key is that population growth is currently running about 2.85 million people per year. The second chart shows the trend of people per housing unit in the United States. The number of persons per unit was trending down until around 1990 and then flattened out. There was a rapid decrease in the '70s as the boomers started forming new households en masse.

The second chart shows the trend of people per housing unit in the United States. The number of persons per unit was trending down until around 1990 and then flattened out. There was a rapid decrease in the '70s as the boomers started forming new households en masse.

Recently the number of people per housing unit has fallen slightly again. This could be due to people moving from renting to homeownership - leaving more vacant rental units. Another factor frequently cited by the National Association of Realtors is 2nd home purchases. A third possibility is speculative purchases.

Whatever the causes, changes in the ratio of people to housing units is a key driver for housing. In the '70s, there was more housing demand due to smaller household units, than due to the growth in the population. Conversely demand in the '90s was almost exclusively due to population growth, as household sizes stabilized. See the following table:

| Housing Added due to Population Growth and changes in Household Size | |||

| Decade | Due to Population Growth | Due to Change in Household Size | Total Housing Units Added |

| 1940s | 5.84 Million | 2.86 Million | 8.70 Million |

| 1950s | 9.11 | 3.08 | 12.19 |

| 1960s | 8.10 | 2.27 | 10.37 |

| 1970s | 9.05 | 10.65 | 19.70 |

| 1980s | 9.13 | 4.77 | 13.90 |

| 1990s | 13.47 | 0.13 | 13.60 |

| 2000s (through July '06) | 7.63 | 2.04 | 9.67 |

Predicting population growth and changes in household size are both important in predicting the need for new housing units. Since population growth is fairly predictable, understanding the reasons for changes in household sizes is the key to determining the number of new housing units needed.

Imagine if household sizes increase - even back to the 2000 level - the number of new housing units required for the remainder of the decade would be much lower than the first 6 years of the 2000s. With the high cost of homeownership, I wouldn't be surprised to see household sizes increase slightly over the next few years, at least until prices fall enough to spur demand.

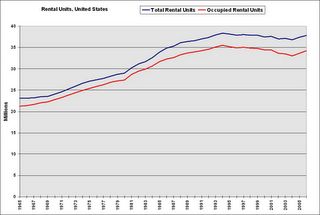

When we talk about housing units that includes both owner occupied units and rentals. Let's take a look at the rental market:

This graph shows the total number of rental units and occupied rental units in the United States. Notice the number of units rose in the '70s as baby boomers moved out of their parent's homes. The number continued to increase sharply in the '80s, but vacancy rates started climbing too. I think this shows there was over-building in the '80s, perhaps because of easy credit from the S&Ls, perhaps because builders were extrapolating demand from the recent past (the '70s).

This graph shows the total number of rental units and occupied rental units in the United States. Notice the number of units rose in the '70s as baby boomers moved out of their parent's homes. The number continued to increase sharply in the '80s, but vacancy rates started climbing too. I think this shows there was over-building in the '80s, perhaps because of easy credit from the S&Ls, perhaps because builders were extrapolating demand from the recent past (the '70s).Then the number of units started falling in the '90s. This probably means units were being converted to condos. In the early '00s, the number of apartments continued to decline as lower interest rates made ownership possible for many renters. Recently the number of apartments has started to increase again - since renting looks more attractive than owning for many Americans.

Mostly I write about New Home sales. New Home sales are from properties developed for sale. When we are talking about total housing units built in any year, we have to include houses built by the owner (either with or without a contractor) and new rentals units.

As an example, in 2005 there were 1.932 million units completed, of which 1.385 million were built for sale, 308 thousand built by owner, and 239 thousand built as rentals.

As an example, in 2005 there were 1.932 million units completed, of which 1.385 million were built for sale, 308 thousand built by owner, and 239 thousand built as rentals.New Home sales are units sold from the "Built for Sale" category only.

During the best decade for adding housing units (the '70s because of changes in household sizes) the U.S. added 1.97 million units per year. Last year, the same number of units were added, even though the demographics appear less favorable for housing (household sizes are fairly stable).

I still haven't answered the key question: How far will New Home sales fall? I'm still working on that ...

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |