by Calculated Risk on 9/19/2006 02:27:00 PM

Tuesday, September 19, 2006

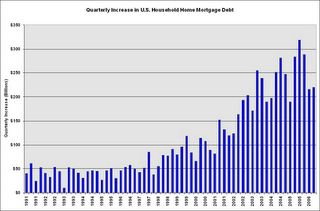

Fed: Household Mortgage Debt Increased $220 Billion in Q2

The Federal Reserve released the Q2 2006 Flow of Funds report today.

From MarketWatch (hat tip Paul): Household net worth up 0.1% in second quarter

The net worth of U.S. households increased 0.1% in the second quarter to $53.3 trillion, the slowest gain in nearly four years, the Federal Reserve said Tuesday.

After adjusting for inflation, net worth fell in the quarter.

...

Household assets grew by $332 billion to $66 trillion in the second quarter, while liabilities increased by $278 billion to $12.7 trillion. The value of real estate holdings increased by $402 billion ...

...

Owners' equity in their real estate fell to a record low 54.1% of market value from 54.4% in the first quarter and nearly 58% in 2000.

...

Mortgage debt increased 9%, the slowest pace since the recession of 2001.

Click on graph for larger image.

Click on graph for larger image.Household mortgage debt increased $220.3 Billion in Q2.

This increase in mortgage debt accounted for 80% of the increase in household liabilities for the quarter.

Even though the rate of increase of mortgage debt has slowed, mortgage debt is still increasing faster than GDP growth. So the ratio of mortgage debt to GDP is still increasing.

Even though the rate of increase of mortgage debt has slowed, mortgage debt is still increasing faster than GDP growth. So the ratio of mortgage debt to GDP is still increasing.Mortgage debt is now at a record 70.6% of GDP.

Look at these all time records:

1) Owner's equity, as a percent of market value, is at an all time low.

2) Mortgage debt, as a percent of GDP, is at an all time high.

3) Mortgage debt service, as a percent of disposable personal income, is at an all time high (from Q1 data, Q2 data will be released soon).

And, according to the Fed estimates, the value of household real estates was still rising in Q2, 2006. Imagine what happens when values start to decline.

Housing Starts and Construction Employment

by Calculated Risk on 9/19/2006 10:48:00 AM

The Census Bureau reports: New Residential Construction in August 2006

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,665,000. This is 6.0 percent below the revised July estimate of 1,772,000 and is 19.8 percent below the August 2005 rate of 2,075,000.

Single-family housing starts in August were at a rate of 1,360,000; this is 5.9 percent below the July figure of 1,445,000.

Click on graph for larger image.

Click on graph for larger image.Comparing housing starts to residential construction employment (SA), it appears the BLS numbers should indicate housing related job losses soon.

Even if housing stabilizes at this level, there are probably 600K residential construction jobs (BLS reported) that will be lost.

Retailers: NRF Sees Subdued Holiday Gains in 2006

by Calculated Risk on 9/19/2006 12:36:00 AM

The National Retail Federation (NRF) Sees Subdued Holiday Gains in 2006

While consumers have shown a surprising amount of resilience in 2006, retailers can expect a more subdued holiday season. According to the National Retail Federation (NRF), total holiday retail sales are expected to increase 5.0 percent over last year... In comparison, holiday sales in 2005 rose 6.1 percent...Not too bad. And the AP reports: Target Increases Sales Forecast for September

"Consumers have faced a number of economic challenges this year and have taken them in stride," said NRF Chief Economist Rosalind Wells. "Although sales gains will not be as robust as last year, retailers can still expect above-average holiday sales growth."

Over the last ten years, the average percentage increase in sales for the holiday season is 4.6 percent. One-fifth of retail industry sales (19.9%) occur during the holiday season, making it the most important time period of the year for the industry.

Target Corp., the nation's second-largest discounter behind Wal-Mart Stores Inc., increased its sales forecast for September late Monday, a sign that retreating gasoline prices may be providing some relief to shoppers.It looks like the U.S. consumer is still alive and spending.

The Minneapolis-based retailer said in a recorded message that it now projects same-store sales, or sales at stores open at least a year, will increase to 5 percent for September. It had originally expected same-store sales to be up from 3 percent to 5 percent.

So far the impact from the housing bust on the general economy has been limited. This makes sense. I expect the housing bust to impact the economy in three ways: first from the loss of housing related jobs, second from the loss of mortgage equity withdrawal (MEW), and third, from the impact of nontraditional mortgages.

Housing related job losses have been modest so far - although job losses should accelerate in the next few months. Cash-out refinance activity has still been strong and the impact from "toxic loans" has been minor.

So far, so good.

Monday, September 18, 2006

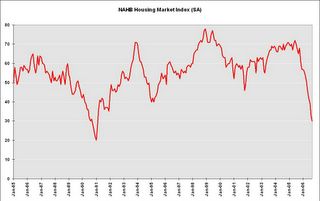

NAHB: Builder Confidence Falls to 15 Year Low

by Calculated Risk on 9/18/2006 12:50:00 PM

UPDATE: The National Association of Home Builders reports: Builder Confidence Slips Further in September

Click on graph for larger image.

Reflecting increasing builder concerns about conditions in the market for new single-family homes, the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) declined for an eighth consecutive month to a level of 30 in September. This amounted to a three-point drop from an upwardly revised 33 reading in August, and is the lowest level the index has reached since February of 1991.Once again this shows that the housing bust is national and is getting worse.

"Builders are adopting an increasingly cautious attitude in their near-term outlook for new-home sales," said NAHB Chief Economist David Seiders. "They’re experiencing falling sales, rising sales cancellations, and increasing inventories of unsold units. And although many builders are offering substantial incentives to bolster sales and limit cancellations, many potential buyers now are waiting on the sidelines to see how the market shakes out before proceeding with a home purchase."

"We are in the midst of an anticipated adjustment period as the housing market subsides from the record-breaking and unsustainable highs of the past few years," Seiders noted. "Our forecast projects the numbers flattening out around the middle of next year and gradually moving back up towards trend in 2008."

...

Two of the three component indexes declined in August. The component that gauges current single-family home sales declined five points to 32, while the component gauging expected sales in the next six months fell four points to 37. The component gauging traffic of prospective buyers remained even from last month, at 22.

The HMI fell in three out of four regions in September. The largest decline was registered in the Northeast, where a six-point drop brought the HMI to 28. The HMI fell five points to 38 in the West and fell three points to 38 in the South. The HMI held steady at 16 in the Midwest, where fundamentally weak economic conditions continue to weigh on the market.

Sunday, September 17, 2006

NY Times: Who Bears the Risk?

by Calculated Risk on 9/17/2006 01:21:00 AM

The NY Times asks: Who Bears the Risk?

The housing boom would never have lasted as long as it did if mortgage lenders had to worry about being paid back in full. But instead of relying on borrowers to repay, most lenders quickly sell the loans ...Of those us that thought there was a housing bubble, Dr. Hamilton asked last year: If there is a housing bubble, "[W]hy are banks making loans to people who aren't going to be able to pay them back?"

As the boom thundered on, the pool of available credit grew larger than the pool of creditworthy borrowers, resulting in an explosion of risky mortgages with features like no money down, interest-only payments and super-low teaser rates. Investors ... currently hold $2 trillion in mortgage-backed securities from investment banks, triple the amount from three years ago. Investors also own $4 trillion in mortgage-backed securities from government-sponsored agencies.

... everyone knows that if mortgage defaults should rise, damage could reverberate throughout the financial system. So far, defaults have inched up. But many homeowners are at a dangerous juncture. Interest rates on adjustable mortgages are rising as home values are weakening, precluding for many the chance to refinance. Economists calculate that $750 billion of outstanding mortgage debt is now at measurable risk of default — about 7 percent of the total.

This is a great question, and the NY Times hints at a possible answer. "In a market so vast and dynamic" it is possible that numerous participants are underestimating the systemic risk.

UPDATE: Tanta understands this market far better than I can ever hope to - I'll post her comments in full. From Tanta (THANK YOU!):

Let me have some coffee and some time to ponder the wisdom of the NYT Editorial Board (*shakes head like Labrador Retriever exiting swimming pool*) and I shall try to have something worthwhile to say.To add to Tanta's comments, here is the story on H&R Block:

First thought of the day, meanwhile: selling loans in the secondary market is, of course, a way of dispersing default risk. But that isn't the only, or even the main reason banks sell loans. There is the matter of interest rate risk (prepayment, duration) for one big thing, plus capital needs and general balance sheet management, plus the desire to book gain on sale right now versus future accrual income. This is important to understand because in reality some banks end up selling/securitizing their best loans (from a pure credit risk standpoint) and keeping the weakest credit risk on their books, even in times like the present with record rates of sale/securitization. You miss this dynamic if you assume that the primary reason for loan sales is to pass off credit risk.

It's also harder to completely pass through credit risk than the NYT probably thinks. There are reps and warranties in every loan sale that can come back to bite the seller of loans even without explicit recourse agreements--H&R Block just recently got its ass bitten by that, as an example. If and when credit risk starts to rise, there's a huge push-back in the industry, as every current holder of toxicity tries to put it back through the chain to the originator. That means that if and when the originator has to take back an impaired loan, it is generally at the wrong time, the wrong price, and the wrong market for resale. So even if the loan comes current or otherwise cures, it still gets written down relative to its original market value. At a certain point, you can end up wishing the damn thing had gone into foreclosure, because you'd have lost less money on it. There is no such thing as "pure" credit risk, in other words.

If that made a limited amount of sense, blame it on caffeine imbalance in my cranial portfolio. I'll be back when I have hedged my coherence gap.

... early defaults have forced lenders such as NetBank Inc., Fremont General Corp. and H&R Block Inc. to buy back loans already sold to whole-loan acquirers, particularly Wall Street investment banks that pool and package those loans into asset-backed securities and then sell them to large investors such as insurance companies and hedge funds. The buybacks, in turn, have led lenders to incur losses and set aside more money in their reserve funds for potential loan repurchases in the future. ... H&R Block told investors ... "an increase in early payment delinquencies" and the resulting "higher level of repurchase requests from loan buyers" led it to increase its loan reserves. ...Original Post: I am reminded of this quote:

"A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional way along with his fellows, so that no one can really blame him."John Maynard Keynes, "Consequences to the Banks of a Collapse in Money Values", 1931

Friday, September 15, 2006

Witness List Released for Senate Hearing: Nontraditional Mortgages

by Calculated Risk on 9/15/2006 02:11:00 PM

The witness list was released this morning for the Senate hearing on Assessing Non-Traditional Mortgage Products. The hearing is Wednesday, September 20, at 10 AM ET.

The first panel will be mostly representatives from the regulatory agencies responsible for the new guidance. One insider suggested the OCC is pushing hard to release the new guidance, and some of the other agencies may be dragging their feet. So this might be interesting.

Panel 1

Ms. Orice Williams , Director, Government Accountability Office

Ms. Kathryn E. Dick , Deputy Comptroller for Credit and Market Risk, Office of the Comptroller of the Currency

Ms. Sandra F. Braunstein , Director of the Division of Consumer and Community Affairs, Federal Reserve

Ms. Sandra Thompson , Director of the Division of Supervision and Consumer Protection, Federal Deposit Insurance Corporation

Mr. Scott Albinson , Managing Director for Examinations, Supervision, and Enforcement, Office of Thrift SupervisionExpect some fireworks from the second panel!

The MBA and the Mortgage Brokers Association oppose the new guidance, or at least want it neutered. The last three panel members will be arguing the guidance is necessary and should have some teeth.

Panel 2

Mr. Robert Broeksmit , Chairman of the Residential Board of Governors, Mortgage Bankers Association

Mr. George Hanzimanolis , NAMB President-Elect, Bankers First Mortgage, Inc. testifying on behalf of the National Association of Mortgage Brokers

Mr. William A. Simpson , Chairman, Republic Mortgage Insurance Company testifying on behalf of the Mortgage Insurance Companies of America

Mr. Michael D. Calhoun , President, Center For Responsible Lending

Mr. Allen Fishbein , Director of Housing and Credit Policy, Consumer Federation of America

The UberNerds will be having fun on Wednesday (a hat tip to Tanta!).

Thursday, September 14, 2006

MBA: More fall Behind on Mortgages

by Calculated Risk on 9/14/2006 10:04:00 PM

From the USA Today: More fall behind on mortgages

More homeowners with shaky credit are falling behind on their mortgage payments, especially in such states as Ohio, Alabama, Tennessee, Michigan and West Virginia, where job losses have struck the local economies, the Mortgage Bankers Association said Wednesday.See the article for a state by state chart of delinquency rate.

The problem is the worst for those with subprime credit who pay higher-than-usual interest rates and who have adjustable loans that have been resetting to higher rates. About 12.2% of such borrowers were late paying their loans in April through June, the highest level since the end of 2003.

About 25% of all mortgages carry adjustable rates, and more than half of those loans are to subprime borrowers. As a result, delinquencies are expected to rise through next year as more adjustable-rate mortgages reset to higher rates, sending ripples through family finances and housing markets.

Calls to the Homeownership Preservation Foundation, which provides free credit counseling, hit a record 2,464 in August, a 25% jump over July. More than half of the distressed callers had ARM loans.

Here is the MBA report: Some Delinquency Measures Tick Upwards

“Going forward we expect some further slowing in the economy and the housing market. As a result, we will see modest increases in delinquency and foreclosure rates in the quarters ahead,” said [Doug Duncan, MBA’s chief economist and senior vice president of research and business development].

Senate Hearing Video

by Calculated Risk on 9/14/2006 12:47:00 PM

For insomniacs, paper_money has posted a video of the "Housing Bubble" Senate hearing.

Calculated Risk: Assessing Non-Traditional Mortgage Products

by Calculated Risk on 9/14/2006 01:33:00 AM

On September 20th at 10:00AM EST the Senate will hold a hearing:

Calculated Risk: Assessing Non-Traditional Mortgage Products

Don't blame me!

Wednesday, September 13, 2006

CFOs Turn Pessimistic

by Calculated Risk on 9/13/2006 07:36:00 PM

Reuters reports: CFOs see 33 pct chance of US recession in 12 months-survey

Chief financial officers of U.S. corporations are increasingly pessimistic about their business and the overall economy, and put the chance of a recession within the next year at 33 percent, a quarterly survey reported on Wednesday.CFOs are a key survey group to gauge future business investment and hiring. As the article notes:

The level of pessimism about the U.S. economy is the highest in five years, the survey by Duke University and CFO Magazine found. Fewer finance chiefs expect to increase capital spending, their forecasts for earnings growth are lower, and expectations for hiring are down, the survey found.

The 10-year old survey has been a strong leading indicator of corporate results and behavior, said survey director John Graham.Since most soft landing scenarios are strongly dependent on increases in business investment, this survey is very negative. Here are their concerns:

"I would expect earnings, capital spending and hiring to go down," Graham said, adding his forecast covered the next 12 months.

"I'm not predicting they'll go negative, but I'm predicting they'll slow," he said.

Sliding consumer demand tops their list of worries. Other major concerns include the rising costs of labor and of energy ...Of course there has been some good news recently on energy prices; since the mini-spike last month due to the Alaska BP pipeline shutdown announcement, spot oil prices have fallen almost $13 per barrel to under $65 per bbl today. And gasoline prices have fallen too, and, as Dr. Hamilton notes: Gasoline prices will fall even more.

So perhaps falling energy prices will cushion the blow from the housing bust. But, even with the recent drop in energy prices, spot oil prices are still up 10% from the beginning of the year.