by Calculated Risk on 9/21/2006 12:27:00 PM

Thursday, September 21, 2006

Philly Fed: No Growth

The Federal Reserve Bank of Philadelphia released September’s Business Outlook Survey today. Here are some excerpts: Click on graph for larger image.

Click on graph for larger image.

Growth Stalls this MonthBut perhaps the most interesting result was the answer to the special question:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, dropped from 18.5 in August to -0.4 this month. This is the first negative reading in the index since April 2003, although the index registered a zero reading in June 2005. [see chart] ...

Six-Month Forecast Falls Significantly

Expectations for future manufacturing growth fell sharply this month. Indicators for future activity, new orders, shipments, and employment all declined from their August readings. The future general activity index fell from 7.4 to -0.2, its first negative reading since January 2001

"Do you expect the following capital expenditure categories in 2007 to be higher than, lower than, or the same as in the current year?"Overall manufacturers currently have lower expectations for investment in all categories as compared to December 2005, especially investment in structures. This is important because many analysts have pinned their hopes for an economic soft landing on future business investment. And the steep drop in anticipated structure investment is especially critical since it was hoped that jobs lost in residential construction would move to nonresidential construction. Of course this is only for manufacturers, and the survey only covers the Third Federal Reserve District.

Thornberg on Bay Area Housing

by Calculated Risk on 9/21/2006 01:53:00 AM

Professor Thornberg is quoted in the San Mateo County Times: Home sales decline, prices stay flat

"We can say, with some certainty, price appreciation is zero and may even be slightly retracting. The market is flat and the bubble has popped," said Chris Thornberg, an economist with Bay Area-based Beacon Economics.Thornberg's forecast appears to be for 4 to 5 years of flat nominal prices, or about a 15% real price decline.

...

Thornberg of Beacon Economics doesn't expect the Bay Area to see substantial price appreciation — which he defines as being in annual range of 2 to 4 percent — until 2010 or 2011.

The reason for the sluggish forecast is that the soaring rise in home prices in the last few years far exceed the size of mortgages that can be paid by average household incomes, said Thornberg.

Until household income and rents rise significantly, housing appreciation will remain flat, he said.

"This thing hasn't shaken out. Price appreciation has pushed home prices to never-seen before levels. It's going to take some time," said Thornberg.

Wednesday, September 20, 2006

DataQuick: California August Home Sales

by Calculated Risk on 9/20/2006 11:14:00 PM

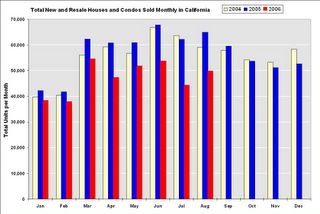

DataQuick reports California August Home Sales  Click on graph for larger image.

Click on graph for larger image.

A total of 49,800 new and resale houses and condos were sold statewide last month. That's up 12.5 percent from 44,250 for July and down 25.1 percent from a revised 66,500 for August 2005.The data I have only goes back to September 2003, but it appears sales are also running below the 2003 rate.

The median price paid for a home last month was $472,000. That was down 0.6 percent from July's $475,000, and up 3.5 percent from $456,000 for August a year ago.

...

The numbers cover all sales, new and resale, houses and condos.

FOMC Meeting

by Calculated Risk on 9/20/2006 08:11:00 PM

For some excellent analysis, I suggest:

Tim Duy's Fed Watch: Unsatisfying

"Like almost everyone, I was expecting policy to remain essentially unchanged at the conclusion of today’s FOMC meeting. Still, I was left unsatisfied by the accompanying statement, posted by Mark Thoma. At best, its brevity makes it look straightforward. At worst, it looks like something cobbled together because FOMC members were unable to reach a uniform opinion on the state of the economy."William Polley: Fed leaves rates unchanged

"The 30 second summary of which is that the housing slowdown is no longer regarded as "gradual" and that energy prices are not as much of a concern as they were previously.And Brad Delong writes succinctly:

...

Steady as she goes for a few more weeks, watching the housing market as well as the inflation numbers, trying to steer a course between the--hoping that no exogenous winds of change blow them off course."

"Good luck, Ben and company..."

Bay Area: How far will prices fall?

by Calculated Risk on 9/20/2006 06:58:00 PM

In the comments to the previous post I suggested that Bay Area prices might fall 40%+ in real terms over 5 to 7 years. ac asked how I came up with that estimate, and Lester suggested somewhat impolitely that the estimate did not match my "moderate, professorial tone".

First, it's important to distinguish between nominal and real price declines. If the U.S. averages 3% inflation over the next 5 years - and nominal prices stay flat - real prices would decline 16%. Many homeowners would think they "broke even", when in fact the real value of their homes declined 16%. Click on graph for larger image.

Click on graph for larger image.

Lets look at the previous bust in California in the early '90s in real terms.

For the Bay Area and San Diego, median real prices declined about 25% over a six year period. In Los Angeles median real prices declined about 35%.

NOTE: Prices are from the OFHEO house price index adjusted by CPI less Shelter from the BLS.

If this bust is similar to the early '90s bust in California, we would expect real price declines of 25% to 35% over a 5 to 7 year period. I think this bust will be worse because I believe the current bubble was larger.

In real terms, prices in San Diego are already about 10% below the peak of last year. For the Bay Area, real prices are already about 4.5% below the peak. (based on DataQuick data).

DataQuick: Bay Area home sales decline, prices level off

by Calculated Risk on 9/20/2006 04:11:00 PM

DataQuick reports: Bay Area home sales decline, prices level off

Home sales in the Bay Area declined again last month as prices continued to level off, a real estate information service reported.

...

The median price paid for a Bay Area home was $620,000 last month. That was down 1.1 percent from $627,000 in July, and up 0.2 percent from $619,000 for August a year ago. Last month's year-over- year increase was the lowest since March 2002 when the $381,000 median fell 1.3 percent.

| Bay Area California Median Home Prices | ||||

| Area | Aug '04 | Aug '05 | Aug '06 | Pct Change |

| Alameda | $497K | $586K | $577K | -1.5% |

| Contra Costa | $468K | $567K | $567K | 0.0% |

| Marin | $717K | $822K | $803 | -2.3% |

| Napa | $511K | $603K | $616K | 2.2% |

| San Francisco | $668K | $745K | $750K | 0.7% |

| San Mateo | $649K | $773K | $721K | -6.7% |

| Santa Clara | $539K | $654K | $658K | 0.6% |

| Solano | $377K | $474K | $483K | 1.9% |

| Sonoma | $462K | $554K | $557K | 0.5% |

| Bay Area | $520K | $619K | $620K | 0.2% |

I added the August 2004 median prices to give a two year perspective on prices.

A total of 9,128 new and resale houses and condos were sold in the nine-county region last month. That was up 14.9 percent from 7,941 for July, and down 24.9 percent from 12,154 for August last year, according to DataQuick Information Systems.

Last month was the slowest August since 1997 when 9,080 homes were sold. DataQuick's statistics go back to 1988: the slowest August was in 1992 with 6,326 sales, the strongest was in 2003 with 12,488. The average August sales count since 1988 is 9,530.

| Bay Area California Homes Sold | ||||

| Area | Aug '04 | Aug '05 | Aug '06 | Pct Change |

| Alameda | 2,742 | 2,612 | 1,876 | -28.2% |

| Contra Costa | 2,560 | 2,497 | 1,910 | -23.5% |

| Marin | 478 | 438 | 380 | -13.2% |

| Napa | 226 | 226 | 119 | -47.3% |

| San Francisco | 735 | 662 | 613 | -7.4% |

| San Mateo | 986 | 969 | 792 | -18.3% |

| Santa Clara | 3,017 | 2,832 | 2,126 | -24.9% |

| Solano | 1,015 | 1,016 | 668 | -34.3% |

| Sonoma | 915 | 902 | 644 | -28.6% |

| Bay Area | 12,674 | 12,154 | 9,128 | -24.9% |

Nontraditional Mortgage Guidance:"weeks, not months"

by Calculated Risk on 9/20/2006 03:40:00 PM

Q: When do you expect to issue the final guidance on nontraditional mortgage guidance?

A: Near term. Weeks, not months.

Q: We were hoping for something more specific.

Senate Hearing: Nontraditional Loans

by Calculated Risk on 9/20/2006 02:36:00 PM

Here is an audio of the Senate hearing (Real Media).

Witness Statements:

Panel 1

Ms. Orice Williams , Director, Government Accountability Office

Ms. Kathryn E. Dick , Deputy Comptroller for Credit and Market Risk, Office of the Comptroller of the Currency

Ms. Sandra F. Braunstein , Director of the Division of Consumer and Community Affairs, Federal Reserve

Ms. Sandra Thompson , Director of the Division of Supervision and Consumer Protection, Federal Deposit Insurance Corporation

Mr. Scott Albinson , Managing Director for Examinations, Supervision, and Enforcement, Office of Thrift Supervision

Ms. Felicia A. Rotellini , Superintendent, Arizona Department of Financial Institutions

Panel 2

Mr. Robert Broeksmit , Chairman of the Residential Board of Governors, Mortgage Bankers Association

Mr. George Hanzimanolis , NAMB President-Elect, Bankers First Mortgage, Inc. testifying on behalf of the National Association of Mortgage Brokers

Mr. William A. Simpson , Chairman, Republic Mortgage Insurance Company testifying on behalf of the Mortgage Insurance Companies of America

Mr. Michael D. Calhoun , President, Center For Responsible Lending

Mr. Allen Fishbein , Director of Housing and Credit Policy, Consumer Federation of America

MBA: Refinance Applications Rise

by Calculated Risk on 9/20/2006 02:03:00 AM

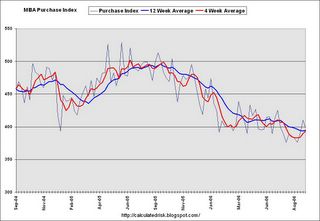

The Mortgage Bankers Association (MBA) reports: Refinance Applications Rise in Latest Survey Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 595.8, an increase of 2 percent on a seasonally adjusted basis from 584.2 one week earlier. On an unadjusted basis, the Index increased 12.3 percent compared with the previous week and was down 22.5 percent compared with the same week one year earlier. The previous week was shortened due to the Labor Day holiday.Mortgage rates were mixed:

The seasonally-adjusted Purchase Index decreased by 3 percent to 397.9 from 410.2 the previous week and the Refinance Index increased by 9.5 percent to 1748.7 from 1597 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.36 percent from 6.32 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 5.95 percent from 5.96 percent ...

| Percent Change in Number of Applications | |||

| Applications | Change from one year ago | ||

| Total | -22.5% | ||

| Purchase | -19.8% | ||

| Refi | -25.7% | ||

| Fixed Rate | -19.4% | ||

| ARM | -29.8% | ||

Purchase activity is off 19.8% from the comparable week last year.

Purchase activity is off 19.8% from the comparable week last year. This graph shows the Purchase Index and the 4 and 12 week moving averages.

Note: Scale does not start at zero to better show changes.

Average year-to-date purchase activity is 13.6% below 2005, and has been running more than 20% below 2005 for the last couple of months.

Tuesday, September 19, 2006

DataQuick: Continued slowdown for Southland home sales

by Calculated Risk on 9/19/2006 06:02:00 PM

DataQuick reports: Continued slowdown for Southland home sales

Home sales in Southern California continued at their slowest pace in nine years as price levels appeared to be nearing a plateau, a real estate information service reported.NOTE: San Diego median prices are below the level of two years ago.

...

The median price paid for a Southland home was $489,000 last month. That was down 0.6 percent from July's $492,000, and up 2.7 percent from $476,000 in August last year. Last month's increase was the smallest since July 1999, when the $193,000 median also rose 2.7 percent from $188,000 a year earlier.

| Southern California Median Home Prices | ||||

| Area | Aug '04 | Aug '05 | Aug '06 | Pct Change |

| Los Angeles | $407K | $494K | $517K | 4.7% |

| Orange County | $543K | $617K | $633K | 2.6% |

| San Diego | $483K | $493K | $482K | -2.2% |

| Riverside | $334K | $388K | $415K | 7.0% |

| San Bernardino | $261K | $344K | $365K | 6.1% |

| Ventura | $514K | $592K | $598K | 1.0% |

| Southern California | $407K | $476K | $489K | 2.7% |

I added the August

A total of 25,628 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 12.8% from 22,712 in July, and down 25.3 percent from 34,292 for August a year ago, according to DataQuick Information Systems.

Sales have declined on a year-over-year basis the last nine months. Last month's sales count was the lowest for any August since 22,308 homes were sold in August 1997. DataQuick's statistics go back to 1988, August sales have varied from 12,769 in 1992 to 35,339 in 1988. An average August has 25,845 sales.

| Southern California Homes Sold | ||||

| Area | Aug '04 | Aug '05 | Aug '06 | Pct Change |

| Los Angeles | 10,710 | 11,653 | 9,193 | -21.1% |

| Orange County | 3,745 | 4,708 | 3,203 | -32.0% |

| San Diego | 5,580 | 5,379 | 3,666 | -31.8% |

| Riverside | 5,579 | 6,542 | 4,879 | -24.4% |

| San Bernardino | 4,319 | 4,522 | 3,611 | -20.1% |

| Ventura | 1,198 | 1,578 | 1,076 | -31.8% |

| Southern California | 31,131 | 34,292 | 25,628 | -25.3% |

Notice that San Diego had declining sales in 2005 compared to 2004. As LA Times writer David Streitfeld noted about the San Diego housing market:

San Diego had the wildest run-up among major California cities, with prices tripling since the mid-1990s. ... The market also began to fade first in San Diego. ...It does appear that San Diego is leading the way, and I think that means declining prices soon in all of SoCal.

Whatever happens [in San Diego], optimists and pessimists agree, will happen later in the rest of the state.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |