by Calculated Risk on 9/21/2006 11:24:00 PM

Thursday, September 21, 2006

Hot New Toy?

For something a little different, I've heard TMX Elmo is off the charts HOT and is already sold out. Here is the EBay page.

Senate Hearing Audio: Nontraditional Mortgages

by Calculated Risk on 9/21/2006 04:07:00 PM

The complete audio (panels 1 and 2) is here.

Note: the second panel starts at 1 hour 30 minutes into the 3 hour audio.

Morgan Stanley's Berner: The Great Housing Debate

by Calculated Risk on 9/21/2006 02:50:00 PM

Economist Richard Berner believes the housing bust will have less of an impact on the economy than many observers expect. From Berner:

US housing activity is in recession and home prices are decelerating sharply, and those trends likely will intensify. The combination could pare as much as 1½ percentage points from US growth in the second half of 2006, and many are thus concluding that the economy is headed for trouble. We continue to think that there are significant offsets to these drags on economic activity, such as stronger global growth and declining energy quotes. As a result, the prognosis for growth could be stronger than either pessimists or market participants expect (see "Is This What A Soft Landing Feels Like?" Global Economic Forum, September 5, 2006). [emphasis added]Berner comments on the weakness in the housing market, but he believes real prices will not fall significantly:

We’re bearish on housing activity and think the deceleration in prices has further to go. ...That may sound bearish, but Berner is painting a soft landing picture. Berner then addresses mortgage equity extraction and he believes the concerns are overblown:

The pessimists argue that the bursting of a putative housing bubble means that prices could decline significantly. There is some risk that prices could decelerate faster or even decline in real terms — after all, investment and speculative activity has picked up in the past five years. But the character of housing demand makes the much-feared decline in prices on a nationwide basis unlikely ...

Nonetheless, prices may fall in markets that are affected by a weak economy (e.g., Detroit), by high speculative activity (e.g., some condominium markets) or where there is a preponderance of second homes (e.g., in Florida or the Sunbelt). ...

However, the recession in housing activity is a nationwide development and will significantly depress growth. We estimate that the decline in 1-family housing starts directly will cut 0.9 percentage point from US real growth in the second half of 2006 (single-family construction amounts to about 3.3% of GDP; we expect that apartment construction will improve somewhat after eight years of no growth, which has limited supply and helped rents to firm). The plunge in single-family housing construction will cost both output and jobs. We expect that the loss of jobs in residential construction, real estate brokerage, and mortgage finance could amount to 10,000 monthly. ...

Of course, that’s not all. The decline in housing demand probably will crimp spending on furniture, appliances and other household goods ... A 10% decline in such outlays over a year could knock another 0.3% off overall GDP.

...it would be reasonable to think that the surge in housing wealth and home equity extraction has fueled significant spending gains in these discretionary items, that households can postpone such purchases, and that even a deceleration in housing wealth could promote declines in these big-ticket outlays.This is a soft landing scenario.

Reasonable, yes, but not entirely accurate. First, housing activity and big-ticket housing-related durables don’t necessarily march in lockstep anymore. ...

Moreover, and most important, in my view the deceleration in housing wealth will have at most one-fifth the impact on consumer spending that some fear. Some, including former Fed Chairman Greenspan, believe that 50 cents of every additional dollar of home equity extraction has financed consumer outlays. Empirical studies, however, suggest that a $1 decline in real housing wealth would trim spending by at most 11 cents, and some suggest that the effect would be half that magnitude (see “Housing Wealth and Consumer Spending” and “Housing, Mortgages and Consumption: Comparing Australia, the UK and the US,” Global Economic Forum, October 7, 2005 and March 2, 2006, respectively). Of course, that’s not negligible; we estimate that the flattening in real housing wealth in our outlook will pare roughly ½ percentage point from the growth in consumer outlays over the coming year.

I disagree with Berner on several points. I think real prices will fall nationwide, both in nominal and real terms. This is an important difference: first, I believe the psychological impact of falling prices will exacerbate the housing bust, and second, falling prices will have a larger impact on borrowers that have used nontraditional loans as affordability products (Berner didn't address the exotic loan issue). I will address Berner's comments on the impact of mortgage extraction in another post.

Philly Fed: No Growth

by Calculated Risk on 9/21/2006 12:27:00 PM

The Federal Reserve Bank of Philadelphia released September’s Business Outlook Survey today. Here are some excerpts: Click on graph for larger image.

Click on graph for larger image.

Growth Stalls this MonthBut perhaps the most interesting result was the answer to the special question:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, dropped from 18.5 in August to -0.4 this month. This is the first negative reading in the index since April 2003, although the index registered a zero reading in June 2005. [see chart] ...

Six-Month Forecast Falls Significantly

Expectations for future manufacturing growth fell sharply this month. Indicators for future activity, new orders, shipments, and employment all declined from their August readings. The future general activity index fell from 7.4 to -0.2, its first negative reading since January 2001

"Do you expect the following capital expenditure categories in 2007 to be higher than, lower than, or the same as in the current year?"Overall manufacturers currently have lower expectations for investment in all categories as compared to December 2005, especially investment in structures. This is important because many analysts have pinned their hopes for an economic soft landing on future business investment. And the steep drop in anticipated structure investment is especially critical since it was hoped that jobs lost in residential construction would move to nonresidential construction. Of course this is only for manufacturers, and the survey only covers the Third Federal Reserve District.

Thornberg on Bay Area Housing

by Calculated Risk on 9/21/2006 01:53:00 AM

Professor Thornberg is quoted in the San Mateo County Times: Home sales decline, prices stay flat

"We can say, with some certainty, price appreciation is zero and may even be slightly retracting. The market is flat and the bubble has popped," said Chris Thornberg, an economist with Bay Area-based Beacon Economics.Thornberg's forecast appears to be for 4 to 5 years of flat nominal prices, or about a 15% real price decline.

...

Thornberg of Beacon Economics doesn't expect the Bay Area to see substantial price appreciation — which he defines as being in annual range of 2 to 4 percent — until 2010 or 2011.

The reason for the sluggish forecast is that the soaring rise in home prices in the last few years far exceed the size of mortgages that can be paid by average household incomes, said Thornberg.

Until household income and rents rise significantly, housing appreciation will remain flat, he said.

"This thing hasn't shaken out. Price appreciation has pushed home prices to never-seen before levels. It's going to take some time," said Thornberg.

Wednesday, September 20, 2006

DataQuick: California August Home Sales

by Calculated Risk on 9/20/2006 11:14:00 PM

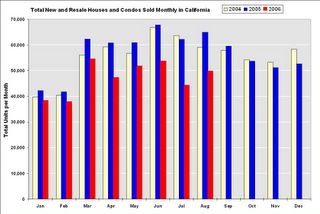

DataQuick reports California August Home Sales  Click on graph for larger image.

Click on graph for larger image.

A total of 49,800 new and resale houses and condos were sold statewide last month. That's up 12.5 percent from 44,250 for July and down 25.1 percent from a revised 66,500 for August 2005.The data I have only goes back to September 2003, but it appears sales are also running below the 2003 rate.

The median price paid for a home last month was $472,000. That was down 0.6 percent from July's $475,000, and up 3.5 percent from $456,000 for August a year ago.

...

The numbers cover all sales, new and resale, houses and condos.

FOMC Meeting

by Calculated Risk on 9/20/2006 08:11:00 PM

For some excellent analysis, I suggest:

Tim Duy's Fed Watch: Unsatisfying

"Like almost everyone, I was expecting policy to remain essentially unchanged at the conclusion of today’s FOMC meeting. Still, I was left unsatisfied by the accompanying statement, posted by Mark Thoma. At best, its brevity makes it look straightforward. At worst, it looks like something cobbled together because FOMC members were unable to reach a uniform opinion on the state of the economy."William Polley: Fed leaves rates unchanged

"The 30 second summary of which is that the housing slowdown is no longer regarded as "gradual" and that energy prices are not as much of a concern as they were previously.And Brad Delong writes succinctly:

...

Steady as she goes for a few more weeks, watching the housing market as well as the inflation numbers, trying to steer a course between the--hoping that no exogenous winds of change blow them off course."

"Good luck, Ben and company..."

Bay Area: How far will prices fall?

by Calculated Risk on 9/20/2006 06:58:00 PM

In the comments to the previous post I suggested that Bay Area prices might fall 40%+ in real terms over 5 to 7 years. ac asked how I came up with that estimate, and Lester suggested somewhat impolitely that the estimate did not match my "moderate, professorial tone".

First, it's important to distinguish between nominal and real price declines. If the U.S. averages 3% inflation over the next 5 years - and nominal prices stay flat - real prices would decline 16%. Many homeowners would think they "broke even", when in fact the real value of their homes declined 16%. Click on graph for larger image.

Click on graph for larger image.

Lets look at the previous bust in California in the early '90s in real terms.

For the Bay Area and San Diego, median real prices declined about 25% over a six year period. In Los Angeles median real prices declined about 35%.

NOTE: Prices are from the OFHEO house price index adjusted by CPI less Shelter from the BLS.

If this bust is similar to the early '90s bust in California, we would expect real price declines of 25% to 35% over a 5 to 7 year period. I think this bust will be worse because I believe the current bubble was larger.

In real terms, prices in San Diego are already about 10% below the peak of last year. For the Bay Area, real prices are already about 4.5% below the peak. (based on DataQuick data).

DataQuick: Bay Area home sales decline, prices level off

by Calculated Risk on 9/20/2006 04:11:00 PM

DataQuick reports: Bay Area home sales decline, prices level off

Home sales in the Bay Area declined again last month as prices continued to level off, a real estate information service reported.

...

The median price paid for a Bay Area home was $620,000 last month. That was down 1.1 percent from $627,000 in July, and up 0.2 percent from $619,000 for August a year ago. Last month's year-over- year increase was the lowest since March 2002 when the $381,000 median fell 1.3 percent.

| Bay Area California Median Home Prices | ||||

| Area | Aug '04 | Aug '05 | Aug '06 | Pct Change |

| Alameda | $497K | $586K | $577K | -1.5% |

| Contra Costa | $468K | $567K | $567K | 0.0% |

| Marin | $717K | $822K | $803 | -2.3% |

| Napa | $511K | $603K | $616K | 2.2% |

| San Francisco | $668K | $745K | $750K | 0.7% |

| San Mateo | $649K | $773K | $721K | -6.7% |

| Santa Clara | $539K | $654K | $658K | 0.6% |

| Solano | $377K | $474K | $483K | 1.9% |

| Sonoma | $462K | $554K | $557K | 0.5% |

| Bay Area | $520K | $619K | $620K | 0.2% |

I added the August 2004 median prices to give a two year perspective on prices.

A total of 9,128 new and resale houses and condos were sold in the nine-county region last month. That was up 14.9 percent from 7,941 for July, and down 24.9 percent from 12,154 for August last year, according to DataQuick Information Systems.

Last month was the slowest August since 1997 when 9,080 homes were sold. DataQuick's statistics go back to 1988: the slowest August was in 1992 with 6,326 sales, the strongest was in 2003 with 12,488. The average August sales count since 1988 is 9,530.

| Bay Area California Homes Sold | ||||

| Area | Aug '04 | Aug '05 | Aug '06 | Pct Change |

| Alameda | 2,742 | 2,612 | 1,876 | -28.2% |

| Contra Costa | 2,560 | 2,497 | 1,910 | -23.5% |

| Marin | 478 | 438 | 380 | -13.2% |

| Napa | 226 | 226 | 119 | -47.3% |

| San Francisco | 735 | 662 | 613 | -7.4% |

| San Mateo | 986 | 969 | 792 | -18.3% |

| Santa Clara | 3,017 | 2,832 | 2,126 | -24.9% |

| Solano | 1,015 | 1,016 | 668 | -34.3% |

| Sonoma | 915 | 902 | 644 | -28.6% |

| Bay Area | 12,674 | 12,154 | 9,128 | -24.9% |

Nontraditional Mortgage Guidance:"weeks, not months"

by Calculated Risk on 9/20/2006 03:40:00 PM

Q: When do you expect to issue the final guidance on nontraditional mortgage guidance?

A: Near term. Weeks, not months.

Q: We were hoping for something more specific.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |