by Calculated Risk on 9/29/2006 02:38:00 PM

Friday, September 29, 2006

IRS introduces New Tool for Mortgage Income Verification

The Hartford Courant reports: Lenders Will Be Spotting Income Fibs Much Faster

Starting Monday, it's going to get much riskier to fib about your income when you apply for a home mortgage. That's because the Internal Revenue Service is overhauling a key income verification tool used by lenders - making it faster and easier to pull up electronically the confidential income tax information of borrowers.

...

Many lenders in recent years have offered "stated income" and other limited documentation mortgages aimed especially at self-employed applicants. Dubbed "liar loans" by industry critics, stated-income mortgage programs allow applicants to bypass standard underwriting requirements for W-2s or copies of personal and corporate income tax records.

Instead, applicants simply assure the loan officer or broker that, yes indeed, we earn enough to qualify for the mortgage, and the transaction proceeds to closing. Often lenders will ask borrowers to fill out what is known as an IRS Form 4506-T along with their other mortgage documents.

That form authorizes the lender or the investor providing the money for the mortgage to obtain transcripts from the IRS summarizing income and tax data for as many as four years. The form must be signed by the borrower and can be used only during the 60-day period after the date of signing.

Until now, the process of faxing in 4506-T requests to the IRS and obtaining transcripts has been paper-driven and non-electronic - making income verifications slow and difficult to fit into lenders' highly automated loan underwriting systems. Most lenders have used 4506-T forms as a way to perform quality-control checks on pools of closed mortgages.

But now, with the IRS promising to provide electronic transcript tax data within one to two business days in an electronic format, more lenders are likely to run income checks before closing - even on loans to applicants who are not self-employed or using stated-income programs.

Nontraditional Mortgage Guidance Released

by Calculated Risk on 9/29/2006 11:55:00 AM

From the Federal Reserve: Federal Financial Regulatory Agencies Issue Final Guidance on Nontraditional Mortgage Product Risks

The federal financial regulatory agencies today issued final guidance to address the risks posed by residential mortgage products that allow borrowers to defer repayment of principal and sometimes interest (Interagency Guidance on Nontraditional Mortgage Product Risks).Addendum

These products, referred to variously as "nontraditional," "alternative," or "exotic" mortgage loans (referred to below as nontraditional mortgage loans), include "interest-only" mortgages and "payment option" adjustable-rate mortgages. These products allow borrowers to exchange lower payments during an initial period for higher payments later.

While similar products have been available for many years, the number of institutions offering them has expanded rapidly. At the same time, these products are offered to a wider spectrum of borrowers who may not otherwise qualify for a similar-size mortgage under traditional terms and underwriting standards. The agencies are concerned that some borrowers may not fully understand the risks of these products. While many of these features exist in other adjustable-rate mortgage products, the agencies' concern is elevated with nontraditional products because of the lack of principal amortization and the potential for negative amortization. In addition, institutions are increasingly combining these loans with other features that may compound risk ("risk layering"). These features include making simultaneous second-lien mortgages and relying on reduced or no documentation in evaluating an applicant's creditworthiness.

The final guidance discusses the importance of carefully managing the potential heightened risk levels created by these loans. Toward that end, management should:Ensure that loan terms and underwriting standards are consistent with prudent lending practices, including consideration of a borrower's repayment capacity;The agencies published for comment proposed interagency guidance on Nontraditional Mortgage Products on December 29, 2005. Comments were received from financial institutions, trade associations, consumer and community organizations, state and financial regulatory organizations, and other members of the public. The agencies made a number of changes to the proposal to respond to the commenters' concerns and to provide additional clarity.

Recognize that many nontraditional mortgage loans, particularly when they have risk-layering features, are untested in a stressed environment. These products warrant strong risk management standards, capital levels commensurate with the risk, and an allowance for loan and lease losses that reflects the collectibility of the portfolio; and

Ensure that consumers have sufficient information to clearly understand loan terms and associated risks prior to making a product or payment choice.

NTM attachment 1 (104 KB PDF) (note: this is the guidance)

NTM attachment 2 (261 KB PDF)

Housing: Reports of Fraud Grow

by Calculated Risk on 9/29/2006 11:36:00 AM

David Streitfeld writes in the LA Times: More Home Buyers Stretch Truth, Budgets to Get Loans

Mortgage fraud continues to escalate in Southern California, FBI figures show, raising concerns of increased defaults and foreclosures as the housing market cools down."It's only when the tide goes out that you learn who's been swimming naked." Warren Buffett.

Lenders filed 4,228 reports of suspicious activity in the region during the first 11 months of the government's fiscal year, which ends Saturday, the FBI said. That puts 2006 on track to nearly double last year's total.

The jump in reports of suspicious activity even as home sales have declined may stem in part from a lag in reporting. But the FBI and industry experts say the trend also reflects growing deceit by average borrowers who overstated their income, exaggerated their assets or hid their debts simply to qualify for a mortgage in the region's sky-high housing market.

...

During the boom, people who lied about their income to get a loan — and then struggled to make the payments — had the option of making ends meet by tapping their newfound equity through refinancing or by selling the property for a profit.

But now, with prices flattening out or declining, those without sufficient equity could be forced to sell for a loss or even default on payments. That could accelerate any downturn in the market by swamping it with foreclosed and bargain-priced properties.

Thursday, September 28, 2006

UCLA on Housing

by Calculated Risk on 9/28/2006 01:58:00 PM

The LA Times reports: UCLA Group Predicts Flat Home Prices

... the UCLA Anderson Forecast reiterates earlier projections that the deteriorating housing sector will slow state and national economic output and job growth through 2008. Although it doesn't rule out a recession, it doesn't expect one.In summary, UCLA is forecasting five years of flat nominal home prices (15% to 20% real price decline) and GDP growth of 1.8% through the first half of '07.

...

"Expect home prices five years from now to be about the same as they are today, though lower in real [inflation-adjusted] terms by 15%-20%," the forecast said.

Although the statewide average price might not decline, a few areas where about 40% of the housing stock is new construction — such as in Yolo and Placer counties — are expected to see drops as builders cut prices to move inventory ...

... the lack of a significant price correction is bad for the economy overall because it will lead to further job and productivity losses in the housing sector, said Edward Leamer, director of the UCLA Anderson Forecast.

"So while your happy homeowner is pleased by the fact that home prices are not going down," Leamer said, "the unhappy home builder is not going to have anything to do."

Leamer cautioned that the outlook was based on data trumped by recent reports showing that housing sales and starts were sliding more rapidly than the group had projected.

If the trend accelerates, he said, "then our forecast is too optimistic."

...

It expects inflation-adjusted economic growth to slow to an average annualized rate of 1.8% through the first half of 2007 and unemployment, now at 4.7%, to rise to 5.1% by the end of next year.

...

"While not a recession, it is hardly a pretty picture," the UCLA report said. "The combination of sluggish growth and rising prices will have the look and feel of a low-level stagflation."

Wednesday, September 27, 2006

Dow Jones: Exotic Mortgage Guidance To Be 'Benign'

by Calculated Risk on 9/27/2006 06:56:00 PM

Dow Jones reports: US Government Exotic Mortgage Guidance To Be 'Benign' -Analysts

Federal bank and thrift regulators are close to releasing final guidelines on exotic mortgage products, but the agencies aren't expected to call for wholesale changes in the way these products are marketed or made, three analysts wrote Wednesday.

...

Those guidelines are expected to become final in the next few days.

"We view the...guidance as relatively benign and unlikely to materially impact the business models of option ARM lenders, namely Countrywide (CFC), Washington Mutual (WAMU), Downey Financial (DSL), and Indymac (NDE)," three analysts from Friedman Billings Ramsey wrote in an industry update. [emphasis added]

New Home Sales and Recessions

by Calculated Risk on 9/27/2006 04:35:00 PM

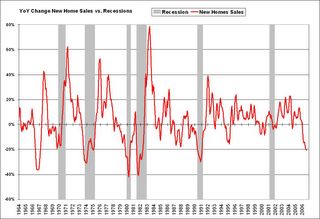

One of the most reliable economic leading indicators is New Home Sales. Click on graph for larger image.

Click on graph for larger image.

New Home sales were falling prior to every recession of the last 35 years, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

The second graph shows the YoY change in New Home Sales vs. Recessions. For a description of this graph, see: Investment and Recessions

With the New Home sales data released today, including downward revisions for the last few months, this indicator is at minus 20.6%, a level that has historically signaled a recession. The one exception was in the mid '60s when the buildup for the Vietnam war kept the economy out of recession.

One of the two best economic leading indicators is now flashing recession. The other reliable indicator is an inverted yield curve, and the yield is currently inverted.

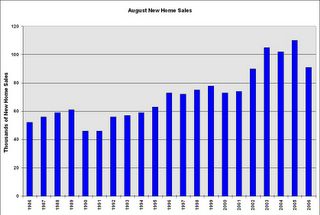

More on August New Home Sales This graph shows August New Home sales for the last 20 years. The recent sharp drop in sales is similar to the decrease at the start of the 1990s housing bust.

This graph shows August New Home sales for the last 20 years. The recent sharp drop in sales is similar to the decrease at the start of the 1990s housing bust.

August sales have fallen back to the 2002 levels.

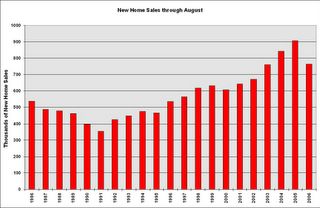

And this graph shows YTD New Home sales through August. It now appears that 2006 will finish as the 4th best year behind 2003.

Given that sales have fallen back to 2002/2003 levels, it would seem reasonable to expect that BLS reported residential construction employment will fall back to the levels of those same years. The following chart shows BLS data for the last 6 years.

| Residential Construction Employment, Monthly Average, Thousands | |||

| Year | Residential building | Residential specialty trade contractors | Total |

| 2001 | 781 | 1849 | 2630 |

| 2002 | 803 | 1887 | 2690 |

| 2003 | 837 | 1965 | 2802 |

| 2004 | 896 | 2123 | 3019 |

| 2005 | 949 | 2278 | 3227 |

| 2006 | 979 | 2346 | 3325 |

There will probably be 600K jobs lost in reported residential construction employment over the next couple of years - if housing stabilizes at this level. If housing continues to fall, something I think is likely, then even more jobs will be lost.

New Home Sales Revisions

by Calculated Risk on 9/27/2006 02:52:00 PM

During periods of housing market weakness, the preliminary estimate of New Home Sales from the Census Bureau has consistently been too high. Click on graph for larger image.

Click on graph for larger image.

This graph shows the previous 12 months of sales using the preliminary estimate and the final estimate - or most recent estimate for last few months, since final estimate isn't available yet.

NOTE: Graph start at 600 thousand units to better show the difference between the preliminary and final estimates.

During the period of flat sales in 2000 and 2001, the Census Bureau's preliminary estimate was too high. And during the current housing bust, the Bureau's preliminary estimates are once again being revised down.

Today's report was no different. The previous months were all revised down, and the odds are New Home Sales for August will be around or under 1 million units when the final estimate is released.

August New Home Sales: 1.050 Million Annual Rate

by Calculated Risk on 9/27/2006 09:57:00 AM

According to the Census Bureau report, New Home Sales in August were at a seasonally adjusted annual rate of 1.050 million. Sales for July were revised down to 1.009 million, from 1.072 million. Numbers for May and June were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in August 2006 were at a seasonally adjusted annual rate of 1,050,000, ... This is 4.1 percent above the revised July rate of 1,009,000, but is 17.4 percent below the August 2005 estimate of 1,271,000.

The Not Seasonally Adjusted monthly rate was 91,000 New Homes sold. There were 110,000 New Homes sold in August 2005.

On a year over year NSA basis, August 2006 sales were 17.3% lower than August 2005. Also, August '06 sales were below August 2004 (102,000) and August 2003 (105,000) sales. This is the lowest August since 2002 when 90,000 new homes were sold.

The median and average sales prices were down slightly. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in August 2006 was $237,000; the average sales price was $304,400.

The seasonally adjusted estimate of new houses for sale at the end of August was 568,000. This represents a supply of 6.6 months at the current sales rate.

The 568,000 units of inventory would have been another record for new houses for sale, except July 2006 was revised up to 570,000.

On a months of supply basis, inventory is above the level of recent years.

This report is very weak, especially considering the strong downward revisions for the previous months.

More later today on New Home Sales and Recessions.

MBA: 30-Year Fixed Rate Declines

by Calculated Risk on 9/27/2006 12:19:00 AM

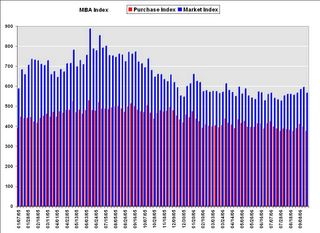

The Mortgage Bankers Association (MBA) reports: 30-Year Fixed Rate Declines Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 566.5, a decrease of 4.9 percent on a seasonally adjusted basis from 595.8 one week earlier. On an unadjusted basis, the Index decreased 5.4 percent compared with the previous week and was down 21.1 percent compared with the same week one year earlier.Mortgage rates decreased:

The seasonally-adjusted Purchase Index decreased by 5.5 percent to 375.9 from 397.9 the previous week and the Refinance Index decreased by 4.1 percent to 1677.5 from 1748.7 one week earlier. The Purchase Index is at its lowest level since November 2003.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.18 percent from 6.36 percent ...

The average contract interest rate for one-year ARMs decreased to 5.90 percent from 5.95 percent ...

The Purchase Index is at its lowest level since November 2003.

The Purchase Index is at its lowest level since November 2003. This graph shows the Purchase Index and the 4 and 12 week moving averages.

Note: Scale does not start at zero to better show changes.

Average year-to-date purchase activity is 13.8% below 2005, and has been running more than 20% below 2005 for the last couple of months.

Tuesday, September 26, 2006

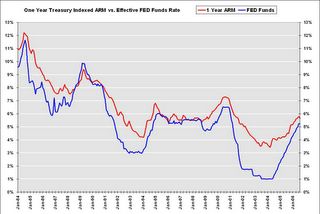

Bernanke's Conundrum

by Calculated Risk on 9/26/2006 07:48:00 PM

Last December I suggested:

I think long rates will start to rise when the Fed starts cutting the Fed Funds rate.First, let's review the relationship between various interest rates and mortgage rates.

This will be Bernanke's "conundrum"! As the economy slows, this will reduce the trade deficit and also lower the amount of foreign dollars willing to invest in the US - the start of a possible vicious cycle.

Click on graph for larger image.

Click on graph for larger image.One of the most popular mortgages is the One-year Treasury-indexed ARM. When the Fed starts cutting rates, the rate on the one year ARM will probably also decrease. This might help the housing market a little, but ...

The most popular loans are still the 30 year fixed rate. Typically long rates start falling when the Fed starts cutting rates, but recently there has been a weakening of the link between long and short rates. What if the next time the Fed starts cutting rates, the long rate rises?

NOTE: Although long rates have fallen recently, rates are still well above the lows of the last couple of years.

Via Mark Thoma: Dallas Fed economist Tao Wu wrote about the weakening link, between the Fed Funds rate and long rates, in an economic letter this month: Globalization’s Effect on Interest Rates and the Yield Curve

Monetary policy’s effects on the economy stem largely from how long-term interest rates respond to central banks’ actions. In most industrialized nations, central bankers have direct control over short-term interest rates and use them as their main policy instrument. When central banks raise short-term rates, it usually leads to increases in market-determined long-term rates, including those for mortgages and commercial loans. Higher long-term rates curb aggregate consumption and investment, ultimately helping contain inflation. Cutting short-term rates, on the other hand, usually leads to lower long-term rates, providing a stimulus for economic activity. Any lasting changes in the links between short- and long-term rates will thus have important implications for the timing and impact of monetary policy actions.After a discussion on globalization, Wu concludes:

Central banks’ ability to affect long-term rates may be severely eroded, as we have seen in the recent "conundrum" period.And this takes us to Brad Setser's post today (caution: lots of numbers): The deterioration in the US income balance has just begun .... In the post, Dr. Setser outlines how the trade deficit could fall in '07, but the current account deficit could continue to rise. Many of the details are interesting, but an important conclusion is that long rates could rise even if short rates start to fall.

Consequently, the effects of monetary policy tightening or loosening may be substantially weakened. Because long rates are less sensitive to short rates, the response of aggregate demand to monetary policy moves may prove sluggish. One example is the lack of response in the mortgage and housing markets in 2004 and early 2005, when homebuyers’ borrowing costs changed little as the Federal Reserve tightened. Low rates kept the housing boom in high gear, stimulating sales and providing builders with incentives to expand operations despite the Fed’s attempt to slow the economy.

Globalization’s impact on the relationship between short- and long-term interest rates poses potentially formidable challenges for central banks around the world.

And finally, when might the Fed start to cut rates? According to the Cleveland Fed, market expectations have risen sharply for a rate cut in December (now at 28%):

Most market participants still expect no action in both October and December, but expectations are definitely rising for a cut in December.

Most market participants still expect no action in both October and December, but expectations are definitely rising for a cut in December.Interestingly this runs counter to recent Fed comments including Paul Volcker's comments yesterday. I recommend (again) Tim Duy's Fed Watch: Widening Disconnect.

So Bernanke might not be deciding between inflation vs. growth. Instead he might face a conundrum with a weakening economy: every time Bernanke cuts rates, long rates might rise (for a year or two). And it's long rates that matter - as Dr. Wu noted:

"Monetary policy’s effects on the economy stem largely from how long-term interest rates respond to central banks’ actions."As always there is the opposite view; several observers are forecasting much lower long rates: PIMCO's Bill Gross and Goldman, Merrill See Bond Rally; 2-Year Yield at 3.6%

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |