by Calculated Risk on 10/12/2006 07:41:00 PM

Thursday, October 12, 2006

Centex Warns

From MarketWatch: Centex slashes quarterly profit forecast (hat tip: Cal)

Centex reported a 28% drop in orders and slashed its fiscal second-quarter profit forecast late Thursday as the home builder suffered from a record level of cancellations.Record levels of cancellations ... profit cut in half ... focusing on generating free cash flow ... buyers' inability to sell their existing homes. Not good.

Net orders for the quarter were 6,828, 28% lower than last year's second quarter, the Dallas-based company said.

...

Second-quarter earnings from continuing operations will now likely be in a range of 65 cents to 75 cents a share. In July, Centex forecast fiscal second quarter earnings from continuing operations of $1.40 a share.

The results reflect "current record levels of home sales contract cancellations," which have been driven by buyers' inability to sell their existing homes, Centex explained.

"The housing market continues to adjust rapidly," Tim Eller, Centex's chief executive, said in a statement. "Cancellation rates that were well outside of historical levels diminished our earnings visibility this quarter."

...

Centex said late Thursday that it's focusing on generating free cash flow and building the strength of its balance sheet to prepare for "strategic reinvestment" when housing market conditions improve.

UPDATE: The "focusing on generating free cash flow" is a red flag. Sure enough, I pulled up CTX's most recent 10-Q and their balance sheet and cash flow statements are UGLY. When the next 10-Q is released, I'll post an analysis (I have no position in CTX).

Fed: Household Debt Service Sets Record in Q2

by Calculated Risk on 10/12/2006 03:54:00 PM

The Federal Reserve released the "Household Debt Service and Financial Obligations Ratios" for Q2 2006 today.

DEFINITIONS: The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.The household DSR (Debt Service ratio) set another record at 14.40%, up from 14.31% in Q1 '06.

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

The owner FOR (Financial Obligation Ratio) set a new record of 18.06%, up from 17.96% in Q1 '06.

The mortgage portion of the FOR set a new record at 11.60%, up from 11.47% in Q1 '06.

Click on graph for larger image.

Click on graph for larger image.With relatively low mortgage rates, one might expect the mortgage portion of the FOR to be lower than previous periods, not at record high levels.

Note that the previous housing bubble peaked with the mortgage portion of the FOR just over 10%.

DataQuick: Continued slowdown for Southland home sales

by Calculated Risk on 10/12/2006 02:11:00 PM

DataQuick reports: Continued slowdown for Southland home sales

Southland homes continued to sell at their slowest pace in nine years in September, the result of buyer reticence and a rebalancing of supply and demand. Prices are leveling off, a real estate information service reported.

...

The median price paid for a Southland home was $484,000 last month. That was down 1.0 percent from $489,000 in August, and up 1.9 percent from $475,000 in September last year. Last month's increase was the smallest since February 1997, when the $160,000 median rose 1.3 percent from $158,000 a year earlier.

| Southern California Median Home Prices | ||||

| Area | Sept '04 | Sept '05 | Sept '06 | Pct Change |

| Los Angeles | $407K | $494K | $509K | 3.0% |

| Orange County | $533K | $610K | $626K | 2.6% |

| San Diego | $480K | $498K | $476K | -4.4% |

| Riverside | $338K | $391K | $423K | 8.2% |

| San Bernardino | $265K | $352K | $365K | 3.7% |

| Ventura | $540K | $604K | $584K | -3.3% |

| Southern California | $409K | $475K | $484K | 1.9% |

I added the September 2004 median prices to give a two year perspective on prices.

A total of 22,654 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 11.6 percent from 25,628 in August, and down 28.6 percent from 31,740 for September a year ago, according to DataQuick Information Systems.

A decline from August to September is normal for the season. Last month's sales count was the lowest for any September since 1997 when 21,320 homes were sold. Since 1988 September sales have ranged from 12,838 in 1992 to 34,653 in 1988. The September average is 23,341, slightly above last month's sales.

| Southern California Homes Sold | ||||

| Area | Sept '04 | Sept '05 | Sept '06 | Pct Change |

| Los Angeles | 10,501 | 10,988 | 7,917 | -27.9% |

| Orange County | 3,585 | 4,072 | 2,664 | -34.6% |

| San Diego | 5,177 | 4,935 | 3,207 | -35.0% |

| Riverside | 5,375 | 6,001 | 4,533 | -24.5% |

| San Bernardino | 4,064 | 4,364 | 3,236 | -25.8% |

| Ventura | 1,240 | 1,380 | 1,097 | -20.5% |

| Southern California | 29,942 | 31,740 | 22,654 | -28.6% |

Notice that San Diego had declining sales in 2005 compared to 2004. As LA Times writer David Streitfeld noted about the San Diego housing market:

San Diego had the wildest run-up among major California cities, with prices tripling since the mid-1990s. ... The market also began to fade first in San Diego. ...It does appear that San Diego is leading the way, and I think that means declining prices soon in all of SoCal.

Whatever happens [in San Diego], optimists and pessimists agree, will happen later in the rest of the state.

Housing: 1,300 jobs lost in Sonoma County

by Calculated Risk on 10/12/2006 12:34:00 PM

The Press Democrat reports: 1,300 jobs lost in Sonoma County's housing slowdown

The housing industry, which propelled Sonoma County out of recession three years ago, is now shedding jobs as builders, mortgage brokers and real estate companies feel the impact of the slowdown.This is probably just the beginning of the housing related job losses.

The sector, which employs one in six workers in Sonoma County, lost 1,300 jobs in the three-month period ending June 30, according to a new study.

It could lose 2,000 more jobs before the shakeout is expected to end next year, reducing employment to 28,700, the study forecasted.

The job losses - the largest since the housing market was in retreat in early 1990s - have been deeper than anticipated, even in an industry accustomed to employment swings as housing cycles run hot and cold.

The effect on the economy will be magnified because many of these workers earned $60,000 to $70,000 or more a year during the housing boom, far more than the typical worker in the county.

Wednesday, October 11, 2006

San Diego Home Prices Continue to Fall

by Calculated Risk on 10/11/2006 08:26:00 PM

The San Diego Union reports: Local home prices continue to fall

San Diego County home prices dropped last month by nearly 4.5 percent, double the rate in August and the biggest year-over-year decline since 1993, DataQuick Information Systems reported Wednesday.

The $476,000 overall median was down $6,000 from August and off $22,000 from September last year, the biggest year-over-year dollar reduction DataQuick has reported since it began keeping local records in 1988.

The latest overall figure represents a drop of $42,000 or 8.1 percent below the all-time peak of $518,000 reached just 11 months ago.

Click on graph for larger image.

Click on graph for larger image.Dashed blue line on graph is current price level.

Looked at another way, with housing back to its early-2005 levels, many sellers who bought since then will be lucky to get what they paid for their property at the peak of the five-year buying boom.Actually prices are back to the July 2004 level.

Meanwhile, sales continued their two-year slide with the total off by more than 35 percent to 3,207 transactions, the biggest year-over-year downturn since 1991. It was the 27th consecutive decline for the category on a year-over-year basis. The total was off 12.5 percent from August, a typical seasonal change, past trends show.

Pimco on Housing and Economy

by Calculated Risk on 10/11/2006 04:46:00 PM

On Bloomberg Video: Gross of Pimco Says Oil's Drop May Cut Demand for Risky Bonds.

Click image for video.

October 11 (Bloomberg) -- Bill Gross, manager of the world's biggest bond fund at Pacific Investment Management, and Paul McCulley, managing director, talked with Bloomberg's Brian Sullivan in Newport Beach, California, yesterday about prospects for a U.S. economic recession, the outlook for the U.S. housing market and Federal Reserve monetary policy, and the impact of falling oil prices on the demand for assets such as corporate and emerging-market debt.(Source: Bloomberg)

Bill Gross on housing prices:

"I don't think the Fed can afford to see the U.S. housing market nationally decline by more than 5%, or perhaps at an extreme, 10%. We've never had those types of declines and you don't want to replicate the Japanese experience of the 1990s. Admittedly that was commercial real estate. But a Real Estate bubble unwinding is a dangerous bubble unwinding, and we don't want to see anything more than minor negatives in terms of prices."Excerpt from Bill Gross on events that would make him change his view for next year:

"We could see stronger growth, as reflected in a housing market that levels off and maybe even comes back; stranger things have happened. That would be a scenario that would certainly flip-flop how we see things happening.

The second scenario would obviously be weaker growth - housing market decimating the real economy, not just as reflected in housing starts and the like, and housing employment, but in consumption and mortgage equitization and those types of things. That's the big question mark and no one really knows. Every economist on Wall Street, every Fed researcher, is trying to analyze exactly what this means for the consumer. We're just going have to find out."

FOMC Minutes on Housing

by Calculated Risk on 10/11/2006 02:12:00 PM

The Federal Reserve released the minutes of the FOMC meeting of September 20th: Minutes of the Federal Open Market Committee. Here are their comments on housing, starting with an overview:

Residential construction activity continued to contract in recent months. Single-family starts fell further in July and August to a level well below the peak in the third quarter of 2005. Construction in the multifamily sector also fell back. Sales of both new and existing single-family homes fell in July and were significantly below the peaks of last summer. A range of indicators suggested that housing market activity was likely to slow further in the near term. Pending home sales dropped noticeably in July, and mortgage rates had increased since the beginning of the year. Available measures suggested that prices of existing homes increased through the second quarter at a much lower rate than the one observed during the same period last year.And looking forward, they see a perfect soft landing:

In their discussion of the economic situation and outlook, meeting participants noted that the pace of the expansion appeared to be continuing to moderate in the third quarter. In particular, activity in the housing market seemed to be cooling considerably, which would contribute to relatively subdued growth over the balance of the year. Growth was likely to strengthen next year as the housing correction abated, with activity also encouraged by the recent decline in energy prices and still-supportive financial conditions. In the view of many participants, economic expansion would probably track close to the rate of growth of the economy's potential next year and in 2008.But some participants clearly expressed more concern about the impact of the housing bust during the discussion:

In their discussion of major sectors of the economy, meeting participants focused especially on developments in the housing market. Although the situation varied somewhat across the nation, housing activity was continuing to contract in most regions. Home sales had slowed considerably, and anecdotal reports suggested that more buyers were canceling contracts for purchases. Participants noted that inventories of unsold homes had climbed sharply in many areas and that builders were taking a number of measures to reduce inventories. Both permits for new construction and housing starts had declined significantly. Available measures of home prices suggested that appreciation had slowed considerably but prices in most areas were not falling, although some sellers were reported to be providing various inducements to potential purchasers that reduced effective prices.

Thus far, the drop in housing market activity appeared not to have spilled over significantly to other sectors of the economy.

... considerable uncertainty was expressed regarding the ultimate extent of the downturn in the housing sector and the degree to which the slowing in housing activity and the deceleration in home prices would affect consumption and other expenditures going forward.

MBA: Mortgage Applications Decrease

by Calculated Risk on 10/11/2006 12:26:00 AM

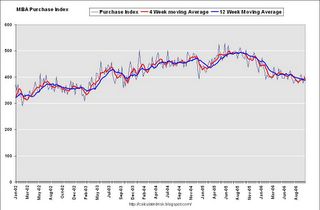

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Decrease Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 599.1, a decrease of 5.5 percent on a seasonally adjusted basis from 633.9 one week earlier. On an unadjusted basis, the Index decreased 5.3 percent compared with the previous week and was down 13.3 percent compared with the same week one year earlier.Mortgage rates increased slightly:

The seasonally-adjusted Refinance Index decreased by 5.8 percent to 1857 from 1970.8 the previous week and the Purchase Index decreased by 5.3 percent to 383.3 from 404.6 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.27 percent from 6.24 percent ...

The average contract interest rate for one-year ARMs increased to 5.88 percent from 5.86 percent ...

This second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

This is the first week of loan activity after the New Nontraditional Mortgage Guidance was released. It will be interesting to see if the guidance has any impact on applications over the next few weeks.

Monday, October 09, 2006

Housing Prediction: Starts, Completions, Sales

by Calculated Risk on 10/09/2006 12:37:00 PM

No one has a crystal ball, but last week Fed Vice Chairman Kohn and former Fed Chairman Greenspan made predictions on the housing market. From Dr. Kohn on Housing Starts:

"... any overbuilding in 2004 and 2005 was small enough to be worked off over coming quarters at close to the current level of housing starts."And from Dr. Greenspan:

... the "worst may well be over" for the U.S. housing industry that's suffering its worst downturn in more than a decade.In the previous post I estimated that overbuilding might have added close to 1.4 million housing units over the last few years. In this post I will estimate the impact on Housing Starts, Completions and New Home Sales. All caveats apply!

The level of completions needed is obviously dependent on the units needed, the amount of recent overbuilding, and the period over which the excess supply is absorbed. Using the Brookings forecasts, and removing mobile homes, we can estimate the U.S. will need about 1.7 million new housing units per year for the next 3 years, before subtracting the impact of recent overbuilding. Then using the 1.4 million estimate of excess supply from the previous post, and working the excess off over 3 years, this gives completions of approximately 1.2 million per year for the next 3 years.

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. completions and starts for the last 40 years (from Census Bureau).

Obviously completions follow starts. Although starts have recently fallen significantly, completions have only just started to decline. It appears builders are still completing too many housing units, and the result is rising inventories of unsold homes. Note that reported inventories have stabilized, but that the Census Bureau does not include cancellations in inventory (see this post), so inventory levels are probably significantly higher than reported.

Although I estimate completions might fall to 1.2 million units per year over the next few years, starts might fall even further at first - perhaps to 1.1 million unit rate (SAAR) or lower until builders start seeing conditions stabilize. This is the typical pattern - starts fall to a lower level than completions as builders react to changing market conditions.

What does this mean for New Home Sales?

This graph shows the reason new housing units were added.

This graph shows the reason new housing units were added.The Green columns are completed new housing units intended for rentals. Blue are homes built directly for the owner and Red are homes built for sale.

The number of units built to rent will probably increase over the next few years, and the homes built for owners might decrease, but most of the decline in starts and completions will come from housing units built for sale.

Some simple addition ... If 600 thousand units are built as apartments or for owners each year, and completions fall to 1.2 million units - that gives 600 thousand housing units built for sale. Since builders will also be working off their inventories, New Home Sales might fall to 800 thousand per year or less - until the excess inventory is absorbed.

Some simple addition ... If 600 thousand units are built as apartments or for owners each year, and completions fall to 1.2 million units - that gives 600 thousand housing units built for sale. Since builders will also be working off their inventories, New Home Sales might fall to 800 thousand per year or less - until the excess inventory is absorbed.Perhaps some of these estimates are too high (or too low), but I think Drs. Kohn and Greenspan are overly optimistic. My view is the housing bust has just started.

Sunday, October 08, 2006

Housing: Estimate of Recent Overbuilding

by Calculated Risk on 10/08/2006 07:44:00 PM

Fed Vice Chairman Donald L. Kohn said this week:

"... any overbuilding in 2004 and 2005 was small enough to be worked off over coming quarters at close to the current level of housing starts."Here are a couple of estimate of the amount of overbuilding in recent years:

Click on graph for larger image.

Click on graph for larger image.This graph is based on estimates from the Brookings Institution: Toward a new Metropolis: The opportunity to rebuild America (hat tip: JLA)

Blue is the estimate of new housing units needed per year from Brookings. This includes new household formation and replacing existing stock (due to demolitions, etc.) Red is the actual number of housing units added to inventory in recent years. The cumulative excess is 1.42 million housing units through 2005.

There is additional overbuilding in 2006 that is not included.

Another approach, to estimate the amount of overbuilding, would be to use the Census Bureau data on the housing inventory and vacancy rates. If vacancy rates fell back to 2000 levels that would mean there are 1.1 million excess units. Add to this the current excess New Home inventory and any second homes that are being held as investments, and the number would be close to the 1.4 million estimate using the Brookings data.

In the next post, I will look at the impact of this overbuilding on starts and New Home sales.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |