by Calculated Risk on 10/18/2006 05:31:00 PM

Wednesday, October 18, 2006

Comptroller Dugan Expresses Concerns on Mortgage Lending

Comptroller of the Currency John C. Dugan, in a speech to the American Bankers Association on Monday, expressed concern about mortgage lending standards:

With respect to retail lending, the underwriting survey showed significant easing in residential mortgage lending standards, including home equity lending. We saw more of what we observed the previous year: longer interest-only periods, more “piggyback” loans to avoid mortgage insurance requirements, higher allowable debt-to-income and loan-to-value ratios, and greater volumes of loans with reduced documentation requirements.And on Tueday, Dugan spoke at the annual convention of America’s Community Bankers. Dugan urged the States to adopt the key principles of the Nontraditional Mortgage Guidance:

This year has brought us at least one thing that’s new, however: a cooling of the red-hot housing market. In many local and regional markets, prices are leveling off, while in others, they have declined. We would normally expect that trend to change the calculus of many mortgage lending decisions, with lenders tightening their underwriting standards and requiring borrowers to provide more equity.

Yet that’s not what the underwriting survey and other recent evidence demonstrates. In fact, with fewer home buyers in the market, competition among lenders appears to be intensifying, and, with some exceptions, that competition has extended to weaker underwriting standards. Frankly, that concerns me. We don’t want to see the lending decisions bankers make today result in excessive foreclosures – and reduced affordable housing credit – tomorrow.

Our issuance of the nontraditional mortgage guidance, as important as it is, can only be viewed as unfinished business. During the comment period, banks and thrifts expressed strong concerns that the guidance would apply only to federally regulated institutions – insured depository institutions and their affiliates – but would not apply to those mortgage lenders and brokers regulated exclusively by the states, which constitute a large portion of nontraditional mortgage originators.

I agree with these concerns. There is an unlevel playing field that plainly distorts competition in the nontraditional mortgage business. And there is also a consumer protection gap with respect to the nontraditional mortgage lending practices of a broad segment of mortgage lenders.

... many ... originators will have no contact with a federally regulated institution at all – so the guidance will never even indirectly touch their operations. For example, institutions may sell the mortgages they originate directly to investment banks that package and securitize them. Indeed, the appetite for mortgages to securitize is so strong that we now see investment banks and other financial intermediaries acquiring mortgage originators in an effort to lock in volume for their securitization business. In some cases, these acquisitions transform a mortgage business that had been subject to federal standards to one that is not.

So when we see this gap, this unlevel playing field, what is the solution? ...

State regulation, effectively enforced, can do this. ...

I have been encouraged by the recent statements by the Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators. These two organizations are working on a version of the nontraditional mortgage guidance that will focus on mortgage underwriting and consumer protection issues. We understand that state agencies then will be urged to adopt and apply this guidance to the entities they regulate. In so doing, it is vital that key principles of our nontraditional mortgage guidance not be watered down. ...

Agencies Provide Consumer Information on Nontraditional Mortgage Loans

by Calculated Risk on 10/18/2006 11:26:00 AM

From the Federal Reserve: Agencies Provide Consumer Information on Nontraditional Mortgage Loans

The federal bank, thrift, and credit union regulatory agencies today announced the publication of a new resource that can help consumers make more informed choices when considering nontraditional mortgage loans.

Interest-Only Mortgage Payments and Payment-Option ARMs--Are They for You? features a glossary of lending terms, a mortgage shopping worksheet, and a list of additional information sources. This information can help consumers, whether buying a house or refinancing a mortgage, decide if an interest-only mortgage (an I-O mortgage) or an adjustable-rate mortgage (ARM) with the option to make a minimum payment (a payment-option ARM) is right for them.

The publication stresses the importance of understanding key mortgage loan terms, warns of the risks consumers may face, and urges borrowers to be realistic about whether they can handle future payment increases. If consumers are not comfortable with these risks, the publication suggests that they ask about other mortgage products.

Many lenders offer home loans that allow consumers to (1) pay only the interest on the loan during the first few years of the loan term; or (2) make only a specified minimum payment that could be less than the monthly interest on the loan. Lenders have a variety of names for these loans, but with I-O mortgages and payment-option ARMs, consumers could face "payment shock." Monthly payments may double or even triple following the interest-only period or when the payments adjust.

In addition, consumers with payment-option ARMs could face negative amortization, a situation in which the monthly payments do not cover all of the interest owed for that month. The unpaid interest is added to the mortgage balance so that the amount owed on the mortgage exceeds the amount originally borrowed.

DataQuick: California Sales Lowest Since 2001

by Calculated Risk on 10/18/2006 11:11:00 AM

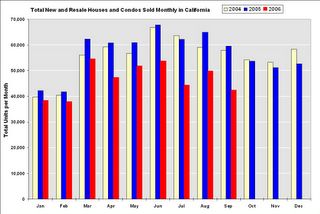

DataQuick reports: California September Home Sales Click on graph for larger image.

Click on graph for larger image.

A total of 42,450 new and resale houses and condos were sold statewide last month. That's down 14.8 percent from 49,800 for August and down 28.8 percent from a 59,600 for September 2005.Although some areas are already seeing YoY nominal price declines (San Diego, Bay Area), the median YoY price in California increased slightly. Real prices are falling for the first time since the early to mid-90s housing bust in California.

Sales almost always decrease from August to September as the sales season moves from summer into fall. Last month's sales made for the slowest September since 2001 when 41,880 homes were sold.

The median price paid for a home last month was $466,000. That was down 1.3 percent from August's $472,000, and up 2.4 percent from $455,000 for September a year ago.

Note: in about 2 weeks, DataQuick will announce a significant increase in California foreclosure activity for Q3.

MBA: Rates Rise as Refinance Applications Decrease

by Calculated Risk on 10/18/2006 12:17:00 AM

The Mortgage Bankers Association (MBA) reports: Rates Rise as Refinance Applications Decrease Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 585.8, a decrease of 2.2 percent on a seasonally adjusted basis from 599.1 one week earlier. On an unadjusted basis, the Index decreased 2.3 percent compared with the previous week and was down 11.4 percent compared with the same week one year earlier.Mortgage rates increased slightly:

The seasonally-adjusted Refinance Index decreased by 5.3 percent to 1758.2 from 1857 the previous week and the Purchase Index increased by 0.4 percent to 384.7 from 383.3 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.33 percent from 6.27 percent ...

The average contract interest rate for one-year ARMs increased to 5.94 percent from 5.88 percent ...

This second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

This is the second week of loan activity after the New Nontraditional Mortgage Guidance was released. It will be interesting to see if the guidance has any impact on applications over the next few weeks.

Tuesday, October 17, 2006

WSJ Econoblog: Housing and the Economy

by Calculated Risk on 10/17/2006 09:50:00 PM

From the WSJ Econoblog: How Could the Housing Slump Affect the Nation's Economy?

This is the mainstream view of housing. Here is the most pessimistic view from Celia Chen, director of housing economics for Moody's Economy.com:

[W]e are all in agreement on the contours of the outlook, that the unwinding of the housing market will depress, but not derail, the broader economic expansion. With a record one in 10 jobs now in housing-related industries, the first impact will be on employment. Not only will residential construction employment decline, but industries ranging from mortgage brokers to furniture retailing to interior design and landscaping will take a hit. Indeed, this impact is already evident, with housing-related industries shedding an average of 10,000 jobs a month since March. And the losses will only accelerate as we move into next year.For a really bearish view, see Dr. Roubini's post: With a Dismal Q3, Will US Q4 Growth Rebound Assuring A Soft Landing? Highly Unlikely As Data Suggest Recession Ahead

The negative wealth effect will take a bit longer to kick in, but by next year it too will be a drag on the economy by removing a source of spending power for consumers. While we can, as Chris has, argue about the mechanism by which rising house prices affect consumption, there is no doubt that the increase in home equity has generated a cash cow for homeowners. Even only including active mortgage equity extraction, homeowners were able to extract an annualized $500 billion of additional spending money -- 5% of all disposable income -- in the first half of this year alone. As house price gains dissipate and mortgage credit quality deteriorates, this extraction will fade away, taking a bite out of consumer spending.

Other aspects of the U.S. economy remain quite healthy and will be able to power their way through the housing downturn. Businesses remain flush with financial resources to continue hiring and expanding, and are unlikely to pull back much over the next year. There are numerous downside risks, however, to this fairly sanguine outlook that my co-bloggers have mentioned and that may provide fodder for future forums.

DataQuick: Bay Area home prices decline, sales slow

by Calculated Risk on 10/17/2006 02:56:00 PM

DataQuick reports: Bay Area home prices decline, sales slow

Bay Area home prices fell on a year-over-year basis for the first time in more than four years last month. Sales were at their lowest level in five years, a real estate information service reported.

The median price paid for a home in the nine-county Bay Area was $611,000 in September. That was down 1.5 percent from $620,000 for the month before, and down 0.8 percent from $616,000 for September last year, according to DataQuick Information Systems.

| Bay Area California Median Home Prices | ||||

| Area | Sept '04 | Sept '05 | Sept '06 | Pct Change |

| Alameda | $480K | $579K | $575K | -0.7% |

| Contra Costa | $463K | $577K | $545K | -5.5% |

| Marin | $687K | $802K | $813 | 1.4% |

| Napa | $522K | $627K | $615K | -1.9% |

| San Francisco | $669K | $721K | $746K | 3.5% |

| San Mateo | $637K | $752K | $745K | -0.9% |

| Santa Clara | $543K | $646K | $657K | 1.7% |

| Solano | $394K | $481K | $470K | -2.3% |

| Sonoma | $466K | $582K | $537K | -7.7% |

| Bay Area | $516K | $616K | $611K | -0.8% |

I added the September 2004 median prices to give a two year perspective on prices.

A total of 7,907 new and resale houses and condos were sold in the region last month. That was down 13.4 percent from 9,128 for August, and down 29.4 percent from 11,205 for September last year, DataQuick reported.

Sales almost always decline from August to September. Last month's sales were the lowest for any September since 2001 when 7,201 homes were sold. September sales have ranged from 5,507 in 1991 to 12,075 in 2004.

| Bay Area California Homes Sold | ||||

| Area | Sept '04 | Sept '05 | Sept '06 | Pct Change |

| Alameda | 2,530 | 2,300 | 1,624 | -29.4% |

| Contra Costa | 2,339 | 2,312 | 1,720 | -25.6% |

| Marin | 456 | 448 | 273 | -39.1% |

| Napa | 224 | 189 | 124 | -34.4% |

| San Francisco | 689 | 600 | 520 | -13.3% |

| San Mateo | 997 | 819 | 639 | -22.0% |

| Santa Clara | 2,865 | 2,689 | 1,867 | -30.6% |

| Solano | 1,049 | 1,030 | 585 | -43.2% |

| Sonoma | 926 | 818 | 555 | -32.2% |

| Bay Area | 12,075 | 11,205 | 7,907 | -29.4% |

NAHB: October Builder Confidence Improves Marginally

by Calculated Risk on 10/17/2006 12:15:00 PM

Update: replace article with NAHB release.

From the National Association of Home Builders: Builder Confidence Stabilizes in October

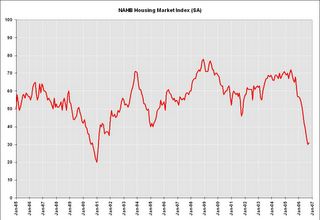

Click on graph for larger image.

Breaking a string of eight consecutive monthly declines, the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), which gauges builder sentiment in the single-family housing market, posted a modest one-point gain to stabilize at a level of 31 in October.

“While the index remains at a low level, the single-point increase from September’s reading suggests that builder attitudes for new-home sales may be stabilizing,” said NAHB Chief Economist David Seiders. “This is attributable to several key economic factors: mortgage interest rates have fallen substantially from their summer highs, energy prices have dropped dramatically from their recent peaks, consumer sentiment has posted a strong rebound and the job market is doing reasonably well.”

“More than three out of four builders are offering substantial sales incentives to move their product and limit cancellations, and this aggressive strategy is working -- making this an opportune time for home buyers to enter the market,” said NAHB President David Pressly, a home builder from Statesville, N.C. “The market correction appears to be approaching the bottom in terms of sales volume, and we expect the supply-demand balance to improve considerably before long.”

Derived from a monthly survey that NAHB has been conducting for 21 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family homes and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

Two of the three component indexes increased in October, while one remain unchanged. The component that gauges current single-family home sales stayed constant at 32, while the component gauging expected sales in the next six months rose four points to 41. The component gauging traffic of prospective buyers edged up one point from last month, to 23.

The HMI posted gains in two regions and fell in two others in October. The HMI gained five points to 33 in the Northeast and registered a four-point gain to 20 in the Midwest. The largest decline was posted in the West, where decreased affordability and a major snap-back in investor activity resulted in a five-point drop to 32. The HMI fell one point to 37 in the South.

Fed's Lacker on Housing

by Calculated Risk on 10/17/2006 12:18:00 AM

In the previous post I quoted from San Francisco Fed President Yellen's speech today. Of all the Fed Presidents and FOMC members, Dr. Yellen has consistently been the most bearish on housing; and therefore, at least so far, the most prescient of the Fed Presidents. As an example, see her speeches from July and October of 2005 - with comments like:

"...analyses do indicate that house prices are abnormally high—that there is a "bubble" element."At the other end of the spectrum is Jeffrey M. Lacker, President of the Federal Reserve Bank of Richmond. Dr. Lacker is the most hawkish member of the FOMC, and Lacker dissented at the last two FOMC meetings:

Mr. Lacker dissented because he believed that further tightening was needed ...Apparently Dr. Lacker is more optimistic about the housing market. From his speech on October 11th (hat tip: Kevin):

It’s important to remember that the recent housing market boom was driven by fundamental factors that were — and still are — quite favorable. I’ll just briefly list a few for you. Population continues to expand; for example, last year the number of households increased by 1 percent nationwide. Income is growing — so far this year, inflation-adjusted disposable income per person has increased at a 2.8 percent annual rate. We are a wealthy nation; household net worth is 53 trillion dollars, which represents over five-and-a-half years of disposable personal income. The tax treatment of housing remains highly favorable. Finally, mortgage interest rates were extremely low for many years, and even now are quite reasonable by historical standards.I disagree with Lacker on several points. As I've noted before, demographics are actually somewhat unfavorable for housing as compared to earlier periods. And the inflation adjusted disposable income per person only increased 1.9%, not 2.8%. This is also the wrong number to use for analyzing the housing market; the top income earners could have had a good year and that would skew the average.

... With the surge in demand apparently satisfied now, we can expect to see a “return to normalcy” in the housing market, if I can borrow a phrase from a former Washington resident. Such a return to normalcy would involve lower production than we saw at the peak, and certainly a lower trajectory for housing prices.

This transition in the housing market is well under way. New home sales are down 17 percent, housing starts have fallen 20 percent, and the rate of price appreciation has fallen substantially, to the point that average prices were slightly lower in August than they were a year ago. These are national figures, of course, and more dramatic swings can be seen in some localities, particularly in areas that saw the strongest increases in housing prices and activity. ...

At the national level, some further retrenchment in housing markets is likely in the months ahead. But while there is substantial uncertainty about where the bottoming out will occur, I don’t think a catastrophic collapse in housing activity is likely, since the fundamental determinants of housing demand that I listed earlier remain favorable: prospects for population and real income growth look good, net worth remains high, and after-tax mortgage interest rates are still historically low. Instead, I believe we are seeing a return to a more conventional level of housing market activity in which volume, inventories and time-on-market are closer to historical averages. This adjustment naturally involves a fair amount of uncertainty for market participants. Both buyers and sellers are probably more unsure than usual right now about where prices need to settle in order to clear markets. In the meantime, they are collectively engaged in a time-consuming process of discovering the prices at which expectations and plans of buyers and sellers are mutually consistent.

Many macroeconomic analysts are concerned about the potential fallout of a weakening housing market. The direct impact of the housing market on overall economic activity is easy to calculate. The measure of residential investment spending that is included in real GDP has now fallen for three consecutive quarters. In the second quarter it fell at an annual rate of 11.1 percent, and appears likely to decline even more rapidly in the second half of this year. Since residential investment accounts for less than 6 percent of GDP, that lowered the real GDP growth rate by about seven-tenths of 1 percent in the second quarter. It would not be surprising to see housing reduce growth by even more for a few quarters. That would be a significant drag on the economy, but it would not end the expansion either, especially in light of offsetting strength in business investment spending, a topic I will touch on later.

While the direct effect of housing on GDP may not be overly large, some analysts worry about indirect effects, such as lower housing wealth leading to lower consumer spending. Again, it’s important to begin with fundamentals. While fluctuations in household wealth are capable of affecting spending at the margin, the behavior of consumers is predominantly determined by their current and future income prospects. And those prospects are looking pretty good right now. With the unemployment rate below 5 percent, the labor market is looking fairly tight right now. Despite large increases in gasoline prices earlier this year, inflation-adjusted incomes are rising, as I noted earlier. And now that we’ve seen some relief at the gas pump, it would not be surprising to see a modest pickup in real income growth in the next couple of months.

The deceleration and fall in housing prices certainly will cut in to household net worth to some extent, but so far, such wealth effects have done little to slow household spending.

Could housing prices end up falling sharply enough to cause consumers to rein in spending? Perhaps, but consumers’ balance sheets generally are not as fragile as some commentary might lead one to believe. Housing debt is only 44 percent of the value of household real estate. With that substantial equity position, most homeowners who are not planning to move for other reasons can pretty much ignore transient price fluctuations. And with relatively high levels of financial net worth, most households are well buffered against price fluctuations. Moreover, as I emphasized earlier, household spending is driven mainly by current and future income prospects. Taking all these considerations into account, I would look for consumer spending to continue to expand at a reasonably good pace, even if housing prices come in weaker than I expect.

I should note that the end of the housing boom could not have been a complete surprise to most participants. Sure, it’s nice to sell your home when bidding wars and escalator clauses are common, as they were in 2005. But these conditions were fairly unusual in most markets, and it’s hard to believe many people seriously thought they would persist indefinitely. This is another reason to believe that most people are likely to be reasonably well-positioned for the end of the boom.

Another potential spillover that some analysts like to mention involves mortgage lending, especially with new financing options available to consumers. My sense is that the underwriting and pricing of mortgages has on the whole been sound, despite some individual anecdotes that suggest otherwise. The broad range of households that have taken out nontraditional mortgages are going to find them advantageous, even if, as with many financial products, a small fraction end up regretting their choice after the fact. Moreover, the banking industry looks healthy right now, with strong profitability and high levels of capital. Loan delinquencies are quite low by historical standards, as are chargeoffs of real estate loans. So it looks to me as if the end of the housing boom is unlikely to have any broader spillovers as a result of financial repercussions. Nor is it likely to be exacerbated by financial disintermediation of the type we saw earlier in the postwar era.

The labor market is another potential arena for adverse spillover effects from the housing market. We have seen employment in the residential construction sector fall this year as residential building activity has declined. Fortunately, however, nonresidential construction is on an upswing — over the four quarters ending in June, real nonresidential investment rose 7.2 percent. Further increases in nonresidential construction will allow many workers to simply change construction jobs rather than become unemployed. Indeed, over the last year overall construction employment has actually risen by nearly 210,000 jobs even as housing activity has softened.

As I mentioned earlier, the expected further weakening in housing activity is likely to be largely offset by business capital spending. Over the last three years, business fixed investment has grown at a quite solid 6.6 percent annual rate. Since business fixed investment is over 10 percent of GDP, this means that is has added about two-thirds of a percentage point to GDP growth, which has counteracted the drag from housing that I cited earlier. Indeed, when business investment demand fell sharply following the technology boom of the late 1990s, and the FOMC lowered interest rates in response, the anticipation was that interest rate-sensitive sectors such as housing and consumer durables would take up some of the slack until business investment spending rebounded. Now that business investment has substantially recovered, it makes sense for housing activity to subside in turn.

Note: to check the DPI per capita number use this table from the BEA. Line 37 is the inflation adjusted DPI per capita. For Q2 2005, DPI per capita was $27,290, for Q2 2006: $27,801.

I'll address Lacker's arguments in a future post.

Monday, October 16, 2006

Fed's Yellen: Housing and new "ghost towns" of the West

by Calculated Risk on 10/16/2006 03:56:00 PM

From Federal Reserve Bank of San Francisco President Janet Yellen: Prospects for the U.S. Economy. This speech is basically a repeat of Dr. Yellen's Oct 9th speech. But I missed this paragraph:

According to some of our contacts elsewhere in this Federal Reserve District, data like these are actually "behind the curve," and they're willing to bet that things will get worse before they get better. For example, a major home builder has told me that the share of unsold homes has topped 80 percent in some of the new subdivisions around Phoenix and Las Vegas, which he labeled the new "ghost towns" of the West. Though the situation isn't that bad everywhere, a significant buildup of home inventory implies that permits and starts may continue to fall and the market may not recover for several years. While builders remain hesitant to cut prices so far, and instead offer sales incentives, price cuts at some point in the future seem almost inevitable.

Saturday, October 14, 2006

Tanta's Linkfest on Sub-Prime Mortgages

by Calculated Risk on 10/14/2006 01:20:00 PM

From Tanta in the comments:

New Century Powerpoint Presentation: extra credit for CR readers who can find the words “repurchase requests,” “early payment delinquencies,” or “fraud” in this document.

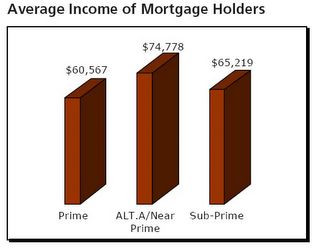

Click on graph for larger image.

Click on graph for larger image.Extra-extra credit for anyone who can figure out how loan acquisition cost/productivity and “stronger secondary execution” can be continuing trends in light of New Century’s apparent move to tighten underwriting standards; enhance "its process for confirming the income information on stated income loans"; and improve its disclosures to consumers per Forbes article (hint: these things cost money). “Stronger secondary execution” depends on aggressive bids by whole loan/securities buyers—who are the parties forcing New Century to tighten standards, enhance processes, etc.From the FDIC: Breaking New Ground in U.S. Mortgage Lending

FDIC: Useful for distinguishing between “nonprime” originations, rate of securitization of originations, MBS issue rate, and MBS outstandings (here’s where you get all the differing numbers). Note: FDIC uses “nonprime” to mean “subprime” (cruddy credit) plus “Alt-A” (prime credit but nonprime features such as stated income, high LTV/DTI, etc. “Private label MBS” means MBS issued by someone other than the GSEs). Tidbits:From FDIC Roundtable, CIBC World Markets View: Scenarios for the Next U.S. Recession NOTE: This document shows numbers through 2004. See chart about for 2005 numbers.

*Nonprime originations were 33% of market in 2005, up from 11% in 2003

*In 2005 68% of all originated mortgages were securitized

*Outstanding private-label MBS represented 29 percent of total outstanding MBS in 2005, more than double the share in 2003

*Of total private-label MBS issuance, two-thirds comprised nonprime loans in 2005, up from 46 percent in 2003

Money quote: “Since 1996, subprime lending has grown five-fold (see Chart 46). And these numbers actually may be understated, as a lot of large banks are reticent to admit that they actually have any type of subprime loans. Instead, it has been called non-prime, or non-traditional.” Tanta’s prediction for 2007: “nonperforming” loans will be reclassified as “differently performing.”From CIBC World Markets: Sub-Prime As Prime Target

Those crazy Canadians: CIBC World Markets does great analysis on mortgage sector. Here’s a fascinating piece on the rise of subprime lending in the Canadian market (Canada seems to be where US was five years ago). Has some good comparative data for US market, too. Tanta’s favorite part: chart showing average borrower income for prime, Alt-A, and subprime. Extra credit for identifying the category with the highest percentage of stated income loans.And from Nomura Securities: MBS Market – Concepts & Topics

Nomura: More data on breakout of MBS issuance/outstanding by credit type (nice charts). You may find this one helpful (along with the CIBC article) if you are still confused about basic bond terminology/mortgage credit class distinctions. Cool charts on issuance volume by mortgage type.Tanta rocks!

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |