by Calculated Risk on 10/22/2006 11:17:00 PM

Sunday, October 22, 2006

Housing and the Economy: Bottoming Out?

Dr. Altig provides us with excerpts from the latest Goldman Sachs newsletter:

"The sharp downturn of the past year seems to have brought total housing starts single-family starts, multi-family starts, and mobile home shipments close to the level justified by the underlying demographics (as best we can measure them)."I agree with this assessment. My calculations also show starts have fallen to the "level justified by the underlying demographics" ... before subtracting the impact of recent overbuilding. So the next step is to account for the recent overbuilding, and that shows a further substantial fall in starts over the next year.

More from Goldman Sachs:

"Still, the fact that the US economy has bent but not broken during the fiercest onslaught of the housing downturn is encouraging. It suggests that real GDP growth probably bottomed for the cycle at the 1% (annualized) pace that we now estimate for the third quarter of 2006. While the headwinds from the direct and indirect effects of the housing bust will remain substantial, a sequential pickup in real GDP growth is now likely."This assessment baffles me. What impact from the housing bust did they expect on the general economy? Yes, the decline in residential investment was a drag on GDP - and will continue to be a drag as residential investment continues to fall. But the significant impact of the housing bust will come from housing related job losses, the loss of mortgage equity extraction (used for consumption) and any financial distress associated with falling housing prices and tighter lending standards.

There is a significant lag between when a housing boom ends, to when housing related employment starts to decline precipitously. As Dr. Thornberg noted (talking about California, but applies everywhere):

"We have seen some losses in jobs in construction, maybe 20,000 over the last eight months or so, but that's not the full extent of it," said Christopher Thornberg, an economist at Beacon Economics, a consulting firm in Los Angeles. "The construction industry is really due to get clobbered; they basically broke even this month."

Click on graph for larger image.

Click on graph for larger image.This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 300K to 400K residential construction employment jobs over the next 6 months. That will be a substantial drag on the U.S. economy.

Note: based on the current level of New Home sales, there are about 600K BLS reported construction jobs that will be lost over the next couple of years.

The second graph shows quarterly mortgage equity withdrawal (MEW) as a percent of GDP for the last 30 years. There is substantial quarterly variability in MEW, but it appears MEW has fallen, as a percent of GDP, from the levels of the last few years.

The second graph shows quarterly mortgage equity withdrawal (MEW) as a percent of GDP for the last 30 years. There is substantial quarterly variability in MEW, but it appears MEW has fallen, as a percent of GDP, from the levels of the last few years.However recent data from the Mortgage Bankers Association (MBA) shows a rise in refinancing activity in Q3 2006, so MEW might have increased again in Q3. Also MEW related consumption probably occurs over several quarters following the extraction from equity. This means the economy is still probably receiving a boost from the record levels of MEW in late 2005.

As housing prices stabilize (and start to fall), MEW will decline and impact consumption. Although retail sales were sluggish in Q3, the impact from less equity extraction on consumption is probably just beginning.

Factor in tighter lending standards, the psychological impact of falling housing prices, rapidly rising foreclosures, and I think the impact of the bust has just started.

Friday, October 20, 2006

Housing Starts, Completions and Construction Employment

by Calculated Risk on 10/20/2006 05:15:00 PM

On Wednesday the Census Bureau released the September report for housing Permits, Starts and Completions. Although Starts rebounded slightly from the rate in August, from a long term perspective Starts are in free fall. Click on graph for larger image.

Click on graph for larger image.

At this point in the housing cycle, Completions are more interesting than Starts. As the first graph shows Completions follow starts with about a 6 to 12 month lag.

For data on the time between Starts and Completions, see Length of Time For New Residential Construction

In September, Completions were at a seasonally adjusted annual rate (SAAR) of 2,084,000. Some of these Completions were for rental units and some were built directly for the owner. The breakdown on the completions by intent isn't available yet from the Census Bureau for Q3. But based on Q2 data, we can estimate that 73% were built for sale, or approximately 1.52 million (SAAR). Since sales are running close to a SAAR of 1.05 million units (and probably less because of cancellations), that means about 1/3 of the units completed in September were added to inventory. Completions are also interesting because Residential Construction employment is closely correlated with Completions. The second graph shows Completions vs. Residential Construction employment over the last 6 years.

Completions are also interesting because Residential Construction employment is closely correlated with Completions. The second graph shows Completions vs. Residential Construction employment over the last 6 years.

Based on the current level of New Home sales, it appears about 600K residential construction employment jobs will be lost over the next few of years. However based on completions, residential construction employment is about right.

And that takes us back to the first graph: Since Starts peaked in early '06, and have been in free fall since then (with an insignificant bounce in Sept), completions, and therefore residential construction employment, will probably start declining rapidly soon.

Update: State Nontraditional Mortgage Guidance

by Calculated Risk on 10/20/2006 12:29:00 AM

UPDATE: I contacted the CSBS Assistant VP Regulatory Affairs this AM. She said: "we do not have a target release date ... We are expecting to release our final guidance within weeks, however, and not months.".

Ms. Felecia Rotellini, Superintendent of the Arizona Department of Financial Institutions, was the representative of the Conference of State Bank Supervisors (CSBS) at the September 20, 2006 U.S. Senate hearing: Assessing Non-Traditional Mortgage Products. Ms. Rotellini provided me with this update tonight:

"The guidance is in process and CSBS, along with the American Association of Residential Mortgage Regulators (AARMR) is working on it and we are hoping that we can issue it very soon."I'm not sure about the definition of "soon", but this reminds me of the comments I tracked while waiting for the Federal Guidance:

June 12th: Bernanke "not-too-far-distant future"Ms. Rotellini also provided me with a contact at the AARMR for more information. I'll be following up tomorrow.

August 18th: "within a few months"

August 29th: "within 60 days"

September 20th: "weeks, not months"

September 29th: Guidance Released.

Thursday, October 19, 2006

Lenders Confess

by Calculated Risk on 10/19/2006 02:48:00 PM

On LEND from Bloomberg: Accredited Home Shares Tumble as Lender Cuts Forecast (thanks to everyone that sent me this!)

"Accredited blamed lower-than-expected loan volumes caused by increased competition and fewer products, lower prices being paid for the loans by investors and a decline in returns on the securities created out of them. The San Diego-based company also said greater-than-expected late payments on loans it made in the last two years will cause it to increase reserves."And on Washington Mutual from Bizjournals: Earnings fall at Washington Mutual

WaMu reported its Home Loan Group lost $33 million during the most recent quarter. That compares to a profit of $302 million in the year-ago third quarter. WaMu attributed the recent quarter's results to fewer home sales and lower gains on sales of loans.ild listened to the WaMu conference call and noted:

There were two questions about how the Interagency Guidance will affect their business. The response was to downplay any possible negative effect, like "we don't offer bad mortgages", "we are working with the regulators to clarify some issues". In mortgage originations they said that they can't compete with others on hybrid programs. As hybrid loans (5/1, 7/1) are the most popular basically their reply was "we can't compete".ild noted that WaMu apparently didn't participate in the recent "business at any cost" push, and that means losses now, but possibly less bad news in the future (as compared to less prudent lenders).

Thornberg: 'Housing a slow moving train wreck'

by Calculated Risk on 10/19/2006 12:40:00 PM

UCLA economics professor Christopher Thornberg spoke at a conference in Torrance yesterday. Here are a few of his comments via the Daily Breeze:

"At the end of last year, the real estate bubble popped. And right now, we're in the middle of the bubble popping," Christopher Thornberg said at the South Bay Economic Forecast Conference. "The real question is, of course, is it going to be a hard or soft landing?"Thornberg's view is that prices will stay flat in nominal terms, until inflation and real wage growth catch up with current prices. On the one hand Thornberg argues that real prices will fall 15% or so (flat nominal prices for five years), and then he argues prices are 30% to 35% overvalued. So it seems he is arguing that prices will still be overvalued in 2011.

Thornberg ... described the housing situation in harsh terms: "This is a slow-moving train wreck."

...

"Prices are easily 30 to 35 percent over-valued," Thornberg said. "Whether prices go down or stay the way they are, you can pretty much guarantee that whatever the value of your house now, that's going to be the value of your house in 2011."

...

The good news is that the rest of the economy is doing well, Thornberg said. That means it's unlikely that we will see mass job losses like we had in the early 1990s, when home values began to tank.

...

"In a housing bubble ... prices tend not to fall," he said. "Housing is not something you day trade."

I think it is more likely that we will see some nominal price declines over several years. I believe a combination of real wage growth, inflation AND some nominal price declines will eventually bring housing prices back in line with incomes.

WSJ: More Home Loans Go Sour

by Calculated Risk on 10/19/2006 12:21:00 AM

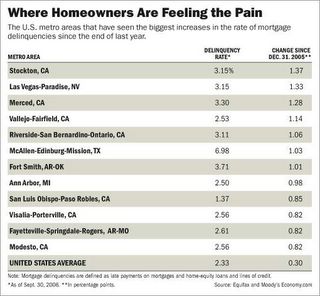

The WSJ reports: More Home Loans Go Sour Click on table for larger image.

Click on table for larger image.

In the latest sign that a cooling housing market and weaker credit standards are beginning to take their toll on borrowers and lenders, the number of past-due mortgages continued to rise in the three months ended Sept. 30, according to data from Equifax Inc. and Moody's Economy.com Inc.

...

A separate report released yesterday by the federal Office of the Comptroller of the Currency found that lenders continued to ease credit standards over the past year.

...

The Comptroller's report found that competitive pressures are driving many banks to further loosen their credit standards.

...

"We have reason to believe that the amount of easing we saw back in March is continuing," says Kathryn Dick, deputy comptroller for credit and market risk at the OCC. Federal bank regulators have been stepping up their scrutiny of residential mortgage lending by large banks, she says, with a particular focus on banks that lend heavily in cooling housing markets.

...

David M. Crosby, a Las Vegas bankruptcy attorney, says he has seen a "surge" in borrowers with mortgage problems. "Most of it is [tied to] the end of the housing boom, but I do see a good percentage of clients who got caught by a change in their mortgage rates." In addition, some clients "bought a number of speculative homes," he says. "The market turned on them, and now they are in a real financial mess."

Some homeowners are calling it quits. "A surprising number of people are walking away from their homes rather than trying to save them," says Mr. Crosby, either because the rate on their loan has jumped or because they owe more than the home is worth.

Wednesday, October 18, 2006

DataQuick: Steep Increase in California Foreclosure Activity

by Calculated Risk on 10/18/2006 05:51:00 PM

DataQuick reports: Steep Increase in California Foreclosure Activity

Residential foreclosure activity in California surged to its highest level in more than four years last quarter, the result of slower home sales and flattening prices, a real estate information service reported.

Lending institutions sent 26,705 default notices to homeowners in the state during the three-month period ending in September. That was up 28.3 percent from 20,812 for the prior quarter, and up 111.8 percent from 12,606 for 2005's third quarter, according to DataQuick Information Systems.

Last quarter's number was the highest since first-quarter 2002 when 30,225 default notices were sent out. Foreclosure activity hit a low during the third quarter of 2004 when 12,145 default notices were recorded. Defaults peaked in first quarter 1996 at 59,897. DataQuick's default statistics go back to 1992. The quarterly average is 32,653.

| California Default Notices, Source: DataQuick | |

| Year | Default Notices |

| 1992 | 100,573 |

| 1993 | 121,416 |

| 1994 | 122,530 |

| 1995 | 135,713 |

| 1996 | 162,597 |

| 1997 | 141,180 |

| 1998 | 122,775 |

| 1999 | 101,053 |

| 2000 | 88,666 |

| 2001 | 81,003 |

| 2002 | 78,784 |

| 2003 | 66,127 |

| 2004 | 52,674 |

| 2005 | 54,476 |

| 2006 (through Q3) | 66,185 |

NOTE: 2006 is through Q3. At the current pace, the number of Default Notices in 2006 will be the highest since 1999.

Comptroller Dugan Expresses Concerns on Mortgage Lending

by Calculated Risk on 10/18/2006 05:31:00 PM

Comptroller of the Currency John C. Dugan, in a speech to the American Bankers Association on Monday, expressed concern about mortgage lending standards:

With respect to retail lending, the underwriting survey showed significant easing in residential mortgage lending standards, including home equity lending. We saw more of what we observed the previous year: longer interest-only periods, more “piggyback” loans to avoid mortgage insurance requirements, higher allowable debt-to-income and loan-to-value ratios, and greater volumes of loans with reduced documentation requirements.And on Tueday, Dugan spoke at the annual convention of America’s Community Bankers. Dugan urged the States to adopt the key principles of the Nontraditional Mortgage Guidance:

This year has brought us at least one thing that’s new, however: a cooling of the red-hot housing market. In many local and regional markets, prices are leveling off, while in others, they have declined. We would normally expect that trend to change the calculus of many mortgage lending decisions, with lenders tightening their underwriting standards and requiring borrowers to provide more equity.

Yet that’s not what the underwriting survey and other recent evidence demonstrates. In fact, with fewer home buyers in the market, competition among lenders appears to be intensifying, and, with some exceptions, that competition has extended to weaker underwriting standards. Frankly, that concerns me. We don’t want to see the lending decisions bankers make today result in excessive foreclosures – and reduced affordable housing credit – tomorrow.

Our issuance of the nontraditional mortgage guidance, as important as it is, can only be viewed as unfinished business. During the comment period, banks and thrifts expressed strong concerns that the guidance would apply only to federally regulated institutions – insured depository institutions and their affiliates – but would not apply to those mortgage lenders and brokers regulated exclusively by the states, which constitute a large portion of nontraditional mortgage originators.

I agree with these concerns. There is an unlevel playing field that plainly distorts competition in the nontraditional mortgage business. And there is also a consumer protection gap with respect to the nontraditional mortgage lending practices of a broad segment of mortgage lenders.

... many ... originators will have no contact with a federally regulated institution at all – so the guidance will never even indirectly touch their operations. For example, institutions may sell the mortgages they originate directly to investment banks that package and securitize them. Indeed, the appetite for mortgages to securitize is so strong that we now see investment banks and other financial intermediaries acquiring mortgage originators in an effort to lock in volume for their securitization business. In some cases, these acquisitions transform a mortgage business that had been subject to federal standards to one that is not.

So when we see this gap, this unlevel playing field, what is the solution? ...

State regulation, effectively enforced, can do this. ...

I have been encouraged by the recent statements by the Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators. These two organizations are working on a version of the nontraditional mortgage guidance that will focus on mortgage underwriting and consumer protection issues. We understand that state agencies then will be urged to adopt and apply this guidance to the entities they regulate. In so doing, it is vital that key principles of our nontraditional mortgage guidance not be watered down. ...

Agencies Provide Consumer Information on Nontraditional Mortgage Loans

by Calculated Risk on 10/18/2006 11:26:00 AM

From the Federal Reserve: Agencies Provide Consumer Information on Nontraditional Mortgage Loans

The federal bank, thrift, and credit union regulatory agencies today announced the publication of a new resource that can help consumers make more informed choices when considering nontraditional mortgage loans.

Interest-Only Mortgage Payments and Payment-Option ARMs--Are They for You? features a glossary of lending terms, a mortgage shopping worksheet, and a list of additional information sources. This information can help consumers, whether buying a house or refinancing a mortgage, decide if an interest-only mortgage (an I-O mortgage) or an adjustable-rate mortgage (ARM) with the option to make a minimum payment (a payment-option ARM) is right for them.

The publication stresses the importance of understanding key mortgage loan terms, warns of the risks consumers may face, and urges borrowers to be realistic about whether they can handle future payment increases. If consumers are not comfortable with these risks, the publication suggests that they ask about other mortgage products.

Many lenders offer home loans that allow consumers to (1) pay only the interest on the loan during the first few years of the loan term; or (2) make only a specified minimum payment that could be less than the monthly interest on the loan. Lenders have a variety of names for these loans, but with I-O mortgages and payment-option ARMs, consumers could face "payment shock." Monthly payments may double or even triple following the interest-only period or when the payments adjust.

In addition, consumers with payment-option ARMs could face negative amortization, a situation in which the monthly payments do not cover all of the interest owed for that month. The unpaid interest is added to the mortgage balance so that the amount owed on the mortgage exceeds the amount originally borrowed.

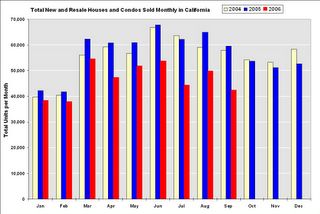

DataQuick: California Sales Lowest Since 2001

by Calculated Risk on 10/18/2006 11:11:00 AM

DataQuick reports: California September Home Sales Click on graph for larger image.

Click on graph for larger image.

A total of 42,450 new and resale houses and condos were sold statewide last month. That's down 14.8 percent from 49,800 for August and down 28.8 percent from a 59,600 for September 2005.Although some areas are already seeing YoY nominal price declines (San Diego, Bay Area), the median YoY price in California increased slightly. Real prices are falling for the first time since the early to mid-90s housing bust in California.

Sales almost always decrease from August to September as the sales season moves from summer into fall. Last month's sales made for the slowest September since 2001 when 41,880 homes were sold.

The median price paid for a home last month was $466,000. That was down 1.3 percent from August's $472,000, and up 2.4 percent from $455,000 for September a year ago.

Note: in about 2 weeks, DataQuick will announce a significant increase in California foreclosure activity for Q3.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |