by Calculated Risk on 11/01/2006 12:28:00 AM

Wednesday, November 01, 2006

MBA: Mortgage Rates and Applications Decline

The Mortgage Bankers Association (MBA) reports: Mortgage Rates and Applications Decline

The MBA Purchase Index is at the lowest level since 2003. Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 570.8, a decrease of 3 percent on a seasonally adjusted basis from 588.6 one week earlier. On an unadjusted basis, the Index decreased 3.3 percent compared with the previous week and was down 11.2 percent compared with the same week one year earlier.Mortgage rates decreased:

The seasonally-adjusted Refinance Index decreased by 4.5 percent to 1709.2 from 1790.4 the previous week and the Purchase Index decreased by 1.8 percent to 375.6 from 382.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.24 percent from 6.36 percent ...

The average contract interest rate for one-year ARMs decreased to 5.93 percent from 5.97 percent ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.The four week moving average for the seasonally-adjusted Market Index is down 2.6 percent to 586.1 from 601.9. The four week moving average is down 1.9 percent to 381.5 from 388.8 for the Purchase Index, while this average is down 3.5 percent to 1778.7 from 1844.1 for the Refinance Index.The 4 week and 12 week moving averages for the Purchase Index are at the lowest levels since 2003. The downtrend in purchase activity is continuing.

Tuesday, October 31, 2006

Northern Trust asks: Housing Recession Isn’t Spreading?

by Calculated Risk on 10/31/2006 05:11:00 PM

Northern Trust's Paul Kasriel writes: Housing Recession Isn't Spreading? Kasriel argues that we may already be seeing spillover from the housing recession into the general economy. A few excerpts: Click on graph for larger image.

Click on graph for larger image.

Graphs and text from Northern Trust.

"For Q3:2006, the year-over-year change in real consumption was 2.8%, down a full percentage point from its reading of Q3:2005 and the lowest year-over-year growth since the first half of 2003. Perhaps it has nothing to do with the housing recession, but the data say that growth in consumer spending, although not yet collapsing, certainly is decelerating."

"Now, direct your eyes to Chart 2, which shows the year-over-year percent change in real expenditures of business equipment and software. In Q3:2006, the year-over-year change was 5.7%, down from 9.3% in Q3:2005 and the slowest year-over-year growth since Q3:2003. Again, although there is no recession in business capital spending, yet, the data show very clearly that the growth in spending on business equipment and software is decidedly moderating."Please see the Northern Trust commentary for more.

Residential Investment leads Business Investment

by Calculated Risk on 10/31/2006 01:12:00 AM

At Econbrowser, Professor Chinn revisits the relationship between Residential Investment, Business Fixed Investment and GDP growth: Skepticism about the Business Fixed Investment Handoff. Chinn quotes Robert Hall and David Papell's textbook Macroeconomics:

"Separating housing investment from business investment reveals some important timing differences. Both business investment and housing investment fluctuate widely during recessions and booms. But housing investment leads real GDP while business investment moves together with real GDP."See the graphs from Dr. Chinn of Residential Investment (RI) vs. GDP and Non-Residential Investment vs. GDP.

Click on graph for larger image.

Click on graph for larger image.This graph shows the YoY change in residential investment vs. nonresidential investment. As I noted in August: In general, residential investment leads nonresidential investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential investment remained strong.

Another interesting period was 2001 when nonresidential investment fell significantly more than residential investment. Obviously the fall in nonresidential investment was related to the bursting of the stock market bubble. But typically changes in residential investment lead changes in nonresidential investment, and GDP, by three to five quarters.

As I noted in the comments to a previous post, both WalMart and Amazon have announced cuts in their capital spending plans. Roubini mentioned WalMart's plans today, and also pointed to the Reuters article indicating slightly weaker loan demand.

When a few companies cut capital spending plans that might increase their profits, but if a slew of companies cut capital spending, overall profits will fall.

Monday, October 30, 2006

The Rise of Eeyore

by Calculated Risk on 10/30/2006 10:07:00 PM

In mid-August, Dallas Fed President Richard Fisher said:

"I expect second-quarter GDP growth to be revised upward to closer to 3 percent. And my best guess one month and two weeks into the third quarter is that the speed at which we are now proceeding is roughly of that magnitude. From my vantage point, despite what you hear from some of the Eeyores in the analytical community, a recession is not visible on the horizon."

And of course those Eeyores in the analytical community have been correct so far.

Here is some more from Dr. Roubini: Another Recession "Canary in the Mine": Wal-Mart Sales Flat in Spite of Lower Oil Prices. A short excerpt:

One of the latest variants of the optimists' soft-landing view is that the weakness in economic growth in Q3 was driven by the spike in oil prices during the summer. Now that oil prices are 25% down relative to the summer peak, the extra income in the pocket of consumers will be spent driving a rebound of consumption and growth in Q4 and 2007. So, now "low" oil prices will come to rescue the US consumer.And from Dr. Krugman (NDN’s James Crabtree notes from speech, hat tip: Mark Thoma):

It is too bad that this fairy tale has a very week base of support. This weekend Wal-Mart reported on its same store sales for October so far; and guess what: they are as bad as they were in December 2000 at the very outset of the last US recession.

In general economic terms we are off the map - in two ways on (1) housing and (2) the trade deficit. Because we are off the map, we are struggling to use our fundamental understanding of economics, and some dubious number crunching, to make sense of a situation that doesn’t look like anything we’ve seen before.Eeyore lives!

...

So here is the economic problem. We have a big trade deficit and a highly inflated housing sector. One result has been that we’ve lost a lot of manufacturing jobs – which are tradable – but we’ve made that up in domestically orientated employment. (Among other things this has included a 50% increase in real estate jobs.) Eventually this will slide back, and we’ll see more jobs in manufacturing if exports pick up. The thing is that the transition will be unlikely to be smooth.

More on MEW

by Calculated Risk on 10/30/2006 03:31:00 PM

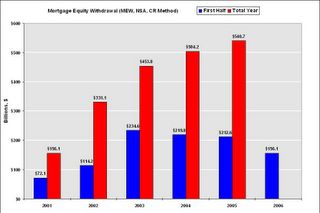

Using my method for calculating Mortgage Equity Extraction (MEW), the following graph shows MEW for the first two quarters of the year, and the total year. Click on graph for larger image.

Click on graph for larger image.

Over the last few years, a growing percentage of equity extraction has occurred in the second half of the year.

Based on preliminary reports from the BEA, Q3 MEW was probably around $100 Billion.

NOTE: Maybe a few more abbreviations in the graph title will make this clear: MEW = Mortgage Equity Extraction, NSA = Not Seasonally Adjusted, CR = Calculated Risk.

Kash: The Previous 'Soft Landing'

by Calculated Risk on 10/30/2006 12:07:00 PM

Professor Kash Mansori of Angry Bear has his own blog: The Street Light.

Today, Kash looks at how the previous 'soft landing' was being reported in 2000. A few excerpts:

September 18, 2000A nice review. Enjoy!

The Wall Street Journal

Economic Data Continue to Augur Soft Landing:

November 27, 2000

Business Week

This Political Shock Won't Upset the Soft Landing: THE FED SEEMS CONTENT that the slowdown is leading toward the desired soft landing, although policymakers are still not convinced that the threat of rising inflation is abating.

Comparing MEW Calculations

by Calculated Risk on 10/30/2006 12:26:00 AM

Note: This might be boring. For a more interesting piece, the previous post has excerpts (and links) to Krugman's piece today on the housing bubble.

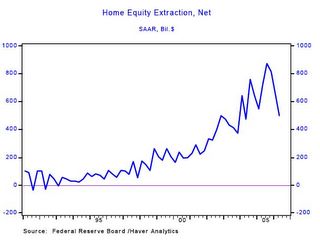

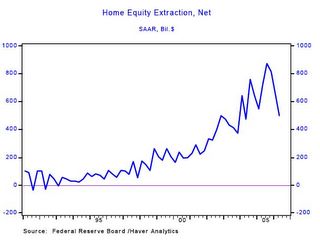

When I excerpted from the recent Merrill Lynch economic forecast, I also presented a graph from Merrill Lynch of Net Mortgage Equity Extraction - what I call mortgage equity withdrawal or MEW. Click on graph for larger image.

Click on graph for larger image.

Brad Setser asked how the Merrill Lynch estimate of MEW compared to my estimate of MEW. Once again, here is the Merrill Lynch graph based on data from the Federal Reserve and Haver Analytics.

This data is presented seasonally adjusted, at an annual rate (SAAR). This is the graph I presented on MEW. This data is also based on the Federal Reserve Flow of Funds report and the BEA GDP report.

This is the graph I presented on MEW. This data is also based on the Federal Reserve Flow of Funds report and the BEA GDP report.

The data is presented as a percent of GDP. Also, this is an estimate of MEW presented on a quarterly basis, NOT seasonally adjusted (NSA). The third graph shows my estimate of MEW at an annualized rate (but still NSA) compared to the Merrill Lynch SA data. It appears my method yields a lower value for MEW, and there are some differences because I haven't SA the data.

The third graph shows my estimate of MEW at an annualized rate (but still NSA) compared to the Merrill Lynch SA data. It appears my method yields a lower value for MEW, and there are some differences because I haven't SA the data.

The seasonal pattern is Q2 and Q3 are the strongest quarters for equity extraction (about 2/3 of the total annual extraction), followed by Q4. The first quarter is usually the weakest quarter with typically less than 10% of the annual extraction. So SA, Merrill Lynch shows strong MEW in Q1 2006 with a significant decline in Q2. NSA data shows Q1 and Q2 about the same for '06.

As a final note, before the Flow of Funds report is available, the BEA provides an estimate of quarterly mortgage interest paid and the effective mortgage interest rate, based on preliminary data from the Fed. It isn't perfect for MEW because the BEA data includes interest on tenant occupied rental housing, but by dividing interest paid by the effective rate, we can estimate the increase in mortgage debt in Q3 2006. This shows that MEW in Q3 2006 was close, or slightly higher, than the level of Q2 2006.

Sunday, October 29, 2006

Krugman: Bursting Bubble Blues

by Calculated Risk on 10/29/2006 11:16:00 PM

Professor Krugman writes in the NY Times: Bursting Bubble Blues

Economist's View has some excerpts:

Here are the five stages of housing grief:See Economist's View for more.

1. Housing bubble? What housing bubble? “A national severe price distortion [in housing] seems most unlikely in the United States.” (Alan Greenspan, October 2004)

2. “There’s a little froth in this market,” but “we don’t perceive that there is a national bubble.” (Alan Greenspan, May 2005)

3. Housing is slumping, but “despite what you hear from some of the Eeyores in the analytical community, a recession is not visible on the horizon.” (Richard Fisher, president of the Federal Reserve Bank of Dallas, August 2006)

4. Well, that was a lousy quarter, but “I feel good about the U.S. economy, I really do.” (Henry Paulson, the Treasury secretary, last Friday)

5. Insert expletive here.

Saturday, October 28, 2006

Merrill Lynch Forecast

by Calculated Risk on 10/28/2006 12:06:00 AM

From the Oct 24th Merrill Lynch forecast: 2007 US interest rate outlook

UPDATE: Bill Cara also has this Merrill Lynch report: The "D" word sets in for the builders — "Desperation"

*[W]e expect that GDP growth could hard-land in late 2007 and early-2008 ...

Click on graph for larger image.

Click on graph for larger image.* Unlike the Fed’s view for “limited” spillover effects from the housing correction, we foresee a substantial degree of economic contagion (from the residential construction correction and from a decline in mortgage equity withdrawals).If there is spillover from the housing bust into the general economy, the initial impacts will be from the loss of housing related jobs and the decline in mortgage equity withdrawal. I don't think we will have to wait until late 2007 to see if there is spillover from the housing bust - the next few quarters should tell the tale.

* In our hard-landing view, this contagion likely will be severe enough to drive the unemployment rate up to 5.8% by the end of 2007 (currently, the unemployment rate is 4.6%).

* In our hard-landing view, monthly US nonfarm payroll growth likely will average 75k to 125k over the very near-term, but that monthly jobs growth should begin to turn negative by 2Q-2007.

Friday, October 27, 2006

GDP Report: Mortgage Interest and Equity Extraction

by Calculated Risk on 10/27/2006 11:44:00 PM

As a supplement (excel file) to the GDP report, the Bureau of Economic Analysis provides an estimate of aggregate mortgage interest and the effective rate of interest on mortgage debt outstanding. This supplement includes mortgage interest for tenant occupied residential housing, so we have to wait for the Fed's Flow of Funds report to calculate mortgage equity withdrawal for Q3.

However this report does suggest that MEW in Q3 was about the same level as Q2. Click on graph for larger image.

Click on graph for larger image.

This graph is based on the BEA supplement, and shows mortgage debt as a percent of disposable personal income.

Not surprisingly, mortgage debt as a percent of DPI is at an all time high.

The second graph shows mortgage interest as a percent of DPI.

During the late '80s housing boom, mortgage interest payments, as a percent of DPI, peaked at 6.3% in 1989. Currently mortgage interest payments as a percent of DPI are a record high of 6.5% - even with relatively low interest rates.