by Calculated Risk on 1/17/2007 10:39:00 AM

Wednesday, January 17, 2007

MBA: Purchase Applications Decrease

The Mortgage Bankers Association (MBA) reports: Refinance Applications Increase and Purchase Applications Decrease Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 667.2, a decrease of 0.6 percent on a seasonally adjusted basis from 671.1 one week earlier. On an unadjusted basis, the Index increased 28.9 percent compared with the previous week and was up 9.8 percent compared with the same week one year earlier.Mortgage rates increased:

The Refinance Index increased by 6.3 percent to 2045.8 from 1923.8 the previous week and the seasonally adjusted Purchase Index decreased by 7 percent to 439.7 from 472.8 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.19 from 6.13 percent ...

The average contract interest rate for one-year ARMs increased to 5.85 percent from 5.79 ...

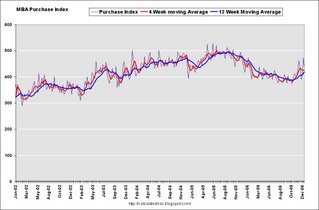

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.2 percent to 427.4 from 426.6 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.2 percent to 427.4 from 426.6 for the Purchase Index.The refinance share of mortgage activity increased to 49.9 percent of total applications from 48.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 21.2 from 20.1 percent of total applications from the previous week.

Tuesday, January 16, 2007

Leamer: Is a Recession Ahead?

by Calculated Risk on 1/16/2007 02:59:00 PM

Dr. Edward Leamer, Director UCLA Anderson Forecast, writes in The Economists' Voice: Is a Recession Ahead? The Models Say Yes, but the Mind Says No

My view, announced in December 2005, is that this time will be different. This time the problems in housing will stay in housing. So far, I am feeling very smug. But this keeps me up at night. In this column, first the models, and then the mind. The models say that a recession is coming soon. The mind says otherwise.I'll have more later, but here is Dr. Leamer's conclusion:

The mind: why i think the models are wrong

The models that rely on history suggest that the extreme problems in housing currently being corrected will almost surely infect the rest of the economy, but that history does not take into account two important facts:

• Manufacturing is not poised to contribute much to job loss.

• Real interest rates are very low and there is no evident credit crunch, now or on the horizon.

These facts make the problem in housing less severe than it would be otherwise, and help to confine the pathology to the directly affected real estate sectors: builders, real estate brokers and real estate bankers.

...

The models say “recession;” the mind says “no way.” I’m going with the mind. This time the problems in housing will stay in housing. If you are a builder or a broker, it will feel like a deep depression. The rest of us will hardly notice.

DataQuick: SoCal New price peak, slowest December in ten years

by Calculated Risk on 1/16/2007 02:06:00 PM

DataQuick reports: New price peak, slowest December in ten years

Southern California's housing market ... prices reached a new peak while sales volume remained at a ten-year low ...

The median price paid for a home in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties was $495,000 last month, a new record. That was up 1.6 percent from $487,000 for the month before, and up 3.3 percent from $479,000 for December a year ago, according to DataQuick Information Systems.

The previous peak was $493,000 last June. Year-over-year price increases have been in the single digits for nine months. Last month's record median was in large part due to strong sales of new homes, which is normal for December.

"The market is still readjusting after the frenzy in 2004 and 2005. Market indicators tend to point in different directions during a turn. We are watching the San Diego market carefully, sales and price trends there have tended to lead the region," said Marshall Prentice, DataQuick president.

A total of 22,485 new and resale homes were sold regionwide last month. That was up 10.3 percent from 20,388 in November, and down 22.3 percent from 28,952 in December a year ago. Last month was the slowest December since 1995 when 19,202 homes were sold. DataQuick's statistics go back to 1988, the December average is 23,699 sales.

...

While year-over-year sales in the region have declined for the last 13 months, San Diego County's sales started to decline 30 months ago. San Diego County's median peaked in November 2005 at $518,000 and was $483,000 last month, a 6.8 percent decline.

Centex, KB Home

by Calculated Risk on 1/16/2007 11:27:00 AM

"We are navigating through one of the most challenging housing environments in the past 25 years. We are responding by reducing our land position and inventory, aligning our workforce to the current sales pace and improving our overall cost structure."

Centex Chairman and Chief Executive Tim Eller, Jan 16, 2007

From MarketWatch: Centex, KB Home write off $793 million on value of land holdings, options

Centex said it will record land-valuation adjustments of about $300 million because of the declining housing market. It also has decided not to exercise land-option contracts on 37,000 lots, resulting in walk-away costs of about $150 million.

...

Centex added closings for the quarter dropped fell 12% to 8,360, and net orders slumped 24% to 6,139.

As for KB Home, it said ... that it will take an inventory-impairment charge of $255 million and an $88 million charge from the abandonment of some land-option contracts.

Monday, January 15, 2007

Berson on Housing Overhang

by Calculated Risk on 1/15/2007 10:35:00 PM

Fannie Mae economist David Berson asks: How large is the housing overhang?

We have argued for some time that the surge in housing demand in recent years (principally from investors over the period from 2004 to early-2006) was unsustainable. Understandably, builders responded to this pickup in overall housing demand by significantly increasing house construction. As a result, too many housing units were built in recent years relative to the underlying pace of housing demand-- bringing unsold inventories up to record highs. But how large is this overhang relative to long-term housing demand?Berson estimates the overhang at about 600K units. In an earlier post, I estimated the overhang at 1.1 to 1.4 million units. The differences in our estimates come from two main sources: 1) I estimated current total demand at about 1.7 million units per year, Berson used 1.8 million units. 2) Since I used a lower number, I also calculated some excess overbuilding prior to 2004; Berson only calculated overbuilding in 2004 through 2006.

The difference is important for estimating the length and depth of the building slump. Using my estimates, I further calculated completions "might fall to 1.2 million units per year over the next few years" and "New Home Sales might fall to 800 thousand per year or less - until the excess inventory is absorbed".

Using Berson's 600K estimate, completions will probably stabilize at around 1.5 million units per year for the next couple of years, and New Home sales will probably decline to 900K per year or so. This is close to Berson's forecast of 975K New Home sales in 2007, and starts of 1.58 million units. (Starts and completions will be close in 2007 if starts stabilize at the 1.5+ million SAAR level).

Tanta: Information is Power, Which is Why You Don’t Get Any

by Calculated Risk on 1/15/2007 01:53:00 PM

About 15 years ago I was working for a decently-sized regional bank in Secondary Marketing (the bitch with the rate sheet), and one fine day this unspeakably cheerful young person from Primary Marketing (the ditz with the Sunday Ad Section) sashayed into my cubicle with the request that I, as a “subject matter expert” (corporate-speak for “nearest available victim”) review this brochure being produced for mortgage applicants and other innocent bystanders. It took the form of a glossary of terms—how original—and it had actually occurred to Marketing that perhaps it should be reviewed for accuracy. Being a sucker for that sort of thing—accuracy, and light bulbs going on over in Marketing, I mean, not extra work—I held out my hand. I will never forget the definition provided for the term “points”: “A fee paid at closing to increase the lender’s yield on the loan.”

Now, that definition is, in fact, perfectly accurate (and copied directly from The Handbook of Mortgage-Backed Securities, second edition, I believe). For a mortgage portfolio investor, it’s a good thing to know, too: you may have a low-rate loan to invest in, but luckily Verne and Mary Sue coughed up some points at closing that you get to amortize over the expected life of the loan to bring that yield up to market. Oh, wait, that definition doesn’t actually tell you that. Not to worry, you’re just an investor with great gobs of money at risk, you don’t need details.

If, on the other hand, you are Verne and Mary Sue, and you have just been confronted with a loan officer telling you to bring a four-figure check to closing to pay for this thing called “points,” and you don’t know what they are, and you check out the handy Glossary of Terms provided by your trusty bank, and it says that points are things you pay just to make the lender richer—there is no other way to construe that sentence if you don’t already know what points are—you will of course happily whip out the checkbook instead of running across the street to some other bank. Happens all the time.

So I got out the red pen and re-wrote the definition of points to indicate that they are an optional fee that you may pay if you want a lower interest rate, and that there are loans that do not charge points, but the interest rate on those loans is higher. After I turned in my marked-up copy, the Marketing Ditz did mention that some of my revisions might get edited a bit for length. Not surprising, I thought; Tanta does blather on.

The final printed version contained the following definition of points: “A fee paid at closing to increase the lender’s yield on the loan.”

I’d like to say we lost customers over it, but I doubt that’s true. I’m sure that net-net—losing all the literate and at least marginally sane borrowers, gaining the ones who cannot be stopped by information of any sort, true or not, keeping everyone with the good sense to refuse to accept a brochure offered by a stranger—we came out even. It used to make me so proud when I went to conventions and met colleagues from other, bigger banks: “You might have more customers than I do, but mine are still more ignorant than yours.”

My point is that there is, in fact, no party to any transaction—borrowers, lenders, investors, regulators, those menacing sorts who squeegee your windshield at busy city intersections, my Aunt Harriet’s cats—for whom this definition is more useful than an acid flashback. If you do not already know something, it either doesn’t tell you enough or tells you the wrong thing. If you already know something, it doesn’t exactly advance you toward the goalposts. It’s a classic example of a statement that is literally true and perfectly worthless. Yet my employer saw fit to use it because it came from a real published textbook, whereas the suggested revision came from that coffee-torqued bitch on the third floor, and besides, it fit into the margins of a tri-fold better. Those of you who know anything about the writing of annual CRA reports will know what we included among our “community outreach” efforts for the year, of course. The regulators were glad to see us make such nice educational commitments, too; I think we got an “Outstanding” rating that year. And people call me cynical.

I have often wondered over the years what happened to the Marketing Ditz, but I wonder no more: looks like she got a job with the Washington Post. Consider, if you can bear to, ”Mortgage-Trapped”:

At 64, and looking toward his retirement next year, Willie Lee Howard agreed to refinance his duplex in Northeast Washington, thinking that a fixed-rate loan would help stabilize his finances.That’s it, kids. That’s all the information provided in the article on Howard’s loan—read the whole thing if you don’t believe me. Read the whole thing anway: you really need to absorb the vicarious-outrage-on-behalf-of-the-uninformed tone of the whole worthless thing in order truly to savor the irony:

What Howard got instead was a mortgage he did not understand. Baffled by the loan documents he was mailed after the closing, he consulted an AARP lawyer and learned that he now had an interest-only loan, a new and controversial kind of mortgage. Howard was told that under its terms, his mortgage balance will rise instead of fall and that he will need to refinance in 10 years, when he may be too old to work.

"This is a bunch of junk they done to me," said Howard, a construction worker.

Howard's chagrin at his mortgage's complex provisions illustrates the confusion felt by many borrowers struggling to adapt to a radically transformed home lending market. . . .

Howard said he was persuaded to refinance his house by a "very friendly" loan officer who called once a week for a year, telling him the time was right to stabilize his finances.

After deciding to take out the loan, he said he told the lender he would need help reading the paperwork at the closing. He said he still doesn't understand exactly what kind of mortgage he signed.

Howard's mortgage contains several of these new features, said Sugarman, who has reviewed the documents. It is an interest-only loan, which is one of the nontraditional mortgages designed to help wealthy people manage their cash flow, and for people whose incomes are likely to rise -- not for those whose incomes, such as Howard's, are likely to fall as they retire on Social Security. The rate is fixed, but only for 10 years. Sugarman said Howard appears to have qualified for it with a "NINA" loan, a "no-income, no assets" loan that required minimal income documentation.

"It's a very exotic mortgage, and he had no idea he was getting that," Sugarman said. "He thought he was doing something smart."

• Howard was told that an interest-only loan would result in a rising balance. This is of course false, a confusion of interest-only with negative amortization. The reporter does not correct this misinformation. Possibly the AARP lawyer is an illiterate moron. Possibly the AARP lawyer was misquoted by the reporter. Possibly a rather condescending article on how borrowers don’t often understand loan terms has gotten off to a rocky start in the second paragraph.

• Later in the article, we are given to understand that a “no-income, no assets” loan requires “minimal” income documentation. There are some misleading terms used by the mortgage industry, but in the case of a NINA, “no” actually means “no.” Not “some.” Loans with “minimal” income documentation are usually called “Reduced Doc” or “Streamlined Doc” or “Alternate Doc.” Have you ever heard the cliché “the blind leading the blind”? Just askin’.

• Howard was told that “he will need to refinance in ten years.” Why? Is the loan a ten-year balloon, which remains, in literal fact, the only kind of loan that really does require you to refinance in ten years? Tanta suspects—but can’t prove—that the loan is not a balloon but a 10/1 ARM. It is possible that Howard might want to refinance it in ten years. It is possible that Howard might not be able to afford the payments after the first rate adjustment. It is possible that Howard can’t afford the payments today. If you do not already know something about how mortgage loans work, what does “he will need to refinance in ten years” mean to you? If the Post thinks these loans are so dangerous to uninformed consumers, what would be the argument against actually letting us know what they’re called? That’s what I thought.

• Howard qualified for the loan with no—or possibly some but not much—income or asset documentation. What, precisely, is the problem with that? Do you know? Did you know before you read the Post? Do you still know after you read the Post? Would it have wrecked the layout of the entire newspaper to add one little sentence pointing out that this was a problem because Howard would not have qualified for the loan if he had provided verifications, or would have gotten a more affordable interest rate if he had provided verifications, or thought that he had provided verifications when in reality the lender threw them away, or perhaps is less an innocent victim than he would like us to think, or whatever the bloody problem actually is? Is it time for a drink yet?

• Howard, the story goes, refinanced his existing loan. He thought, the story goes, that “a fixed-rate loan would help stabilize his finances.” Um, did Howard start out with an ARM? Did he start out with a really high-rate loan? Did he need to take cash out? Other facts aside—and Dog knows we aren’t getting any anyway—if Howard already has a high-rate adjusting ARM, how, exactly, did he get screwed by being put into a 10/1 IO ARM? How did he fail to recognize another ARM? Is Howard illiterate? Would better-written disclosures have helped him in that case? Does the reporter actually believe that an IO loan legally prevents you from making the equivalent of an amortizing payment if you want to? If not, would it be worth providing that advice to people who have one? Could it be that Howard couldn’t have afforded a fixed rate amortizing loan if one had been offered? Does the reporter understand that amortizing fixed rate loans require higher payments and carry higher interest rates than IO ARMs do? Does Howard have faulty expectations as well as missing information? Does Howard have a very serious problem—he cannot afford his home with any available mortgage type—that cannot, actually, be solved merely by the provision of more information by a more honest loan officer? Would it be worth sacrificing the lack-of-lender-disclosure-screws-borrower-who-always-wants-the-right-thing-but-doesn’t-get-it boilerplate narrative in order to examine the question of what the real problem is? Could we, like, advance the ball?

There’s a definition of “news” that involves providing relevant information that readers don’t already have—true information, even—and there’s a definition of “serious reporting” that involves not providing unintentional comedy by parading one’s ignorance about mortgages in an article full of high-minded tut-tutting over ignorance about mortgages. There is. Really. Maybe we should send out a press release.

Fleck: Home-loan house of cards ready to fall

by Calculated Risk on 1/15/2007 01:05:00 AM

Bill Fleckenstein writes at MSN Money: Home-loan house of cards ready to fall

... a former top executive at a subprime lender (whose chronicling of the unwind has been amazingly accurate and timely), told me that serious issues are developing, and that large companies like New Century Financial (NEW, news, msgs), Accredited Home Lenders (LEND, news, msgs) and NovaStar Financial (NFI, news, msgs) will, in his words, "hit the wall" very soon.This is a rumor, Fleck has been bearish for some time, and he is short New Century Financial. But it is still interesting.

Sunday, January 14, 2007

Mankiw Confuses Fed Transparency and Oversight with Independence

by Calculated Risk on 1/14/2007 11:55:00 PM

Professor Mankiw reads Greg Ip at the WSJ: Fed Chairman May Face Heat At Hearings

When Federal Reserve Chairman Ben Bernanke testifies on monetary policy next month, he is likely to get far more scrutiny than usual.Mankiw asks:

By law, the Fed chairman must testify twice a year to Congress: in February and July. Ordinarily, each installment lasts two days, one before the Senate Banking Committee, the other before the House Financial Services Committee. There are no other witnesses.

In a break with that tradition, Barney Frank, the Massachusetts Democrat who took over the House panel this month, said he plans to hold an additional day of hearings in which witnesses, such as economists and labor experts, will give their views on what Mr. Bernanke said.

"After reading a story like this, one might worry that more Congressional scrutiny will translate into less Fed independence and ... worse macroeconomic outcomes."Mankiw's concern about Fed independence is a false worry. The hearings may provide more heat than light, but, as Fed President William Poole wrote in 2004: FOMC Transparency

It is natural to ask why central banks need to be transparent. One answer is that central banks are governmental agencies and as such are accountable to the public for their actions.This is called oversight. But Poole also argues that transparency leads to better results:

The roots of central bank transparency are found not only in the principles of democratic accountability but also in economic theory.Better transparency usually leads to better results, not worse.

...

Transparency should help markets to make the best possible adjustments over time and minimize uncertainty flowing from monetary policy itself.

Oversight. Transparency. Perhaps these extended hearings will not be especially productive in terms of oversight or transparency, but then they are at worst neutral in terms of macroeconomic outcomes. And these hearings are definitely not an assault on Fed independence.

Lansner Q&A with Lender

by Calculated Risk on 1/14/2007 11:27:00 AM

Excerpt from Jon Lansner at the OC Register: Insider Q&A with local lender

Lansner: What are your home-buying clients thinking? What's the popular financing for this crowd?"Strategic financing".

Aaron [local lender]: The buyers that I have consulted with lately are first time homebuyers. They are feeling a bit of a pinch, but are able to qualify using strategic financing. We structure the deal using a seller financed buy-down of the interest rate. The beauty of this is that the buyer receives a below market interest rate to help them ease into the home. Additionally, the tax write-off afforded through the pre-paid interest on the purchase loan is given to the buyer in the year the purchase closes. It doesn't matter that the seller paid for the buy-down.

Seller "buy-down" of interest rate.

Help the buyer "ease into the home".

File under phrases no one really wants to hear (at least no one associated with the housing market).

Saturday, January 13, 2007

Thornberg: "The worst is in front of us"

by Calculated Risk on 1/13/2007 01:10:00 AM

This bears repeating:

"The worst is not over. The worst is in front of us."We can debate whether or not the housing bust will significantly impact the economy, but there is no question the "worst is in front of us."

Dr. Christopher Thornberg of Beacon Economics, Jan 12, 2007

More from the Press Enterprise:

[Thornberg] warned that the housing slowdown has appeared slower and less daunting than it really is, because it takes a while for home prices to drop.

"This isn't going to hit bottom in 2007. This is going to be a mess for quite a while," he said. As a result Thornberg said construction-related jobs should feel a bigger pinch ...