by Calculated Risk on 1/22/2007 02:23:00 PM

Monday, January 22, 2007

Record Foreclosure Activity in 2007?

From the Cincinnati Enquirer: Thousands face loss of homes

For the seventh straight year, foreclosure filings hit record highs not only here but in all of Ohio and Kentucky.And from the Dallas Morning News: Foreclosure lists near 1989 record

Record foreclosures were also a national phenomenon, and Ohio, Indiana and Kentucky were at the front. Through Sept. 30, Ohio led the nation with 3.32 percent of its home loans in foreclosure, according to the Mortgage Bankers Association.

Indiana was second at 2.9 percent; Kentucky, fifth at 1.76 percent. The national average was 1.05 percent.

... the 1,940 homes in Dallas County and 1,274 Tarrant County homes threatened with foreclosure are approaching record highs, said George Roddy, president of Foreclosure Listing Service.These are the areas that saw limited price appreciation during the housing boom. In 2007, the states with the highest appreciation will probably start experiencing near record levels of foreclosure activity. In California, foreclosure activity is already in the "normal range", according to DataQuick, and early January data suggests 2007 might exceed the records set in 1996.

"This is getting serious," Mr. Roddy said. "This level is getting very close to the all-time records set in 1989, when an average of 2,000 postings were filed monthly on Dallas County residences."

Back then, it was a regional recession that caused the number of home foreclosures to spike.

This go-around it's often because of poor consumer choices, credit analysts say.

"Some of them got into more house than they can afford," said Gail Cunningham with Consumer Credit Counseling Service of Greater Dallas.

This is one of the keys to my 2007 housing forecast.

Sunday, January 21, 2007

More Trouble for Lenders

by Calculated Risk on 1/21/2007 11:47:00 AM

From the Bradenton Herald: Developer leaves Coast Bank in lurch

A developer unable to complete construction on hundreds of homes has put $110 million worth of mortgage loans in jeopardy for Bradenton-based Coast Bank.From the Arizona Republic: Valley fighting mortgage fraud wave

The management of Coast Financial Holdings Inc., parent company of Bradenton-based Coast Bank, announced Friday that it was anticipating problems with loans to 482 borrowers after a local development company said it may not have sufficient funds to complete construction on the homes.

A wave of mortgage fraud is rippling through pockets of the Valley, inflating home values through scams called cash-back deals.

Left unchecked, cash-back deals cost homeowners and lenders millions of dollars and could erode confidence and values in Arizona's real estate market.

The fraud involves obtaining a mortgage for more than a home is worth and pocketing the extra money in cash. Neighbors may then discover home values in the area are exaggerated. Homeowners stuck with overpriced mortgages may never recover the difference. And lenders end up with bad loans that, in the long run, could hurt the Arizona real estate market, the largest segment of the state economy.

While the extent of the fraud is unclear, an Arizona Republic investigation into these cash-back deals found organized groups of speculators have bought multiple homes this way, leaving whole neighborhoods with inflated values. Add to these the individual deals done by amateurs who hear others talk about the easy money they made from cash-back sales.

State investigators and real estate industry leaders want more enforcement and greater public awareness to stop the spread of cash-back deals before the damage mounts.

"Mortgage fraud in the Valley has become so prevalent people think it's a normal business practice," said Amy Swaney, a mortgage banker with Premier Financial Services and past president of the Arizona Mortgage Lenders Association.

Saturday, January 20, 2007

What would change my mind?

by Calculated Risk on 1/20/2007 04:56:00 PM

Update: When I first started this blog, I promised to try to call the next recession - as a fun exercise. I didn't think we would have a recession in '05 or '06. Now I think there is a chance, so I'm going out on a limb.

For those interested in recession predictions, here is an excellent paper on why most forecasters miss recessions: The Arcane Art of Predicting Recessions

Since I've just turned bearish on the general economy (update: this is for '07, not next week or Q1 - sorry if that was confusing), I'd like to note what would change my mind.

1) Show me several hundred thousand residential construction jobs lost, and little or no impact on the general economy.

There are many stories like this one from the San Diego Union on the local economy: With real estate sector cooling, employment stays on simmer

Construction firms shed 1,800 workers during December and real estate firms cut 500 positions, according to data released yesterday by the California Employment Development Department.

...

During 2006, construction firms in the county lost a total of 5,000 jobs, more than 5 percent of their work force. Statewide, construction firms have axed 15,300 workers, a 1.7 percent loss.

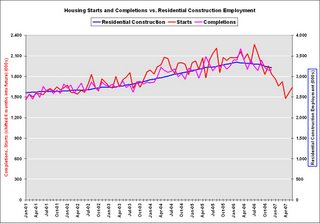

Click on graph for larger image.

Click on graph for larger image.That sounds grim, but in reality very few residential construction jobs have been lost so far. Since residential construction employment peaked in February 2006 at 3,347.4 thousand, only 133.6 thousand jobs have been lost according to the BLS, or about 4%.

Based on the current level of starts, many more jobs will be lost in the coming months (note starts are shifted 6 months into the future on graph, since completions and employment follow starts by about 6 months).

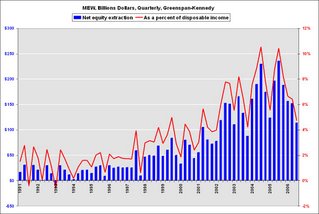

2) Show me mortgage equity withdrawal (MEW) at less than 3% of disposable personal income (DPI), with little or no impact on consumer spending.

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show "Homeowners extracted $113.5 billion ... via mortgage refinancing and other means in the third quarter, the lowest since the fourth quarter of 2003, according to new estimates by a Federal Reserve staffer and former chairman Alan Greenspan3) Show me near record foreclosure activity, with little or no impact on lenders or the general economy. I'll have more on foreclosure activity this week.

That amount ... was down from $151.8 billion in the second quarter, and the high of $235.9 billion recorded in the third quarter of last year. The latest figure equals 4.7% of households' after-tax income, compared to 10.4% in the third quarter of 2005."

I don't ask for much.

Friday, January 19, 2007

First Horizon Hurt by Mortgage Unit

by Calculated Risk on 1/19/2007 03:17:00 PM

From Reuters: First Horizon profits fall, hurt by mortgage unit

First Horizon National Corp. said on Wednesday quarterly earnings fell a steeper-than-expected 28 percent as mortgage banking revenue plunged.UPDATE from Tanta (lifted from comments):

...

First Horizon of Memphis, Tennessee said pretax income from mortgage banking slid 91 percent to $3.5 million, while revenue from mortgage banking fell 27 percent to $111.9 million.

Lordy, the whole statement's worth a read. Looks like a perfect storm:

1. The carry trade died: "Net interest income decreased 41 percent to $20.4 million in fourth quarter 2006 from $34.7 million in fourth quarter 2005. An inverted yield curve resulted in compression of the spread on the warehouse, which was 1.24 percent in fourth quarter 2006 compared to 2.06 percent for the same period in 2005. Additionally, an 18 percent decrease in the warehouse related to lower origination activity negatively impacted net interest income."

2. Gain on sale dropped: "Net origination income decreased 22 percent to $69.2 million from $89.1 million in fourth quarter 2005 as loans delivered into the secondary market decreased 21 percent to $6.3 billion."

3. Keeping the loans rather than selling them didn't help credit quality: "Provision for loan losses increased to $23.0 million in fourth quarter 2006 from $16.2 million in fourth quarter 2005. This increase primarily reflects continued growth of the commercial and construction loan portfolios and an expectation of slowing economic growth. As a result of this increase, the allowance to loans ratio has increased from 92 basis points in fourth quarter 2005 to 98 basis points in fourth quarter 2006. Nonperforming assets were $139.0 million on December 31, 2006, compared to $79.7 million on December 31, 2005. The nonperforming assets ratio related to the loan portfolio increased to 58 basis points in fourth quarter 2006 from 33 basis points last year. The nonperforming asset ratio continues to migrate from historical low levels due to maturation of the loan portfolio, issues with several commercial credits in the retail commercial bank's traditional lending markets, and deterioration in the residential real estate portfolio reflecting the slow down in the housing market. The net charge-off ratio increased to 25 basis points in fourth quarter 2006 from 22 basis points in 2005 as net charge-offs grew to $13.5 million from $11.0 million during a period of strong loan growth."

I also see they increased their portfolio of residential construction loans by 11%, and also took a $7MM loss, part of which was "the result of employee misrepresentation in our construction lending business."

On Turning Bearish

by Calculated Risk on 1/19/2007 02:12:00 PM

I've recently turned bearish on the U.S. economy. This shouldn't be confused with my longer held negative views on housing.

For housing, I'm very confident that 2007 will be worse than 2006 by every material measure: prices, sales, residential construction employment, starts, MEW, percentage of homeowner equity, and the number of foreclosures.

But the impact of the continuing housing bust on the U.S. economy is far less certain. Although I think a recession is better than a "coin flip" in '07, the odds of a soft landing are still good.

Professor Leamer identified two key missing ingredients for a recession: enough job losses, and a credit crunch (see: Is a Recession Ahead? The Models Say Yes, but the Mind Says No). These are the two issues I wrestled with over the holidays, and I couldn't come to a definitive conclusion.

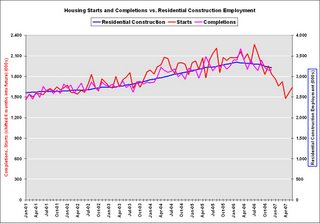

At the core, recessions are about jobs, and it is easy to imagine scenarios with job growth slowing to 100K per month, maybe even 50K per month. But that isn't a recession. Click on graph for larger image.

Click on graph for larger image.

This graph shows the average monthly job growth since 1997. In 2001, the economy lost an average of 147K jobs per month - and that was a fairly mild recession.

Over the last three years, the U.S. has added an average of 164K jobs per month. Right now, based on housing starts, it looks like residential construction employment will fall by 400K to 600K jobs by this Summer. Many of these workers will find new jobs, but it is easy to imagine job growth slowing to 100K per month. Adding in other housing related lost jobs, and some ripple effect, maybe growth will slow to 50K per month. Not enough for a recession.

So how can the U.S. economy slide into recession in '07?

Some possible sources: a credit crunch based on bad loans in the RE sector (and possibly in CRE and C&D too), less consumer spending based on falling MEW, and another downturn in the housing market. If all of these can be avoided, a recession is unlikely.

Right now I don't think these problems can be avoided.

Thursday, January 18, 2007

Pulte Homes Warns

by Calculated Risk on 1/18/2007 08:02:00 PM

Pulte Homes warns on Q4 results.

"Pulte Homes continues to navigate through a challenging operating environment, with demand for new homes during the fourth quarter still far below pre-2006 levels."Pulte had already guided earnings expectations lower. Now they are reducing their Q4 earnings estimates again:

Richard J. Dugas, Jr., President and CEO of Pulte Homes, Jan 18, 2007

The Company expects fourth quarter results to be in the range of a loss of $.05 to earnings of $.05 per diluted share from continuing operations. Pulte Homes had previously issued earnings guidance in the range of $.30 to $.70 per diluted share, guiding to the lower end of the range in its earnings conference call for the third quarter.Orders are getting worse:

The Company closed 12,566 homes during the fourth quarter of 2006, a decline of 20% from the fourth quarter of 2005. Net new orders for the quarter were 6,446 homes, a 34% decrease from last year's fourth quarter. For the full year 2006, home closings were 41,487, down 9% compared with 2005. Net new orders for the full year 2006 decreased 29% from the prior year to 33,925 homes.But the cancellation rate improved slightly:

"... [Pulte] experienced a stabilization to a slight improvement in our fourth quarter cancellation rate compared with the third quarter, as this metric showed progressive improvement throughout the period."Of course if orders fall to zero, the cancellation rate will decline to zero too. So this metric needs to be kept in context.

Impairments are much worse than expected:

On a preliminary basis, Pulte Homes anticipates that these impairments and land-related charges will be in the range of $330 million to $350 million for the fourth quarter, or $.83 to $.88 per diluted share. The Company previously issued guidance of $150 million for impairments and land-related charges.Perhaps the only good news is Pulte is reducing their production:

"[Pulte] continue[s] to reduce the number of homes we are starting, as evidenced by our meaningful reduction in speculative units under construction during the quarter."

DataQuick: 2006 California Sales Lowest Since 1996

by Calculated Risk on 1/18/2007 02:39:00 PM

DataQuick reports: California December Home Sales

Last month's sales made for the slowest December since 1996 when 33,591 homes were sold.Note that 1996 was the last year of the early '90s housing bust in California.

Click on graph for larger image.

Click on graph for larger image.A total of 41,100 new and resale houses and condos were sold statewide last month. That's up 4.8 percent from 39,200 for November and down 22.2 percent from a 52,800 for December 2005.Although some areas in California are already seeing YoY nominal price declines - like San Mateo, Sonoma, San Diego and Ventura - the median YoY price in California increased slightly.

Last month's sales made for the slowest December since 1996 when 33,591 homes were sold.

The median price paid for a home last month was $474,000. That was up 1.1 percent from November's $469,000, and up 3.5 percent from $458,000 for December a year ago.

Housing: Starts and Completions

by Calculated Risk on 1/18/2007 11:06:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits rose slightly:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,596,000. This is 5.5 percent above the revised November rate of 1,513,000, but is 24.3 percent below the December 2005 estimate of 2,107,000.Starts were up for the second straight month:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,642,000. This is 4.5 percent above the revised November estimate of 1,572,000, but is 18.0 percent below the December 2005 rate of 2,002,000.And Completions were flat, at just below the recent record levels:

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 1,900,000. This is 0.4 percent above the revised November estimate of 1,893,000, but is 2.7 percent below the December 2005 rate of 1,953,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

I'm a little surprised at the slight rebound in starts, especially since completions and inventories are still near record levels. Still Starts have fallen "off a cliff", and completions have just started to fall.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 400K to 600K residential construction employment jobs by this Summer.

Wednesday, January 17, 2007

Worth a second look ...

by Calculated Risk on 1/17/2007 05:51:00 PM

If you missed Tanta's most recent post, it is definitely worth reading (and rereading): Information is Power, Which is Why You Don’t Get Any.

Make sure you read the comments too.

I just hope she wasn't referring to me when she wrote:

"... next time I'll write something calm and polite and professional and bland and get my case jumped by the readers who are tired of calm and polite and professional and bland because that's all you ever get in the newspaper and we come to blogs for some juice."

DataQuick: Bay Area home prices flat, slow sales

by Calculated Risk on 1/17/2007 05:14:00 PM

From DataQuick: Bay Area home prices flat, slow sales

Bay Area home prices were flat last month while the sales pace was the slowest pace in a decade ...Just six months ago, DataQuick reported "indicators of market distress are still largely absent" and "foreclosure rates are coming up from last year's low point, but are still below normal levels". Now foreclosures are in the "normal range", and from the information I'm receiving, foreclosures will be significantly above normal shortly.

A total of 7,488 new and resale houses and condos sold in the Bay Area last month. That was up 3.9 percent from 7,204 in November, and down 19.9 percent from 9,347 for December last year, according to DataQuick Information Systems.

Sales have declined on a year-over-year basis the last 21 months. Last month's sales count was the lowest for any December since 1996 when 7,180 homes were sold. The average for all Decembers since 1988 is 8,339.

...

The median price paid for a Bay Area home was $612,000 in December. That was down 0.6 percent from $616,000 in November and up 0.5 percent from $609,000 for December a year ago. The median peaked last June at $644,000.

...

Indicators of market distress are still in the normal range. Financing with adjustable-rate mortgages is flat. Foreclosure activity is rising but is still in the normal range. Down payment sizes are stable. Flipping rates and non-owner occupied buying activity are down, DataQuick reported.