by Calculated Risk on 1/31/2007 09:59:00 AM

Wednesday, January 31, 2007

MBA: Mortgage Applications Increase

The Mortgage Bankers Association (MBA) reports: Refinance and Purchase Applications Both Increase

Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 631.3, an increase of 3.2 percent on a seasonally adjusted basis from 611.3 one week earlier. On an unadjusted basis, the Index increased 5.9 percent compared with the previous week and was up 0.7 percent compared with the same week one year earlier.Mortgage rates were mixed:

The Refinance Index increased by 4.9 percent to 1940.2 from 1848.8 the previous week and the seasonally adjusted Purchase Index increased by 1.3 percent to 408.0 from 402.7 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.29 from 6.22 percent ...

The average contract interest rate for one-year ARMs decreased to 5.86 percent from 5.91 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.1 percent to 430.8 from 430.5 for the Purchase Index.

The refinance share of mortgage activity decreased slightly to 47.4 percent of total applications from 47.8 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 21.4 from 20.3 percent of total applications from the previous week.

Forbes: The Adventurer (Part II)

by Calculated Risk on 1/31/2007 01:38:00 AM

Jim Clash interviews Sasha (part II)

Part I was here.

Tuesday, January 30, 2007

JPMorgan CEO: Recession Signs

by Calculated Risk on 1/30/2007 06:43:00 PM

From MarketWatch: Dimon sees a sign of recession

Rising defaults in some of the riskiest home loans offered by J.P. Morgan Chase & Co. signal a recession may be looming, Jamie Dimon, the bank's chief executive said Tuesday.Did someone just say "credit crunch"?

Dimon, speaking at Citigroup's annual financial services conference, said high-risk loans - as measured by credit scores and loan-to-value ratios of 90% or more -- make up 2% of the bank's home equity portfolio, Dimon said according to a live webcast.

He also said defaults are rising at J.P. Morgan "a little bit," adding, "home equity is subject to deterioration" from a recession, but that the bank is well positioned to sustain a downturn in the economy. The bank has largely exited the subprime lending area.

Give Bernanke Credit

by Calculated Risk on 1/30/2007 04:28:00 PM

"We've never had a decline in housing prices on a nationwide basis. What I think is more likely is that house prices will slow, maybe stabilize ... I don't think it's going to drive the economy too far from its full-employment path, though."From the AP: Thumbs Up for Bernanke on First Year

Dr. Bernanke, July 29, 2005

The economy tested Federal Reserve Chairman Ben Bernanke during his first year on the job. A sinking housing market and a troubled auto industry threatened to short-circuit economic activity. Gyrating energy prices threatened as well.Although I've disagreed with Bernanke at times, I think he deserves credit so far. I included the above quote as a point of disagreement - I expect we will see housing prices decline on a nationwide basis in 2007.

By most accounts, the Fed chairman passed.

I'd also argue that Bernanke hasn't been tested yet. From Stephen Roach in late 2005:

"Alan Greenspan faced a stock-market crash two months after he took over in August 1987. Paul Volcker had to cope with a rout in the bond market three months after he became chairman in August 1979. G. William Miller was challenged immediately by a dollar crisis in the spring of 1978. For Arthur Burns, it was the inflation bogie in the early 1970s."So far Bernanke hasn't faced anything like the challenges of his predecessors, but I do feel a little vindicated for supporting his nomination.

Monday, January 29, 2007

Record Homeowner Vacancy Rate

by Calculated Risk on 1/29/2007 05:02:00 PM

The Census Bureau reports the Homeowner Vacancy Rate was a record 2.7% in Q4 2006. Click on graph for larger image.

Click on graph for larger image.

This graph shows the recent surge in the homeowner vacancy rate. This is further evidence of the significant supply overhang in the housing market.

Fannie Mae economist David Berson has estimated the overhang at 600K units. This data from the Census Bureau suggests the overhang may be closer to my estimate of 1.1 to 1.4 million units.

Update: For a 50 year chart see: Empty homes everywhere

Sunday, January 28, 2007

OC Register on Subprime Lenders

by Calculated Risk on 1/28/2007 06:24:00 PM

From the OC Register: Subprime's grip slips

Many of Orange County's boldest lenders are struggling to stay in the black – and in some cases to stay in business – as their customers miss mortgage payments in record numbers.The article has this great quote:

...

Sluggish home prices, rising interest rates and lax underwriting spurred defaults on subprime loans made just last year to the highest level in six years. Perhaps most troubling, loans made by Orange County companies in 2006 were among the quickest to see defaults, data show.

And many of those subprime companies – which tend to cluster here in Orange County – are in trouble.

...

UBS Investment Bank ... found subprime loans made in 2006 are on track to be the worst-performing loans ever issued.

...

So what went wrong, exactly?

Lenders made two mistakes, according to UBS and other analysts. They didn't scrutinize borrowers' incomes, and they allowed subprime borrowers, who by definition have had past problems with their credit, to take on lots of risk.

...

Borrowers gambled on rising home prices to bail them out of trouble, analysts said. Consumers thought home prices would keep climbing, which would enable them to sell or refinance if they got into a jam, analysts said.

"[Borrowers] lost the motivation or incentive to send in the checks."This sounds like a quote from "Office Space":

David Liu, director of UBS' mortgage strategy group, Jan 28, 2007

PETER: I, uh, I don't like my job. I don't think I'm gonna go anymore.

JOANNA: You're just not gonna go?

PETER: Yeah.

JOANNA: Won't you get fired?

PETER: I don't know. But I really don't like it so I'm not gonna go.

JOANNA (LAUGHS) SO YOU'RE GONNA QUIT?

PETER: No, no, not really. I'm just gonna stop going.

JOANNA: When did you decide all that?

PETER: About a week ago.

JOANNA: Really?

PETER: Oh, yeah.

JOANNA: Ok. So, so you're gonna get another job?

PETER: I don't think I 'd like another job.

JOANNA (LAUGHS): SO WHAT ARE YOU GOING TO DO ABOUT MONEY AND BILLS?

PETER: Y'know, I never really liked paying bills. I don't think I'll do that either.

Saturday, January 27, 2007

On Blogging

by Calculated Risk on 1/27/2007 12:24:00 PM

This is my first post with the new blogger. I'd like to take this moment to offer some thoughts on my blogging experience:

I started blogging just to share a few thoughts with my friends. To my surprise, more and more people have been reading this blog - and happily I've made several new internet friends. That was unexpected and has been very rewarding for me.

The downside to more readers is I'm not able to answer all the questions in the comments or sent to me in emails. I appreciate all the emails and information I receive, and please accept my apology if I miss your question or I'm slow to respond to your email. I also receive many other inquiries or requests: interviews, link exchanges, offers for sponsorship, etc.

Given all these requests, I'd like to make this clear: this is a personal blog, I've made no effort to market this blog, I haven't accepted advertising or sponsorships, and I'm not looking for any publicity for myself or for this blog. I have no current plans to change my approach.

Perhaps readers have a sense of my personalty from this blog. One of the highlights for me was Don Luskin complaining I was "too polite"! I'm also happy to correct any mistakes I make, and point out when I've been wrong. These traits have served me well in real life.

I believe the one major misperception is that I'm all doom and gloom. Readers have frequently expressed surprise, in the comments, and occasionally via email, at my positive long term outlook. This reaction is probably understandable since most of my posts have a bearish economic tone.

At the time I started writing this blog, I was becoming increasingly concerned about the apparent excessive speculation in the housing market. I was also concerned that the inevitable housing correction might have a negative impact on the U.S. economy. Add in my very negative views of the current U.S. administration, and naturally my posts have had a cautious tone.

I've discovered there is quite an industry of publications catering to people's fears. My negative posts have led to several offers to write for these doom and gloom websites and magazines. That isn't me, and I've declined all these offers. I'm looking forward to being positive in my posts - maybe I'll get offers from Wall Street then!

That is all for now. My best to everyone, and hopefully the new blogger will work well.

Friday, January 26, 2007

More on December New Home Sales

by Calculated Risk on 1/26/2007 06:08:00 PM

Please see the earlier post: December New Home Sales

2006 is the 4th best year for New Home Sales behind 2003.

| New Home Sales | |

| Year | Sales |

| 2000 | 877,000 |

| 2001 | 909,000 |

| 2002 | 972,000 |

| 2003 | 1,088,000 |

| 2004 | 1,203,000 |

| 2005 | 1,283,000 |

| 2006 | 1,063,000 |

Click on graph for larger image.

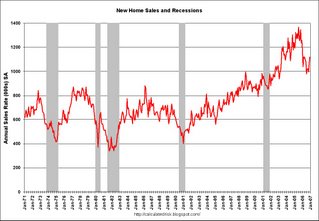

Click on graph for larger image.One of the most reliable economic leading indicators is New Home Sales.

New Home sales were falling prior to every recession of the last 35 years, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

Some more optimistic observers will argue that sales have fallen back to a sustainable level after the excesses of 2004 and 2005. Others will argue that sales have to fall more in coming years, to make up for the excesses of recent years. That is one of the reasons 2007 will be such an interesting year.

The second graph shows monthly Not Seasonally Adjusted (NSA) New Home sales. This provides a different prospective of the housing bust.

This shows why the Spring selling season is so important in 2007. Will sales recover? Or will Spring 2007 look like 1982 or 1991 when Spring sales were disappointing.

NY Times: Tremors at the Door

by Calculated Risk on 1/26/2007 10:36:00 AM

“The market is paying me to do a no-income-verification loan more than it is paying me to do the full documentation loans. What would you do?”From the NY Times: Tremors at the Door

William D. Dallas, the chief executive of Ownit Mortgage Solutions, Jan 26, 2007

Wall Street’s big bet on risky mortgages may be souring a lot faster than had been previously thought.

...

The grim statistics ... also indicate that mortgage lenders became more generous last year, giving 100 percent financing and allowing borrowers to state their incomes with little or no documentation in an effort to bolster volume, according to industry experts.

Banking regulators have increasingly voiced concerns about the loosening of lending practices by subprime lenders. Late last year some demanded that applicants be more closely vetted before being qualified for adjustable-rate and other risky loans.

Yet, housing advocates and industry experts say policy makers are also worried that too sharp a pullback in lending by Wall Street and commercial banks could cut off consumer access to credit.

December New Home Sales: 1.12 Million SAAR

by Calculated Risk on 1/26/2007 10:09:00 AM

According to the Census Bureau report, New Home Sales in December were at a seasonally adjusted annual rate of 1.12 million. Sales for November were revised up to 1.069 million, from 1.047 million. Numbers for September and October were revised downwards.

Click on Graph for larger image.

Sales of new one-family houses in December 2006 were at a seasonally adjusted annual rate of 1,120,000... This is 4.8 percent above the revised November rate of 1,069,000, but is 11.0 percent below the December 2005 estimate of 1,259,000.

The Not Seasonally Adjusted monthly rate was 76,000 New Homes sold. There were 87,000 New Homes sold in December 2005.

On a year over year NSA basis, December 2006 sales were 12.6% lower than December 2005. Also, December '06 sales were below December 2004 (83,000).

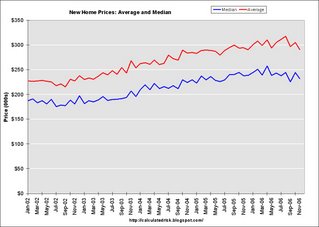

The median and average sales prices were mixed. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in December 2006 was $235,000; the average sales price was $290,100.

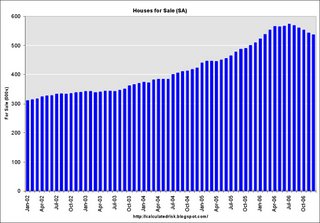

The seasonally adjusted estimate of new houses for sale at the end of December was 537,000.

The 537,000 units of inventory is slightly below the levels of the last six months. Inventory numbers from the Census Bureau do not include cancellations - and cancellations are at record levels. Actual New Home inventories are much higher - some estimate about 20% higher.

This represents a supply of 5.9 months at the current sales rate.

More later today on New Home Sales.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |