by Calculated Risk on 2/15/2007 02:27:00 PM

Thursday, February 15, 2007

Builder Confidence Improves in February

Click on graph for larger image.

Click on graph for larger image.

The National Association of Home Builders/Wells Fargo Housing Market Index (HMI)increased from 35 in January to 40 in February, its highest level since June of 2006.

Here is the NAHB press release.

WSJ: Mortgage Hot Potatoes

by Calculated Risk on 2/15/2007 11:12:00 AM

From the WSJ: Mortgage Hot Potatoes. Excerpts:

Efforts by major banks and Wall Street firms to unload bad U.S. housing loans are speeding up a shakeout in the subprime mortgage industry.

As more Americans fall behind on mortgage payments, Merrill Lynch & Co., J.P. Morgan Chase & Co., HSBC Holdings PLC and others are trying to force mortgage originators to buy back the same high-risk, high-return loans that the big banks eagerly bought in 2005 and 2006.

Wednesday, February 14, 2007

Q4 GDP to be Revised Down

by Calculated Risk on 2/14/2007 08:09:00 PM

Rex Nutting at MarketWatch reports: Big downward revision to GDP coming

The U.S. economy was growing much slower in the fourth quarter of 2006 than the government's first estimate of 3.4%, economists say.This has been discussed at MacroBlog, The Big Picture and by Nouriel Roubini.

Instead of fairly robust 3.4% annualized growth, the government's next estimate will probably be closer to 2.2%, according to median forecast of economists surveyed by MarketWatch. Instead of bouncing back, the economy would have turned in its third quarter in a row of below-trend growth.

The first quarter also looks fairly tepid, with weak retail sales, falling homebuilding and growing signs that business investment isn't picking up the slack.

2007 Update

by Calculated Risk on 2/14/2007 05:03:00 PM

For some time I've felt the first half of 2007 was when we would start to see significant spillover effects from the housing bust into the general economy. I suggested we would see:

1) Several hundred thousand residential construction jobs lost.

Rex Nutting at MarketWatch wrote: Many layoffs coming in housing, economists say

The home-building industry collapsed in 2006, but surprisingly few workers lost their jobs, revised government data show. That could change this year, economists said.

Between December 2005 and December 2006, the number of building permits for new homes plunged 23.5%, while spending on residential construction projects fell by 12.4%. But over that time, employment in residential construction fell by just 1.4% from 3.38 million to 3.34 million. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows residential construction employment vs. completions and starts (Starts are shifted 6 months into the future). Part of my Housing 2007 forecast concerned the loss of 400K to 600K residential construction jobs over the first 6 months of 2007.

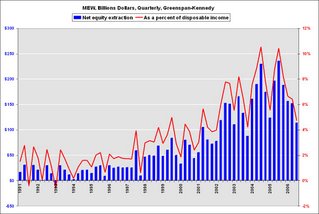

2) A significant decline in Mortgage Equity Withdrawal (MEW), and a negative impact on consumer spending.

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show "Homeowners extracted $113.5 billion ... via mortgage refinancing and other means in the third quarter, the lowest since the fourth quarter of 2003, according to new estimates by a Federal Reserve staffer and former chairman Alan Greenspan3) Rising defaults with an impact on lenders.

That amount ... was down from $151.8 billion in the second quarter, and the high of $235.9 billion recorded in the third quarter of last year. The latest figure equals 4.7% of households' after-tax income, compared to 10.4% in the third quarter of 2005."

"We're in the midst of an adjusting market right now, and we won't know until spring or summer if this [foreclosure activity] is ominous or not,"

Marshall Prentice, DataQuick president, Jan 24, 2007

Click on graph for larger image.

Click on graph for larger image.This graph shows Notices of Default (NOD) by year in California since 1992.

2006 had the highest number of NODs since 1998. And it now appears 2007 will see record or near record NODs.

It is now six weeks into 2007, and I think we can agree that there has already been a significant impact on mortgage lenders. We are still waiting for the other two shoes to drop ...

Accredited Home stops making riskier loans

by Calculated Risk on 2/14/2007 03:18:00 PM

From MarketWatch (hat tip: REBear): Accredited Home stops making riskier loans

Accredited Home Lenders said on Wednesday that it has stopped making some riskier types of loans as the market for low-end mortgages showed signs of a mini credit crunch.Hey, there it is ... "mini credit crunch". I was wondering when that phrase would appear in a story.

"In response to what we were hearing from the whole loan buyers, we began making adjustments to products with high combined loan-to-value ratios, products with low credit scores and products with less than full income documentation," Joseph Lydon, chief operating officer of Accredited, said during a conference call with analysts on Wednesday.

Accredited eliminated stated income loans with higher combined loan-to-value ratios (CLTVs) to borrowers with FICO credit scores of less than 640, Lydon explained. ...

The company also curtailed first-time homebuyer programs and dramatically reduced combo loan products, helping to significantly cut back second mortgage loans, he added.

DataQuick: SoCal Slowest January since 1998, stable prices

by Calculated Risk on 2/14/2007 02:45:00 PM

DataQuick reports: Southland home sales: Slowest January since 1998, stable prices

Southern California home buyers and sellers continued to eye each other without doing much last month, resulting in the slowest January in nine years, a real estate information service reported.

A total of 18,128 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 25.1 percent from a revised 24,209 for December, and down 17.2 percent from a revised 21,895 for January last year, according to DataQuick Information Systems.

A sales decline from December to January is normal for the season. The year-over-year decline was the most moderate since sales fell 14.8 percent last May. Last month's sales count was the lowest for any January since 1998 when 17,692 homes sold. Since 1988 the average January has had 18,610 sales.

...

The median price paid for a Southern California home was $485,000 last month, down 1.0 percent from a revised $490,000 for December, and up 5.0 percent from a revised $462,000 for January last year. The overall median always declines from December to January because of changes in market mix. December's median matched the peak reached last June.

Bernanke on Housing

by Calculated Risk on 2/14/2007 11:37:00 AM

The risks to this outlook are significant. To the downside, the ultimate extent of the housing market correction is difficult to forecast and may prove greater than we anticipate. Similarly, spillover effects from developments in the housing market onto consumer spending and employment in housing-related industries may be more pronounced than expected.From Bernanke's Semiannual Monetary Policy Report to the Congress:

Chairman Bernanke, Feb 14, 2007

"By the middle of 2006, monthly sales of new and existing homes were about 15 percent lower than a year earlier, and the previously rapid rate of house-price appreciation had slowed markedly. The fall in housing demand in turn prompted a sharp slowing in the pace of construction of new homes. Even so, the backlog of unsold homes rose from about four-and-a-half months' supply in 2005 to nearly seven months' supply by the third quarter of last year. Single-family housing starts have dropped more than 30 percent since the beginning of last year, and employment growth in the construction sector has slowed substantially.

Some tentative signs of stabilization have recently appeared in the housing market: New and existing home sales have flattened out in recent months, mortgage applications have picked up, and some surveys find that homebuyers' sentiment has improved. However, even if housing demand falls no further, weakness in residential investment is likely to continue to weigh on economic growth over the next few quarters as homebuilders seek to reduce their inventories of unsold homes to more-comfortable levels.

Despite the ongoing adjustments in the housing sector, overall economic prospects for households remain good. Household finances appear generally solid, and delinquency rates on most types of consumer loans and residential mortgages remain low. The exception is subprime mortgages with variable interest rates, for which delinquency rates have increased appreciably."

MBA: Mortgage Applications Increase

by Calculated Risk on 2/14/2007 10:43:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Increase (Purchase Applications Decrease)  Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 639.8, an increase of 1.5 percent on a seasonally adjusted basis from 630.1 one week earlier. On an unadjusted basis, the Index increased 4.5 percent compared with the previous week and was up 10.9 percent compared with the same week one year earlier.Mortgage rates were mixed:

The Refinance Index increased 4.5 percent to 2031.7 from 1943.4 the previous week and the seasonally adjusted Purchase Index decreased 1 percent to 400.7 from 404.7 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.24 percent from 6.23 percent ...

The average contract interest rate for one-year ARMs decreased to 5.8 from 5.84 percent ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is down 2.4 percent to 404 from 413.8 for the Purchase Index.

The refinance share of mortgage activity remained unchanged at 46.1 percent of total applications. The adjustable-rate mortgage (ARM) share of activity decreased to 21.2 from 22.3 percent of total applications from the previous week.

Tuesday, February 13, 2007

Home Mortgages and the Trade Deficit

by Calculated Risk on 2/13/2007 03:00:00 PM

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."The Census Bureau reported "today that total December exports of $125.5 billion and imports of $186.7 billion resulted in a goods and services deficit of $61.2 billion."

Alan Greenspan, Feb, 2005

Click on graph for larger image.

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

Looking at the trade balance, excluding petroleum products, the deficit has been fairly stable since the second half of 2005.

Brad Setser reviews the 2006 trade data and points out several key stories:

The first is that US exports grew quite strongly in 2006. ... The second is that the pace of non-oil import growth slowed. ... The third is that higher oil prices do lead even the US to cut back on its use of oil. ... The fourth big story -- one that is somewhat controversial for reasons that elude me -- is that exchange rate adjustment works.Another possible key story is the relationship between the trade deficit and mortgage debt. As Greenspan noted, "correlation is not causation", but it is possible that a slowdown in the U.S. housing market has also led to a reverse in the U.S. trade deficit. This could have significant implications going forward.

Perhaps we have seen a Virtuous Cycle as depicted in the following diagram:

Starting from the top: There is no question that lower interest rates led to an increase in housing prices. And those higher housing prices led to an ever increasing equity withdrawal by homeowners - until very recently (See Kennedy-Greenspan MEW graph). Based on research by Greespan, it appears a large percentage of this equity withdrawal has flowed to consumption (maybe 50%), increasing both GDP and imports over the last few years. Then, to finance the current account deficit, foreign Central Banks (CBs) have been investing heavily in dollar denominated securities. Some analysts have suggested that these investments have lowered interest rates by between 40 bps and 200 bps.

Starting from the top: There is no question that lower interest rates led to an increase in housing prices. And those higher housing prices led to an ever increasing equity withdrawal by homeowners - until very recently (See Kennedy-Greenspan MEW graph). Based on research by Greespan, it appears a large percentage of this equity withdrawal has flowed to consumption (maybe 50%), increasing both GDP and imports over the last few years. Then, to finance the current account deficit, foreign Central Banks (CBs) have been investing heavily in dollar denominated securities. Some analysts have suggested that these investments have lowered interest rates by between 40 bps and 200 bps. The result: a Virtuous Cycle with higher housing prices leading to more borrowing and more consumption, leading to lower interest rates, followed by higher housing prices.

The following diagram depicts the possible unwinding of the current cycle.

As housing cools down (prices do not need to collapse), this will lead to lower equity withdrawal. In turn this will lead to a slow down in GDP growth and lower imports.

Lower imports might lead to a lower trade deficit, depending on the strength of exports. This could lead to less foreign CB investment in dollar denominated assets. And this could lead to higher interest rates followed by lower housing prices and the cycle repeats.

This is why I'm predicting a decline in the trade deficit, and an increase in long rates.

Dr. Setser doesn't see the trade deficit decreasing in 2007.

"Here though I am a bit of a holdout. I am not convinced that it makes sense to project out current trends -- at least not the current y/y growth rates.Of course I'm looking at the trade deficit from a housing centric view, and I realize that view might be too narrow.

The monthly trends seem to me to suggest a slowdown in the pace of export growth (look at the first graph in the BEA data release). Conversely, there are some tenative signs that non-oil import growth is picking up a bit (December imports were $134b, up from $131-132b in October/ November). My personal view is that the trade deficit is more likely to stabilize at roughly its current level than to shrink."

"It happened overnight."

by Calculated Risk on 2/13/2007 11:45:00 AM

"When you throw out the words 'foreclosure,' 'short sale,' 'repo,' the buyer thinks it's a deal. It's still very early, but I'm convinced that's where the market is going."David Streitfeld writes in the LA Times on Inland Empire housing: It's their default position

Home Center President Jason Bosch

During the four-year boom that ended last summer, Home Center expanded from 15 agents to 80 in three offices. The roster of agents has since sunk to 52, only about half of whom are active.There are some amazing quotes in the article:

"The rest are looking for side jobs at McDonald's," said Home Center President Jason Bosch. "It happened overnight."

"To make a living, you had to push a product you didn't believe in," said Aimee Quigley, a Home Center mortgage broker. "It was like being a defense attorney where you know your client did it, but you have to say he didn't."

Quigley says she tried to emphasize how quickly these loans would adjust, causing payments to balloon, but the message rarely got through.

"Nine out of ten times when these loans closed, we would sit there and say, 'How long can they hold it together?'"