by Calculated Risk on 2/17/2007 02:59:00 PM

Saturday, February 17, 2007

Subprime: The impact on Existing Home Sales in 2007

What will be the impact of tighter lending standards in the subprime mortgage market on existing home sales? First, some numbers ...

UPDATE: Here is a graph from immobilienblasen (via mish):

This graph is from Inside Mortgage Finance and shows the subprime share of the mortgage market near or over 20% for each of the last 3 years.

Original Post:

From America’s Second Housing Boom (hat tip: Blackstone):

By 2005, subprime originations had risen to $625 billion, now up to 20 percent of total originations and 7 percent of the total outstanding mortgage stock.

This is 2005 data, and other sources (and here) suggest non-prime (subprime and Alt-A) mortgage lending was about one third of all originations in 2005 and 2006.

Nonprime originations were 33% of market in 2005, up from 11% in 2003And, according to this note perhaps 25% of subprime borrowers will be unable to obtain loans in 2007:

Merrill researcher Kamal Abdullah raised the specter of a subprime "contagion" that could lead to the inability of the "bottom" 25% of all subprime borrowers to get loans.So if one fourth of potential subprime borrowers are unable to purchase homes in 2007, as compared to 2005 and 2006, then 25% of 20%, equals 5% of the total market. In 2006, there were 6.48 million existing homes sold, so 5% would be just over 300K homes.

But it's worse: The housing market is a sequence of chained reactions (just ask any agent or broker). If 300K buyers are excluded, the number of fewer houses sold in 2007, compared to 2006, is some multiple of that number. So this will probably have a significant impact on sales in 2007.

How far will sales fall?

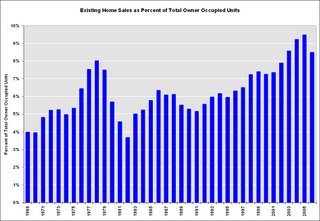

Click on graph for larger image.

Click on graph for larger image.This graph shows sales normalized by the number of owner occupied units. This shows the extraordinary level of sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.

Some of the sales were for investment and second homes, but normalizing by owner occupied units probably provides a good estimate of normal turnover. If sales fell back to 6% that would about 4.6 million units. If sales fell back to the level of 1998 to 2001 (7.3% of total owner occupied units sold) that would be about 5.6 million units in 2007.

Fannie Mae is projecting existing home sales will fall to 5.925 million units in '07. My guess is existing home sales will "surprise" to the downside, perhaps in the 5.6 to 5.8 million unit range.

Friday, February 16, 2007

Warehouse Lender Acting "Irrationally"

by Calculated Risk on 2/16/2007 04:23:00 PM

From MarketWatch: Merrill, J.P. Morgan pull back in credit crunch at low-end of mortgage market. This article is mostly a summary of recent events:

A credit crunch in the market for low-end mortgages has left companies specializing in these subprime loans at the mercy of big banks like Merrill Lynch & Co. and J.P. Morgan Chase.But this is interesting:

...

Warehouse lenders have started worrying about the quality of subprime loans that have been originated in recent years. Some are now asking subprime specialists for bigger haircuts, putting the originators in financial peril and forcing some into bankruptcy.

"Warehouse lenders are the lifelines for a lot of these subprime originators because they don't have the financial capacity to fund these loans by themselves," Ernie Napier, head of the specialty finance team at rating agency Standard & Poor's, said. "To the extent that these warehouse lenders go away, the whole process starts to unravel."

"We have eight different warehouse lenders; I would say the majority of them are acting very rationally," [Stuart Marvin, executive vice president, Accredited Home Lenders] said. "There is one that is acting somewhat irrationally, although I won't mention them by name. We have migrated the fundings away from that warehouse lender to one of the other seven until they begin to act more rationally again."Someone is acting "irrationally"? Maybe someone has taken some huge losses. Or maybe, in Mr. Marvin's view, the seven other warehouse lenders will start acting "irrationally" soon.

Industry publication National Mortgage News said this week that Merrill Lynch has been making margins calls. A Merrill spokesman declined to comment.

Wells Fargo and Subprime Loans

by Calculated Risk on 2/16/2007 02:48:00 PM

From Credit Suisse Financial Services Forum, "[Banks are] Bracing for a challenging year of EPS growth due to tepid net interest income growth and rising credit losses..." and Wells Fargo President and Chief Operating Officer John Stumpf amde it clear that "roughly 72% of the mortgage originations attributed to Wells Fargo Financial in the league tables for the 1H06 were co-issue originations."

Housing Starts and Completions

by Calculated Risk on 2/16/2007 09:11:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits declined:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,568,000. This is 2.8 percent below the revised December rate of 1,613,000 and is 28.6 percent below the January 2006 estimate of 2,195,000.Starts declined significantly:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,408,000. This is 14.3 percent below the revised December estimate of 1,643,000 and is 37.8 percent below the January 2006 rate of 2,265,000.And Completions declined slightly and are just 8% below the level of last January:

Privately-owned housing completions in January were at a seasonally adjusted annual rate of 1,880,000. This is 1.2 percentbelow the revised December estimate of 1,902,000 and is 8.0 percent below the January 2006 rate of 2,044,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

Starts are now at the lowest level since Aug 1997. Completions are still just 8% below one year ago, and are at about the same level as early 2005.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 400K to 600K residential construction employment jobs by this Summer.

Thursday, February 15, 2007

CNNMoney: Record home price slump

by Calculated Risk on 2/15/2007 07:12:00 PM

From CNNMoney: Record home price slump

The slump in home prices was both deeper and more widespread than ever in the fourth quarter, according to a trade group report Thursday.Here is the NAR report: Fourth Quarter Metro Home Prices & State Sales Likely Have Hit Bottom

Prices slumped 2.7 percent in the fourth quarter compared to the fourth quarter a year earlier, according to the report from the National Association of Realtors (NAR). That's the biggest year-over-year drop on record and follows a 1.0 percent year-over-year decline in the third quarter.

I mostly use the OFHEO House Price Index, not the NAR data. OFHEO will release Q4 data on March 1st.

DataQuick: Bay Area Prices Fall, Slowest Sales Since 1996

by Calculated Risk on 2/15/2007 05:49:00 PM

DataQuick reports: Bay Area home prices edge down, slowest sales in eleven years

Home sales in the Bay Area fell for the 24th month in a row in January as prices slipped to their lowest level in a year and a half, a real estate information service reported.

A total of 6,168 new and resale houses and condos sold in the nine- county Bay Area last month. That was down 26.3 percent from a revised 8,372 in December, and down 4.1 percent from a revised 6,434 for January last year, according to DataQuick Information Systems.

A decline from December to January is normal for the season. Sales last month were the lowest for any January since 1996 when 5,504 homes were sold. The average January since 1988 has had 6,455 sales. Last month's year-over-year decline was the most moderate since March 2005 when sales fell 2.7 percent. Year-over-year sales declines peaked last July at 32.4 percent.

...

The median price paid for a Bay area home was a revised $601,000 last month, down 2.8 percent from a revised $618,000 for December, and down 1.5 percent from a revised $610,000 for January last year. Year-over-year price changes have been negative three of the last four months, ending a 57-month rise that started in December 2001. Last month's median was the lowest since $597,000 in May 2005.

S&P to Warn Earlier

by Calculated Risk on 2/15/2007 04:05:00 PM

From Bloomberg: Subprime Mortgage Bondholders to Get Earlier Warnings From S&P

Standard & Poor's said it will no longer wait for homes to be foreclosed and sold for losses before alerting investors in mortgage-backed securities that it expects to lower ratings on their bonds.And it's not just subprime:

The ratings company will now consider issuing downgrade warnings based on the amount of loans that are delinquent, in foreclosure proceedings or already backed by seized property, Robert B. Pollsen, an analyst at the firm, said on a conference

call today.

...

``It is a watershed event'' because it means S&P is now actively considering downgrading bonds within their first year and has a new program to address high levels of early delinquencies, said Daniel Nigro, an asset-backed securities portfolio manager in New York at Dynamic Credit Partners ...

One of the bonds S&P warned about yesterday was backed by Alt A -- often called ``near prime'' -- mortgages, the firm's first warning about that type of security sold last year.S&P also expressed concerns about home equity loans.

...

``In terms of performance, I'd say there are equal concerns'' about Alt A loans and subprime loans at S&P based on early delinquencies, [Ernestine Warner, an S&P analyst] said. The Alt A bond that S&P warned about was issued by Calabassas, California-based Countrywide Financial Corp., the country's top mortgage lender.

Builder Confidence Improves in February

by Calculated Risk on 2/15/2007 02:27:00 PM

Click on graph for larger image.

Click on graph for larger image.

The National Association of Home Builders/Wells Fargo Housing Market Index (HMI)increased from 35 in January to 40 in February, its highest level since June of 2006.

Here is the NAHB press release.

WSJ: Mortgage Hot Potatoes

by Calculated Risk on 2/15/2007 11:12:00 AM

From the WSJ: Mortgage Hot Potatoes. Excerpts:

Efforts by major banks and Wall Street firms to unload bad U.S. housing loans are speeding up a shakeout in the subprime mortgage industry.

As more Americans fall behind on mortgage payments, Merrill Lynch & Co., J.P. Morgan Chase & Co., HSBC Holdings PLC and others are trying to force mortgage originators to buy back the same high-risk, high-return loans that the big banks eagerly bought in 2005 and 2006.

Wednesday, February 14, 2007

Q4 GDP to be Revised Down

by Calculated Risk on 2/14/2007 08:09:00 PM

Rex Nutting at MarketWatch reports: Big downward revision to GDP coming

The U.S. economy was growing much slower in the fourth quarter of 2006 than the government's first estimate of 3.4%, economists say.This has been discussed at MacroBlog, The Big Picture and by Nouriel Roubini.

Instead of fairly robust 3.4% annualized growth, the government's next estimate will probably be closer to 2.2%, according to median forecast of economists surveyed by MarketWatch. Instead of bouncing back, the economy would have turned in its third quarter in a row of below-trend growth.

The first quarter also looks fairly tepid, with weak retail sales, falling homebuilding and growing signs that business investment isn't picking up the slack.