by Calculated Risk on 3/16/2007 09:52:00 PM

Friday, March 16, 2007

Roach: The Great Unraveling

"Sub-prime is today’s dot-com – the pin that pricks a much larger bubble."Stephen Roach writes: The Great Unraveling

Stephen S. Roach, Managing Director and Chief Economist of Morgan Stanley, Mar 16, 2007

Sub-prime is today’s dot-com – the pin that pricks a much larger bubble. Seven years ago, the optimists argued that equities as a broad asset class were in reasonably good shape – that any excesses were concentrated in about 350 of the so-called Internet pure-plays that collectively accounted for only about 6% of the total capitalization of the US equity market at year-end 1999. That view turned out to be dead wrong.

...

This time, it’s the US housing bubble that has burst, and the immediate repercussions have been concentrated in a relatively small segment of that market – sub-prime mortgage debt, which makes up around 10% of total securitized home debt outstanding. As was the case seven years ago, I suspect that a powerful dynamic has now been set in motion by a small mispriced portion of a major asset class that will have surprisingly broad macro consequences for the US economy as a whole.

Too much attention is being focused on the narrow story ... To me, the real debate is about “spillovers” – whether the housing downturn will spread to the rest of the economy.

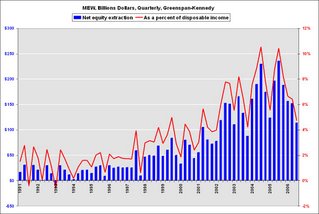

Click on graph for larger image.

Click on graph for larger image.This is a graph of the Greenspan-Kennedy MEW results through Q3

... the US economy is now flirting with ... sub-2% GDP trajectory – while consumer demand remains brisk, a pullback in personal consumption could well be the proverbial straw that breaks this camel’s back. The case for a consumer spillover is compelling, in my view. ... the asset-dependent mindset of the American consumer, debt and debt service obligations have surged to all-time highs ... Equity extraction from rapidly rising residential property values has squared this circle – more than tripling as a share of disposable personal income from 2.5% in 2002 to 8.5% at its peak in 2005. The bursting of the housing bubble has all but eliminated that important prop to US consumer demand. The equity-extraction effect is now going the other way ... that puts the income-short, saving-short, overly-indebted American consumer now very much at risk – bringing into play the biggest spillover of them all for an asset-dependent US economy. February’s surprisingly weak retail sales report – notwithstanding ever-present weather-related distortions – may well be a hint of what lies ahead.

Retail Sales and Q1 GDP

by Calculated Risk on 3/16/2007 04:40:00 PM

Update: for a review of inflation, see Macroblog: The Inflation Report: Just Not Getting Better

With the release of the inflation report this morning, we can start to estimate the real growth of consumer spending on goods (durable and nondurable) in Q1, and the contribution of retail spending to Q1 real GDP growth. This estimate is based on data for the first two months of the quarter, and could change significantly with the March data. Click on graph for larger image.

Click on graph for larger image.

This first graph shows the YoY change in nominal retail sales (from the Census Bureau) vs. the change in nominal personal consumption spending on goods (from the BEA).

The two series track very well, especially over the last ten years. This shouldn't be a big surprise since the BEA has started using the Census Bureau data to estimate spending on goods. (See Note 6: Key source data and assumptions for "advance" estimates - excel file)

Note that Q1 2007 was based on the first two months of the quarter. The second graph shows the YoY change in real retail sales (using CPI to adjust). This clearly shows the slowdown in retail spending (in real terms).

The second graph shows the YoY change in real retail sales (using CPI to adjust). This clearly shows the slowdown in retail spending (in real terms).

Now something unusual happened in Q4 2006 (and it was not widely reported). The increase in real PCE was greater than the increase in nominal PCE for the first time in about 50 years (as predicted here). This simply means that PCE prices declined in Q4.

So even though nominal spending on goods declined in Q4, the BEA reported that real spending on durable goods increased 4.4% annualized, and nondurable goods spending increased 6.0% annualized. This contributed 1.54% to Q4 GDP (out of 2.2% real annual growth). Because of the unusual decline in prices, this adjustment will probably not be repeated in Q1 2007.

Right now it looks like nominal consumer spending on goods will increase about 4% (annualized) in Q1, or about 1.0% to 1.5% (annualized) in real terms. This means consumer spending on goods will probably only contribute 0.4% or less to GDP in Q1. Those looking for 2.0% or higher GDP in Q1 will probably have to look elsewhere (or hope for a blowout March). Of course this doesn't include spending on services - about 60% of all personal consumption expenditures.

DataQuick: California House Sales Decline in February

by Calculated Risk on 3/16/2007 12:28:00 PM

DataQuick reports: California February 2007 Home Sales

A total of 31,228 new and resale houses and condos were sold statewide last month. That's down 3.7 percent from 32,425 in January, and down 21.3 percent from 39,676 in February 2006. A sales decline between January and February is not unusual. The year-over-year sales decline peaked last September at 34.5 percent.

Last month's sales made for the slowest February since 1997, when 28,710 homes sold. February sales from 1988 to 2007 range from 22,262 in 1995 to 48,409 in 2004. The average is 33,282.

The median price paid for a home last month was $472,000. That was up 2.2 percent from $462,000 in January and up 3.4 percent from $456,500 for February a year ago. The median peaked at $480,000 last June.

LA Times: A town right on the default line

by Calculated Risk on 3/16/2007 09:15:00 AM

David Streitfeld writes in the LA Times: A town right on the default line

In California, Perris is at the epicenter of mortgage problems. From November to January, 177 homes in Perris' central ZIP Code have received notices of default, the first step toward foreclosure.

That's about 1 of 53 houses ... The neighboring towns of Lake Elsinore and Moreno Valley came in second and third.

A few doors away from De Leon's house sits a second empty property foreclosed on by its lender. "A divorce," he explains. "The husband couldn't afford it alone. He was paying $2,500 a month. Ridiculous."

A few blocks away is a third foreclosure, this one only a frame skeleton abandoned by its builder. A young woman who answers the bell at a fourth house .... She pays rent to someone who pays the owner, she says; please go away.

...

There are other signs of distress. De Leon's development, called the Villages of Avalon, has an unusual number of homes for sale, considering it's so new that the Google Earth satellite scan still shows much of it as dirt.

At the top of his street, next to the charred shell of a house that mysteriously burned a few months ago, is a house for sale. The house immediately next door is on the market too. A few doors away from De Leon's home in the other direction is a third house looking for a buyer. Some owners are trying to rent their places out, advertising with little signs on the front lawn.

"Biggest Foreclosure Bloodbath Ever"

by Calculated Risk on 3/16/2007 02:56:00 AM

From Reuters: Mortgage Meltdown Pulls in More Than Those on Edge

[Lori Gay, president and chief executive of Los Angeles Neighborhood Housing Services] said she has begun meeting with lenders, at their request, to try to stave off what could be "the biggest foreclosure bloodbath that we've ever had."And on commercial real estate, from the WSJ: Subprime Troubles Bite Into Office-Space Sector

"We are seeing every age group, every single income level now, people with similar problems, and I haven't seen that in my career," she added.

Fallout from the imploding subprime-mortgage market is spreading to regions of the country where the once-torrid mortgage business generated jobs and filled office buildings.

No place is this more apparent than Orange County, Calif., where mortgage lenders including New Century Financial Corp. and Ameriquest Mortgage Co., a unit of ACC Capital Holdings Corp., have laid off workers, and landlords are bracing for a dive in what was previously one of the nation's strongest office markets. Employment in Orange County's mortgage-lending and consumer-finance sector has fallen 6.4% to 51,200 in the fourth quarter of 2006, from a peak of 54,600 in the fourth quarter of 2005, according to the Labor Department.

Thursday, March 15, 2007

Default Misery

by Calculated Risk on 3/15/2007 07:57:00 PM

Recently we've seen two interesting maps: the MBA delinquency map and the BusinessWeek "Map of Misery" showing the percentage of loans with payment options by state.

Here is the BusinessWeek Map of Misery. This map is from BusinessWeek's cover story: Nightmare Mortgages

If we combine the maps, are we looking into the future?  Click on Map for animated GIF combining the two maps.

Click on Map for animated GIF combining the two maps.

No wonder Goldman Sachs expressed concern yesterday about "the credit quality of ... prime ARMs with very low initial interest rates ... deteriorating at pace that is similar to that of subprime ARMs."

This map shows what might happen in the near future with delinquency rates.

Toll: Spring Was a "Bust"

by Calculated Risk on 3/15/2007 05:14:00 PM

From Bloomberg (hat tip Brian): Toll Calls Spring `A Bust,' Can't Predict Recovery

"When will the market rebound?" [Toll Brothers Inc. Chief Executive Officer Robert Toll] said at a conference in Las Vegas today. "Who knows? The Shadow knows. I have no idea. I would've thought that it would've rebounded by now and I would've been dead wrong, and I was."The Wall Street consensus was for a bottom in Q1 2007. That view is "no longer operative". I'll try to call the bottom for New Home sales, a couple of quarters before it happens, but IMO it is still too early to even try.

...

"You saw no jump in all the other markets and the spring selling season, or the prime selling season, was pretty much a bust on a per community basis," Toll said.

Mortgage malaise may bring recession: Merrill

by Calculated Risk on 3/15/2007 02:33:00 PM

From Reuters: Mortgage malaise may bring recession: Merrill

House prices could tumble 10 percent this year and force the United States into recession if a credit crunch taking shape in the mortgage market gathers steam, Merrill Lynch said in research notes this week.Wow. And I though I was bearish on housing. My prediction was for a 1% to 3% nationwide price decline in 2007 (as measured by OFHEO).

...

"It is not inconceivable (given what is happening now to mortgage originations) that we end up with something closer to a 10 percent decline in home prices this year," Merrill Lynch said.

...

However, if the inflation-fighting Federal Reserve were to keep rates unchanged to contain price growth -- instead of cutting by 1 percentage point in the second half of 2007 as Merrill expects -- then this would put the probability of an outright recession in the second half at "very close to 100 percent."

Greenspans Sees Problems Spreading

by Calculated Risk on 3/15/2007 02:23:00 PM

From CNNMoney: Greenspan: Subprime risk may spread

Former Federal Reserve Chairman Alan Greenspan said on Thursday there was a risk that rising defaults in subprime mortgage markets could spill over into other economic sectors.

Speaking to the Futures Industry Association, Greenspan conceded that it was "hard to find any such evidence" about spillover from housing yet. But he added: "You can't take 10 percent out of mortgage originations without some impact."

...

He said that subprime woes were "not a small issue" ...

Goldman Sachs: "Mortgage Problems Go Well Beyond Subprime"

by Calculated Risk on 3/15/2007 11:08:00 AM

In a research note titled "Mortgage Credit Quality Problems Go Well Beyond Subprime", Goldman Sachs suggests (short excerpt):

According to our (very rough) estimates, the credit quality of so-called “teaser-rate” debt—prime ARMs with very low initial interest rates—is deteriorating at pace that is similar to that of subprime ARMs. Since teaser-rate ARMs typically have a longer reset schedule than subprime ARMs, this suggest that the teaser-rate problem could ultimately well exceed the subprime problem.