by Anonymous on 6/26/2007 07:55:00 AM

Tuesday, June 26, 2007

BONG HiTS 4 BEAR*

Gretchen Morgenson on the Everquest IPO. Being the vicious nasty blogger with no redeeming social qualities that I am, I must take the opportunity to point out that I have no idea how accurate this reporting on the Everquest deal is, but sentences like this do not raise my confidence level:

The funds that sold the securities to Everquest invested in big pools of loans backed by home mortgages, known as collateralized debt obligations.

"Pools of loans backed by home mortgages"? I'm drinking some good coffee this morning--for which I have our generous tippers to thank--but I don't think there's enough coffee in the continental U.S. to make that sentence mean anything. I believe the linguists call it "word salad."

That doesn't mean that the rest of the reporting is equally confused, of course, but then again it makes me tread cautiously. UberNerds 4 Warned.

*Dear Chief Justice Roberts: the title of this post is not an "incitement to imminent lawless action." It is a "joke." And you people can't throw my sorry little butt out of high school because I've already got my diploma and I don't need you anymore.

Monday, June 25, 2007

NAR Blames Builders for Housing Woes

by Calculated Risk on 6/25/2007 07:46:00 PM

From the WSJ: Existing Home Sales, Prices Decline

"If builders can be disciplined and cut back on production, then overall inventory would begin to diminish,"New home inventory is actually a small portion of the overall inventory. See this post from Saturday: Housing: Total Inventory

Lawrence Yun, senior economist for the Realtors association.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year end inventory levels, since 1982, for new and existing homes. (2007 numbers are for April, I'll update when the New Home numbers are released tomorrow).

Yes, the builders need to cut back on production, but even if the builders stopped building, it would take some time to work through the significant excess supply currently on the housing market.

Alternatively a significant price decline might spur demand; I wonder why the NAR economist doesn't suggest that solution?

BusinessWeek: Bear's Big Loss Arouses SEC Interest

by Calculated Risk on 6/25/2007 04:53:00 PM

From BusinessWeek: Bear's Big Loss Arouses SEC Interest

Bear Stearns (BSC) may have a lot of explaining to do about a big restatement of losses at one of its troubled hedge funds—and not just to its investors. BusinessWeek has learned that the Securities & Exchange Commission recently opened a preliminary inquiry into the near-collapse of Bear Stearns' High-Grade Structured Credit Strategies Enhanced Leveraged Fund. People familiar with the inquiry say regulators are interested in learning how the Wall Street investment firm came to dramatically restate the April losses for the 10-month-old fund ...Your daily dose of BS. (uh, Bear Stearns).

...

Privately, Bear Stearns is spreading the word that the April restatement was prompted by actions by some of their lender banks. People familiar with the matter say the Wall Street firm claims the banks began demanding that the hedge fund put up more collateral for the loans it had taken.

The banks, on their own accord, began marking down the value of the subprime bonds that the hedge fund had invested in, which had the effect of precipitating the current crisis, according to the people familiar with Bear Stearns' account of the events.

UPDATE: BofA Analyst on impact on housing of Bear Stearns Hedge Fund debacle, via Mathew Padilla: Will Bear Stearns' woes lead to higher mortgage rates, lower home prices?

• While these discrepancies may not be revealed in the short term, we believe the object lesson in liquidity would at the very least give CDO investors a reason to require better yields and more likely would result in more restrictive margining requirements by those firms accepting CDOs as collateral. A cascading deleveraging from CDO^2s through CDOs to the non-investment grade tranches of private label securitizations would ultimately produce higher rates to new mortgage borrowers.

• Short-term, private label securitizers (of subprime and Alt-A) should experience weaker gain on sale margins and/or reduced securitization leverage (increased non-investment grade retention). Longer term, it should result in higher coupon rates, reducing mortgage borrowing demand, which the disproportionate impact on subprime and Alt-A would further pressure housing prices by taking out of the market the marginal buyers. Weaker house prices and higher rates would not only increase the pace of foreclosures but more importantly increase loss severities on the foreclosures. The higher losses would in turn create more pressure for higher rates (relative to reference rates) potentially triggering another round of tightening. ...

More on May Existing Home Sales

by Calculated Risk on 6/25/2007 12:43:00 PM

For more existing home sales graphs, please see the previous post: May Existing Home Sales

NAR reported that existing home inventories are at record levels today. To put these numbers into perspective, here are the year-end inventory and months of supply numbers, since 1982 (Note: The only data I have is year-end starting in 1982). Click on graph for larger image.

Click on graph for larger image.

The current inventory of 4.431 million units is an all time record. The "months of supply" metric is now above the level of the previous housing slump in the early '90s, but still below the levels of the housing bust in the early '80s.

The "months of supply" is calculated by dividing the total inventory by the seasonally adjusted annual rate (SAAR) of sales, and multiplying by 12. Currently inventory is 4.431 million, SAAR sales are 5.99 million giving 8.9 months of supply.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units (a measure of turnover). See the second graph.  One of the rarely mentioned stories, related to the housing boom, was the increase in turnover of existing homes. This graph shows sales and inventory normalized by the number of owner occupied units.

One of the rarely mentioned stories, related to the housing boom, was the increase in turnover of existing homes. This graph shows sales and inventory normalized by the number of owner occupied units.

Note: all data is year-end except 2007. For 2007, the May sales rate and inventory are used. For owner occupied units, Q1 2007 data from the Census Bureau housing survey was used for May 2007.

This graph shows the extraordinary level of existing home sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.

Some of the sales were for investment and second homes, but normalizing by owner occupied units probably provides a good estimate of normal turnover. A decline in sales to 6% of owner occupied units would result in about 4.6 million sales. If sales fall back to the level of 1998 to 2001 (7.3% of total owner occupied units sold) that would be about 5.6 million units in 2007.

Also look at inventory as a percent of owner occupied units; an all time record of 5.9%! Imagine if sales fell back to the median level for the last 35 years; the months of supply would be ONE YEAR.

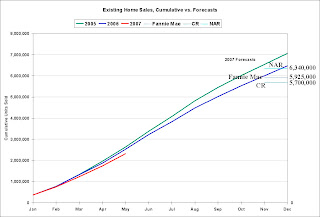

And writing about sales, the followings shows the actual cumulative existing home sales (through May) vs. three annual forecasts for 2007 (NAR's Lereah, Fannie Mae's Berson, and me). My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

NSA sales are 91% of 2006 at this point. If sales maintain that percent of 2006, then total sales will be 5.94 million - about at Fannie Mae's forecast.

To reach the NAR forecast (revised downward on April 11 to 6.34 million units), sales will have to be above 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say the recent NAR forecast is "no longer operative"!

UPDATE: We do requests (occasionally) at CR. The following graph was requested by BrooklynInDaHouse. This graph shows the ACTUAL annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the May inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the ACTUAL annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the May inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

Unfortunately I don't have inventory data prior to 1982. Note that in graph 2 above, sales and inventory are normalized by the number of Owner Occupied Units.

May Existing Home Sales

by Calculated Risk on 6/25/2007 10:12:00 AM

The National Association of Realtors (NAR) reports Home Sales Show Market is Under Performing

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – eased by 0.3 percent to a seasonally adjusted annual rate1 of 5.99 million units in May from an upwardly revised pace of 6.01 million in April, and are 10.3 percent below the 6.68 million-unit level in May 2006.

...

The national median existing-home price2 for all housing types was $223,700 in May, which is 2.1 percent below May 2006 when the median was $228,500.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. For New home sales, March is usually the strongest sales month of the year. For existing homes, the Summer months are more critical.

The second graph shows the months of supply. With the months of supply now over 8 months, we should expect falling prices nationwide. The NAR reports that YoY prices fell again in May.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to a record 4.431 million units in May.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to a record 4.431 million units in May.Total housing inventory rose 5.0 percent at the end of May to 4.43 million existing homes available for sale, which represents an 8.9-month supply at the current sales pace, up from an 8.4-month supply in April.For some reason the NAR forgot to mention this is the all time record for inventory (not months of supply though). More on existing home sales later today.

Sunday, June 24, 2007

Tips for Tanta

by Calculated Risk on 6/24/2007 12:23:00 PM

To celebrate Tanta's six month anniversary as my co-blogger, from now through next Saturday (June 30th), instead of splitting the tips, all the tips will go to Tanta.

This is your chance to tip Tanta without the greedy CR taking half!

I'm sure everyone appreciates that Tanta is an incredible writer with extensive knowledge of the mortgage industry. She is a former bank officer and mortgage lending specialist, on extended medical leave while undergoing treatment for cancer.

Let me be clear: This isn't a cry for sympathy. This isn't charity. And Tanta isn't destitute. Only tip her if you appreciate her work.

These are tips for her virtuoso writing performances - think of it like tipping Billy Joel at the piano - except Tanta is smarter and better looking.

Just tap the Tip Jar on the right, and it will take you to a PayPal payment screen.

I'm doing this without her knowledge or permission.

P.S. A warm thank you to the many generous readers for your previous tips.

Murk to Muddle

by Anonymous on 6/24/2007 08:17:00 AM

naked capitalism has a nice post up this morning that combines all of my favorite themes: models, valuations, risk management, and what the hell is the matter with the New York Times today?

I am not a Times Select subscriber--I get most of my useful business analysis from Opera Weekly--so I don't spend enough time picking on Gretchen Morgenson since she went behind the pay wall.

But Yves is out there doing the heavy lifting:

Back to Morgenson. She got a very important issue wrong:Officials at ratings agencies have said in the past that their ratings reflect their estimates of future performance, not market pricing. So the agencies are also marking to model.

Ratings agencies are not Bloomberg terminals. They provide ratings.

There aren't many people who are more cynical than I am about the rating agencies, but a whole lot of people need to memorize those last two simple sentences. We can argue all day long about whether these bond ratings are sufficiently stress-tested, whether downgrades are too slow, whether the rating agencies conflate "collateral problems" and "structural problems" in their analysis. The whole sorry issue of their fee structure and non-arm's-lenth relationships with the bond underwriters could keep us talking for weeks. But if you want to tell me there's an "observable market rating" to which the agencies should be "marking," you'll have to tell me who writes your prescriptions.

To suggest that the rating agencies are "marking to model" is mind-numbingly dimwitted. This is just like The Great FICO Uproar: everybody wants to get all fired up about whether FICO scores are "inflated" or "manipulated" or what have you, as if FICOs are somehow supposed to be something other than just scores produced by a model.

News flash: There are good models, bad models, and ugly models. There are transparent and opaque models. There are stress-tested and untested models. They're all models. And if they're claiming to model probability of principal loss via default of the underlying collateral, that number you get at the end isn't a dollar price. The number you get at the end could be an input into a pricing model, to be sure. But would you really want to claim that an apparent failure of your pricing model is caused solely by one credit model-generated input failing to correlate to a future market price? If so, you aren't using a "pricing model." I don't doubt that there are some stupid investors out there who have been acting as if a certain credit rating--on a mortgage loan or a CDO tranche--guaranteed a certain market price. But the technical financial-accounting term for those people is "doofuses."

Maybe we could just have a moratorium on anyone using the phrase "mark to _____" for rhetorical flourish until we all get a little clearer on the concept.

Saturday, June 23, 2007

Housing: Total Inventory

by Calculated Risk on 6/23/2007 04:32:00 PM

Floyd Norris at the NY Times writes: Homes Sell. Homes Don’t Sell. Builders Still Build.

And here are the charts from the NY Times story.

THE American housing market, as measured by home-building activity, is falling at the most rapid rate in decades ... [and] the weakness will last while builders seek to sell homes they have already built.However, it isn't just the inventory of new homes for sale that will impact the homebuilders. Existing homes are a competing product for new homes, and the record inventory of existing homes for sale will also pressure home-building activity.

It is unlikely that home starts will turn up significantly until that inventory is significantly reduced.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year end inventory levels, since 1982, for new and existing homes. (2007 numbers are for April).

The second graph shows annual starts vs. total housing inventory (new and existing homes).

Look at the previous housing bust in the early '90s. Starts picked up as inventory fell in '92, and starts continued to increase in '93 and '94 as total inventory fell further.

This time the total inventory is so high that starts will probably not pick up until the total inventory levels have fallen significantly. And, with tighter lending standards, demand will probably continue to fall too. Instead of looking for when home-building activity will pick up, perhaps we should be looking for the next decline in housing starts.

This time the total inventory is so high that starts will probably not pick up until the total inventory levels have fallen significantly. And, with tighter lending standards, demand will probably continue to fall too. Instead of looking for when home-building activity will pick up, perhaps we should be looking for the next decline in housing starts.More data will be available this week, as the existing and new home sales reports for May will be released on Monday and Tuesday, respectively.

Saturday Rock Blogging: I Smell a Rat

by Anonymous on 6/23/2007 04:18:00 PM

Bear, the two of us need look no more

We both found what we were looking for

With a loan to call my own

I won’t pick up the phone

When Merrill Lynch calls me--

You've got a fund in me

(you've got a fund in me)

Bear, you're always losing here and there

Your own bonds aren’t wanted anywhere

If your lenders look behind

And don't like what they find

There's one thing you should know

You've got a fund you owe

(you've got a fund you owe)

I used to say "I" and "me"

Now it's "us,” now it's "we"

I used to say "gains are mine"

Now it's "Bear, loss is thine"

Bear, most lenders would just make me pay

I don't listen to a word they say

They don't see me as you do

They think they’re being screwed

I'm sure they wouldn’t care

If they had a friend like Bear

(a friend) Like Bear

(like Bear) Like Bear

A Tale of Two Hedge Funds

by Anonymous on 6/23/2007 11:24:00 AM

We begin to get some backstory on the Great Bear Hedge Fund Meltdown of 2007, courtesy of the New York Times. The leitmotif, which I prophesy will become the Unshakable Story That Everyone Will Stick To, is that this is all directly and apparently unproblematically related to subprime mortgage loans:

The crisis this week from the near collapse of two hedge funds managed by Bear Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime, credit, leaving many of them struggling to stay in their homes.

Let's leave, for the moment, the question of the incredibly complex and opaque layers of leverage, synthetic structures, derivatives swaps, and mark-to-model valuations that transformed mere commonplace mortgage loan write-downs into 23% losses of $600MM invested equity in approximately 9 months on a fund created because its precursor fund, which had dawdled along for two years or so generating a mere 1.0-1.5% a month return, we are informed, just wasn't good enough for the high rollers who didn't damn well put their money in hedge funds to earn 12-18% a year. This is really all about a bunch of subprime loans.

Notice deployment of the Mozilo Defense:

The first fund, the Bear Stearns High-Grade Structured Credit Fund — the one bailed out yesterday — was started in 2004 and had done well, posting 41 months of positive returns of about 1 percent to 1.5 percent a month. But investors were clamoring for even higher yields, which would require more aggressive bets on riskier mortgage-related securities and significantly higher levels of borrowed money, or leverage, to bolster returns.

So, a bunch of first-time homebuyers with no money made Angelo write a bunch of regrettable loans. Angelo undoubtedly made Bear Stearns buy those loans. A bunch of insane hedge fund investors who aren't happy with 12-18% annual returns from investing in the first loss position on the loans Angelo was forced to make got out their pitchforks and "clamored" until Bear Stearns gave them a new fund that used 10x leverage to sell protection to somebody who is exposed to the losses on the underlying reference securities (you want to bet me that'd be Fund 1?) that were valued by Bear's nifty models to start with.

No, wait. All that stuff is way too complicated for any reader of the Saturday Times to follow. Let's stick with how this "stems directly" from Teh Subprime. Besides the fact that we all know what Teh Subprime is about (don't we?), which makes this story easier to understand, it helps us get away from the implications of printing things like this:

Bear Stearns is bailing one of the funds out because it is worried about the damage to its reputation if it stuck investors and lenders with big losses, said Dick Bove, an analyst with Punk Ziegel & Company.

“If they walked away from it, investors would have lost all their money and lenders would have lost all of the money,” Mr. Bove said. But “if they did that to everyone in the financial community, the financial community would have shut them down.”

You see, unlike those deadbeat subprime homebuyers, Bear Stears is honorable enough not to stick it to the bagholders. Sure, that aborted attempt at the Everquest IPO might appear to have been an attempt to find a different subset of the "financial community" to stick it to, but Bear obviously realized that its holy reputation might not withstand offloading the nuclear waste onto retail investors, so it dutifully fell on its own sword and bailed out the people who forced it to open such a stupid fund in the first place.

But horrors! cries the crowd. What about BSC's shareholders? Why should they pay for this fiasco?

The Times doesn't mention that part, but if Fitch is to be believed, the "bailout" of Fund 1 is not an equity infusion but . . . wait for it . . . a loan modification! Apparently BSC is offering Fund 1 a collateralized repo facility with which the "financial community" can be paid off and BSC can now be collateralized by fund assets that still do or do not have any value as far as we don't know.

Unfortunately, the earlier storyline we spent most of last week on, the question of how much of all this to-do was a mere strategem to avoid having to mark to market any of this fine "collateral," now appears to have retreated a bit. I must say I'm wondering how Bear Stearns can can offer a collateralized repo facility to a "troubled" hedge fund and not mark that sucker to market every day of its life. Can anyone explain how this is going to get unwound?

No, we can't explain how this is going to get unwound. Let us, therefore, focus obsessively on lenders making bad mortgage loans to subprime borrowers. If we do that, maybe people won't notice that there don't seem to be nearly enough reported principal losses on actual subprime loans to account for the magnitude of the BS Funds' losses on a dollar-for-dollar basis, which does kind of suggest to us simpletons that something out there is magnifying, rather than dispersing, all this credit risk.

Remember the Brookstreet story? Catastrophic mark-to-market losses on a whole mess of mortgage-backed bonds that seem to affect only one brokerage? And nobody else seems to be marking to that price? Or could it be that everyone else is, in fact, marking to that price, but no one else was either stupid or criminally insane enough to buy illiquid and hence somewhat fuzzily-valued bonds for customer accounts at 9 to 1 leverage?

Nah, it's those stupid subprime borrowers.