by Calculated Risk on 7/10/2007 02:05:00 PM

Tuesday, July 10, 2007

Housing Spillover and the Consumer Slowdown

There is more evidence today that the housing slump is spilling over into consumer spending. We already know that Personal Consumption Expenditures (PCE) slowed sharply in Q2. And today, Home Depot and Sears released "troubling forecasts".

From Reuters: ... Disappointing Forecasts From Home Depot and Sears

... investors ... cringed at troubling forecasts from retailers Home Depot and Sears.From AP: Home Depot Warns 2007 Will Be Weaker Than Expected

... Home Depot Inc., Sears Holdings Corp. and homebuilder D.R. Horton Inc. offered disappointing financial outlooks that raised concerns about the housing market dampening consumer spending.

Home Depot said it now expects its earnings per share to decline by 15 percent to 18 percent for fiscal 2007. In May, the company had projected an earnings per share decline of 9 percent for the year.Also from AP: Sears Lowers Earnings Guidance on Languid Summer Sales Figures

...

[Chief Executive Frank Blake] said Home Depot sees "continued headwinds through 2007 and probably some into 2008 as well."

Sears Holdings Corp.'s second-quarter earnings will likely fall well below Wall Street expectations due to more disappointing sales of home appliances ...Please allow me to repeat this from a post in May:

During a nine-week period that ended July 7, same-store sales at Kmart's U.S. locations fell 3.9 percent while same-store sales fell 4 percent at Sears.

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

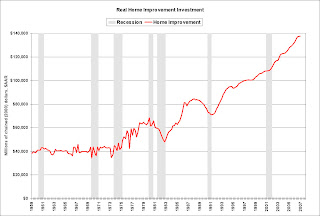

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

D.R. Horton: 38% Cancellation Rate

by Calculated Risk on 7/10/2007 12:18:00 PM

"Market conditions for new home sales declined in our June quarter as inventory levels of both new and existing homes remained high, and we expect the housing environment to remain challenging. We adjusted our sales prices as selling conditions deteriorated, and we continue to react quickly to market dynamics. We expect to report a profit from operations before impairments for the June 30, 2007 quarter. However, as a result of the factors mentioned above, we will realize significant asset impairments which will result in a loss for both the quarter and the nine months ended June 30, 2007."Press Release: D.R. Horton, Inc. ... Reports Net Sales Orders for the Third Quarter of Fiscal Year 2007

Donald R. Horton, Chairman, D.R. Horton

D.R. Horton, Inc. ... the largest homebuilder in the United States, ... reported net sales orders for the third quarter ended June 30, 2007 of 8,559 homes ($2.0 billion), compared to 14,316 homes ($3.8 billion) for the same quarter of fiscal year 2006. Net sales orders for the first nine months of fiscal year 2007 totaled 27,313 homes ($6.9 billion), compared to 41,550 homes ($11.4 billion) for the same period of fiscal year 2006. The Company's cancellation rate (sales orders cancelled divided by gross sales orders) for the third quarter of fiscal 2007 was 38%.Remember when improving cancellations rates were the sign that housing had bottomed? Well, cancellations rates are rising again. The builders are taking "significant asset impairments" and reporting losses. And prices are being adjusted down as "conditions deteriorate".

There is no question that the housing market has taken another down turn. I expect this bad news from the builders to show up soon in the new home sales and housing starts reports.

S&P Changes Subprime Ratings Methodology

by Anonymous on 7/10/2007 12:00:00 PM

S&P managed to surprise the markets this morning by publishing a whopper of a combined downgrade list/methdology change for subprime mortgage-backed securities this morning.

Many of the classes issued in late 2005 and much of 2006 now have sufficient seasoning to evidence delinquency, default, and loss trend lines that are indicative of weak future credit performance. The levels of loss continue to exceed historical precedents and our initial expectations.

We are also conducting a review of CDO ratings where the underlying portfolio contains any of the affected securities subject to these rating actions (see separate media release to be published today). . . .

On a macroeconomic level, we expect that the U.S. housing market, especially the subprime sector, will continue to decline before it improves, and home prices will continue to come under stress. Weakness in the property markets continues to exacerbate losses, with little prospect for improvement in the near term. Furthermore, we expect losses will continue to increase, as

borrowers experience rising loan payments due to the resetting terms of their adjustable-rate loans and principal amortization that occurs after the interest-only period ends for both adjustable-rate and fixed-rate loans.

Although property values have decreased slightly, additional declines are expected. David Wyss, Standard & Poor's chief economist, projects that property values will decline 8% on average between 2006 and 2008, and will bottom out in the first quarter of 2008. While our LEVELS model assumes property value declines of 22% for the 'BBB' and lower rating category stress environments (with higher property value declines for higher rating category stress environments), the continued decline in prices will apply additional stress to these transactions by

increasing losses on the sale of foreclosed properties, as well as removing or reducing the borrowers' ability to refinance or sell their homes to meet debt obligations.

As lenders have tightened underwriting guidelines, fewer refinance options may be available to these borrowers, especially if their loan-to-value (LTV) and combined LTV (CLTV) ratios have risen in the wake of declining home prices. . . .

Data quality is fundamental to our rating analysis. The loan performance associated with the data to date has been anomalous in a way that calls into question the accuracy of some of the initial data provided to us regarding the loan and borrower characteristics. A discriminate analysis was performed to identify the characteristics associated with the group of transactions

performing within initial expectations and those performing below initial expectations. The following characteristics associated with each group were analyzed: LTV, CLTV, FICO, debt-to-income (DTI), weighted-average coupon (WAC), margin, payment cap, rate adjustment frequency, periodic rate cap on first adjustment, periodic rate cap subsequent to first adjustment, lifetime max rate, term, and issuer. Our results show no statistically significant differentiation between the two groups of transactions on any of the above characteristics. . . .

As performance continues to deteriorate, we have increased the severity of the surveillance assumptions we use to evaluate the ongoing creditworthiness for this group of transactions. The level of severity was increased to 40% from 33% to reflect the average severity that subprime servicers are currently experiencing . . .

In addition, we have modified our approach to reviewing the ratings on senior classes in a transaction in which subordinate classes have been downgraded. Historically, our practice has been to maintain a rating on any class that has passed our stress assumptions and has had at least the same level of outstanding credit enhancement as it had at issuance. Going forward, there

will be a higher degree of correlation between the rating actions on classes located sequentially in the capital structure. A class will have to demonstrate a higher level of relative protection to maintain its rating when the class immediately subordinate to it is being downgraded. . . .

For transactions that close on or after July 10, 2007, We will incorporate several changes to our ratings methodology that will result in greater levels of credit protection for rated transactions. Our cash flow methodology assumptions will include a simultaneous combination of faster voluntary and involuntary (default) prepayments that will result in less credit to excess

spread. Furthermore, our default expectation for 2/28 hybrid ARM loans will increase by approximately 21%. We are in the process of updating our LEVELS and SPIRE models. A separate article will be released in the next few days describing the revisions to our ratings methodology, and will provide the estimated timing for release of the updated models. . . .

Given the level of loosened underwriting at the time of loan origination, misrepresentation, and speculative borrower behavior reported for the 2006 vintage, we will be increasing our review of the capabilities of lenders to minimize the potential and incidence of misrepresentation in their loan production. A lender's fraud-detection capabilities will be a key area of focus for us. The review will consist of a detailed examination of: (a) the overall capabilities and experience of the executive and operational management team; (b) the production channels and broker approval process; (c) underwriting guidelines and the credit process; (d) quality control and internal audits; (e) the use of third-party due diligence firms, if applicable; and (f)secondary marketing. A new addition to this review process will be a fraud-management questionnaire focusing on an originator's tools, processes, and systems for control with respect to mitigating the potential for misrepresentation.

Oh, my, no. A fraud management questionnaire? What a crackdown!

More later . . .

Note: the entire document is available in pdf on standardandpoors.com if you are a registered user.

Fitch Downgrades Two Second-Lien ABS

by Anonymous on 7/10/2007 11:23:00 AM

I think we missed our Friday afternoon downgrades last week because of the odd holiday schedule. This one, however, caught my eye today:

Fitch Ratings-New York-09 July 2007: Fitch takes rating actions on the following Structured Asset Security Corp. (SASCO) residential mortgage-backed certificates:

Series 2006-ARS1:

--Class A1 affirmed at 'AAA';

--Class M1 affirmed at 'AA+';

--Class M2 affirmed at 'AA';

--Class M3 affirmed at 'AA-';

--Class M4 rated 'A+' is placed on Rating Watch Negative;

--Class M5 downgraded to 'A-' from 'A' and placed on Rating Watch Negative;

--Class M6 downgraded to 'BBB' from 'A-' and placed on Rating Watch Negative;

--Class M7 downgraded to 'BB' from 'BBB+' and placed on Rating Watch Negative;

--Class M8 downgraded to 'B' from 'BBB' and placed on Rating Watch Negative;

--Class M9 downgraded to 'C' from 'BBB-'; assigned distressed recovery (DR) rating of 'DR6'

--Class B1 downgraded to 'C' from 'BB+'; assigned DR rating of 'DR6';

--Class B2 downgraded to 'C' from 'BB+'; assigned DR rating of 'DR6'.

Series 2006-S1

--Class A1 & A2 affirmed at 'AAA';

--Class M1 affirmed at 'AA';

--Class M2 affirmed at 'AA-';

--Class M3 rated 'A+' and placed on Rating Watch Negative;

--Class M4 downgraded to 'A-' from 'A' and placed on Rating Watch Negative;

--Class M5 downgraded to 'BBB+' from 'A-' and placed on Rating Watch Negative;

--Class M6 downgraded to 'BBB-' from 'BBB+' and placed on Rating Watch Negative;

--Class M7 downgraded to 'BB' from 'BBB' and placed on Rating Watch Negative;

--Class M8 downgraded to 'B' from 'BBB-' and placed on Rating Watch Negative;

--Class B1 downgraded to 'C' from 'BB+'; assigned DR rating of 'DR6';

--Class B2 downgraded to 'C' from 'BB'; assigned DR rating of 'DR6'.

Fitch's Distressed Recovery (DR) ratings, introduced in April 2006 across all sectors of structured finance, are designed to estimate recoveries on a forward-looking basis while taking into account the time value of money. For more information on Distressed Recovery ratings, see the full report ('Structured Finance Distressed Recovery Ratings'), which is available on the Fitch Ratings web site at 'www.fitchratings.com'.

The affirmations reflect adequate relationships of credit enhancement (CE) to future loss expectations and affect approximately $327 million of outstanding certificates. CE is in the form of subordination, overcollateralization (OC) and excess spread. The negative rating actions, affecting approximately $111.1 million of outstanding certificates, reflect deterioration in the relationship between CE and expected losses.

Approximately 11.31% of the pool for series 2006-ARS1 is more than 60 days delinquent (including loans in Bankruptcy, Foreclosure and Real Estate Owned [REO]). The OC amount is currently $5,954,369, or roughly $11 million below its target amount. At 12 months since the first distribution date, the OC is currently equal to 2.54% of the original collateral balance, as compared to a target level of 7.65% of the original collateral balance. In four of the past 6 months, the excess spread has not been sufficient to cover the monthly losses incurred and as a result, OC has further deteriorated. Cumulative losses as a percent of the original collateral balance are 7.98%.

For series 2006-S1, approximately 6.19% of the pool is more than 60 days delinquent (including loans in Bankruptcy, Foreclosure and REO). This series was structured to have growing OC. Because of the faster-than-expected prepayments and earlier-than-expected collateral losses, the OC did not reach the initial target amount of $19.2 million. In five of the past 6 months, the excess spread has not been sufficient to cover the monthly losses incurred. Cumulative losses as a percent of the original collateral balance are 3.70%.

The transactions are twelve and sixteen months seasoned, respectively. The pool factors (current mortgage loan principal outstanding as a percentage of the initial pool) are approximately 71% and 58%, respectively.

The mortgage pools consist of conventional, fixed rate, fully-amortizing and balloon, second lien residential mortgage loans. The mortgage loans were acquired by Lehman Brothers Holdings Inc. from various banks and other mortgage lending institutions and are master serviced by Aurora Loan Services, Inc., which is rated 'RMS1-' by Fitch.

The first security (2006-ARS1) is subprime credit; the second (2006-S1) is definitely Alt-A (I checked the prospectus). The very different serious delinquency numbers reflect that: 11.31% for the subprime pool and 6.19% of the Alt-A pool. Yet these two pools are in almost exactly the same boat, ratings-wise.

How did that happen? The subprime pool started out with more overcollateralization, but losses have exceeded excess interest and so the OC is shrinking. The Alt-A pool started out with low OC--it was meant to grow through application of excess interest--but it too experienced losses exceeding the excess, as well as fast prepayments which have reduced the gross excess spread amount, and so its OC has not grown to its target.

You will notice also that both of these pools are fixed rate closed-end second liens. These borrowers did not get caught in a nasty rate adjustment, nor did they max out a credit line in order to pay bills.

The moral of the story, it seems to me, is twofold: Alt-A isn't performing anywhere near as well as its boosters claimed it would, for one thing. For another, a bad security structure can go a long way to offsetting the higher credit quality of the collateral. A security set up with "growing" OC, that is, initial low overcollateralization that is expected to reach its "target" over time, depends absolutely crucially on the accuracy of the prepayment speed estimates and the loss timing projections that went into its initial structure. The media's obsession with credit risk to the exclusion of other kinds of risk is obscuring this problem for sure.

Monday, July 09, 2007

Junk-rated loans hit new lows

by Calculated Risk on 7/09/2007 11:17:00 PM

From the Financial Times: Junk-rated loans hit new lows

The price of junk-rated loans in the US and European markets has tumbled in the past couple of weeks as investors begin to turn away from the asset class, according to new data from S&P LCD, the market information service.

US leveraged loan prices have fallen to their lowest level in more than four years, while in the derivatives markets a sell-off has pushed the prices of both US and European loan risk to less than the face value of the loans themselves.

The fall in prices is significant for banks and private equity firms preparing to launch new debt deals after recent buy-outs because it implies a rise in loan yields, which means higher borrowing costs.

More on Freddie Mac Housing Forecast

by Calculated Risk on 7/09/2007 10:53:00 PM

The details of Freddie Mac chief economist Frank Nothaft's housing forecast are now available.

Nothaft is predicting combined new and existing home sales will fall to 6.28 million this year (2007), but Nothaft is only counting "new and existing detached single-family homes". (emphasis added).

So adjusting for total sales, Nothaft's estimate is around 7.05 million for 2007; this is significantly above my estimate of 5.6 to 5.8 million existing home sales (including attached homes) and 0.85 new home sales.

As an aside, the Bloomberg story used 6.2 million for 2001:

Sales of new and previously owned homes probably will total 6.28 million, according to the world's second-largest mortgage buyer. That would be the lowest since 6.20 million in 2001.The 6.2 million number is total sales, including attached homes, and is not comparable to Nothaft's forecast. This is an error in the Bloomberg story.

Finally, it is pretty clear that Freddie Mac's forecast is already wrong. Sales would have to pickup to reach their forecast, and that seems very unlikely.

Freddie Mac: 2007 Home Sales to Decline to 6.28 Million

by Calculated Risk on 7/09/2007 01:13:00 PM

From Bloomberg: U.S. Housing Sales to Tumble to Six-Year Low on Rates, Defaults (hat tip Yal)

Sales of new and previously owned homes probably will total 6.28 million, according to the world's second-largest mortgage buyer. That would be the lowest since 6.20 million in 2001.I'd like to see the details. I've been forecasting 5.6 to 5.8 million existing home sales and close to 0.85 million (or so) new home sales. It sounds like Freddie Mac chief economist Frank Nothaft is in the same range - or actually even lower - now.

Here is the link for Freddie Mac's forecasts. (July 9th isn't available yet).

Citigroup Concerned about Consumer

by Calculated Risk on 7/09/2007 10:48:00 AM

"The contagion and contamination I'm most concerned about is what effect this will have on the consumer."From Bloomberg: U.S. Rebound May Be Bumpier Than Fed Expects as Credit Tightens

William Rhodes, senior vice chairman at Citigroup Inc. in New York.

The biggest worry is that falling home prices and rising interest rates will undermine consumer spending, the bedrock of the economy.

Consumers are showing some signs of stress. They fell behind on loan payments in the first quarter at the highest rate since 2001, the American Bankers Association reported.

Retailers feel the fall-out. The International Council of Shopping Centers and UBS Securities last week cut their forecast for June sales growth at retailers to 1.5 to 2 percent, from 2 percent.

``It's soft,'' says Michael Niemira, chief economist at the council. ``More retailers are feeling that something has changed after years of pretty healthy demand.''

Atlanta Foreclosures

by Calculated Risk on 7/09/2007 01:35:00 AM

From the NY Times: Increasing Rate of Foreclosures Upsets Atlanta

Despite a vibrant local economy, Atlanta homeowners are falling behind on mortgage payments and losing their homes at one of the highest rates in the nation, offering a troubling glimpse of what experts fear may be in store for other parts of the country.This is probably just the beginning of increasing foreclosure activity in Atlanta and the entire country.

...

A big reason the fallout is occurring faster here is a Georgia law that permits lenders to foreclose on properties more quickly than in other states. The problems include not just people losing their homes, but also sharp declines in property values, particularly in lower-income and working-class neighborhoods.

For example, a three-bedroom house near Turner Field, where the Atlanta Braves baseball team plays, fetched a high bid late last month of $134,000 at an auction by the bank that took possession of it. Almost three years ago, the new home was bought for $330,000.

Housing and Consumption

by Calculated Risk on 7/09/2007 12:07:00 AM

The "unexpected" sharp slowdown in Q2 Personal Consumption Expenditures (PCE) will likely restart the discussion of the impact of the housing slump - and less Mortgage Equity Withdrawal (MEW) - on PCE.

Some variation of the following graph will probably be part of the discussion. Click on graph for larger image.

Click on graph for larger image.

This graph shows MEW(1) as a percent of Disposable Personal Income vs. the Year-over-year change in Real PCE. An example of the use of this graph is presented as Exhibit 5 in this paper from Wells Fargo: Housing Bust Without A Consumption Bust???. The author writes:

Exhibit 5 shows virtually no relationship between real consumption growth and MEW. As MEW exploded between 1998 and 2003, consumption growth declined from over 5 percent to about 2 percent. As MEW has collapsed since 2005 from about 10 percent to about 3 percent, consumption growth has remained remarkably healthy at about 3.5 percent. Despite the widespread belief that MEW is a primary driver of consumer spending and the fear that any decline in MEW would certainly cause a collapse in consumption, this exhibit suggest consumer spending has been and continues to be little impacted by MEW.First, although the author is correct that there is no clear correlation between MEW and the change in real PCE during the period presented, perhaps he has it backwards; maybe the reason PCE was in the normal historical range for the last few years was because of MEW.

Of course the graph is flawed too. The author uses the YoY change for PCE (introducing a lag in PCE) and compares it to the current quarterly value for MEW (even though studies have shown MEW is spent over a number of quarters following extraction). This error in graphing led the author to this conclusion:

As MEW has collapsed since 2005 from about 10 percent to about 3 percent, consumption growth has remained remarkably healthy at about 3.5 percent.If declining MEW was going to have an impact on PCE, we wouldn't expect it to happen until several quarters after MEW declined. And since the YoY real PCE presentation introduces a mathematical lag, we would expect the graph to show a decline in PCE significantly after MEW declines - so the author's conclusion regarding "remarkably healthy" PCE while MEW is "collapsing" is, at best, premature.

Another perspective comes from Dallas Federal Reserve senior economist John V. Duca (written last November): Making Sense of the U.S. Housing Slowdown

The limited U.S. econometric evidence indicates that the strong pace of MEW may have boosted annual consumption growth by 1 to 3 percentage points in the first half of the present decade.[8] This implies that a slowing of home-price appreciation into the low single digits might shave 1 to 2 percentage points off consumption growth and 0.75 to 1.5 percentage points from GDP growth for a few years.

While these estimates provide an idea of housing’s potential economic impact, considerable uncertainty exists about how much a slowdown in MEW might restrain consumption growth. Key issues include how much home-price appreciation might slow, how much the deceleration would affect MEW and how much a slowdown in MEW would restrain consumer spending.

Dr. Duca presents this graph (as chart 4). Duca suggests that the recent increase in PCE as a percent of GDP might have been driven by MEW - and declining MEW might "shave 1% to 2%" off consumption growth for "a few years".

Duca's paper also includes references to much of the recent research on the impact of MEW.

Now we just have to wait for the "unexpected" decline in Q2 PCE!

(1) MEW calculations courtesy of James Kennedy, and are based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.