by Calculated Risk on 8/01/2007 12:20:00 PM

Wednesday, August 01, 2007

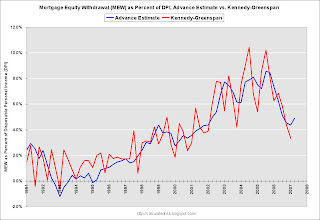

Advance Q2 MEW Estimate

Based on the Q2 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $120 Billion or 4.9% of Disposable Personal Income (DPI). This would be an increase from the Q1 estimates, from the Fed's Dr. Kennedy, of $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

The actual Q2 data for MEW is released after the Flow of Funds report is available from the Fed (scheduled for Sept 17th for Q2). Click on graph for larger image.

Click on graph for larger image.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high (0.89) but there is substantial differences quarter to quarter. Also, there are some seasonal adjustment issues. This does suggest that MEW rebounded somewhat in Q2. We will have to wait until September to know for sure.

MEW will probably decline precipitously in the second half of 2007, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I believe a slowdown in consumption expenditures is likely.

Here are the Kennedy-Greenspan estimates of home equity extraction for Q1 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. For Q1 2007, Dr. Kennedy calculated Net Equity Extraction as $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

For Q1 2007, Dr. Kennedy calculated Net Equity Extraction as $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

This graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

ADP Employment Report

by Calculated Risk on 8/01/2007 11:23:00 AM

Nonfarm private employment grew 48,000 from June to July of 2007 on a seasonally adjusted basis, according to the ADP National Employment Report TMSince changing their methodology, ADP has been pretty close to the BLS number (due Friday). The current consensus is for the BLS report to show 150K jobs, but that includes government jobs - ADP is for the private sector only.

More Viscous Cycle

by Anonymous on 8/01/2007 09:51:00 AM

This is not going to be all Bloomberg all day. I hope.

Aug. 1 (Bloomberg) -- Railroads, chemical producers and insurance companies are blaming the worst U.S. housing slump in 16 years for their earnings woes.

Burlington Northern Santa Fe Corp., the second-biggest U.S. railroad, said lower shipments of housing products and lumber reduced second-quarter earnings. DuPont Co., the third-largest chemical maker, said slumping demand for kitchen and bathroom countertops was partly responsible for its profit drop. Genworth Financial Inc., the former insurance unit of General Electric Co., said earnings will be at the ``lower end'' of its forecast this year as mortgage-insurance claims increase.

``The subprime slime is oozing,'' said Gary Shilling, president of A. Gary Shilling & Co. in Springfield, New Jersey, who correctly predicted the recession in 2001. ``As home equity evaporates, that takes out the foundation of strong consumer spending growth, which has been the mainstay of the economy.''

MMI: Stabilizing

by Anonymous on 8/01/2007 08:37:00 AM

So far this morning, the Muddled Metaphor Index is stabilizing. Colorfuls lead Cliches by 2-1. Analysts fear that current levels of unmixed metaphors may be supported by inability of fund managers to breathe deeply enough to utter multiple phrases; comments remain on Watch Negative until further notice.

My favorites so far today:

``There will be more pain,'' said Felix Stephen, a strategist who helps oversee the equivalent of $7.5 billion at Advance Asset Management Ltd. in Sydney. ``I'm giving it a couple of months at least. It's not the subprime issue that really matters, it is the first card to fall in the tower of cards in this situation.''

and

``There are still some more cockroaches to come out from under the fridge,'' said Chris Viol, a credit analyst at Citigroup Inc. in Sydney. ``We are getting a lot of questions about the big picture and the amount of contagion to investment grade credit.''As long as the cockroaches do not start laying their cards on the table, I think we may get out of this with our tentacles intact.

Moody's: Alt-A Rating Changes Effective Aug 1st

by Calculated Risk on 8/01/2007 01:05:00 AM

The earlier article on Moody's and Alt-A didn't mention the effective date. From Reuters: Moody's refines ratings methodology for Alt-A loans

Moody's Investors Service said on Tuesday it has refined its method for rating residential mortgage securitizations backed by Alt-A loans in response to rising delinquencies in pools of loans securitized in 2006.

The changes, which will go into effect on Aug. 1, address the poor performance of subprime-like loans, low and no equity loans, and low and no documentation loans which are present in certain Alt-A transactions, it said.

Tuesday, July 31, 2007

Another Bear Stearns Hedge Fund Is in Trouble

by Calculated Risk on 7/31/2007 06:27:00 PM

From the WSJ: Another Bear Stearns Hedge Fund Is in Trouble (hat tip ac)

Bear Stearns ... is now facing big losses in a third fund that has roughly $900 million in mortgage investments, according to people familiar with the matter.Not subprime. Not leveraged. Ouch.

The fund, known as the Bear Stearns Asset-Backed Securities Fund, ran into trouble in July and has refused to return investors' money for the moment, according to these people. One of these people said the redemption requests were postponed in hopes that the fund's assets would rebound in value. The fund contains a range of mortgages, but only a small slice of them that are considered subprime, the area that has given so many firms heartburn in recent weeks. Unlike the two other Bear funds that are being closed, this fund is not leveraged.

Also from Bloomberg: Oddo to Shut Three Funds `Caught Out' by Credit Rout

Oddo & Cie, a French stockbroker and money manager, plans to close three funds totaling 1 billion euros ($1.37 billion), citing the ``unprecedented'' crisis in the U.S. asset-backed securities market.

Oddo said it will wind down the funds within the ``shortest possible time frame'' because of a plunge in prices for collateralized debt obligations, notes backed by other bonds, loans and their derivatives.

Moody's Says Some `Alt A' Mortgages Are Like Subprime

by Calculated Risk on 7/31/2007 04:38:00 PM

From Bloomberg: Moody's Says Some `Alt A' Mortgages Are Like Subprime (hat tip Hong Kong Fuey)

Moody's Investors Service described some so-called Alt A mortgages as no better than subprime home loans, saying it will change how it rates related securities after failing to predict how far delinquencies would rise.

The ratings firm said today its expectations for losses on Alt A mortgages will rise between 10 percent and 100 percent, depending on whether a loan pool has a lot of debt extended to borrowers with low credit scores and little money for down payments. It's also raising loss expectations when borrowers don't fully document their incomes.

``Actual performance of weaker Alt-A loans has in many cases been comparable to stronger subprime performance, signaling that underwriting standards were likely closer to subprime guidelines,'' Marjan Riggi, Moody's senior credit officer, said in a statement. ``Absent strong compensating factors, we will model these loans as subprime loans.''

Moody's said in a separate statement that its expectations for losses on ``option'' adjustable-rate mortgages, part of the Alt A market, would rise even farther. Initial minimum payments on the loans fail to cover the interest borrowers owe, creating growing balances and possible payment spikes.

American Home Mortgage Provides Update

by Calculated Risk on 7/31/2007 01:26:00 PM

Press Release: American Home Mortgage Investment Corp. Provides Update on Liquidity

American Home Mortgage Investment Corp. today reported that it is working diligently to determine how best to resolve the liquidity issues that have recently developed with respect to its business. These issues are primarily the result of the unprecedented disruption now occurring generally in the secondary mortgage market.

American Home Mortgage noted that this disruption has fueled concerns in the market regarding credit risk, causing many market participants to suspend the purchase of loans from a variety of originators including American Home. Accordingly, American Home is currently experiencing a hindering of access to its traditional credit facilities. Additionally, American Home's lenders have initiated margin calls in response to the decline in the collateral value of certain of the Company's loans and securities held in its portfolio. The Company has received and paid very significant margin calls in the last three weeks and has substantial unpaid margin calls pending. Further pressure on the Company's liquidity presently exists due to its warehouse lenders effectively reducing, in this environment, their advance rate on new loans made by the Company.

Based on the foregoing, the Company at present is unable to borrow on its credit facilities and was unable to fund its lending obligations yesterday of approximately $300 million. It does not anticipate funding approximately $450 to $500 million today.

American Home Mortgage emphasized that it is seeking the course of resolution, in this environment, that is least disruptive to its business and to the many thousands of home buyers to whom it has committed to provide mortgages. The Company has retained Milestone Advisors and Lazard to assist in evaluating its strategic options and advising with respect to the sourcing of additional liquidity including the orderly liquidation of its assets.

Case-Shiller: Home prices fall further in May

by Calculated Risk on 7/31/2007 10:34:00 AM

From MarketWatch: Home prices fall further in May, Case-Shiller says

The Case-Shiller 20-city index fell 2.8% compared with a year earlier, S&P said. ... "At a national level, declines in annual home price returns are showing no signs of a slowdown or turnaround," said Robert J. Shiller, chief economist at MacroMarkets LLC., and the co-inventor of the price index.The typical pattern for a housing bust is small steady real price declines over several years, so this is probably just the beginning of the price declines.

The closely watched OFHEO House Price Index is schedule to be released August 30th for Q2.

June Construction Spending

by Calculated Risk on 7/31/2007 09:59:00 AM

From the Census Bureau: June 2007 Construction Spending at $1,175.4 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2007 was estimated at a seasonally adjusted annual rate of $1,175.4 billion, 0.3 percent below the revised May estimate of $1,178.4 billion. The June figure is 2.4 percent (±2.1%) below the June 2006 estimate of $1,204.0 billion.

During the first 6 months of this year, construction spending amounted to $550.0 billion, 3.5 percent below the $570.1 billion for the same period in 2006.

...

[Private] Residential construction was at a seasonally adjusted annual rate of $544.3 billion in June, 0.7 percent below the revised May estimate of $548.3 billion.

[Private] Nonresidential construction was at a seasonally adjusted annual rate of $346.6 billion in June, 0.3 percent above the revised May estimate of $345.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private construction spending for residential and non-residential (SAAR in Billions). While private residential spending has declined significantly, spending for private non-residential construction has been strong.

The second graph shows the YoY change for both categories of private construction spending.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.Over the weekend, the Chicago Tribune reported: Subprime pain spreads into office market

"The downturn in the residential sector has spilled over into the commercial side as the mortgage lenders, title companies, real estate and mortgage brokers shut down or downsize," said Doug Shehan, a senior director at Cushman & Wakefield Illinois Inc.That story describes the normal historical pattern; nonresidential construction spending follows residential. The question is: Will we see the normal pattern?

Over the past several months the contraction of these firms has kept vacancy rates high, rents modest and building sales uncertain, he said.

"It's changed the landscape of the suburban markets dramatically," Shehan said. "Now, what will be the next industry to absorb the space?"

...

But the pain is not restricted to companies in real estate. Businesses that provide their technology, accounting and marketing also might be feeling the pinch, said Faith Ramsour, Cushman's research director.

...

"The ripple effect could be very deleterious because no other industry is growing enough to fill the space," said Geoffrey Hewings, an economics professor and regional job market expert at the University of Illinois.

I think the answer is yes.