by Calculated Risk on 8/03/2007 10:01:00 PM

Friday, August 03, 2007

American Home Mortgage to file for bankruptcy

From Newsday: American Home Mortgage to file for bankruptcy, Strauss sells off shares

American Home is in the process of filing for bankruptcy, senior vice president Tim Neer told about 200 now-former employees around 10:15 a.m. Friday.

...

Later Friday, it was revealed in a filing that founder and chief executive Michael Strauss had sold off almost 3 million shares of company stock on Wednesday for $1.17 a share. The same day he reaped almost $3.5 million, employees had been told in a conference call to stay positive and keep processing loan applications.

Should the Fed cut rates on Tuesday?

by Calculated Risk on 8/03/2007 09:17:00 PM

Our first poll: It is very unlikely that the Fed will cut rates on Tuesday, but should they?

Here are the current Fed Funds Rate Predictions from the Cleveland Fed.

Some economists are suggesting the Fed will move to a neutral bias on Tuesday, from their current view:

"... the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected."Perhaps some people would like to use the comments here to discuss the merits of a Fed rate cut.

Cramer Goes Crazy

by Calculated Risk on 8/03/2007 04:51:00 PM

Cramer: Bernanke, Wake Up

Update: Of course Cramer is wrong. This is a classic credit crunch with rapidly increasing nonprice rationing. Cutting the rate would help a few homeowners, but it is the tightening lending standards for both mortgages and corporate credit (especially junk rated bonds) that are causing the credit crunch.

Cerberus Closes Chrysler, JPMorgan Owns Pier

by Calculated Risk on 8/03/2007 03:59:00 PM

From Bloomberg: DaimlerChrysler Closes Sale of Chrysler to Cerberus

Banks led by JPMorgan Chase & Co. are taking on the remaining $10 billion.The other Chrysler pier owners are Goldman Sachs Group, Bear Stearns, Morgan Stanley and Citigroup. The impact of these "hung" bridge loans on the growing credit crunch is significant.

Note: a bridge loan is supposed to be temporary financing while the banks syndicate the debt. When the debt can't be sold, the bridge loan becomes a "pier loan" - a bridge to nowhere - and ties up the capital of the investment banks.

Fannie and Freddie Limiting the Bailout

by Anonymous on 8/03/2007 02:30:00 PM

Mike Perry, chief executive of mortgage lender IndyMac Bancorp said on Thursday that he got a phone call this week from U.S. Sen. Christopher Dodd, D-Conn., who asked whether Congress can help the U.S. mortgage industry in any way.

"I also have talked to the Chairman of Fannie Mae this morning and have traded calls with the Chairman of Freddie Mac," Perry wrote in a company blog. "Fannie Mae's Chairman (is) telling me that they are 'prepared to step up and help the industry'."

Fannie and Freddie have a Federal charter that requires them to provide liquidity and stability to the mortgage market. However, those organizations made it clear on Friday that any help will be limited.

"Congress is very focused on this issue," Doug Duvall, a spokesman at Freddie Mac, said. "There's a squeeze in the market right now and lenders are tightening their standards. But having a little more prudent underwriting isn't a bad thing. It's important to keep people in their homes and to make sure they buy homes they can afford."

Freddie has pledged to invest $20 billion in new subprime mortgage products, however those loans have to meet much stricter underwriting standards.

Brian Faith, a Fannie Mae spokesman, said the company is "playing an active but prudent role in the effort to stabilize the secondary market."

Fannie has so far refinanced $5.4 billion of formerly subprime mortgages, bought $450 million of state HFA rescue packages and modified terms on more than 20,000 loans, he noted.

"We will continue to work with our lender customers to provide additional liquidity where we can to help stabilize and support the market," Faith added.

However, another person close to Freddie Mac who didn't want to be identified stressed that Fannie and Freddie aren't just going to buy up non-conforming loans to bail out troubled players in the secondary market.

MMI: Intraday Volatility

by Anonymous on 8/03/2007 12:21:00 PM

Bloomberg wipes up the floor with WSJ today. I hope you weren't having lunch.

Credit Brothel Raided, Even Piano Player Not Safe: Mark Gilbert

By Mark Gilbert

Aug. 3 (Bloomberg) -- As the financial-liquidity police raid the credit-market brothel, even the piano player faces arrest. The malaise enveloping global markets is becoming increasingly indiscriminate in choosing its victims. . . .

At least 70 U.S. mortgage companies have shut, gone bust or sold themselves since the start of last year, according to Bloomberg data. As Dennis Gartman, economist and editor of the Suffolk, Virginia-based Gartman Letter, is fond of saying in his research reports, there's never only one cockroach.

Cockroach Counting

What investors have to decide, especially those still confident about the outlook for stocks, is how many cockroaches they are willing to endure before deciding the credit market is cracked, derivatives are doomed, and the economy imperiled.

The credit bordello has enjoyed some wild times in the past few years, luring customers into the room at the back where the exotica are displayed. As the raid ensnares more and more of the regulars, newcomers are likely to become increasingly wary of the derivatives market's wares. And when the piano player is led off to jail, the music stops.

Andrew Davidson on the Securitization Food Chain

by Anonymous on 8/03/2007 08:19:00 AM

Andrew Davidson & Co. generally produces thoughtful stuff; they are a well-known provider of pricing and risk analytics models to the mortgage and securitization industry. This essay attempts to get at the problem of "degrees of separation" of risk in the current industry model, and it arrives at the conclusion that having larger capital stakes at the origination points--skin in the game--would probably help.

In aid of which argument the following graphical illustration is provided:

Every time I look at something like this, I confess, I am less struck by the question "Where's the capital stake?" than I am by the question "How many mouths can a homeowner feed?" Davidson, just as a for instance, provides high-quality software and consulting services. They aren't free. And this chart doesn't even show you the points were the mortgage insurers enter, where due-diligence firms get paid to look at loans, where banks with a trust department serve as document custodians for these securities (for a fee), or all of the other for-profit businesses that have grown up around not just mortgage lending as such, but secondary-market mortgage lending. Tax service contracts, for instance: in a thrift-style lend-and-hold model, you don't need to pay a vendor to track property tax bills for you; you need that if the servicing rights to the loan are going to change hands six times prior to maturity. Every loan needs a "flood hazard determination" to assure that the home isn't in a flood plain, but now you pay incrementally more to get a "transferrable" one. A company called MERS, Inc. exists solely to replace the old-fashioned assignment of mortgages in the old-fashioned county land records with an "electronic registration," the entire demand for which is a function of secondary market sales of loans.

Somebody is paying for all this, and it would be you, the homeowner. You pay part of it in your interest rate; you pay a lot of it in fees and closing costs and prepayment penalties. There's an argument that increasing technological innovation (like MERS, or those transferrable tax service contracts) does make it cheaper for all this to go on, and that you benefit by having "access" to secondary market lenders, who can now afford to take your risk. I'm not interested in arguing that today.

I simply want to point out that "due diligence" is not missing from the chart above, at certain points, because no one thought it necessary. It was missing because subprime borrowers cannot buy overpriced homes and still pay a high enough interest rate that we can afford to have Clayton look at every loan in the deal. Well, not if some fund manager is going to take 2 and 20 we can't.

I've listened to more investor conference calls than I should have, life being as short as it is, and I can tell you that I rarely hear anyone ask if enough money is being spent on "inefficiency" to assure that operational risk is being priced correctly. The usual political response by industry lobbyists to increased regulations is always that the costs of it will be passed on to you, the consumer. It is worth you, the consumer, asking what costs you're already covering.

July Employment Report

by Calculated Risk on 8/03/2007 08:18:00 AM

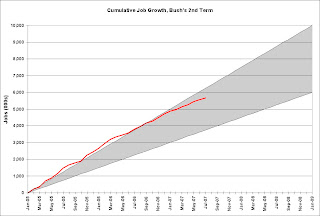

The BLS reports: U.S. nonfarm payrolls rose by 92,000 in June. The unemployment rate was up slightly at 4.6% in July.  Click on graph for larger image.

Click on graph for larger image.

Here is the cumulative nonfarm job growth for Bush's 2nd term. The gray area represents the expected job growth (from 6 million to 10 million jobs over the four year term). Job growth has been solid for the last 2 1/2 years and is near the top of the expected range.

Residential construction employment was flat in July, and including downward revisions to previous months, is down 141.2 thousand, or about 4.1%, from the peak in March 2006. (compare to housing starts off 30%).

Note the scale doesn't start from zero: this is to better show the change in employment.

The ADP report wasn't close to the BLS report this month. ADP estimated private employment grew by only 48K in July, and the BLS reported private employment grew by 120K.

MMI: Gamma Deltas the Alphas With a Beta

by Anonymous on 8/03/2007 07:46:00 AM

Well, it sounds better in Greek. Via Seeking Alpha, I present The Slatin Report:

Led by seismic subprime holdings, the roiling debt markets are casting a pall over the entire real estate sector. And so they should: published reports put the total number of unsold loans sitting in financial institutions' warehouses waiting to be resold at around $260 billion in the US and another $200 billion in Europe. And with investment spigots turning off across the US, that money is going to sit for a while. . . .

Yes, it's quiet out there. Too quiet.

Thursday, August 02, 2007

More on 'Major Changes' in Home Lending

by Calculated Risk on 8/02/2007 06:49:00 PM

Bloomberg covers the IndyMac CEO's letter to employees, and mentions the following lenders: IndyMac, Rivals Make `Major Changes' in Home Lending

National City ... the 16th-largest home lender last year ... In its Aug. 1 notice ... said it won't buy loans that can't be resold to Fannie Mae or Freddie Mac, the two largest mortgage buyers, unless the borrowers' income and assets are fully documented.I expect the impact on home sales, from these 'major changes' in home lending, to show up first in the Census Bureau's August New Home sales report (released in September), but not show up in the NAR's existing home sales report until the September report (released in October).

... Wachovia, the seventh largest home lender, discontinued making Alt A mortgages through brokers because ``it's becoming more difficult to sell these mortgages in the secondary market as the financial markets continue to tighten,'' spokeswoman Christy Phillips-Brown said.

... Wells Fargo & Co., the second-biggest lender, said last week that it would no longer make subprime home loans through brokers, while continuing to make them in a retail channel.

... SunTrust Banks Inc., the 14th largest home lender, has ``pretty much gotten out of Alt A'' for now, said Sterling Edmunds, who heads its mortgage unit.