by Calculated Risk on 10/26/2007 05:23:00 PM

Friday, October 26, 2007

Economist Berson Leaves Fannie Mae, Joins PMI

From PMI: David W. Berson Joins PMI as Chief Economist and Strategist (hat tip Lurker).

I wish Dr. Berson well at PMI, but I'm going to miss his publicly available economic analysis at Fannie Mae. Here is his final Fannie Mae piece: Twenty years of economic, housing, and mortgage market analysis.

Friday, October 26, 2007 marks my retirement from Fannie Mae after almost exactly 20 years (I started on Monday, November 2). Much has changed in the economy, housing, and mortgage finance markets over that time -- but there are many similarities as well. In that 1987 period, the stock market had crashed just two weeks before and analysts weren’t sure if the economy would head into a downturn (or worse) as a result (it didn’t). Today, we have the severe housing downturn and a broadening credit crisis. Will this be the precursor of a downturn? Most economists don’t think so, although we are skirting dangerously close to recession (not that the real GDP numbers show it) and economists are notorious for egregiously missing business cycle turning points (both up and down). The high odds of a downturn (even if not over 50 percent) suggest that households, businesses, and governments should start to make contingency plans for such an event. Another interesting similarity between that late-1980s period and today has been the rise of new, aggressive mortgage products. In the earlier period, we saw a rise of low-documentation lending -- starting out with loan-to-value ratios (LTVs) of less than 70 percent, but over time moving to LTVs of over 90 percent. Additionally, the investor share of purchase originations rose sharply. More recently we have had a plethora of low-doc, no-doc, investor, 2/28 subprime, even more investors, and option ARMs -- arguably more aggressive lending than in the late-1980s. Of course, in late 1987 the housing/mortgage market was still ramping-up with these new mortgage products. Today, we are suffering the downside of overexposure to them (making 2007 perhaps more similar to 1990, in that regard). Ultimately, the lending practices of the late 1980s resulted in an extended period of weakness in home sales, house prices, and mortgage market volumes. We may be in year two of a similar five-year downturn today. (Note that not all of these areas fell for five years in the earlier period, nor are they all likely to decline for five years this time -- but some of them may.)Best wishes to David Berson! Thanks for all the great analysis.

...

And now, in the immortal words of Porky Pig, “that’s all folks!”

emphasis added

Record California Foreclosure Activity

by Calculated Risk on 10/26/2007 02:35:00 PM

From DataQuick: Record California Foreclosure Activity

Lenders started formal foreclosure proceedings on a record number of California homeowners last quarter, the result of declining home prices, sluggish sales and subprime mortgage distress, a real estate information service reported.It's hard to imagine, but next year will probably be worse.

A total of 72,571 Notices of Default (NoDs) were filed during the July-to-September period, up 34.5 percent from 53,943 during the previous quarter, and up 166.6 percent from 27,218 in third-quarter 2006, according to DataQuick Information Systems of La Jolla.

Last quarter's default level passed the previous peak of 61,541 reached in first-quarter 1996. A low of 12,417 was reached in third-quarter 2004. An average of 34,781 NoDs have been filed quarterly since 1992, when DataQuick's NoD statistics begin.

"We know now, in emerging detail, that a lot of these loans shouldn't have been made. The issue is whether the real estate market and the economy will digest these over the next year or two, or if housing market distress will bring the economy to its knees. Right now, most California neighborhoods do not have much of a foreclosure problem. But where there is a problem, it's getting nasty," said Marshall Prentice, DataQuick's president.

Half the state's default activity is concentrated in 293 zip codes, almost all of which are in the Inland Empire and Central Valley. Grouped together, those zip codes saw year-over-year home price increases that reached 34.0 percent in first quarter 2005. Prices peaked in third-quarter 2006 at $399,000. Last quarter's median of $352,250 is 11.7 percent off that peak.

...

Most of the loans that went into default last quarter were originated between July 2005 and September 2006. The median age was 18 months. Loan originations peaked in August 2005. The use of adjustable-rate mortgages for primary purchase home loans peaked at 77.8% in May 2005 and has since fallen.

Because a residence may be financed with multiple loans, last quarter's 72,751 default notices were recorded on 68,746 different residences.

Census Bureau: Vacancy Rates Stable in Q3

by Calculated Risk on 10/26/2007 01:57:00 PM

From the Census Bureau on Residential Vacancies and Homeownership

National vacancy rates in the third quarter 2007 were 9.8 percent for rental housing and 2.7 percent for homeowner housing, the Department of Commerce’s Census Bureau announced today. The Census Bureau said the rental vacancy rate was not statistically different from the third quarter rate last year, or the rate last quarter. For homeowner vacancies, the current rate was higher than a year ago (2.5 percent), but was not statistically different than the rate last quarter (2.6 percent). The homeownership rate at 68.2 percent for the current quarter was lower than the third quarter 2006 rate, but was not statistically different from the rate last quarter.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, but it does appear the vacancy rate has stabilized.

This leaves the homeowner vacancy rate almost 1% above normal, or about 750 thousand excess homes.

The rental vacancy rate has been trending down slightly for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.

The rental vacancy rate has been trending down slightly for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. This would suggest there are about 600 thousand excess rental units in the U.S. that need to be absorbed.

This suggests there are about 1.35 million excess housing units in the U.S. that need to be worked off over the next few years. These excess units will keep pressure on housing starts for some time.

Snow on MLEC

by Anonymous on 10/26/2007 12:00:00 PM

While we're on the subject of "price discovery," it appears that former Treasury Secretary Snow isn't impressed by Sivvie Mac ("The Knife"):

WASHINGTON, Oct 26 (Reuters) - Former U.S. Treasury Secretary John Snow on Friday said a proposed multibillion-dollar fund assembled by top banks to prevent a fire sale of shaky debts may cause problems by delaying inevitable losses.Is anyone else enjoying the spectacle of Snow sounding smarter than Paulson?

"We've got all this paper out in the system, and my inclination is to say, let's accelerate the price discovery process on this paper," Snow said on CNBC Television.

"We know that when you prop things up artificially -- Japan -- we know when you prop things up artificially -- the (savings and loans) in the United States -- you get bigger adverse consequences," said Snow, the immediate predecessor of current Treasury Secretary Henry Paulson.

Snow, now chairman of private equity firm Cerberus Capital Management, said he has not discussed the fund with Paulson.

Moody's Cuts Ratings on CDOs

by Calculated Risk on 10/26/2007 11:57:00 AM

From Bloomberg: Moody's Cuts Ratings on CDOs Tied to Subprime Bonds (hat tip Robert)

Moody's ... cut the ratings of collateralized debt obligations tied to $33 billion of subprime mortgage securities, a decision that may force owners to mark down the value of their holdings.

Securities from at least 45 CDOs were either cut or put under review, according to news releases sent by the New York- based ratings company.

AHM v. LEH: The Revenge of Mark to Model

by Anonymous on 10/26/2007 11:47:00 AM

This is killing me:

PHILADELPHIA (Dow Jones/AP) - Bankrupt lender American Home Mortgage Investment Corp. has sued Lehman Bros., accusing the investment bank of essentially stealing from the company as it struggled to stay on its feet.That's an interesting theory of levering up your "assets": if the market says "no bid," you apparently get "no mark" and therefore "no call" and hence "no bankruptcy."

The lawsuit, filed Wednesday in the U.S. Bankruptcy Court in Wilmington, Del., accuses Lehman Bros. of hitting American Home with improper margin calls in July and demanding money the company says it did not owe.

When the Melville, N.Y.-based lender couldn't meet Lehman's second margin call, for $7 million, Lehman foreclosed on $84 million worth of subordinated notes issued in American Home's structured-finance operation. . . .

American Home is relying in part on the frozen market for mortgage-industry paper to make its case against Lehman Bros. Without actual trades to show the value of the notes had declined, American Home argues that Lehman Bros. should have obtained an independent valuation before issuing the margin call.

The thing is, in a nutshell, that AHM was using these borrowings to fund new mortgage origination operations. A "frozen market for mortgage-industry paper" means no money to make new loans with (proceeds from sales of commercial paper backed by the warehouse of held-for-sale loans) until you can sell the loans you've already made. But you can't sell the loans you've already made, unless you want to take a nasty hit on them, because nobody's buying decent whole loans in a "frozen market," and there is excellent reason to think AHM's warehouse held a boatload of not exactly decent loans. We know this because AHM was forced to visit the confessional about its massive number of buybacks of loans that didn't make the first three payments sucessfully.

So Lehman wanted out of its exposure to AHM's held for sale pipeline, as far as I can tell, because unlike your usual "pipeline," this one was a pipe to nowhere (kind of like the bridge to nowhere). It sounds like AHM is now saying that Lehman made up some ugly mark to model valuation instead of getting "independent" verification of the fact that there were no bids--or horrible ones--for the AHM loans. I guess the fact that AHM couldn't get 'em sold in the first place, which is the whole point of having a "held for sale pipeline," is insufficient evidence that the stuff was worthless.

I look forward to hearing about Lehman's response to this.

(Many thanks to the indefatiguable Clyde)

Countrywide reports $1.2 billion loss

by Calculated Risk on 10/26/2007 09:13:00 AM

From MarketWatch: Countrywide reports $1.2 billion loss

... mortgage lender Countrywide Financial Corp. reported Friday its first quarterly loss in 25 years ...

The Company ... said it has also negotiated $18 billion in additional liquidity that it characterized as "highly reliable." Countrywide also said it expects to turn a profit in the fourth quarter and in 2008. ...

Its mortgage-banking business suffered a $1.3 billion loss in the latest quarter.

...

"We view the third quarter of 2007 as an earnings trough, and anticipate that the company will be profitable in the fourth quarter and in 2008," Sambol said.

Countrywide said it took losses and write-downs of about $1 billion on non-agency loans and mortgage-backed securities. Moreover, The company increased its loan-loss provisions on its held-for-investment portfolio to $934 million, up from $293 million in the second quarter.

The lender also raised its estimates of future defaults and charge-offs due to a worsening housing market, higher delinquencies and tighter credit. Countrywide plans to cut between 10,000 and 12,000 workers by the end of the year as a result of plunging origination volume.

...

The company said it expects the housing market to continue to weaken in the near term, and unless interest rates head lower, it sees lower mortgage originations through 2008.

Thursday, October 25, 2007

Analyst: AIG may take $9.8B Hit

by Calculated Risk on 10/25/2007 08:30:00 PM

From MarketWatch: AIG may take $9.8 bln subprime hit, analyst says

American International Group could take a $9.8 billion hit from its exposure to subprime mortgages, Friedman, Billings, Ramsey analyst Bijan Moazami estimated on Thursday.This was the big rumor today.

The write-downs will be big, but manageable...

BoA Exits Wholesale Mortgage Business

by Anonymous on 10/25/2007 06:15:00 PM

Mr. Lewis is not a happy camper:

CHARLOTTE, N.C. - In addition to scaling back its investment banking operations, Bank of America Corp. is exiting the wholesale mortgage business and eliminating about 700 jobs, bank officials said Thursday.Hey, I can relate, Ken. These days nobody likes being a servicer . . .

The nation's second-largest bank will stop offering home mortgages through brokers at the end of the year to focus on direct-to-consumer lending through its banking centers and loan officers. The move also eliminates the jobs in the bank's consumer real estate unit. . . .

The cuts are part of a 3,000-job reduction engineered by Chief Executive Ken Lewis after the nation's second-largest bank reported a huge decline in third-quarter earnings.

"When Ken talks about a top-to-bottom review in five days time, you can't make that happen. These cuts were in the works, and expect more," said Tony Plath, an associate professor of finance at the University of North Carolina at Charlotte. "Don't underestimate the depth of Lewis' disappointment in earnings. This guy is pissed." . . .

"Ken says he likes the retail business, he likes getting to know customers, underwriting, and managing his risk," said Plath, the university professor. "He just doesn't like the securitization and servicing sides of the business."

Up to $4 Trillion Decline in U.S. Household Real Estate Value Predicted

by Calculated Risk on 10/25/2007 01:41:00 PM

Update: Dean Baker says maybe up to$8 Trillion. (hat tip Lindsey)

Last week, in the comments, I noted that some economists were predicting financial losses of $100 Billion from the mortgage crisis. I joked that maybe they dropped a zero - and I also noted that that estimate didn't include the $2 Trillion or more that will be lost in U.S. household net worth.

The NY Times had an article this morning that provided new estimates for these losses: Reports Suggest Broader Losses From Mortgages.

Note: Tanta excerpted part of the same NY Times article this morning on Foreclosure Predictions.

The article includes these projections of financial and household losses:

... economists say the troubles in the mortgage market could, all told, cost financial firms and investors up to $400 billion.These unnamed economists didn't add a zero - yet - to the earlier projections, but they are getting closer!

That is far more than the roughly $240 billion cost, adjusted for inflation, of the savings and loan crisis of the early 1990s, according to estimates of the combined financial toll of that crisis on both the federal government and private sector. The loss in total real estate wealth is expected to range from $2 trillion to $4 trillion, depending on how far home prices fall, according to several economists.

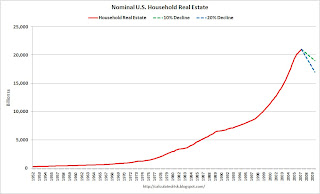

Let's look at these projected U.S. household real estate losses. Currently (end of Q2) U.S. household real estate was valued at $20.997 Trillion (Fed: Flow of Funds report). So a $2 Trillion dollar loss is about a 10% decline in total U.S. household real estate value. A $4 Trillion dollar loss is a 20% decline.

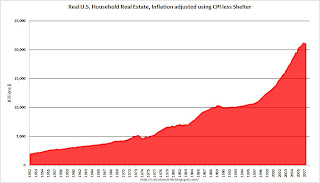

Click on graph for larger image.

Click on graph for larger image.This graph shows the real (inflation adjusted using CPI less Shelter) value of U.S. household real estate since 1952. The real value increases because new homes are built each year, older homes are improved, and, in general, the value of land increases (especially in dense areas) faster than the rate of inflation.

Even adjusted for inflation, the value of U.S. household real estate increased sharply in recent years.

The second graph shows the nominal value (not adjusted for inflation) of U.S. household real estate. This is useful because the $2 Trillion to $4 Trillion in potential losses described in the article are nominal values.

Just to put these numbers into perspective, I've plotted the two declines - $2 Trillion and $4 Trillion - assuming the price declines happen between now and the beginning of 2010. Note that this doesn't add in any new homes or home improvement.

A decline of this magnitude in U.S. household real estate value seems very possible.