by Calculated Risk on 11/05/2007 04:20:00 PM

Monday, November 05, 2007

Commercial Real Estate Update

With the release of the Fed Loan Survey, we have further evidence of a possible Commercial Real Estate (CRE) slump. Click on graph for larger image

Click on graph for larger image

This graph shows the YoY change in nonresidential structure investment (dark blue) vs. loan demand data (red) and CRE lending standards (green, inverted) from the Fed Loan survey.

The net percentage of respondents tightening lending standards for CRE has risen to 50%. (shown as negative 50% on graph).

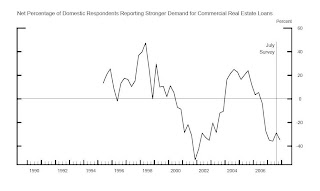

The net percentage of respondents reporting stronger demand for CRE has fallen to negative 34.6%.

Loan demand (and changes in lending standards) lead CRE investment for an obvious reason - loans taken out today are the CRE investment in the future. This report from the Fed suggests a slowdown in CRE investment in the near future.

Data Source: Net Percentage of Domestic Respondents Reporting Stronger Demand for Commercial Real Estate Loans

Fed: October 2007 Senior Loan Officer Opinion Survey

by Calculated Risk on 11/05/2007 02:57:00 PM

From the Fed: The October 2007 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, domestic and foreign institutions reported having tightened their lending standards and terms on commercial and industrial (C&I) loans over the previous three months. ... Both domestic and foreign institutions noted weaker demand for commercial real estate loans over the past three months. In the household sector, domestic banks reported, on net, tighter lending standards and terms on consumer loans other than credit card loans, as well as tighter lending standards on prime, nontraditional, and subprime residential mortgages over the survey period. Lending standards on credit card loans were, by contrast, little changed. Demand for residential mortgages and consumer loans of all types had reportedly weakened, on net, over the past three months.

Click on graph for larger image.

Click on graph for larger image.This graph from the Fed shows loan demand for CRE loans. Clearly demand is weak, and lenders are tightening standards. (more later on CRE).

More charts here for residential mortgage, consumer loans and C&I.

Fitch: Credit Uncertainty May Spread Further

by Calculated Risk on 11/05/2007 02:05:00 PM

Fitch Press Release: Credit Uncertainty May Begin Affecting U.S. Non-Mortgage ABS

U.S. structured finance sectors that have so far been immune to the subprime market troubles may show signs of vulnerability due to rising uncertainty about credit conditions, along with income and employment prospects, according to Fitch Ratings in its latest Credit Action Report.Maybe Fitch should have just checked with Professor Roubini: The bloodbath in credit and financial markets will continue and sharply worsen

'Economic growth was strong during the third quarter in spite of housing and credit market weakness, but tighter credit conditions will likely put a damper on consumer spending and lead to a deteriorating labor market outlook,' said Director Kevin D'Albert. 'Additionally, increased uncertainty about income and employment prospects may put a crimp in consumer spending, which in turn may adversely affect various consumer ABS segments.'

For the time being, however, non-mortgage ABS remains resilient as performance in prime segments is expected to remain positive through early part of next year, though subprime auto and credit card ABS may be under the microscope with delinquencies and losses expected to rise. Elsewhere, strong fundamentals are still evident in U.S. CMBS as performance remains strong, though Fitch also expects an uptick in delinquencies in 2008 (albeit off of historical lows) in part due to less available capital.

... calling this crisis a sub-prime meltdown is ludicrous as by now the contagion has seriously spread to near prime and prime mortgages. And it is spreading to subprime and near prime credit cards and auto loans where deliquencies are rising and will sharply rise further in the year ahead. And it is spreading to every corner of the securitized financial system that is either frozen or on the way to freeze: CDOs issuance is near dead; the LBO market – and the related leveraged loans market – is piling deals that have been postponed, restructured or cancelled; the liquidity squeeze in the interbank market – especially at the one month to three months maturities - is continuing; the losses that banks and investment banks will experience in the next few quarters will erode their Tier 1 capital ratio; the ABCP and related SIV sectors are near dead and unraveling; and since the Super-conduit will flop the only options are those of bringing those SIV assets on balance sheet (with significant capital and liquidity effects) or sell them at a large loss; similar problems and crunches are emerging in the CLO, CMO and CMBS markets; junk bonds spreads are widening and corporate default rates will soon start to rise. Every corner of the securitization world is now under severe stress, including so called highly rated and “safe” (AAA and AA) securities.What happened to containment?

Citigroup: $134.8 billion in 'level 3' assets

by Calculated Risk on 11/05/2007 11:00:00 AM

From MarketWatch: Citigroup reports $134.8 billion in 'level 3' assets

Citigroup Inc. ... said its so-called level 3 assets as of Sept. 30 were $134.84 billion. Level 3 assets are holdings that are so illiquid, or trade so infrequently, that they have no reliable price, so their valuations are based on management's best guess.From the Citi 10-Q:

Level 3—Model derived valuations in which one or more significant inputs or significant value drivers are unobservable.(emphasis in report)

More Citi

by Calculated Risk on 11/05/2007 12:23:00 AM

From Vikas Bajaj at the NY Times: Bankers’ Lesson From Mortgage Mess: Sell, Don’t Hold

Bankers on Wall Street frequently describe themselves as being in the moving and not the storage business. They make money by trading stocks and bonds, not by owning them.Bajaj goes on to describe how Merrill and Citigroup kept many CDOs on their balance sheets, waiting for better prices.

In the last week, top executives at two of the world’s largest banks, Citigroup and Merrill Lynch, have come under scrutiny for ignoring that fundamental principle.

“A lot of us were scratching our heads wondering ‘Where did these bonds go,’” said a banker at a rival institution who was not authorized to speak publicly.The banks didn't realize there was a systemic problem not captured by their historical models - falling house prices - and diversification doesn't reduce this risk.

“They just sat on them, putting them here or there on the balance sheet. They thought they were going to be O.K.”

C.D.O.’s were created on the premise that managers could lower the risks of default by investing in loans made by different companies and dispersed across the country. The notion that one could lower risk by diversifying, and including a small reserve of cash, was supported by historical patterns and allowed the bonds issued by C.D.O.’s to earn higher ratings than the bonds they owned, said Mark Adelson, an independent analyst and consultant.This brings us back to the key sentence in Citi's Press Release: Citi's Sub-Prime Related Exposure in Securities and Banking

...

“The notion that you could be really diversified because some of your production had an Option One name and some had the New Century name and some had the Ameriquest name seems absurd,” he said referring to mortgage companies that specialized in risky home loans.

... fair value of these super senior exposures is based on estimates about, among other things, future housing prices ...Perhaps Citi should release their forecast for house prices so we can see if the $8B to $11B writedown is sufficient.

Also note that many of the IBs (especially Citi) might be making a similar mistake - being in the "storage business" - by keeping the LBO related pier loans on their balance sheets while waiting for better prices.

Sunday, November 04, 2007

Citi: additional $8 billion to $11 billion in writedowns

by Calculated Risk on 11/04/2007 07:47:00 PM

From WSJ: Charles Prince Resigns As Citi CEO, Chairman

Meanwhile, Citigroup is poised to report billions of dollars in additional writedowns on mortgage-related securities, according to people familiar with the matter. Estimates of the writedowns ranged from $8 billion to $11 billion. That would far surpass the roughly $2.2 billion in mortgage-related writedowns and trading losses that Citigroup reported in its third-quarter earnings last month.ADDED: Here is the press release: Citi's Sub-Prime Related Exposure in Securities and Banking

Citigroup Inc. (NYSE: C - News) announced today significant declines since September 30, 2007 in the fair value of the approximately $55 billion in U.S. sub-prime related direct exposures in its Securities and Banking (S&B) business. Citi estimates that, at the present time, the reduction in revenues attributable to these declines ranges from approximately $8 billion to $11 billion (representing a decline of approximately $5 billion to $7 billion in net income on an after-tax basis).

These declines in the fair value of Citi’s sub-prime related direct exposures followed a series of rating agency downgrades of sub-prime U.S. mortgage related assets and other market developments, which occurred after the end of the third quarter. The impact on Citi’s financial results for the fourth quarter from changes in the fair value of these exposures will depend on future market developments and could differ materially from the range above.

Citi also announced that, while significant uncertainty continues to prevail in financial markets, it expects, taking into account maintaining its current dividend level, that its capital ratios will return within the range of targeted levels by the end of the second quarter of 2008. Accordingly, Citi has no plans to reduce its current dividend level.

The $55 billion in U.S. sub-prime direct exposure in S&B as of September 30, 2007 consisted of (a) approximately $11.7 billion of sub-prime related exposures in its lending and structuring business, and (b) approximately $43 billion of exposures in the most senior tranches (super senior tranches) of collateralized debt obligations which are collateralized by asset-backed securities (ABS CDOs).

Lending and Structuring Exposures

Citi’s approximately $11.7 billion of sub-prime related exposures in the lending and structuring business as of September 30, 2007 compares to approximately $13 billion of sub-prime related exposures in the lending and structuring business at the end of the second quarter and approximately $24 billion at the beginning of the year.1 The $11.7 billion of sub-prime related exposures includes approximately $2.7 billion of CDO warehouse inventory and unsold tranches of ABS CDOs, approximately $4.2 billion of actively managed sub-prime loans purchased for resale or securitization at a discount to par primarily in the last six months, and approximately $4.8 billion of financing transactions with customers secured by sub-prime collateral.2 These amounts represent fair value determined based on observable transactions and other market data. Following the downgrades and market developments referred to above, the fair value of the CDO warehouse inventory and unsold tranches of ABS CDOs has declined significantly, while the declines in the fair value of the other sub-prime related exposures in the lending and structuring business have not been significant.

ABS CDO Super Senior Exposures

Citi’s $43 billion in ABS CDO super senior exposures as of September 30, 2007 is backed primarily by sub-prime RMBS collateral. These exposures include approximately $25 billion in commercial paper principally secured by super senior tranches of high grade ABS CDOs and approximately $18 billion of super senior tranches of ABS CDOs, consisting of approximately $10 billion of high grade ABS CDOs, approximately $8 billion of mezzanine ABS CDOs and approximately $0.2 billion of ABS CDO-squared transactions.

Although the principal collateral underlying these super senior tranches is U.S. sub-prime RMBS, as noted above, these exposures represent the most senior tranches of the capital structure of the ABS CDOs. These super senior tranches are not subject to valuation based on observable market transactions. Accordingly, fair value of these super senior exposures is based on estimates about, among other things, future housing prices to predict estimated cash flows, which are then discounted to a present value. The rating agency downgrades and market developments referred to above have led to changes in the appropriate discount rates applicable to these super senior tranches, which have resulted in significant declines in the estimates of the fair value of S&B super senior exposures.

Damaged REOs in Las Vegas

by Calculated Risk on 11/04/2007 12:28:00 PM

From the Las Vegas Review-Journal: Foreclosure Fallout: Home Sour Home

Housing crisis leads some former owners, tenants to take anger out on property

...

As many as 25 percent of Las Vegas' bank-foreclosed homes suffer intentional damage, according to an informal R-J survey of valley appraisers and real estate agents. According to Thomas Blanchard, owner/broker of First Realty Group, this damage -- most of which is inflicted in the four to 12 months between the notice of default and the constable's knock at the door -- typically requires $3,000 to $10,000 to repair. However, it can approach or exceed 10 percent of a home's total value.

This is a video I found of a vandalized REO in Las Vegas."Some of the time, the house's worth is a detriment to the land value," says Blanchard. "It's amazing what some people will do to their houses." |

Housing Price Correction Calculator

by Calculated Risk on 11/04/2007 11:12:00 AM

From Kevin at the Baltimore Housing bubble:

This months edition of Fortune Magazine (November 12, 2007) had a great article on housing called How Low Can They Go? by Shawn Tully (no online link available yet, but I’ll modify post once it is). It combined extensive analysis of 54 metro housing markets with the combined work of Moody’s Economy.com, Fortune Analysts, PPR, & NAR. The basis of the article was to provide a snapshot of what the future of housing will look like in 5 years from June 2007. They determined a correction value (sometimes positive) by comparing present day price to rent ratios with the average of the past 15 years.Kevin has developed a spread sheet (download here) based on the numbers for all 54 metro housing markets from the Fortune article.

Instructions on how to use the calculator are in the file and you will be able to modify to be bullish or bearish on how the next 5 years play out.Here is Kevin's post: Price Correction Calculator. He would appreciate any feedback. Enjoy.

NY Times: Rubin Likely Interim Citi Chairman

by Calculated Risk on 11/04/2007 12:27:00 AM

From the NY Times: Ex-Treasury Chief to Fill In as Chairman at Citigroup

Citigroup’s board is highly likely to name Robert E. Rubin ... as its interim chairman at an emergency meeting today ...Waiting for the news ...

Saturday, November 03, 2007

Mortgage Risk Perception

by Anonymous on 11/03/2007 12:12:00 PM

Good morning, everyone. I slept better than Citicorp's board did last night. But didn't we all?

Yves at naked capitalism has an interesting post up this morning on risk perception. The text is this essay, "Researchers study how people think about what is and isn't risky," at PhysOrg.com, which takes as its point of departure the question of why people live in fire-hazard areas like Disneyland. And thereabouts.

I was struck by this paragraph:

Researchers found people link perceived risk and perceived benefit to emotional evaluations of a potential hazard. If people like an activity, they judge the risks as low. If people dislike an activity, they judge the risks as high. For example, people buy houses or cars they like and find emotionally attractive, then downplay risks associated with the purchase.Without having seen the original research, I can't tell if the word "activity" here is meant literally or is simply infelicitous phrasing. My intuition, at least, is that what people like in the above examples is more usefully described as a state of being rather than an activity: people like owning nice homes and cars, not the activity of purchasing homes and cars. In fact, my intuition is that on the whole most people seriously dislike at least certain parts of the activity of purchasing such things. It is only the emotional lure of getting past the purchasing activity that keeps them going.

Anyone who has purchased a home knows that once you get past the early steps--perusing the McMansion porn in the Sunday papers, touring the open houses with a flattering, obsequious real estate agent--it gets to unpleasantries like contracts, inspections, lawyers, financing. Recreational home shopping certainly exists as a phenomenon, as any disappointed broker or home seller will tell you, but recreational home buying is certainly rare. It's just not like whipping out the Visa to snap up another pair of Nikes that you don't really need. Not even the most devoted flipper or serial homebuyer can pull that off every weekend.

I bring this up because I have contended, for some time now, that it is a mistake to see lowering of credit standards as the only real problem we've had going in the mortgage industry lately. It is the attempts to make the process of financing or refinancing a home quick and "painless" that is at the root of the problem. Certainly part of the way you make it "painless" is by relaxing credit standards; these things are related. But the important effect is that borrowers no longer feel put under a microscope (or a proctoscope, as those who borrowed mortgage money ten years or more ago are likely to describe it).

How does that change a prospective mortgagor's perception of the risk of buying a home or refinancing an existing mortgage? It doesn't seem unreasonable to conclude that making the activity less intrusive, in the borrower's subjective experience of it, means that the borrower is less likely to take seriously the written disclosures that describe the risks.

Back when the mortgage process was a great deal more "intrusive," borrowers used to complain bitterly about it. This perception of "intrusiveness" didn't arise simply in the matter of the borrower's credit and financial history; borrowers would routinely moan about lenders "interfering" in sales contracts. Why does some appraisal matter? I should be able to pay whatever I decide the property is worth. Why should the lender delve into my "side agreements" with the seller? Why should the lender be able to delay closing over incomplete items? If I don't care whether the driveway is done or the sod laid, why should the lender care?

The usual lender retort was always that you're doing all these things with someone else's money, and that you pay a lower interest rate for secured money than for unsecured money, implying that the lender has to care as much about the quality of the collateral as about the quality of the borrower. Don't like the lender's view of your collateral? Put it on the Visa; Visa doesn't care what you buy with the loan proceeds. But one of our most powerful ripostes, particularly in the case of cash-out refinances, was the old "paternalistic" standby: you are hocking the roof over your family's head! Take this seriously, will you?

Of course all of that lender "interference" and borrower complaining made for some tense, unpleasant transactions for both sides. And since no "sales oriented culture," which is what even depository mortgage lending operations became once the consultants got done with us, can stand to have unpleasantness, we began easing up on precisely those credit and collateral processing standards that drew the most complaints.

I've heard a number of folks argue that the genesis of recent wretched lending standards is the growth, over the last 20 years or so, of "affordable lending" programs, as if those efforts, led mostly by HUD and the GSEs, to put first-time homebuyers in low-down programs were the main impetus, a number of years later, for stated wage-earner programs using an AVM to offer 1-hour approval for a 95% LTV cash-out refinance on a jumbo property. There may be some truth to the idea that the success of older affordable housing programs was used as a justification for letting subsequent homebuyers and current homeowners do any stupid thing they wanted to do, but to argue that none of it would have happened if those "government" programs hadn't existed is to display one's political biases.

The fact is that those older "government" programs were the most "intrusive," "red-tape"-laden loans that have ever existed. FHA and the GSEs steadily lost market share in the purchase-money mortgage business over the last seven to ten years, as did the private mortgage insurers, even in those markets in which loan amount limits weren't an issue, and even when the rates on their products (30-year fixed) were highly competitive and attractive. "Private" programs were being developed to meet a fairly specific "need," encapsulated by the name of the famous Countrywide product, "Fast and Easy."

I think you can argue that consumers paid more attention to disclosures, spent more time reading documents, and generally proceeded with more fearfulness when things were "Slow and Difficult." It's not because they used to be smarter or we used to disclose more; in fact, just about every year the number and timing of mortgage- and RE-related disclosures has increased in the last two decades. But because the activity of getting a mortgage was painful, the seriousness with which borrowers viewed the risks of it was heightened.

This implies that more disclosure, or more vivid disclosure, is not the answer. We have to go back to a mortgage process that is, intellectually and emotionally, commensurate with its risks. This position can easily be mocked as a suggestion that we do our civic duty by providing wretched customer service. Of course you have to argue, rather than merely assert, that "good customer service" includes removing all visible traces of risk assessment from the process. Nobody is saying you should be rude when you demand those W-2s, or that you should "forget" to ask for them up front, and badger some borrower the day before closing about it. At least one of us is willing to say that that kind of half-assed "customer service" is most likely to thrive precisely in an environment in which our view of risk analysis is totally incoherent to start with.

There's a perfectly silly e-mail making the rounds, asking people to sign a petition opposing H.R. 3519, which the authors of the petition believe would outlaw yield spread premiums (money paid to a broker in exchange for a customer taking a higher rate). The unproven assertion is that all YSP is used to "pay" the borrower's closing costs via a credit, and therefore outlawing YSP would make loans more expensive to consumers. (Yes, the "closing costs" that are "paid" by the YSP include the broker's fees. This is different from the broker just taking YSP from the wholesaler in cash and not charging its compensation in the closing costs because.) It's really a lovely composition, purporting to be from "President" of mortgage company, not third-grader of Mother Khazakstan:

I need all the help I can get this morning. We have U.S. House of Representatives that are considering changing law that would eliminate the use of yield spread premiums in the mortgage place. This bill, H.R. 3915 will affect every one of us weather you are in the mortgage industry or if you are a consumer. This will allow the banks to take full control of all pricing and products available to all Americans. This would make it impossible for third party mortgage loan origination, which would reduce the number of real estate transactions for attorneys, appraisers and home inspectors. This bill would make it impossible for anyone to negotiate an interest rate with lower closing costs associated with the loan or if a borrower has credit issues may not get a loan at all.Nobody is asking what the effect on consumer perception of risk is in a situation in which not only is no cash down payment required for a purchase, no actual cash outlay for closing costs on a refi is required. It is unpleasant to cough up even a token contribution toward closing costs in actual cash. But that moment of concentration of the mind--writing a check for a thousand or two to a mortgage lender--has been eliminated from the process. It really isn't that the financial facts of this are not disclosed: the TILA disclosures do pretty clearly show the effect on APR of these "no cost" deals. But people do not perceive that "real money" is at risk when they are not asked to pay "real money" in order to close the transaction.

Back in the old days, we referred to that deposit that a property seller requires before signing a sales contract as "earnest money." As in, proof that the buyer is in earnest about going through with the transaction, as it was nonrefundable. Earnest money weeds out recreational and impulse buyers, and also forces serious buyers to pay attention to the process. (It appears to have little effect on manic speculators, but how manic do speculators get when 20% down payments are required on non-owner-occupied properties?)

Removing all the unpleasantness as well as the cash outlays from mortgage transactions, and speeding them up enough to seriously cut into the "cooling off period," is like removing earnest money from RE transactions. I seriously doubt that any study of consumer ability to read and comprehend mortgage loan disclosures is going to tell us anything useful, unless and until the researchers can find a way to approximate stakes for it: the experimental subjects need to have the emotional pull (buying the house, getting the cash) as well as the emotional push (you forfeit your privacy, your time, and a hefty check in the process). It would be enlightening to see a control group with the pull but not the push (no docs required, 1-hour approval, no cash fees). My guess is that more people can spot the difference between the APR and the "payment rate" on an Option ARM if you tell them they forfeit $1,000, payable immediately in cash, if they get the wrong answer, than if they face a monthly payment that is $5.00 higher (because the $1,000 is financed in the loan).

There really isn't anything you can do about the pull: as long as people like to own homes--this isn't an intellectual matter at this level--the pull will be there, as it will be for that big fat check you get in a cash-out. There isn't any particular reason for people not to enjoy those things. My point is that you can waive disclosure documents in front of people all day long, but if the pull is strong enough and the process is so painless that there is no countervailing pain in the activity of getting what you want, the disclosures will strike people as involving remote, rare, manageable risks if they bother to read them at all.

There is some evidence to suggest that borrowers don't actually read them, based on oral representations by interested parties that they are "just legalese": a perfect illustration of an attempt to make the homebuying or refinancing process "painless" (don't subject yourself to the unpleasantness of having to read awkwardly-written, math-heavy documents). A common sense response to this is to make the first disclosure a one-sentence form in 36-point boldface on neon orange paper that says "ANYONE SUGGESTING THAT YOU NOT READ EVERY WORD OF EVERY DOCUMENT YOU SIGN 24 HOURS PRIOR TO CLOSING IS NOT YOUR FRIEND AND IS TRYING TO MAKE MONEY OFF OF YOUR FOOLISHNESS AND IS VIOLATING FEDERAL LAW." But if you did that, you would, well, be taking the "Fast and Easy" part out of the whole transaction.

I expect, by the way, that a real-world example of this dynamic is underway around some preternaturally-waxed conference table in some climate-controlled high-rise office building in New York as we speak. The risk of all those CDOs was undoubtedly presented in the board packets, but the CEO assured the board members that it was just a bunch of "legalese."