by Calculated Risk on 11/14/2007 11:16:00 AM

Wednesday, November 14, 2007

Retail Sales Slowed in October

A couple of quotes ...

From the WSJ: Consumers ‘Hanging on for Dear Life’

The report was weaker than anticipated due to a significant downward revision to August ... The retail sales report often contains some sizeable revisions, but a 0.4 percentage point adjustment to the two months back reading is unusually large. In this case, the revision was not concentrated in any single category — it was scattered across almost every component… The consumer is facing the twin headwinds associated with high energy costs and a negative wealth effect tied to lower housing prices. One of the keys going forward will be whether the labor market continues to provide sufficient income support to prevent too much of a slide in consumer demand. –Morgan Stanley ResearchFrom the National Retail Federation: Consumer Spending Continues to Show Restraint

“Gas prices and other economic issues are beginning to have an effect on consumer spending,” said NRF Chief Economist Rosalind Wells. “While spending did increase in many important areas such as apparel and electronics, the consumer is showing caution while spending.”Here is the Census Bureau report for October.

Deutsche Bank FC Problems and Revenge of the Nerd

by Anonymous on 11/14/2007 09:30:00 AM

I have been asked literally dozens of times in comments of this blog, in emails, and even in posts on other blogs, to comment on this post on I am Facing Foreclosure.Com regarding the dismissal of a foreclosure suit filed by Deutsche Bank. I will tell you right now that it's just too hard to know where to begin: that blog post is so badly written that I don't even know exactly what facts are being alleged to be in evidence. Sorry, but these folks let their outrage run ahead of their reportage, and the result is chaos. So I'm not going to opine on the subject of whether this is an "important" court ruling unless and until one of our kind readers with PACER access emails me a copy of the Order in question. If someone does that, I promise I will make every possible effort to understand it and report back to you all.

Until then, I intend to amuse you (or perhaps just myself) with a story. The first point of this little exercise is to convince you that sometimes things happen because somebody screwed up a bit of paperwork; it is not always a case of things happening because of Organized Predatory Conspiracy to Defraud mortgagors. The second point is to indulge myself in a few minutes of childish vindication of my years spent as Detail Obssessed Literal-Minded Small Picture Pain in the Ass Who Doesn't Play Ball. To everyone who has ever jumped my personal case in the last 20 years about my habit of making a big deal over "technicalities," I have a message to send. Via Deutsche Bank's foreclosure department.

Several years ago I represented a large bank in the process of securitizing a big chunk of its seasoned portfolio loans. Among other things that meant I reviewed several thousand notes. Now, when a loan changes hands, this is effected on the note by an endorsement. It's very much like a check endorsement: you slap a stamp on the back of the note that says "pay to the order of [endorsee] without recourse [endorsor] by [person] its [officer title]," under which is "signature." Each subsequent time a loan changes hands, a new endorsement is made from the prior endorsee to the new endorsee. When loans are securitized, the last endorsement is often "in blank," meaning that the new endorsee is not named. The entire original note goes into the physical custody of the new endorsee or its legal custodian with that blank endorsement, that can be subsequently completed if necessary by the security sponsor. This is a very common and uncontroversial practice.

So I had a couple thousand notes to look at, and about a third of them had an endorsement chain that looked like this: first endorsement from Bank of the County, the original lender, to Bank of the State. Second endorsement from Bank of the State to Bank of the Region. Third endorsement from Bank of the Country to Bank of the Nation. My job was supposed to be to endorse these things on my client's behalf (from Bank of the Nation to blank).

Well, there's a big problem. There was no endorsement from Bank of the Region to Bank of the Country. (The same problem occurred with the chain of assignments of the mortgage.) With a missing link in the chain, there are grounds to question the current owner's rights to endorse this note over to someone else.

Aha! You say. That Tanta: she single-handedly brought down a major banking fraud ring! She blew the whistle on a big name bank who tried to pass off millions of dollars worth of someone else's loans as its own, for ill-gotten gains! How exciting! Will Julia Roberts play Tanta in the movie version?

Hardly. As a matter of fact I knew perfectly well, as did everyone else involved, that Bank of the Country had merged with Bank of the Region, and was legally its successor in interest to these mortgage loans. That wasn't a secret; it had been in the newspapers. The problem was that some dweeb had failed to write the endorsement correctly (it should have been Bank of the Country, successor in interest to Bank of the Region, to Bank of the Nation. Or perhaps someone should have used one of Bank of the Region's old stamps to endorse the note from Region to Country on the same day that it endorsed it from Country to Nation).

There are ways you can fix stuff like that. In this particular case, it ended up involving getting my hands on copies of board resolutions (with an original seal, thank you) showing the successorship, plus a copy of another board resolution (and another original seal!) showing that the officer of Country was also an officer of Region, plus an original board resolution (and seal) giving one Tanta a power of attorney that allowed her legally to void an incorrect endorsement and execute a new one on original notes that didn't actually belong to Tanta. All this had to be done in less than 48 hours, because somebody had already made a commitment to settle tens of millions of dollars and there were some Extremely Unhappy People on both sides of that trade who really really wished that this Tanta person punk had just ignored this problem and certified the pool. One vice president of my client who had had to drag the secretary of the board off the golf course on a sunny Saturday afternoon was good enough to tell me just exactly how unlikely I was to ever get work in this town again.

If I recall correctly the whole episode, which included flying Tanta half-way across the country on a few hours' notice to visit the vault where these original notes were kept, cost the seller about $20,000. It would have cost somebody about $20 to have had a new endorsement stamp made after the merger that included the "successor in interest" verbiage. Throughout the whole thing, Tanta kept explaining that one can spend a whole lot more than $20,000 if one of these puppies goes to foreclosure and some sharp-eyed attorney notices a bad endorsement/assignment chain.

The seller didn't want to spend that money, but the seller's counsel told its executives that once this problem had been brought to the notice of the buyer of the loans, which it had, there was no real choice. After all the dust settled, Tanta managed to re-establish a decent relationship with her client, and so it ended well enough.

However, Tanta knows plenty of people in this business for whom it did not end well. Plenty of insitutions who won't pay the $20,000 to fix their own error because "it's just a technicality," which of course it is. Just a technicality. Tell it to Deutsche Bank.

Allow me to drive home the point, please: before everyone gets all fired up about OMG! Securitized loans can't be foreclosed! Fraud!, please back up a few steps. As I said, I don't have a copy of the court documents, and I'm not going to rely on an amateur paraphrase thereof to make claims about what, specifically, happened in the DB case. But all my years of experience tell me that somebody somewhere used a bad endorsement stamp, pulled the wrong boilerplate verbiage for an affidavit, recorded a lis pendens and an assignment of mortgage in the wrong order, failed to provide a schedule attachment to a blanket assignment showing which loans were covered by it, or something like that. Or perhaps there was a copy board resolution without an original seal, if you can imagine such nefariousness. These kinds of screwups go on all the time in this business.

On the one hand, mistakes just do get made, in any business. On the other hand, the mortgage industry's back room got incredibly sloppy during the boom. You had experienced closing and post-closing staff laid off and replaced by temps who don't know an endorsement from a box of Wheaties, you had loans being sold by brand-new entrants into the business with no experience in these legal transactions, you had gigantic pressures to move loans through the pipeline into a security as fast as possible and paperwork be damned, you had a business too comfortable working on reps and warranties and indemnifications--on a promise to make it good if it ever blows up rather than fixing it now. You had regulators of big depositories that were sound asleep when it came to such operational "trivia."

And this kind of thing with Deutsche Bank and the foreclosure mess is the result. And when Wall Street analysts stand up and demand that companies beef up back rooms, pay veteran employees rather than outsourcing, and slow the hell down so that things are done right the first time, I'll eat every promissory note I've ever endorsed. For every little Tanta with her hands on her hips demanding competent but expensive operations, there's some Chainsaw Al out there "streamlining" the company.

So here's my message to my fellow bloggers: sensationalist stories about LEGAL HANKY PANKY are fun to write and get you a lot of attention. No doubt you have frightened (or pleased) a whole bunch of people with the idea that foreclosures will all grind to a halt nationwide because one fouled-up filing by one Master Servicer of one security in one state means that "They Own Nothing!" Of course they own plenty, and they'll end up establishing it. It might cost them an additional $20,000 or so, but that's the punishment meted out to cost-cutters.

The difficult story to write is the one about how this happens, and what it really means, and who are the hidden victims (all those laid-off employees or non-working consultants whose bad news isn't welcome, plus some shareholders) and hidden villains (like everyone who applauded every time some big bank announced more operational cutting and expertise-dumping). Even if you don't want to write that story, I'd suggest not hyping a story with a hysterical headline based on one email from one interested party. As far as I can tell, the writers of that blog post never even saw the court order itself; the entire post seems to be based on the hyperbolic burbling of a lawyer whose job is to delay foreclosure filings.

I have no particular beef with lawyers who represent homeowners in a foreclosure trying every trick in the book, including exploiting the lender's paperwork errors, in an attempt to stave off the foreclosure or force the lender to work out the loan. That's how the court system works, and frankly, when lenders know this can happen to them, they get smarter about doing their homework correctly.

I do, however, have some problem with lawyers who take their own smoke-blowing tactics too seriously. It's one thing to get a case dismissed because the plaintiff's affidavit is in error; why shouldn't you do that if it's in your client's best interest? It's another thing entirely to smoke your own dope and call this "rampant foreclosure fraud," and for a blogger to claim that this will single-handedly bring down the securitization market. That's fighting bongwater with bongwater. I did a quick Google search this morning to look for any follow-ups to this post, and found the following: "It appears that the holders of CDO's do not have legal title to the properties that have been defaulted on, so they cannot foreclose, so they get a big fat NOTHING." That this is not about CDOs, not about title to real estate, and not about anyone getting NOTHING isn't stopping the internet-chain of conclusion-leaping that make my client's endorsement-chain problems look like a careful business practice. Now a bunch of vocal people "know" something that they do in fact not know. And people like me will be trying to swat this fly forever in the interest of having a useful conversation.

As I said, I might be wrong about the specifics of the DB case, because I haven't seen the actual court order. If someone sends me a copy and it turns out that I'm wrong and this is a Big Deal instead of a Little Deal, I'll be the first to post a mea culpa. Until then I will ask everyone to develop the habit of reading past the hype and evaluating the credibility of a source. Me included.

Bear Stearns: $1.2 Billion Writedown

by Calculated Risk on 11/14/2007 09:00:00 AM

Click on photo for larger image.

Click on photo for larger image.

Headlines on Bear Stearns (hat tip Brian).

"Goal is to keep the franchise intact", Bear Stearns, Nov, 14, 2007

From AP: Bear Stearns to Take $1.2 Billion Credit Writedown, Post Loss in the Fourth Quarter

Investment bank Bear Stearns Cos. will take a $1.2 billion writedown in the fourth quarter related to its credit portfolios, Chief Financial Officer Samuel Molinaro Jr. said Wednesday..

Molinaro said the writedown will lead the company to post a loss during its fiscal fourth quarter, which ends Nov. 30.

Molinaro, presenting at the Merrill Lynch Banking and Finance Conference in New York, said Bear Stearns latest round of writedowns should "suffice" in accurately valuing products such as subprime mortgages and collateralized debt obligations

HSBC: $3.4 billion Writedown, Warns of "Further Deterioration"

by Calculated Risk on 11/14/2007 08:50:00 AM

From MarketWatch: HSBC to take $3.4 billion charge over U.S. losses

HSBC Holdings on Wednesday ... it's taking a $3.4 billion loan-impairment charge in its U.S. consumer finance business during the third quarter, which it said was $1.4 billion higher than would have been implied by extrapolating first-half trends.From AP: HSBC mortgage takes $3.4B charge in US (hat tip Keith)

...

"I think the thing that's emerged in the third quarter is that the housing market deterioration is beginning to have a broader impact, both within the market and beginning to extend into other areas," said Douglas Flint, group finance director, in a prepared interview.

HSBC warned that the subprime crisis could deepen and said further volatility as a result of the credit crunch was "more than a remote possibility"The confessional is busy this morning.

"There is the probability of further deterioration if the current housing market distress continues and further impacts the broader economy," the company said.

Countrywide Commercial Real Estate Loan Pipeline

by Calculated Risk on 11/14/2007 12:48:00 AM

In the Countrywide 8-K SEC filing Tuesday was a table that included the company's commercial real estate loan pipeline (hat tip idoc). Click on graph for larger image.

Click on graph for larger image.

In October, Countrywide had $752 Million commercial real estate loans in their pipeline, compared to $1,824 million last October and $1,323 million in September.

This is more evidence that the CRE boom is over.

Tuesday, November 13, 2007

Percent Owner Occupied Households With Mortgages

by Calculated Risk on 11/13/2007 08:29:00 PM

NOTE: See next post for context for this data.

Some useful data from the 2006 American Community Survey

B25097. MORTGAGE STATUS BY MEDIAN VALUE (DOLLARS) - Universe: OWNER-OCCUPIED HOUSING UNITS

United States | ||

Estimate | Margin of Error | |

Median value -- |

|

|

Total: | 185,200 | +/-489 |

Median value for units with a mortgage | 208,000 | +/-379 |

Median value for units without a mortgage | 140,400 | +/-549 |

B25096. MORTGAGE STATUS BY VALUE - Universe: OWNER-OCCUPIED HOUSING UNITS

United States | ||

Estimate | Margin of Error | |

Total: | 75,086,485 | +/-218,471 |

With a mortgage: | 51,234,170 | +/-153,174 |

Less than $50,000 | 2,242,784 | +/-23,231 |

$50,000 to $99,999 | 7,002,253 | +/-48,064 |

$100,000 to $149,999 | 8,245,296 | +/-49,068 |

$150,000 to $199,999 | 7,219,252 | +/-44,875 |

$200,000 to $299,999 | 8,898,887 | +/-41,910 |

$300,000 to $499,999 | 9,785,782 | +/-43,282 |

$500,000 or more | 7,839,916 | +/-38,531 |

Not mortgaged: | 23,852,315 | +/-87,013 |

Less than $50,000 | 3,840,853 | +/-30,480 |

$50,000 to $99,999 | 4,972,827 | +/-33,618 |

$100,000 to $149,999 | 3,773,919 | +/-28,801 |

$150,000 to $199,999 | 2,857,034 | +/-23,712 |

$200,000 to $299,999 | 3,025,977 | +/-23,331 |

$300,000 to $499,999 | 2,942,344 | +/-22,828 |

$500,000 or more | 2,439,361 | +/-17,432 |

Bloomberg's Berry: No Recession

by Calculated Risk on 11/13/2007 06:43:00 PM

From Bloomberg: Consumer Spending Won't Fall and Cause Recession: John M. Berry. An excerpt on the impact of declining homeowners' equity:

Some analysts argue that falling home prices are wiping out a chunk of owners' equity and limiting their ability to borrow against it. In addition, having less equity will depress owners' willingness to spend on consumption, they say.First, a typo correction in Berry's piece. According to the Fed's Flow of Funds report, the value of household real estate was

Again, there is some truth to both those points, though it's not clear how much.

While homeowners' equity has begun to fall and is likely to continue doing so for some time, there are still huge paper gains in place from previous years.

For example, the Federal Reserve's most recent Flow of Funds report said that at the end of the second quarter owners' equity was $18.85 trillion. That was still almost $40 billion more than at the end of last year and $1.56 trillion more than at the end of 2004.

...

So homeowners can still borrow to supplement their current income even though it may be more difficult and somewhat more expensive.

Berry notes correctly that homeowner equity has started to decline, and will decline further in the future. But then he argues that "there are still huge paper gains in place" that homeowners can continue to borrow against.

Really? Are there huge gains that homeowners can borrow against to supplement their incomes?

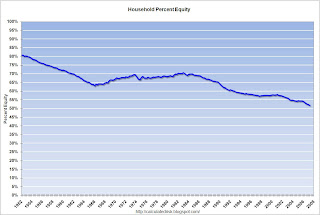

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of homeowner equity for the last 50 years. Although the percent of homeowner equity was at a record low of 51.7% at the end of Q2 2007, that still sounds pretty good ... at least until you realize that about 1/3 of all owner occupied households have no mortgage debt (their homes are paid off).

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 2/3. But it is unreasonable to expect these more risk-averse homeowners will suddenly change their habits and start borrowing against their homes.

So, although there have been gains, there is a real question of much more the already leveraged homeowners can borrow against their equity.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.With falling house prices, the value of household assets will probably fall significantly as a percent of GDP. Yet Berry appears to be arguing that mortgage debt, as a percent of GDP, will continue to increase. And remember that 1/3 of owner occupied households have no mortgage debt.

Although there are several unknowns, if assets fell to 120% of GDP, it is hard to conceive of mortgage debt growing faster than GDP - even staying even with GDP would imply that the mortgaged 2/3 would owe something like 80% of the value of their homes - unlikely.

On this point, I think Berry is wrong. Sure, some homeowners will be able to supplement their incomes by borrowing against their homes, but I think in the aggregate this borrowing will slow significantly over the next few quarters.

Pending Home Sales Flat in September

by Calculated Risk on 11/13/2007 03:03:00 PM

From the National Association of Realtors: Modest Recovery for Existing-Home Sales in 2008 as Credit Crunch Subsides

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in September, rose 0.2 percent to a reading of 85.7 from an index of 85.5 in August. It was 20.4 percent lower than the September 2006 level of 107.6.Here is the NAR Pending Home Sales data.

And here is the NAR forecast:

Existing-home sales are projected at 5.67 million this year, edging up to 5.69 million in 2008, in comparison with 6.48 million in 2006 which was the third highest year on record. Existing-home prices are expected to decline 1.7 percent to a median of $218,200 for all of this year and hold essentially even in 2008 at $218,300.Another downward revision (a monthly ritual for the NAR), but they are getting closer with only one more downward revision scheduled for December. The NAR price forecast is a complete joke too.

Note that Pending Home Sales lead existing home sales by about 45 days. So this September report is partially for October sales and partially for November. The 6.5% decline in August Pending Home sales will also impact the October existing home sales report (due on Nov 28th).

JPMorgan: SIVs have No Business Purpose

by Calculated Risk on 11/13/2007 02:05:00 PM

Quote of the day from Bloomberg: JPMorgan's Dimon Says SIVs Will `Go the Way of the Dinosaur'

"SIVs don't have a business purpose."

Jamie Dimon, JPMorgan Chase & Co. CEO, Nov 13, 2007

Hot Potato

by Anonymous on 11/13/2007 11:55:00 AM

From Triad's 10-K (thanks, Clyde):

On November 5, 2007, American Home Mortgage Investment Corp. and American Home Mortgage Servicing, Inc. filed a complaint against Triad Guaranty Insurance Corp. in the U.S. Bankruptcy Court for the District of Delaware. The plaintiffs are debtors and debtors in possession in Chapter 11 cases pending in the U.S. Bankruptcy Court. The lawsuit is an action for breach of contract and declaratory judgment. The basis for the complaint’s breach of contract action is the cancellation by us of our certification of American Home Mortgage’s coverage on 14 loans due to irregularities that we allegedly uncovered following the submission of claims for payment and that existed when American Home Mortgage originated the loans. The complaint alleges that our actions caused American Home Mortgage to suffer a combined net loss of not less than $1,132,105.51 and seeks monetary damages and a declaratory judgment. We expect to rescind additional loans originated by American Home Mortgage and we intend to contest the lawsuit vigorously.Something to keep in mind: these days a lot of mortgage insurance works on the same "representation and warranty" business that everything else in mortgage-land does. The insurer does not necessarily or even usually underwrite the loan file itself prior to issuing a certificate; it "delegates" this to the lender. However, that means that the insurer can refuse to pay if it believes that the lender knew or should have known that the loan did not meet the insurer's requirements. The insurer generally doesn't find this out unless 1) the file is subject to routine QC audit or 2) the worst happens and a claim is filed.

So it's another episode of Finding Out Later, and the MIs don't want to hold the bag for it.