by Calculated Risk on 11/15/2007 02:58:00 PM

Thursday, November 15, 2007

DataQuick: California Bay Area Home Sales Slump Continues

From DataQuick: Bay Area home sales drag along bottom

Bay Area home sales remained at their lowest level in decades last month, the result of mortgage market turbulence and hesitant buyers. Prices continued to hold up best in core markets, while declines steepened in some inland areas, a real estate information service reported.

A total of 5,486 new and resale houses and condos were sold in the nine-county Bay Area in October. That was up 9.4 percent from 5,014 in September, and down 35.7 percent from 8,532 for October a year ago, DataQuick Information Systems reported.

Sales have decreased on a year-over-year basis the last 33 months. Last month was the slowest October in DataQuick's statistics, which go back to 1988. Until last month, the slowest October was in 1990 when 6,443 homes were sold. The strongest October was in 2003 when sales totaled 13,392. The average for the month is 8,930.

...

The median price paid for a Bay Area home was $631,000 last month, up 1.0 percent from $625,000 in September, and up 2.4 percent from $616,000 for October last year. The median peaked at $665,000 last June and July.

...

Foreclosure activity is at record levels ...

How Much Cash is Left in the Home ATM?

by Calculated Risk on 11/15/2007 01:11:00 PM

This post is a followup to: Bloomberg's Berry: No Recession (Hat tip NJ_Bob for graph ideas)

One of the questions raised by the Bloomberg article is how much more equity can be borrowed on U.S. household real estate. Based on the Fed's flow of funds report, the percent of homeowner equity was at a record low of 51.7% at the end of Q2 2007.

However, according to the Census Bureau, 31.8% of all U.S. owner occupied homes have no mortgage. You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 68%. But we can construct a model based on data from the 2006 American Community Survey (see table here). Click on graph for larger image.

Click on graph for larger image.

This graph shows the distribution of U.S. households by the value of their home, with and without a mortgage. This data is for 2006.

By using the mid-points of each range, and solving for the price of the highest range (to match the Fed's estimate of household real estate assets at the end of 2006: $20.6 Trillion), we can estimate the total dollar value of houses with and without mortgages.

Using this method, the total value of U.S. houses, at the end of 2006, with mortgages was $15.27 Trillion or 74.2% of the total. The value of houses without mortgages was $5.32 Trillion or 25.8% of the total U.S. household real estate.

Since all of the mortgage debt is from the houses with mortgages, these homes have an average of 36% equity. It's important to remember this includes some homes with 90% equity, and some homes with negative equity.

The following graph shows the impact of falling house prices on the percent aggregate equity. At the end of 2006, aggregate equity for mortgage holders was 36%.

At the end of 2006, aggregate equity for mortgage holders was 36%.

If household assets fall 10%, and liabilities stay the same, the percent equity will fall to 28.9%. If household assets fall 20%, the percent equity will fall to 20%.

If assets fall 35%, there will be no equity in the aggregate - households with positive equity will be offset by households with negative equity. Although I don't expect prices to fall anywhere near 35%, even a decline of 10% will probably severely limit the ability of marginal homeowners to borrow from their home equity.

This is based on 2006 data. Mortgage equity borrowing was still strong through the first three quarters of 2007 (Q3 estimated), and the situation is even worse now.

Corporations Taking Hits to Marketable Securities

by Calculated Risk on 11/15/2007 12:44:00 PM

Here is an interesting development, from an 8-K filed today by ADC Telecommunications (hat tip BR)

We hold a variety of highly rated interest bearing auction rate securities that most often represent interests in pools of either interest bearing loans or dividend yielding preferred shares. These auction rate securities provide liquidity via an auction process that resets the applicable interest rate at predetermined calendar intervals, usually every 7, 28, 35 or 90 days. This mechanism allows existing investors either to rollover their holdings, whereby they would continue to own their respective interest in the auction rate security, or to gain immediate liquidity by selling such interests at par. For several months, certain of these auctions have not had sufficient bidders to allow investors to complete a sale, indicating that immediate liquidity at par is unavailable.This is probably not significant for ADC, but these investments were pitched to many other corporations were the losses might be more significant. As BR noted:

At the end of our third quarter for fiscal 2007, we identified approximately $149.0 million of auction rate securities for which there were insufficient bidders at the scheduled rollover dates and another approximately $21.3 million which we believed were at risk of having this occur. As of November 15, 2007 we hold investments subject to auction processes with insufficient bidders with a par value of $169.8 million. These investments represent all of our investments held in auction rate securities.

We are continuing to monitor and analyze our auction rate securities investments. Recently one of these investments with a par value of approximately $17 million was downgraded from a Aaa rating to a A2 rating by Moodys Investor Services. We are not aware of any other of our auction rate securities investments that have been downgraded to date. In light of developing circumstances, we are analyzing the extent to which the estimated market value of this investment may no longer approximate its par value. We have not finalized this analysis. Further, it is possible we will determine other of these investments no longer approximate their par value. If we determine one or more investments no longer approximates its par value, it is possible we will have to record (a) an unrealized loss in the other comprehensive income section of shareowners' investment in our balance sheet as of October 31, 2007, and/or (b) an other-than-temporary impairment charge. An unrealized loss would be recorded in other comprehensive income to the extent we determined the loss on an investment was only temporary in nature and determined that we have the ability to continue to hold the investment until a recovery in market values occurs. In such an event, an unrealized loss would not reduce our net income for the quarter and year ended October 31, 2007, because the loss would not be viewed as permanent. An other-than-temporary impairment charge would be recorded against net income to the extent we determine the loss in fair value of any of these investments is other than temporary.

Several contacts of mine tell me that the money center banks pitched this ... to money funds and corporations over the past 2 years as a little spice on the stew but still AAA. They bought it like candy.

CRE Loan Volumes Fall in Q3

by Calculated Risk on 11/15/2007 10:59:00 AM

It's been some time since I made my prediction in March: Commercial Real Estate Bust?

This might be a story later this year: the start of a commercial real estate bust.Now from Mathew Padilla at the O.C. Register: Commercial real estate loans dipped in Q3

The Mortgage Bankers Association said today commercial real estate loans nationwide fell 4% for all types of real estate in the third quarter vs. a year ago and 30% vs. the second quarter of this year.See Matt's post for more details.

Also from Nouriel Roubini: The Next Shoe to Drop in the Credit Meltdown: Commercial Real Estate and Its Massive Forthcoming Losses

This is chart is a repeat from earlier this week: From Countrywide's 8-K SEC filing on Tuesday, here is a table that included the company's commercial real estate loan pipeline (hat tip idoc).

Click on graph for larger image.

Click on graph for larger image.In October, Countrywide had $752 Million commercial real estate loans in their pipeline, compared to $1,824 million last October and $1,323 million in September.

So Q3 was off 30% from Q2 (according to the MBA) and Q4 is off to a very weak start based on the Countywide October numbers. It looks like the CRE slowdown has started.

Barclays $2.7 Billion Writedown

by Calculated Risk on 11/15/2007 10:13:00 AM

Apparently this was better than expected. From the WSJ: Barclays Ends Speculation Over Subprime Exposure

Barclays PLC Thursday disclosed net charges and write-downs totaling £1.3 billion ($2.67 billion) ... in a move to end speculation over the size of its exposure to the subprime mortgage crisis.Another visit to the confessional.

...

The figure was lower than expected ...

GM Watch: The Flap Continues

by Anonymous on 11/15/2007 08:24:00 AM

So there was a pretty breathlessly hyped story on a blog about how the dismissal of a foreclosure filing meant that the entire MBS market is more or less toast. Then there was a tedious attempt by Tanta to sort through it and figure out what the real issue was and perhaps cool down some of the rhetoric. You know what had to happen next. Gretchen Morgenson got ahold of it.

Do read the whole piece. Perhaps I have gone temporarily blind, and there is somewhere in this article an acknowledgement that this story was "broken" on a blog. (Not mine, by the way: I Am Facing Foreclosure.com "broke" the story. I ignored it as long as I thought I could.) Query: is this where GM has been getting a lot of story juice lately? Could that be why some of her recent reporting, especially on Countrywide, is such a noxious mixture of fact and hype, information and innuendo?

All I know about journalistic practice tells me that if this story had originally been reported in the Podunk Inquirer, GM would have credited the ol' PI in her story. But you can fish in the blogs, it appears, without having to admit it. And without identifying the blog-source of your stories, you avoid having to confront the evaluation problem. There are great blogs and terrible blogs out there. There is carefully gleaned and analyzed information, and there is rumor, garbled gossip, and speculation masquerading as fact. There are people whose agenda and biases are perfectly clearly spelled out, and there are those who are talkin' a book or just shilling. If you want to seine the blogs for NYT material, you have to deal with this problem for yourself and for your readers. Identifying your sources is not simply professional courtesy, it's the beginning of the process of evaluating the source. Yes, I am not a professional reporter and this is a blog and I am lecturing the NYT on Journalism 101. I'm afraid to open the fridge to get milk in case there's a trout in there.

I said most of what I want to say about the issue yesterday. Let me just pause over this one tidbit in GM's article this morning:

When a loan goes into a securitization, the mortgage note is not sent to the trust. Instead it shows up as a data transfer with the physical note being kept at a separate document repository company. Such practices keep the process fast and cheap.I rail endlessly about mortgage industry practices that are "fast and cheap" and that sacrifice risk management. You all have never heard me complaining about the practice of third-party document custody because it is one of the very few old-fashioned slow expensive risk management processes that the New Paradigm people have not yet managed to do away with. Document custodians are the Nerdiest Nerds there are, and their nerditude is in so many cases the only thing separating the current secondary market from a Wild West clown show. They are the thin red-tape line between us and chaos. I have never met anyone having anything to do with mortgage loans who has not at least once indulged in a major bitch-fest about dealing with some Iron-Fisted Custodian who won't just certify pools or mail notes around or change reports because some punk says to. They want appropriately-signed authorizations. They want Trust Receipts. They want originals, not copies; they want letters, not phone calls. They are, personally and institutionally, the kind of people who count the teaspoons after the dinner party guests leave.

And it costs money to use document custodians, who are, if you want to know, required to be financial institutions with a trust department that has direct authorization from its regulator to offer trust services. That does not make them perfect, but to call them "document repository companies" may give you all the impression that we're dealing with some fly-by-night Docs R Us outfit. I don't have exact numbers handy, but I would guess off the top of my head that after Fannie and Freddie, who are the custodians of most but not all of their own notes and mortgages, the single largest concentration of custody docs in this country is probably Wells Fargo. (I invite correction if I'm wrong about that.) Like anyone else who has ever certified pools, I've visited Wells's custodial operations center. I don't remember having to take my shoes off and put them in a basket before they let me in, but then again it was several years ago. At the time, Well's security was better than most airports'.

It has to be. Not only do they hold the documents collateralizing trillions of dollars of debt that belongs to someone else, but they do, in fact, hold those notes I was talking about yesterday that are endorsed in blank. Such a thing is rather more secure than a simple bearer bond, but not by much.

In the case of the DB foreclosure suit dismissal we looked at yesterday, there should have been a set of original notes and original recordable-form (but possibly not actually recorded) assignments of mortgage in the physical custody of a document custodian when DB went to file its FC action. It should therefore have been a matter of DB requesting the pertinent docs from the custodian, who would send them to DB's legal people in order to prepare the filing. Either this did not happen, or the custodian lost the docs, or DB lost the docs, or the docs were never there in the first place. If that last part is true, I want to know how a custodian certified those pools at issuance. If the custodian certified the pools on condition that some missing assignments get turned in later, then when and how did the custodian follow up on that? This is Deal, Big.

It is, mind you, possible that DB is acting as its own custodian. It's a bank, it has a trust department, it qualifies as a custodian. And if DB is acting as its own custodian, and certifying pools without having its hot little hands on the docs first, or it is misplacing those docs it had when it certified the pool to start with, then that, my friends, is a Story. It is a story that Deutsche Bank's regulators might be really really interested in. I know I am.

But this story will not get written by anyone who misunderstands what custodians are, how much they cost (real fee dollars), and how they are supposed to act like the Gatekeepers and SuperNerds of the whole process. In other words, they are supposed to be a check against "fast and cheap," not part of "fast and cheap."

Wednesday, November 14, 2007

GE Bond Fund Breaks the Buck

by Calculated Risk on 11/14/2007 06:15:00 PM

UPDATE: from Reuters: GE says outside investors quit bond fund

All outside investors ... withdrew their money after the company offered them the chance to redeem their holdings at 96 cents on the dollar ...From Andrew Bary at Barron's: Mortgage Woes Damage a GE Bond Fund. (hat tip barely)

Barron's reports that a short-term institutional bond fund managed by GE Asset management has offered investors 96 cents on the dollar.

The GE fund, totaling $5 billion, is an "enhanced" cash fund, meaning it seeks to provide a slightly higher yield than a money-market fund while preserving principal and maintaining an asset value of $1 per share.The one year return of 5.49% (through June 30th) probably seemed pretty attractive for short term money - until now!

...

In a Nov. 8 e-mail to institutional holders of the fund, GE Asset Management cited "extreme conditions in the credit markets" and told investors that "it will soon begin to sell certain securities held in the Fund which will result in realized losses and likely bring the Fund's yield to zero."

In the e-mail, GE Asset Management said the fund has "sufficient liquidity to redeem all non-GE subscribers at the current net asset value (.96) ..."

Cerberus LBO of United Rentals Appears Off

by Calculated Risk on 11/14/2007 04:05:00 PM

From MarketWatch: United Rentals says Cerberus not to proceed with purchase

United Rentals Inc. said Wednesday Cerberus Capital Management LP informed the company that Cerberus is not prepared to proceed with the purchase of United Rentals on the terms agreed on July 22.And from Bloomberg: Cerberus Seeks to Renegotiate United Rentals LBO (hat tip Brian)

Cerberus Capital Management LP is seeking to cut the price on its $4 billion agreement to buy United Rentals Inc., the largest U.S. construction-equipment rental company, people familiar with the transaction said.The banks still can't sell the debt for these LBOs, and they can't afford anymore pier loans (bridge loans that go nowhere and stay on the IBs balance sheet).

...

The United Rentals deal marks the second time in less than a month that Cerberus has sought to get out of a leveraged buyout as investors balk at buying an estimated $300 billion in debt committed to LBOs. ...

``This deal was expected to close sometime this week,'' wrote Stephen Volkmann, an analyst with J.P. Morgan Securities Inc. in New York. ``The banks were struggling with selling the associated debt offering.''

And here is a great quote from Bloomberg (no link yet): Hands Says LBO Bankers Whimpering `in Their Baskets'

``Bankers are like dogs,'' said Hands, the chief executive officer of London-based Terra Firma Capital Partners Ltd., at the industry's SuperInvestor conference in Paris today. ``They hunt in a pack and go into a feeding frenzy. When hit, they whimper, and hide in their baskets. The bankers have been hit very hard, and they're not going to come out of their baskets.''

CNBC: partial FASB 157 Delayed One Year

by Calculated Risk on 11/14/2007 02:37:00 PM

Update from LaSalle Street in the comments:

I e-mailed the FASB today about the implementation of Rule 157. (There was a news story on CNBC about delaying Rule 157)Here is their reply:I did not see this report, but several people have confirmed seeing it on CNBC (hat tip Tim, gamma and others). Perhaps a portion of FASB 157 has been delayed, so we need to wait for more news.On Oct 17, the FASB agreed not to defer the effective date of FASB Statement 157, Fair Value Measurement, in its entirety. At today's meeting, the staff reviewed various deferral alternatives. The Board voted on Alternative "B" - to defer the effective date of Statement 157 for one year for all nonfinancial assets and nonfinancial liabilities, except for those items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually).

More information about Alternative "B" is available in the Board meeting handouts, a link to which is provided at www.fasb.org. More details about what was decided today will also be posted shortly on www.fasb.org.

Communications Manager

Financial Accounting Foundation

FASB 157 was scheduled for implementation tomorrow.

Just one month ago, the WSJ reported: FASB Won't Delay Market-Value Rule

Accounting rule makers decided against deferring a new rule that lays out for companies how to apply market values to financial instruments, as well as some nonfinancial assets, and that mandates disclosures breaking down differences in easy-to-value versus hard-to-price securities.emphasis added.

But a divided Financial Accounting Standards Board left the door open to deferring the rule as it applied to nonfinancial assets on corporate balance sheets, or perhaps to private companies who follow generally accepted accounting principles. Groups such as Financial Executives International, an industry group, had lobbied the board to defer in its entirety the rule, known as FAS 157, for a year.

The seven-member FASB rejected such a proposal by a four-to-three vote.

FAS 157 takes effect for companies with fiscal years beginning after Nov. 15, 2007. This means that most companies will have to begin using the standard from the start of next year. However, many large investment houses and banks chose to adopt the standard early and its disclosures have proven crucial during the recent unrest in debt markets.

Perhaps this is a delay for nonfinancial assets on corporate balance sheets.

DataQuick: Record Low SoCal Home Sales

by Calculated Risk on 11/14/2007 01:32:00 PM

From DataQuick: Southland home sales plummet

Southern California home sales remained at their lowest level in more than 20 years last month ... Prices have dropped back to spring 2005 levels, a real estate information service reported.Also, from Mathew Padilla at the O.C. Register: O.C foreclosures highest in decade

A total of 12,999 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in October. That was up 4.4 percent from 12,455 for the previous month, and down 45.3 percent from 23,745 for October last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any October in DataQuick's statistics, which go back to 1988. The previous low was in October 1992 when 16,887 homes sold. The October sales average over the past 20 years is 24,725.

...

The median price paid for a Southland home was $444,000 last month, down 3.9 percent from $462,000 in September, and down 8.0 percent from $482,750 for October last year. The year-over-year decline reflects depreciation as well as the recent change in market mix - fewer mid-to-high-priced homes selling with jumbo mortgages. When adjusted for shifts in mix, home values dropped 6.7 percent compared with a year ago. Last month's median sales price was the lowest since $440,000 in April 2005.

Foreclosure activity is at record levels ...

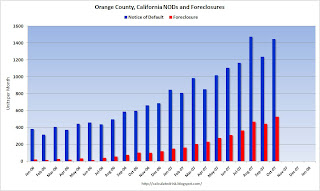

Amid a slumping housing market and a shortage of available loans, banks foreclosed on 530 homes in Orange County last month, the highest monthly total in more than a decade ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the Notice of Default (NOD) and foreclosure data from Padilla's story. Orange County was supposed to be one of those areas immune to a housing bust. I don't think so.