by Anonymous on 11/23/2007 09:39:00 AM

Friday, November 23, 2007

In Which Floyd Meets Nina

And innocence is lost. I wonder what would happen if we told him about PIWs.

We're All Subprime Now

by Anonymous on 11/23/2007 09:20:00 AM

A little cognitive dissonance with your coffee from The Arizona Republic, via our friends at Housing Doom:

The Valley's growing foreclosure problem is hitting the upper and middle class the hardest.Let's skip over the part about how those poor folk with no pride are "better prepared" than their wealthier brethren who face the horror of admitting to their equally overextended peers that they're in the same boat as the working poor but like to pretend otherwise. We have to skip over that part because it's still a holiday weekend and I don't need to get that cranky today.

Metro Phoenix homes in neighborhoods where prices range from $400,000 to $450,000 now have the highest foreclosure rate. . . .

All segments of the Valley's housing market have been hurt by falling home prices and rising interest rates and payments on adjustable-rate and subprime mortgages. But the problems are worse for homes in the $400,000-to-$450,000 range because many speculators bought in those neighborhoods, some families moved up beyond their means, and the recent credit crunch has made getting mortgages for more than $400,000 tougher. . . .

"The two groups of homeowners hit the hardest now are investors and those who overextended themselves," said Jay Butler, director of realty studies at Arizona State University's Morrison School. "That's why more people in higher-end neighborhoods are struggling now."

Also, there are more loan programs to help lower-income homeowners, while fewer lenders are eager to make loans above $417,000. Mortgage giants Fannie Mae and Freddie Mac are restricted to mainly [sic] investing in loans below $417,000.

"Often, people with lower incomes are better prepared to survive tough times and look for help," Butler said.

"People with higher incomes and bigger homes have a harder time telling neighbors and co-workers they can't afford their mortgage anymore."

Let us, instead, ask ourselves what constitutes the "upper and middle classes." If they "moved up beyond their means," then . . . their means are what, exactly? If 100% or near 100% financing is required to keep these neighborhoods stable (loans over $400,000 for houses in the $400,000-$450,000 price range), then in what sense are they neighborhoods of the "upper and middle classes"? Does our current definition of "middle class" (not to mention "upper class") include having insufficient cash assets to make even a token down payment on a home? Things seem to have changed since I did Econ 101.

What is the utility of this kind of thinking?

Homeowner's Insurance: Risk Shifting

by Anonymous on 11/23/2007 08:32:00 AM

From the New York Times:

“It was a kind of avuncular, sleepy line of business,” said William R. Berkley, the chief executive of W. R. Berkley, a commercial insurer in Greenwich, Conn. “Then losses started to outstrip even what investment income might have been able to make up.”Yeah, yeah, that's what we used to say about the mortgage business.

Now what would really be cool is if all those people who took over risks from their insurers also had ARMs . . . wait . . .

Thursday, November 22, 2007

$2.13 Billion in Subprime Losses for Japan Banks

by Calculated Risk on 11/22/2007 11:36:00 PM

From MarketWatch: Japanese banks suffer 230 bln yen in subprime losses: report

Japanese financial institutions have had to write down about 230 billion yen ($2.13 billion) on holdings linked to the U.S. subprime mortgage market ... Japan's financial regulator, the Financial Services Agency, released the figure late Thursday saying it represented losses suffered by major and regional banks, credit associations and credit cooperatives as of Sept. 30, the Nikkei News reported in its Friday morning edition...I wonder what will happen when people realize this isn't just a subprime problem?

SIV Superfund Seeking Support

by Calculated Risk on 11/22/2007 11:21:00 PM

From the WSJ: SIV-Plan Founders to Seek More Support for Superfund

[Bank of America Corp., Citigroup Inc. and J.P. Morgan Chase & Co] ... are expected next week to start soliciting their industry brethren to pitch in with the effort ...The purpose of the Superfund is to buy time for a "more orderly demise" of many of these SIVs. To buy time, other institutions will have to get involved, so this will be interesting to follow.

... BlackRock Inc. is expected next week to be named the manager for the $75 billion to $100 billion fund ...

The participation of other banks will play a significant role in the fund's success. ... some banks have expressed informal interest ...

Thanks

by Anonymous on 11/22/2007 09:05:00 AM

There are no better commenters on the net than the ones on this blog. This is an objective fact.

Wednesday, November 21, 2007

Tanta Writes Letters

by Calculated Risk on 11/21/2007 04:44:00 PM

Recommended reading: Tanta's letter to Treasury Secretary Paulson this morning: Dear Mr. Paulson

I'm from The Blogs and I'm here to help you.Enjoy.

Credit Crunch Hits Asia

by Calculated Risk on 11/21/2007 03:43:00 PM

From Ambrose Evans-Pritchard at the Telegraph: Credit "heart attack" engulfs China and Korea (hat tip James)

The global credit crisis has hit Asia with a vengeance for the first time, triggering a massive flight to safety as investors across the region pull out of risky assets.A credit crunch in Europe, Asia and America. Is "decoupling" going the way of "containment"?

Yields on three-month deposits in China and Korea have plummeted to near 1pc in a spectacular fall over recent days, caused by panic withdrawls from money market funds and credit derivatives.

"This is a severe warning sign," said Hans Redeker, currency chief at BNP Paribas. "Asia ignored the credit crunch in August but now we're seeing the poison beginning to paralyse the whole global economy," he said.

ABX and CMBX: Your Daily Plunge!

by Calculated Risk on 11/21/2007 02:49:00 PM

See the ABX-HE-AAA- 07-2 close today.

Another day, another record low.

The CMBX indices are setting new records too.

Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

See the CMBX-NA-AAA-3 close today.

For some background, here is a post at the Cleveland Fed back in March:

the ABX.HE index is telling us something about credit default swaps (CDS). A CDS is like a derivative that gives you insurance. For example, a bank may wish to buy protection against default by RiskyCorp (perhaps because they’ve given RiskyCorp a loan). They do this by entering into a contract where they pay another firm (who is selling protection) a fixed amount, periodically, as long as RiskyCorp doesn’t default on its corporate bonds. (In general, the “credit event” might be something else, such as a major downgrade, missed payments, or so forth.) If RiskyCorp does default, the seller of protection makes a payment to the buyer of protection. This might be a cash payment equal to the value of the bond, it might be the bond itself, or potentially whatever the contracting parties agree to. We like to think of the “swap rate” or “swap spread” that the protection buyer must pay as an insurance premium.The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies (see previous post of Q3 data from the Fed) for commercial real estate is probably impacting the CMBX.

Notice that the more likely RiskyCorp is to default, the higher the insurance premium, that is, the higher the swap spread, so this market can give us some idea of how risky some firms are. In a frictionless market, the swap spread should be comparable to the risk premium on one of RiskyCorp’s corporate bonds (corporate bond yield minus the comparable riskless yield). Furthermore, because the CDSs are more standardized and generally more liquid than corporate bonds, you can see why Federal Reserve Vice Chairman Donald Kohn states that “instead of looking to the bond market to measure default risk, we are increasingly turning to the market for credit default swaps” (the full text of his remarks to the Board Conference on Credit Risk and Credit Derivatives is well worth reading).

Credit default swaps eventually became based on other types of assets, such as mortgage-backed securities, whose payoff is derived from a pool of mortgages (such asset-based swaps became known as ABCDS, for obvious reasons). Likewise, there was no reason to restrict your CDS so that it protected you against default from only one firm, and although such “single-name” CDSs still make up the bulk of the market, “multiname” CDSs are growing in popularity.

Mortgage-backed securities offer several different levels of risk or tranches. Tranches are ways of slicing up the payment stream from homeowners to give different levels of risk, so roughly speaking, the tranches first in line for payments are less risky than those further down the line.

At long last: the ABX.HE is a series of five indexes that track CDSs based on tranches of mortgage-backed securities comprised of subprime mortgages and home equity loans. The tranches differ by their ratings, from AAA (best credit) to BBB-, (least good credit). See MarkiT, which produces the indexes for the real details. For an example of how indexes work, see here.

Fed: Delinquency Rates Rise in Q3

by Calculated Risk on 11/21/2007 02:10:00 PM

From the Federal Reserve Charge-off and Delinquency Rates.

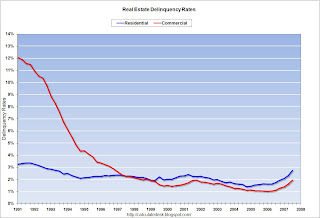

Delinquency rates rose in Q3 for real estate (residential and commercial), consumer loans and commercial and industry loans.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the delinquency rates for residential and commercial real estates since 1991 (start of series).

For residential real estate, the delinquency rate increased from 2.32% to 2.74%. For commercial real estate, the delinquency rate increased from 1.61% to 1.94%.

There was a also sharp increase for consumer credit card delinquencies, rising from 4.03% to 4.29% in Q3.

Update: Note that the Commercial Real Estate delinquency rate is above the peak of the '91 '01 recession (1.94% now, 1.93% then). I doubt CRE delinquencies will match the S&L crisis levels of the late '80s, early '90s - but clearly delinquencies are rising rapidly.

Yes, it does appear the curves are about to go parabolic!