by Calculated Risk on 11/28/2007 12:28:00 PM

Wednesday, November 28, 2007

More on October Existing Home Sales

For more existing home sales graphs, please see the earlier post: October Existing Home Sales

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. Click on graph for larger image.

Click on graph for larger image.

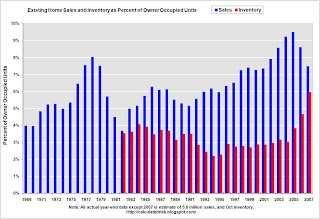

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the October inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.453 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.8 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, and closing in on the worst levels of the housing bust in the early '80s (inventory was 11.5 months at the end of 1982).

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units. For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - October sales were at a 4.97 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

The third graph is an update to my mid-year forecast adding the actual results for July, August, September and October in 2007. Update: Labels fixed.

Update: Labels fixed.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through October there have been 4.9 million units sold, and it looks like the total for 2007 will be just over 5.6 million units.

Bloomberg: Derivatives Indicate Commercial Property "Meltdown"

by Calculated Risk on 11/28/2007 11:05:00 AM

From Bloomberg: Deadbeat Developers Signaled by Property Derivatives (hat tips Brian & FormerlyknownasJS)

The cost of derivatives protecting investors from defaults on the highest-rated bonds backed by properties more than doubled in the past month, according to Markit Group Ltd. Prices suggest traders anticipate defaults rising to the highest level since the Great Depression, according to analysts at RBS Greenwich Capital in Greenwich, Connecticut.The fundamentals for CRE appear to be at a turning point: vacancy rates are rising, more inventory is coming online, prices for commercial property are now falling, and lending standards (as loose as subprime lending) are being tightened. That sounds like the ingredients for a "significant correction".

The seven-year rally in offices and retail properties ended in September when prices fell an average of 1.2 percent, according to Moody's Investors Service. More losses are likely because banks are holding $54 billion of commercial mortgages they can't sell, data compiled by New York-based Citigroup Inc. show.

...

Real estate deals are coming apart at the fastest pace since September 2001, when the U.S. economy was shrinking, because banks are tightening standards for loans, said Robert White, president of Real Capital Analytics, a New York-based research firm.

...

``The commercial real estate market is imploding,'' said James Ortega, who manages $150 million at Saenz Hofmann Fund Advisory in Sao Paulo. Ortega has set trades to profit from a decline in property companies' shares. ``We're about to experience a very significant correction.''

October Existing Home Sales

by Calculated Risk on 11/28/2007 10:00:00 AM

The NAR reports that Existing Home sales fell below 5 million (SAAR) in October, the lowest level since 2000.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – eased by 1.2 percent to a seasonally adjusted annual rate1 of 4.97 million units in October from a downwardly revised level of 5.03 million in September, and are 20.7 percent below the 6.27 million-unit pace in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, October sales were slightly above September.

The impact of the credit crunch is obvious as sales in September and October declined sharply from earlier in the year.

For existing homes, sales are reported at the close of escrow. So October sales were for contracts signed in August and September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was up slightly at 4.453 million homes for sale in October.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was up slightly at 4.453 million homes for sale in October. Total housing inventory rose 1.9 percent at the end of October to 4.45 million existing homes available for sale, which represents a 10.8-month supply at the current sales pace, up from a downwardly revised 10.4-month supply in September.This is basically the same inventory level as the last few months, although the months of supply increased to 10.8 months as SA sales fell, and inventory increased slightly.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the 'months of supply' metric for the last six years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of December 2000.

This shows sales have now fallen to the level of December 2000. More later today on existing home sales.

CFC BK Investigation: It's About Costs, Again

by Anonymous on 11/28/2007 09:38:00 AM

Given the tizzy certain segments of the press and internet commentariat went through over a handful of Federal District Court Judges sending foreclosing lenders back to the office to dig up the correct paperwork, I anticipate similar tizzy over this, from Gretchen Morgenson:

The federal agency monitoring the bankruptcy courts has subpoenaed Countrywide Financial, the nation’s largest mortgage lender and loan servicer, to determine whether the company’s conduct in two foreclosures in southern Florida represented abuses of the bankruptcy system. . . .So what does this mean?

In court documents, the trustee said that it intended to examine the procedures Countrywide used to determine that it had a valid claim to the properties and that it had correctly calculated the amounts it said the borrowers owed. The trustee’s office asked Countrywide to produce a copy of the notes and mortgages, a payment history on both loans and the correspondence it had with the borrowers.

First, it is perfectly possible that the charges to the borrowers were intentionally inflated. If so, this action by the trustee will remove a major incentive for lenders to do that, and is therefore to be applauded.

Second, it is perfectly possible that the charges to the borrowers were wholly and completely effed up beyond all recognition by a servicing operation that doesn't bother to assemble all the right documents, review each item for accuracy, and cross-check with the payment history (the printout of all transactions on the account since inception). PJ at Housing Wire makes a good case that the foreclosure filing dustups in Ohio have a lot to do with the way the operations are structured and a "timeline" built into them that encourages attornies to file first, review the case later.

Item the second here is not, by the way, a "defense" of Countrywide or anyone else. Frankly, it'd be better news for all of us if this turned out to be a case of intentional misconduct. I'm betting, frankly, that it's probably a case of operational slovenliness, undertrained staff, bad "timeline" policies, and low-bid contract legal work on the ground being unmanaged by a huge national servicer headquartered a continent away. This is the worst case because, well, that's how the business model of the 800-pound gorilla mortgage servicer works.

Force the giant, "efficient" servicers to do their homework--which is what both the bankruptcy trustees and the foreclosure judges are doing--and you just "added back" the costs of doing business that the consolidation and automation and outsourced-legal work processes were supposed to subtract out of the whole thing. Do enough of that, and all of a sudden it's as expensive for a Countrywide to service a $1.5 trillion mortgage portfolio as it is for ten small regional servicers to handle $150 billion a pop.

Now is that bad news? It depends on your point of view. If you think deconsolidation would manage risk better, improve customer service, and slow down the magic refi machine by sending mortgage transaction costs back to their appropriate levels, then you probably don't think this is bad news at all. If you have a financial or political interest in keeping the punch bowl out, you will find this a distressing idea.

Please, let's be clear here. This kind of thing is going to do a real number on mortgage lending, servicing, and securitization profitability not, in my view, because that profitability has been exclusively due to inflated BK bills. That profitability has been due to "efficiencies" that result, among other things, in inflated BK bills (and insufficiently documented foreclosure filings). In other words, this is going to end up like Sarbanes-Oxley, I suspect: it'll hurt not because it will flush out a bunch of Enrons, but because it will force everyone to pay their risk management and operational control costs.

So let's please skip the uproar over "Countrywide has to prove it owns the loans!" That's not the point here with requiring copies of the notes and mortgages and payment histories and correspondence files. The point of all that is making Countrywide--and everyone else, eventually--"show its work" in its filings. If you present a bill to the trustee, you back it up with documentation of the charge. That's a perfectly unexceptional requirement. That the industry will spin as "red-tape paperwork burdens" is inevitable and should be dismissed as the usual defensive piffle.

What we are seeing here on both the foreclosure and the bankruptcy front is a movement toward having to deal with the true costs of secured lending: the costs involved in maintaining one's security and liquidating it in the event of default. That is going to change the math of securitization economics as well as the profitability of mortgage servicing operations, and that is going to directly impact the consumer in terms of curtailing easy credit and increasing the cost of mortgage financing. Not all of us think that's a bad outcome. If it means servicers hiring specialists with deep skill sets instead of paper-pushing temps, then I for one have no problems with it. I'd like to see the costs of that come out of executive bonuses and dividends rather than new fees to consumers, of course, but no bankruptcy trustee or foreclosure judge is going to make that happen. That'll take a shareholder revolt. Good luck.

Fed's Kohn: Policy to be "Nimble"

by Calculated Risk on 11/28/2007 09:24:00 AM

From Fed Vice Chairman Donald L. Kohn: Financial Markets and Central Banking

... uncertainties about the economic outlook are unusually high right now. In my view, these uncertainties require flexible and pragmatic policymaking--nimble is the adjective I used a few weeks ago.That sounds like Kohn supports a rate cut in December.

Tuesday, November 27, 2007

Freddie Cuts Dividend

by Calculated Risk on 11/27/2007 06:54:00 PM

From Reuters: Freddie Mac cuts dividend, slates $6 billion preferreds

Freddie Mac ... said it halved its quarterly dividend and will sell $6 billion in preferred stock to bolster capital in anticipation of mortgage-related losses.No surprise.

Wells Fargo Visits the Confessional

by Calculated Risk on 11/27/2007 06:50:00 PM

From MarketWatch: Wells sets aside $1.4 bln to cover home loan losses (hat tip crispy&cole)

Wells Fargo & Co., the second-largest U.S. mortgage lender, said late Tuesday that it will set aside $1.4 billion during the fourth quarter to cover higher losses on home-equity loans caused by deterioration in the real estate market.

...

The special reserve covers an $11.9 billion portfolio of loans that the bank originated or acquired through indirect sources such as mortgage brokers, Wells explained. That portfolio will be sold off under the guidance of a dedicated management team, the bank added.

Goldman Sachs on Housing

by Calculated Risk on 11/27/2007 05:34:00 PM

Goldman Sachs Chief Economist Jan Hatzius released a new report on housing today: Housing (Still) Holds the Key to Fed Policy

There is no link available.

Note: The following excerpts are used with permission.

In this new report, Goldman revised down their housing outlook significantly (here is their August forecast). Goldman now sees housing starts falling to 750K (their earlier forecast was for starts to fall to 1.1 million units).

On housing prices:

Home prices are also likely to decline substantially. If the economy narrowly escapes a full-blown recession—as we continue to expect in our baseline forecast—a peak-to-trough decline of 15% in house prices is the most likely outcome. This would imply price declines in states such as Florida of up to 30%. If the economy does enter a recession, prices could decline as much as 30% nationwide.On the impact of less Mortgage Equity Withdrawal (MEW) on consumer spending:

Consumer spending growth has remained stable over the last 1-2 years as rising equity prices and sturdy income growth have offset the drag from falling mortgage equity withdrawal (MEW) and slowing home prices. Nevertheless, consumption has underperformed income growth, as predicted by our MEW-augmented consumption model. Going forward, our model points to a more substantial drag of housing on real consumer spending growth, with a slowdown from the recent 3% pace to a 1% annualized rate in early 2008.

Click on graph for larger image.

Click on graph for larger image. On negative equity:

The basic problem is that house price declines create large amounts of negative equity. Homeowners with negative equity lose their ability to respond to adverse financial events such as job loss or mortgage reset by refinancing or selling their home, and they therefore become much more likely to default. The importance of this problem is illustrated in Exhibit 16, which shows the distribution of home equity among US mortgage holders at the end of 2006 according to an analysis by First American CoreLogic, Inc. About 7% of US mortgage holders had negative equity at that point, and another 14% had equity of less than 15%. Thus, 21% of all mortgage holders—holding about $3 trillion in aggregate mortgage debt given the average mortgage debt held by the vulnerable borrowers—would be put into a negative-equity position if home prices fell by 15%.There is much more in the report. Goldman now puts the odds of a recession in 2008 at around 40%, and they see the unemployment rate rising to 5.5% by the end of 2008.

In the past, such a rise in the unemployment rate has invariably come in the context of an overall recession ... The risk that it would do so again is high ... however, our analysis does not imply a recession when taken at face value. Instead, it points to a long period of below-trend growth.I'll post more on the details of their analysis - and offer my view - later this week. Goldman has definitely turned significantly more bearish on housing and the economy.

House Prices: Real vs. Nominal

by Calculated Risk on 11/27/2007 02:59:00 PM

The S&P Case-Shiller National home price index was released this morning. (See note at bottom).

The reported Case-Shiller numbers are nominal; not adjusted for inflation. Most people think in nominal terms, but it's also important to look at real house prices.

| Click on graph for larger image. The first graph shows the nominal Case-Shiller index. The index peaked in Q2 2006, and nominal prices have declined about 5% from the peak. |

The second graphs shows real prices according to the Case-Shiller index (adjusted using CPI less Shelter). Real Prices peaked in Q1 2006, and are off about 8% from the peak.

The second graphs shows real prices according to the Case-Shiller index (adjusted using CPI less Shelter). Real Prices peaked in Q1 2006, and are off about 8% from the peak.The second graph probably provides a better first estimate of how far prices still need to fall (for the Case-Shiller universe). If prices fall to 120 (in real terms) that is about another 25% from the current level.

This could happen with falling nominal prices, or from several years of inflation, or a combination of both. Say nominal prices fall 15% over the next three years, with a 2% per year inflation rate, then real prices would fall to about 130 on the Case-Shiller index.

This suggests to me that price declines have just started, and that the process will last several years. It's important to remember that different areas will see different percentage price declines - the bubble areas will see the largest declines - and the time frames for each location will be different.

NOTE: There are significant differences between the OFHEO HPI and the Case-Shiller National index. This is an excellent summary by OFHEO economist Andrew Leventis: A Note on the Differences between the OFHEO and S&P/Case-Shiller House Price Indexes. The OFHEO note suggests that the primary reason for the difference between Case-Shiller and OFHEO price indices is geographical coverage (not the loan limitations for OFHEO).

LA Times: How Far Will House Prices Fall?

by Calculated Risk on 11/27/2007 01:35:00 PM

Peter Y. Hong at the LA Times writes: Homeowners' big question: How low will prices go?  Click on graph for larger image.

Click on graph for larger image.

The LA Times article focuses on California. This graph shows the Case-Shiller home price index for several selected cities. If SoCal prices fall 25%, then prices in other areas - like Miami and Las Vegas - will probably decline a similar amount. These are nominal prices, I'll have more on Real vs. Nominal prices later today.

From the LA Times:

No one knows how severe the slump will be, but economists and real estate experts interviewed by The Times, and who were willing to make predictions, said prices could fall 15% to 25% before turning back up.

Most said values would continue falling through at least next year, and some thought the market wouldn't reverse course until 2010.

That could translate to big declines for home buyers who bought at the peak of the market, which various measures place in late 2006 or early 2007.

...

Some analysts, including UC Berkeley professor Kenneth Rosen, believe the severity of the downturn will vary by region.

Areas such as the Central Valley and the Inland Empire will be the hardest hit, he said, because these attracted a higher percentage of new buyers with shaky credit, and many of them are now defaulting on their loans. He believes values in these communities could fall by 15%.

But "in areas where there is very little new housing, where it's hard to build and a lot of wealthy people live, there will be little decline or maybe none at all."

...

But others call this wishful thinking, saying low prices eventually work their way to even the most affluent areas.

"Every place takes the hit in the long run," said Christopher Thornberg of Beacon Economics, a consulting firm in L.A.

...

[Edward E. Leamer of UCLA's Anderson Forecast] and Thornberg are among the most bearish of analysts, saying the recently ended housing boom pushed prices out of sync with incomes.

Los Angeles County median home prices are about 40% to 50% higher than the median income justifies, Thornberg said. He said the market would settle when prices and incomes became more closely aligned.

"Southern California prices will fall 25% from their peak and won't find their bottom until the end of 2009," Thornberg said.

Leamer also sees a drop-off at the high end of the range -- 20% to 25% -- and sees the downturn lasting into 2010.