by Calculated Risk on 12/06/2007 12:11:00 PM

Thursday, December 06, 2007

The Big Freeze: Details Soon

Mr. Bush speaks at 1:40PM ET. Mr. Paulson at 1:45PM. Tanta at 2:00PM.

OK, I'm just kidding about Tanta, but I'm looking forward to her comments.

MBA: Mortgage Delinquencies Highest Since 1986

by Calculated Risk on 12/06/2007 10:07:00 AM

The MBA is reporting today (no link) that mortgage delinquencies increased sharply in Q3 2007. A few data points:

Total, 1-4 units delinquences increased to 5.59% from 5.12% in Q2.

Prime increased to 3.12% from 2.73% in Q2.

Subprime increased to 16.31% from 14.82% in Q2.

Delinquencies and foreclosures increased for every category, including prime fixed rates.

'Lack of interest' in Super Fund SIV

by Calculated Risk on 12/06/2007 01:46:00 AM

From the WSJ: 'Super Fund' for SIVs, Hoped for $100 Billion, May Be Half the Size

The three banks assembling a "super fund" ... are scaling back its size due to a lack of interest ...Two weeks ago it was "next week". Now it's the next several days. Shrinkage and schedule slippage are not a good signs for the

Originally envisioned as a $100 billion fund that would buy assets from the struggling investment vehicles, the fund may now wind up being about half that size... The banks, which have informally been seeking participation from other financial institutions, expect to start a formal syndication process within the next several days.

Wednesday, December 05, 2007

CDO Liquidates for "Less than 25% of par value"

by Calculated Risk on 12/05/2007 09:11:00 PM

From Standard & Poor's: S&P Cuts All Adams Square Funding I Rtgs To ‘D’ On Liquidation (hat tip Brian)

Standard & Poor's Ratings Services today lowered its ratings to 'D' on the senior swap and the class A, B-1, B-2, C, D, and E notes issued by Adams Square Funding I Ltd. The downgrades follow notice from the trustee that the portfolio collateral has been liquidated and the credit default swaps for the transaction terminated.Bloomberg is reporting (no link) that $165 million of debt, originally rated AAA will not be repaid.

The issuance amount of the downgraded collateralized debt obligation (CDO) notes is $487.25 million.

According to the notice from the trustee, the sale proceeds from the liquidation of the cash assets, along with the proceeds in the collateral principal collection account, super-senior reserve account, credit default swap (CDS) reserve account, and other sources, were not adequate to cover the required termination payments to the CDS counterparty. As a result, the CDO had to draw the balance from the super-senior swap counterparty. Based on the notice we received, the trustee anticipates that proceeds will not be sufficient to cover the funded portion of the super-senior swap in full and that no proceeds will be available for distribution to the class A, B, C, D, or E notes.

Today's rating actions reflect the impact of the liquidation of the collateral at depressed prices. Therefore, these rating actions are more severe than would be justified had liquidation not been ordered, in which case our rating actions would have been based on the credit deterioration of the underlying collateral. Across the cash flow assets sold and credit default swaps terminated, we estimate, based on the values reported by the trustee, that the collateral in Adams Square Funding I Ltd. yielded, on average, the equivalent of a market value of less than 25% of par value.

From triple AAA to nothing. That is a deep cut.

More on the Freeze Plan

by Anonymous on 12/05/2007 07:30:00 PM

I am, in fact, working on detailed post about The Plan. Since it appears there will be details released tomorrow, I expect to have more worthwhile to say after that.

But, to speak to what just got released (as presented in Bloomberg): this thing with the FICO score buckets seems to have taken a lot of people aback. Certainly we hadn't heard explicit mentions of FICO bucketing in the earlier hints about The Plan.

I think what this is about is a way to keep this focused on subprime loans. As regular readers of this blog (at least) know, there really aren't hard-and-fast definitions of subprime. Saying that efforts will be "prioritized" by FICOs under 660 is a way to try to target this effort to what we would consider "subprime," regardless of how the loans might be described by a servicer or in a prospectus.

And that, really, is a way to target the "freeze" to start rates that are already pretty high. I think some people are getting a bit misled by the idea of "teaser" rates here. As Bloomberg reports quite correctly, the loans being targeted have a start rate in the 7.00% to 8.00% range. (My back-of-the-envelope calculation is a weighted average of about 7.70%, with a weighted average first adjustment rate of just over 10.00%.) Nobody wants to come out and say that "Hope Now" is all about freezing just the highest initial ARM rates that there are, but that's in fact what it's about.

So asking, in essence, why we are "rewarding" people with the worst credit profiles is, really, missing the point. The point is that the cost of this goes directly to investors in asset-backed securities, and those investors are being asked to forgo 10% (the reset rate) and take 7.70% (the current or start rate). They are not being asked, say, to forgo 7.70% and take 5.70%, which is roughly what it would be if this "freeze" were extended to the significantly-over-660 crowd (Alt-A and prime ARMs).

So far, I'm prepared to believe assurances that this will not involve taxpayer subsidies: the cost of this is, actually, going to be absorbed by investors in mortgage-backed securities. This is why "good credit" borrowers are not going to be "rewarded"--because investors cannot be brought to forgo that much interest. Somebody did the math, and somebody concluded that freezing a rate that is still about 200-250 bps over the 6-month LIBOR isn't going to be a disaster (at least not compared to having to foreclose these things).

More tomorrow.

The Bush / Paulson Mortgage Freeze Plan

by Calculated Risk on 12/05/2007 05:08:00 PM

I believe Tanta is working on an analysis for tomorrow or later this week. Meanwhile here are some details via Bloomberg: Subprime Rate Five-Year Fix Agreed by U.S. Regulators

The freeze may apply to mortgages issued between January 2005 and July 2007 that are currently scheduled to reset between January 2008 and July 2010, said a person who has seen a draft proposal. Borrowers whose credit scores are below 660 out of a possible 850 and haven't risen by 10 percent since the loan was issued will be given priority.

Home Builders and Homeownership Rates

by Calculated Risk on 12/05/2007 04:00:00 PM

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year. Note: A special thanks to Jan Hatzius. Much of the ideas for this post are from his piece: "Housing (Still) Holds the Key to Fed Policy", Nov 27, 2007 Click on graph for larger image.

Click on graph for larger image.

The first graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The reasons for the change in homeownership rate will be discussed later in this post, but here are two key points: 1) The change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the rate (red arrow is trend) appears to be heading down.

The U.S. population has been growing close to 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these numbers, there would be close to 1.25 million new households formed per year in the U.S. (just estimates).

Since about 2/3s of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year. If an additional 500K per year moved to homeownership - as indicated by the increase in the homeownership rate from 1995 to 2005 - then the U.S. would have needed 1.3 million additional owner occupied homes per year.

Important note: these number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for to compare the numbers.

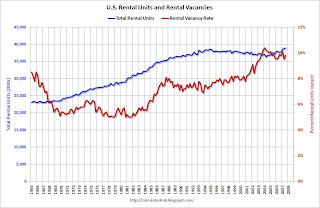

During that same period, since about 1/3 of all households rent, the U.S. would have needed about 400K+ new rental units per year, minus the 500K per year of renters moving to homeownership. So the U.S. needed fewer rental units per year from 1995 to 2005. Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

What this change in homeownership rate meant for the homebuilders was that they had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units, but the builders definitely benefited from the increase in homeownership rate.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.33% per year (Goldman's Hatzius estimated 0.5% per year). This would mean the net demand for owner occupied units would be 833K minus about 333K or 500K per year - about 40% of the net demand for owner occupied units for the period 1995 to 2005.

This means the builders have two problems over the next few years: 1) too much inventory, and 2) demand will be significantly lower over the next few years than the 1995-2005 period, and even when the homeownership rate stabilizes and the inventory is reduced, demand (excluding speculation) will only be about 2/3 of the 1995-2005 period.

Why did the homeownership rate increase?

A recent research paper - Matthew Chambers, Carlos Garriga, and Don E. Schlagenhauf (Sep 2007), "Accounting for Changes in the Homeownership Rate", Federal Reserve Bank of Atlanta - suggests that there were two main factors for the recent increase in homeownership rate: 1) mortgage innovation, and 2) demographic factors (a larger percentage of older people own homes, and America is aging).

The authors found that mortgage innovation accounted for between 56 and 70 percent of the recent increase in homeownership rate, and that demographic factors accounted for 16 to 31 percent. Not all innovation is going away (securitization and some smaller downpayment programs will stay), and the population is still aging, so the homeownership rate will probably only decline to 66% or 67% - not all the way to 64%.

This isn't the first time mortgage innovation contributed to a significant increase in the homeownership rate. The follow graph is from the referenced paper:

After World War II, the homeownership rate increased from 48 percent to roughly 64 percent over twenty years. This period was not only an important change in the trend, but determined a new level for the years to come. The expansion in homeownership during the postwar period has been part of the so-called "American Dream." ...Not all mortgage innovation is bad!

Prior to the Great Depression the typical mortgage contract had a maturity of less than ten years, a loan-to-value ratio of about 50 percent, and mortgage payment comprised of only interest payments during the life of the contract with a "balloon payment" at expiration. The FHA sponsored a new mortgage contract characterized by a longer duration, lower downpayment requirements (i.e., higher loan-to-value ratios), and self- amortizing with a mortgage payment comprised of both interest and principal.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.

And finally, the current boom in homeownership rate hasn't be a U.S. only phenomenon. This chart (from the paper) shows the 1995 and 2005 homeownership rate for various countries.The 5% increase in the U.S. is actually less than many other countries.

Once again, looking forward this means the builders will face two problems over the next few years: too much supply and significantly lower demand (not even counting for speculation).

Moody's: MBIA Capital Shortfall "Somewhat Likely"

by Calculated Risk on 12/05/2007 01:40:00 PM

From Bloomberg: MBIA Capital Shortfall May Be `Likely,' Moody's Says (hat tip Mike and Brian)

MBIA Inc. is ``somewhat likely'' to face a capital shortfall, throwing its AAA credit rating in jeopardy and putting at risk the rankings of the state, municipal and corporate debt it guarantees, Moody's Investors Service said. ...

A review of MBIA, the largest bond insurer, will be completed within two weeks ...

``The guarantor is at greater risk of exhibiting a capital shortfall than previously communicated,'' Moody's said. ``We now consider this somewhat likely.''

The loss of MBIA's top ranking would cast doubt over the ratings of $652 billion of municipal and structured finance bonds that the company guarantees.

Orange County: Bankrupt in '94, Now Invested in SIVs

by Calculated Risk on 12/05/2007 12:19:00 PM

From Bloomberg: Orange County Funds Hold SIV Debt on Moody's Review

Orange County, California, bankrupted in 1994 by bad bets on interest rates, bought structured investment vehicles similar to those that caused a run on funds invested by local governments in Florida.It doesn't sound like Orange County will suffer any significant losses, but I doubt they will be investing in any more SIV asset backed commercial paper.

Twenty percent, or $460 million, of the county's $2.3 billion Extended Fund is invested in so-called SIVs that may face credit-rating cuts, said Treasurer Chriss Street. ...

Orange County's money is invested in commercial paper under review by Moody's that was issued by Centauri Corp.'s CC USA Inc., Citigroup Inc.'s Five Finance Inc., Standard Chartered Plc.'s Whistlejacket Capital Ltd. and Tango Finance Corp., according to Rodenhuis.

FHASecure, OK. FHA Modernization, Not OK.

by Anonymous on 12/05/2007 11:17:00 AM

Much has been said and debated about the Hope Now Alliance and Treasury Secretary Paulson’s comments last week thereon. Accrued Interest has a good post on the subject, which I take in part as kind of a nudge to explain some of my discomfort with the proposal. I’m working on a longer post addressing the question that seems to bother people the most, namely the question of the extent to which this involves the government changing the terms of existing contracts, or providing protection from liability for servicers who might be accused of violating contracts. That’s a big issue and in many ways a highly technical one, so it may take me a while to deal with it.

In the meantime, though, I wanted to point out one large problem I have with Paulson’s remarks, and a news item this morning gives me a great excuse to do so:

NEW YORK, Dec 5 (Reuters) - Countrywide Financial Corp's (CFC.N: Quote, Profile , Research) chief executive called on the U.S. Congress to temporarily raise the maximum size of mortgages that Fannie Mae (FNM.N: Quote, Profile , Research), Freddie Mac (FRE.N: Quote, Profile , Research) and the Federal Housing Administration may buy or insure by 50 percent to $625,000.You may recall that Bernanke, in a fit of exuberance, had suggested at one point that the GSE limit be raised to $1,000,000. Like most people, I pretty much instantly discounted that as a real possibility. Apparently even Angelo Mozilo has been forced to back off from $850,000 down to $625,000, and only on a temporary basis, at that. I suggest to the powers that be that continuing to ignore this sort of thing is working: wait til they get down to about $420,000, and then close the deal.

In an opinion piece in the Wall Street Journal on Wednesday, Chief Executive Angelo Mozilo, whose company is the largest U.S. mortgage lender, said the increase from $417,000 should be implemented for up to a year.

He said this would go a long way toward alleviating a nationwide housing crunch, which analysts expect to pinch borrowers and lenders throughout 2008 and probably beyond.

"It should be enacted as part of a broader package of reforms to ensure that these linchpins of our mortgage system can aggressively support the housing market in a time of need, and that the appropriate controls and oversight are in place to protect taxpayers," Mozilo wrote.

Mozilo had previously called for the cap to be raised to as much as $850,000.

But I do not trust Henry Paulson one little bit when it comes to ignoring this sort of thing. This is from Paulson’s speech to the OTS’s National Housing Forum, part of his remarks on the Hope Now proposals:

We in the federal government are also taking steps. This fall, HUD initiated "FHASecure" to give the FHA the flexibility to help more families stay in their homes, even those who have good credit but may not have made all of their mortgage payments on time. An estimated 240,000 families can avoid foreclosure by refinancing their mortgages under the FHASecure plan.FHASecure and “FHA Modernization” are horses of a different color. “FHASecure” is HUD’s response to the subprime refinance market meltdown; it is a way to offer refinances for a specific class of borrowers facing exploding ARM resets. It still requires a minimum of 3.00% equity, and it does not involve an increase in the maximum mortgage amount. You can read about the details here.

The Administration is taking action to help homeowners, and Congress must do the same before it leaves for the year. Since August, the President has been calling on Congress to pass his FHA modernization proposal which, by lowering the down payment requirement, increasing the loan limit and allowing risk-based pricing, will make affordable FHA loans more widely available. The Administration's proposed bill would help refinance another estimated 200,000 families into FHA-insured loans.

“FHA Modernization” is the kind of thing that got us into this mess in the first place. It is disingenuous of Paulson to say that Bush has been asking for this “since August”; he has been asking for it as far as I know since his first presidential campaign in 1999 (when the whole “Ownership Society” thing got launched). Only someone drinking too much bongwater, in my view, can think that now is a good time for FHA to start taking the oversized no-down loans (with casual appraisals) that are blowing up in the conventional sector. The Bush administration simply treats “FHA Modernization” like tax cuts: they’re good when the economy is good, they’re good when the economy is bad, they’re good when the economy is indifferent. They’re good; it’s a religion. Using the cover of the current crisis to sneak in permanent changes to the base FHA programs, changes that would allow future purchase transactions of the sort that we need FHASecure to bail out, is playing politics. Bad on Paulson.

Do note that FHA loan limits are now, and would be under “modernization,” tied to some percentage of the GSE conforming limit. This means that any change to Fannie and Freddie’s loan limits are an automatic change to the FHA limits. The “modernization” proposal would increase “lower cost” area limits from 48% to 65% of the conforming limit, and “higher cost” areas from 87% to 100% of the conforming limit. Therefore, the combination of “modernization” and—should it occur—increases in the conforming limit could very rapidly increase FHA loan amounts, at the same time that it relaxes appraisal requirements and lowers down payments. If Mozilo’s proposal were enacted along with FHA Modernization, the FHA limits would go to $406,000 (lower cost areas) and $625,000 (higher cost areas). Without “modernization,” the FHA limits would still increase to $300,000 and $546,000, respectively, unless there were a specific limitation in the bill holding the line on FHA limits. Those are pretty big loan amounts for a program that currently allows 97% financing and that is lobbying for the ability to offer 100% financing.

So far, cooler heads seem to be prevailing on the question of raising the conforming limits. So far. This is what Lockhart had to say on the subject to American Banker (subscription only):

"From the Fannie and Freddie side at this point, they should really stick to their knitting, given their capital constraints and given their lack of experience in the jumbo market," Office of Federal Housing Enterprise Oversight Director James Lockhart said in an interview last week. "From my standpoint, they have their hands full in the conforming loan market, and they're doing a good job, and if they're going to go anywhere, I think it should be to help out more in the affordable [housing market], because that's part of their mission."If Fannie and Freddie don’t belong in the jumbo market, then FHA certainly doesn’t.

My position has always been that the only really good thing about a full-blown credit crisis is that it creates a context in which restrictive legislation that would normally get successfully fended off by industry lobbyists can get passed, as part of the price tag of various bailout or pseudo-bailout efforts. In other words, you can kick them while they’re down. Changes to bankruptcy law to allow cram-downs is a great example of this, as are the state laws seriously curtailing or outright prohibiting stated-income lending. Those aren’t the kind of regulations you get when the punchbowl is still full.

Using the current crisis as an excuse to sneak through more irresponsible “innovation” is making a bad situation worse. The best thing you can say about FHA and the GSEs over the last several years is that while they took on some real risk—everyone did—they did not—they could not—participate in the worst of the excesses. It was left to the purely private sector to go where the agencies would not go; they went there; we got a postcard; it’s not a pretty one. So the agencies will have to be part of the cleanup. Programs like FHASecure and the GSEs’ various near-prime or “expanded approval” refinances for troubled loans are out there, and will save as many loans as they can save. I can live with that, personally.

What I don’t intend to live with is changes to the agencies’ statutory and charter limits that put them in the front of the next bubble. Put down your coffee and any sharp objects you happen to be holding, and read this interview from August of 2006 with Brian Montgomery, FHA Commissioner (and former “director of advance” for Bush-Cheney 2000):

Q: When we spoke about a year ago, on your 34th day on the job, you noted your vision for FHA and the things about FHA that you wanted to improve. Has your vision for FHA changed or evolved during your first year as FHA commissioner? What do consider your biggest accomplishment at FHA within the past year?That's the Bush administration in a nutshell: give happy speeches, see happy faces, hit "send." The fact that they're still pushing hard for this even "post-turmoil" tells me that it has nothing to do with "Hope Now," and everything to do with "Just Keep Hoping."

A: I'll tell you that the vision is pretty much the same, as far as what we need to do to make FHA viable again. I'd even go so far as to say that it's been strongly reinforced by the many speeches that I give around the country and the many home-ownership events and ribbon-cuttings where I'm actually getting to meet some of the families who've been able to purchase their first home because of FHA. Getting to see the excitement on their faces tells us we're doing the right thing.

I'd also say that, speaking relative to the industry, when we embarked on this quest to modernize FHA, we worked closely with many industry partners, including the MBA [Mortgage Bankers Association]--in particular, at their conference [92nd Annual Convention & Expo 2005] down in Orlando.

Kurt [Pfotenhauer, MBA's senior vice president, government affairs] and others had set up a roundtable of about 25 small to medium-sized FHA lenders, and what was going to be about an hour-long sit-down ended up being an hour and 45 minutes where they all gave me their input on how FHA should be.

Every one of them essentially gave me an earful--in a pleasant way, mind you--but every one of them would start off [by saying], "I started out in FHA" and "I cut my teeth in FHA or my partner did."

It was good for me to see--again reinforcing that our industry partners firmly believe that FHA needs to play a large role in today's mortgage marketplace--that we're definitely heading down the right path. I haven't met anyone yet who said, "We think FHA has outlived its usefulness." Quite the contrary--they all tell us we're doing the right things.

As far as a biggest accomplishment, I would say modernizing some of the ways we do our business relative to our procedures and processes. Some of the feedback we've gotten from the industry, because we rely on the industry and we're partners in all of this, [include] improvements in how we do appraisals.

Some previously called [our rules for appraisals] "unique," some called them "onerous" and some [called them] things worse than that, and we just thought maybe in today's hurry-up world it's not so important to go back two or three times to make sure a cracked window pane is fixed or maybe the tear in the carpet has been adequately repaired. Now, if it's something structural, that's a different story.

I think [another accomplishment would be a] lot of those common-sense solutions--the lender insurance initiative [FHA's Lender Insurance Program, introduced by HUD in September 2005], that now about half our loans are using lender insurance, but we were about the last entity out there to send the thick case binders back and forth as our only means of really processing loans.

We decided that it was time for us to come into this century and do what everyone else was doing--just hitting the "send" key.