by Calculated Risk on 12/11/2007 12:35:00 PM

Tuesday, December 11, 2007

Freddie: More Losses, Record Defaults

From Bloomberg: Freddie Expects 4th-Quarter Loss, Record Default Rate

Freddie Mac ... said default rates on mortgages it owns or guarantees are rising to a record, likely leading to a fourth-quarter loss similar to its largest-ever loss last quarter.

``Our fourth-quarter results are not going to be effectively better than they were in the third quarter,'' Chief Executive Officer Richard Syron told investors today at a conference in New York sponsored by Goldman Sachs Group Inc. ``We are not promising a silver bullet, a short-term quick fix.''

Freddie Mac expects a 3 percent to 3.5 percent default rate, exceeding the record 2.4 percent rate on its books in 1991, the company said, according to a slide presentation. Credit losses on the current book of business will be $10 billion to $12 billion, Syron reiterated today. Almost half the impairments were reflected in third-quarter results reported on Nov. 20, the company said.

The decline in housing ``will get tougher before it gets better,'' Syron said.

Broker's Commissions Decline Sharply

by Calculated Risk on 12/11/2007 11:34:00 AM

Jon Lansner at the O.C. Register writes: Home-sale commissions off $13 billion from ‘05 peak

Want to see more housing pain? Real estate agent commissions nationwide will tumble $10 billion to $55 billion this year, says figures from ForSaleByOwner.com.This data is apparently a subset of the total brokers' commissions on sale of residential structures.

By this Web site’s math, commissions nationwide peaked at $68 billion in 2005, and dipped to $65 billion last year. Now, $55 billion isn’t bad, by this math. The last time agents’ total take was lower was 2003 ($51 billion) — and in 2000, for example, it was just $36 billion.

According to the BEA, total residential broker's commissions peaked at $109.9 billion in 2005 ($116.5 billion in Q3 2005 at a seasonally adjusted annual rate) and have declined to $81.1 billion (SAAR) in Q3 2007. Commissions have declined by $35 billion (SAAR) from the peak in Q3 2005.

Here is the BEA and NAR data for the last 3 years, and Q3 2007:

| 2004 | 2005 | 2006 | Q3 2007 (SAAR) | |

| BEA Broker's Commissions (millions) | $96,077 | $109,855 | $101,518 | $81,081 |

| NAR Existing Home Sales | 6,778,000 | 7,076,000 | 6,478,000 | 5,420,000 |

| NAR Average Sale Price | $244,400 | $266,600 | $268,200 | $267,500 |

| Commission Percentage (calculated) | 5.80% | 5.82% | 5.84% | 5.59% |

Click on graph for larger image.

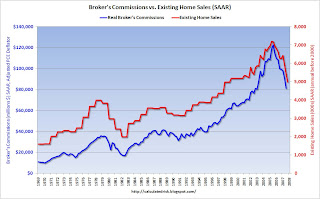

Click on graph for larger image.This graph shows real broker's commissions (adjusted by PCE deflator), compared to existing home sales since 1969. Obviously commissions have tracked sales pretty well, although there was a strong growth in real commissions, since the late '90s, as house prices surged.

As sales and prices continue to fall in 2008, commissions will probably decline significantly.

Freddie Mac: DQ Loans Stay in Pools

by Anonymous on 12/11/2007 11:08:00 AM

There have been some questions about what this means (thanks, Ramsey, for bringing it to my attention):

MCLEAN, Va., Dec. 10 /PRNewswire-FirstCall/ -- Freddie Mac (NYSE: FRE - News) announced today that the company will generally purchase mortgages that are 120 days or more delinquent from pools underlying Mortgage Participation Certificates ("PCs") when:

-- the mortgages have been modified;

-- a foreclosure sale occurs;

-- the mortgages are delinquent for 24 months;

or

-- the cost of guarantee payments to security holders, including advances

of interest at the security coupon rate, exceeds the cost of holding

the nonperforming loans in its mortgage portfolio.

Freddie Mac had generally purchased mortgages from PC pools shortly after they reach 120 days delinquency. From time to time, the company reevaluates its delinquent loan purchase practices and alters them if circumstances warrant.

Freddie Mac believes that the historical practice of purchasing loans from PC pools at 120 days does not reflect the pattern of recovery for most delinquent loans, which more often cure or prepay rather than result in foreclosure. Allowing the loans to remain in PC pools will provide a presentation of its financial results that better reflects Freddie Mac's expectations for future credit losses. Taking this action will also have the effect of reducing the company's capital costs. The expected reduction in capital costs will be partially offset by, but is expected to outweigh, greater expenses associated with delinquent loans.

It appears to me that Freddie Mac has decided it doesn't want to go there. It is therefore doing what, presumably, Peter Eavis wants it to do: leave the delinquent loans in the MBS pools unless and until that becomes more expensive than taking them out.

The accounting here is rather complex (which won't stop some people from having a cow over it, but I can't help that). The somewhat simplified view is this: the GSEs guarantee timely payment of principal and interest to MBS investors. They do not guarantee that investors will earn interest forever, but only as long as principal is invested. If a loan payment is not made by the borrower, either the GSE or the servicer (depending on the contract) has to advance scheduled principal and interest payments to the MBS until such time as the loan catches up (the borrower makes up the past due payments) or is foreclosed and liquidated.

The GSEs collect guarantee fees from seller/servicers (it works like servicing fees: it comes off the monthly interest payment). They also collect some other lump-sum fees when pools are settled. This is revenue to the GSEs, with a corresponding liability (to make the advances, with the risk that the advances will not be reimbursed completely at liquidation of the loan).

Therefore, when there are deliquent loans in an MBS, and the servicer is not obligated to advance for them, the GSE has a choice: it can buy the loan out of the MBS, put it into the GSE's own portfolio, and take any and all losses directly as any other investor would (and also any income). Or, it can leave the loan in the pool, while advancing the scheduled P&I to the pool investors. Only in some specific cases is the GSE obligated to take out a loan: when mortgages are modified, when the foreclosure sale occurs, or when the loan has been delinquent for 24 months or more. In other situations, it comes down to the question of which is cost-effective for the GSE: to leave it there and continue to advance, or to take it out with portfolio capital and do the fair value write-down.

Do note that if Fannie Mae had adopted this policy that Freddie has just announced--basically, that buying the loan out of the MBS will be the last rather than the first resort--it would not have shown big fair value write-downs, those would not have affected the credit loss ratio, and a big dust-up would not have occurred. There would still have been an effect on the financials, but just in a different place: in advances (coming out of G-fees received). So you either have expense (P&I advanced to bondholders) or you have expense (capital used to buy out the loans).

Insofar as everyone has been all worked up about the GSEs' capital ratios, this should be good news: they are levering investors' capital to carry delinquent loans until they can be cured (or liquidated). Insofar as investors want principal back faster, it's maybe not good news. But you can't really have it both ways.

I think it is important to understand that the GSEs are supposed to cover guarantee costs out of g-fees, not with portfolio purchases. You might have noticed that both Fannie and Freddie are increasing the g-fees and postsettlement/loan level pricing adjustments they charge seller/servicers. So they are beefing up the funds they have to cover MBS losses with. Nothing guarantees that will be enough; I don't think anybody knows right now what will be enough. But for what it's worth, I don't see this as "playing games" with capital requirements. I guess we'll have to see what Fortune Magazine thinks.

Monday, December 10, 2007

More Details on BofA Fund Closure

by Calculated Risk on 12/10/2007 09:29:00 PM

From the WSJ: Investor Withdrawals Shut BofA Fund

Columbia Management is shutting its Strategic Cash Portfolio ...So small investors - with just $25 million - will receive 99.4 cents on the dollar. Large investors will be paid "in kind". Ouch!

Only some investors will get their cash out. The fund's biggest investors will be paid "in kind" -- that is, they will be given their share of the underlying securities, rather than a cash payment. Smaller shareholders can cash out at the fund's share price, which is currently 99.4 cents on the dollar. The fund required a minimum investment of $25 million.

Some enhanced funds are doing even worse:

A report Monday by Standard & Poor's found that about 30 U.S.-oriented enhanced cash funds rated by S&P had lost a total of $20 billion, or 25% of their assets, in the third quarter. In one of the more dramatic instances, one fund (which S&P declined to identify) saw its assets under management shrink by 98% or $2.5 billion.

Even traditional money-market funds have felt pressure. ... at least a half-dozen financial institutions, including Bank of America, have taken steps such as buying the funds' troubled securities to protect their money funds....

Money-market funds are required to maintain an unchanging $1-per-share net asset value; if they waver from that they are said to "break the buck." Enhanced cash funds don't have the same requirement.

Morgan Stanley: Recession Likely

by Calculated Risk on 12/10/2007 06:02:00 PM

Update: Here is the Morgan Stanley piece. (hat tip Carlomagno)

From Rex Nutting at MarketWatch: Mild recession likely, Morgan Stanley says

The U.S. economy is likely to slip into a mild recession in 2008, said economists at Morgan Stanley, which is the first major Wall Street firm to predict a recession.Also moving into the recession camp, according to the Wall Street Journal, is Paul Kasriel of Northern Trust, the 2006 recipient of the Lawrence R. Klein Award for Blue Chip Forecasting Accuracy.

Domestic demand is expected to fall 1% annualized over the next three quarters with zero growth in gross domestic product and a 5% to 10% drop in corporate earnings, said chief economist Richard Berner and U.S. economist David Greenlaw in an updated forecast on the firm's Global Economic Forum Web site. For the full year, Morgan Stanley sees 1% growth.

...

"Those negatives sound like the recipe for a serious recession, so why do we think it will be mild?" Berner and Greenlaw wrote. "Although it is slowing, global growth is still strong, and we expect that net exports will add about 3/4 percentage point to growth through the end of 2008. In addition, we think that corporate capital and hiring discipline in this expansion mean that there are no business-investment or labor-market excesses to unwind, adding to U.S. economic resilience."

WaMu Cuts Dividend, Raises Capital

by Calculated Risk on 12/10/2007 04:59:00 PM

WaMu PR: WaMu to Raise $2.5 Billion in Additional Capital, Reduce Dividend, Resize Home Loans Business and Cut Expenses to Fortify Capital Base

Washington Mutual, Inc. (NYSE:WM - News) announced today a series of actions designed to address the unprecedented challenges in the mortgage and credit markets by strengthening the company’s capital and liquidity and accelerating the alignment of its Home Loans business with its retail banking operations.

These actions include:A capital offering of convertible preferred stock with aggregate proceeds of approximately $2.5 billion;In addition, the company said its Board of Directors intends to reduce the quarterly dividend rate to $0.15 per share from its most recent quarterly dividend rate of $0.56 per share.

A major reduction in company-wide noninterest expense of approximately $500 million for 2008 as a result of a substantial resizing of its Home Loans business and reduced corporate support expense; and

A significant change in the strategic focus of its Home Loans business in response to a changed market.

...

Continued deterioration in the mortgage markets and declining housing prices have led to increasing fourth quarter charge-offs and delinquencies in the company’s loan portfolio. As a result, the company now expects its fourth quarter provision for loan losses to be between $1.5 and $1.6 billion, approximately twice the level of expected fourth quarter net charge-offs.

The company currently expects its first quarter 2008 provision for loan losses to be in the range of $1.8 to $2.0 billion, reflecting an increase in provision well ahead of charge-offs, which are also expected to increase significantly during the quarter. The first quarter range reflects the company’s current view that prevailing adverse conditions in the credit and housing markets will persist through 2008.

While difficult to predict, the company also currently expects quarterly loan loss provisions through the end of 2008 to remain elevated, generally consistent with its expectation for the first quarter of 2008.

2008 Existing Home Sales Forecasts

by Calculated Risk on 12/10/2007 01:46:00 PM

"Existing-home sales, after reaching the third highest total on record, 6.48 million in 2006, are forecast at 6.44 million in 2007 and 6.64 million next year."Just thought I'd start with a little comic relief from Those Wacky NAR Forecasts! Compare to the current NAR forecast:

National Association of Realtors, Feb 2007.

Existing-home sales are likely to total 5.67 million this year, the fifth highest on record, rising to 5.70 million in 2008, in contrast with 6.48 million in 2006.I think their forecasting model is broken.

NAR, Dec 2007

Last December it was hard to find a Wall Street firm with a forecast under 6.0 million existing home sales in 2007. David Berson, then Chief Economist at Fannie Mae, forecast 2007 sales would be 5.925 million - and that was considered bearish. My forecast was for sales to "surprise to the downside, perhaps in the 5.6 to 5.8 million unit range."

Now we are starting to see forecasts for 2008. Back in August, Goldman Sachs forecast existing home sales would fall to 4.9 million in 2008. However, since then, Goldman has becoming even more bearish on housing.

Here is another forecast for 2008 via AP:

Patrick Newport, an economist at Global Insight, forecasts that home sales will drop from 5.66 million this year to 4.7 million in 2008I'll put together a forecast at the end of the year, but this is why I posted the chart of sales as a percent of owner occupied units this morning (see 2nd chart). At the bottom of a housing cycle, sales typically fall to 5% or even 4% of owner occupied units (a measure of turnover). There are currently just over 75 million owner occupied units in the U.S., so 6% (the median for the last 40 years) would be sales of about 4.5 million in 2008, 5% would be sales of 3.75 million, and 4% would be 3.0 million units. This isn't a forecast - just a review of historical data - but it is possible that sales could fall sharply from the current levels.

It's About Not Having To Work Very Hard

by Anonymous on 12/10/2007 12:06:00 PM

Tom Petruno in the LAT gets it:

Some analysts said the risk of borrowers returning for more forbearance could be intensified by a provision in the program that calls for fast-tracking hundreds of thousands of loans for a rate freeze, as opposed to undertaking a detailed and time-consuming study of the borrowers' finances.That is the issue and has always been the issue. But then Paulson wasn't in much of a position to lecture servicers about doing things right the first time and displaying a "degree of care":

"To decide if a modification is beneficial," analysts at brokerage Deutsche Bank Securities wrote in a note to clients Friday, a mortgage servicer needs to assess the borrower "with the same degree of care as a new borrower walking through the door."

Determining eligibility for a rate freeze based on just a few criteria, as the Bush plan proposes, "is to repeat the same type of underwriting shortcuts that got us here," the analysts wrote, referring to the no-questions-asked frenzy of 2005 and 2006 that gave home loans to almost anyone who could fog a mirror.

But the administration and its financial industry allies said the crumbling housing market dictated the need for speed in addressing the problem many borrowers are facing in holding on to their homes.

"The standard loan-by-loan evaluation process that is current industry practice would not be able to handle the volume of work that will be required," Treasury Secretary Henry M. Paulson Jr. said Thursday in announcing the program.

As President Bush announced the modification plan, The Wall Street Journal reported that the SIV fund likely would be half of the $100 billion originally envisioned, apparently because some SIVs did not want to participate.I don't know that I've ever really seen this much homework eaten by this many dogs before. I guess the good news is that the dogs aren't going to starve.

The loan modification agreement, meanwhile, came together in a relative rush. Sources said that discussions on it did not begin until after Thanksgiving, and that the first meeting on it was not until Nov. 29. Details of the plan were still being worked out until moments before the announcement Thursday afternoon.

Indeed, federal regulators appeared to have been kept in the dark about many of the plan's details. That proved awkward at a House Financial Services Committee hearing on loan modifications Thursday morning. Chairman Barney Frank challenged bank regulators on the plan, who acknowledged it was still in flux.

A Treasury spokeswoman did not return calls seeking comment. [American Banker, registration required]

Of course, if you ask Paul Krugman, he'll tell you that it's not so much that the dog ate the homework; it's that we're grading on the Bush Curve:

By Bush administration standards, Henry Paulson, the Treasury secretary, is a good guy. He isn’t conspicuously incompetent; and he isn’t trying to mislead us into war, justify torture or protect corrupt contractors.There's a masterpiece of damning with faint praise.

So putting together some sloppy plan to let sloppy servicers slop along with sloppy modifications is probably the best we could have hoped for. At least no one is (yet) suggesting that we load the nonperforming loans up in CIA planes and fly them to secret detention centers in the dead of night for a few torture sessions. What a relief. I doubt we could have found the original loan file to put it on the plane . . .

But fear not: having gotten permission to do sloppy mods, we're sure that lenders are done asking for permission to do more sloppy stuff, right? Wrong. According to Mortage News Daily (sub required):

To deal with a large volume of loan modifications, the Mortgage Bankers Association is asking the Financial Accounting Standards Board for relief from its rules for evaluating credit impairment on hundreds of thousands of subprime adjustable-rate mortgages. The MBA has endorsed President Bush's plan to freeze the resets on subprime ARMs. However, its members maintain that they don't have the systems capacity to evaluate loan impairment under Financial Accounting Standard No. 114 on a loan-by-loan basis and would like to use FAS 5 instead. "FAS 5 provides for a cost-effective approach to accurately measuring probable credit losses on large volumes of loans, which is consistent with the objective of a loan modification, which is to reduce the prospect of future credit losses," the MBA says in a letter to FASB.I guess we're supposed to be grateful that they're asking first.

CNBC Reports Bank of America Freezes $12 Billion Money Market

by Calculated Risk on 12/10/2007 11:25:00 AM

CNBC reports that Bank of America Corporation (BAC) has stopped redemptions on a $12 billion money market fund for Institutional investors called Columbia Strategic Cash portfolio. More when news is released ...

Note this is for institutional investors.

UPDATE: BAC denies "CNBC report that the fund had been frozen".

From Reuters: Bank of America says closing money market fund

The bank's Columbia Strategic Cash Portfolio fund, which has less than $11 billion in assets, has been closed to new investors, said Columbia spokesman Jon Goldstein.

Goldstein denied a CNBC report that the fund had been frozen, saying that clients were being offered the option of cash redemptions or of switching their assets into other Columbia-managed funds.

Comments on the 2008 NAR Forecast

by Calculated Risk on 12/10/2007 10:45:00 AM

Included in the NAR Pending Home sales release was their 2008 forecast::

Existing-home sales are likely to total 5.67 million this year, the fifth highest on record, rising to 5.70 million in 2008, in contrast with 6.48 million in 2006.First, will sales in 2008 be the "fifth highest on record"? The answer is it will be close, since it appears sales will be just over 5.6 million in 2007.

Here are the top existing home sales years:

| Rank | Year | Sales (000s) |

| 1) | 2005 | 7,076 |

| 2) | 2004 | 6,778 |

| 3) | 2006 | 6,478 |

| 4) | 2003 | 6,175 |

| 5) | 2002 | 5,632 |

| 6) | 2001 | 5,335 |

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales and year end inventory since 1969 (inventory since '82). For 2007, 5.6 million sales and current inventory are graphed.

For the last couple of months, sales have been running at the 5.0 million SAAR. In September, sales were at a 5.03 million SAAR, and October, sales were at a 4.97 million SAAR. The Pending Home Sales index suggests sales are still running at around 5 million.

The second graph shows sales as a percent of total owner occupied units. This is a measure of turnover of existing homes.

The second graph shows sales as a percent of total owner occupied units. This is a measure of turnover of existing homes.It appears sales in 2007 will come in at about 7.5% of owner occupied units, well above the long term median of 6%. If sales fall to 5.0 million in '08, that will still be about 6.7% of Owner Occupied units - still above the median level.

If sales fall back to the median level, sales will be around 4.6 million n 2008. Note also that usually sales fall below the median level during a housing slowdown.

Based on slowing turnover rate and tighter lending standards, we can probably already say the NAR forecast of 5.7 million units in '08 is way too high. I will have a forecast soon, but sales below 5 million units in '08 is very likely.