by Calculated Risk on 12/14/2007 08:13:00 PM

Friday, December 14, 2007

Condo Conversions

The following story concerns how poorly the conversion from condos to apartments was apparently handled by a developer in D.C. From the WaPo: Condo Crunch

... Senate Square, was converting condos to apartment rentals. The Web site for the project confirmed the news with a new advertising pitch for "luxury apartments."More interesting - at least to me - is this story fits with my analysis of the rental market. (See Housing Inventory and Rental Units)

Since Q2 2004, there have been 2.6 million rental units added to the U.S. inventory according to the Census Bureau, but only 773 thousand units completed as 'built for rent' since Q2 2004.

The other 1.8+ million rental units added must be older out-of-service units being brought back to the rental market, condo "reconversions", flippers becoming landlords, or homeowners renting their previous homes instead of selling. As I noted in the earlier post, this shows the substantial excess inventory in 2004 and 2005 that didn't show up in the new home or existing home inventory numbers at the time (although many of us thought correctly that there was a huge unaccounted for inventory).

The 2nd part of the WaPo story is grim:

Danah Leeson, a registered nurse, agreed to pay $615,000 for a two-bedroom condo at the Phoenix in Arlington in July 2005. She put down a deposit of about $31,000. But this summer, when she tried to secure a loan to complete the purchase, the lender told her she would have to come up with an extra $100,000 to make up the difference between the purchase price and the current value of the unit. "The lender won't give us more than the appraised value," she said.Can you imagine a lender not wanting to loan more than the appraised value? How traditional. But Danah's choices aren't find $100K or lose her deposit. Her choices are renegotiate with the builder or walk away.

Her choice? Find $100,000 or lose her $31,000 deposit.

Downey Financial Non-Performing Assets

by Calculated Risk on 12/14/2007 03:51:00 PM

From the Downey Financial 8-K released today. (hat tip Credit Bubble Stocks and others)

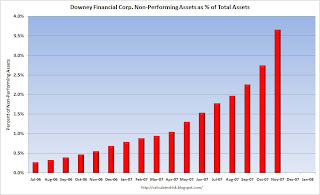

| Click on graph for larger image. This would be a nice looking chart, except those are the percent non-performing assets by month. Yes, by month! |

BTW, Herb Greenberg provides this quote from an unidentified source: Extrapolating Downey to WaMu, others

DSL was supposed to be the best underwriter. That’s why I owned it at one point. They were the lowest loan-to-value lender, which is interesting considering the data we are seeing now. The problem is that lenders did a horrible job tracking if there was a second lien behind them. Borrowers have so much leverage (first lien + second) and house prices are falling so fast, that they are just deciding to walk away from the home. This is something the Paulsen plan does not address. It’s not a question of being able to make the next payment…it’s looking at the value of your home and thinking ‘wow I am going to be under water for a long time ...

CNBC: Merrill Writedowns could be $4B to $6B More than Expected

by Calculated Risk on 12/14/2007 03:15:00 PM

Via Dow Jones (no link, hat tip Brian): CNBC's Charlie Gasparino, citing unnamed sources inside Merrill's fixed-income department, reported that Merrill's writedowns could be $4 billion to $6 billion more than is currently expected.

More 2008 Housing Forecasts

by Calculated Risk on 12/14/2007 02:11:00 PM

From Bloomberg: Housing Crash Deepens in 2008 as U.S. Realtors See Record Drop

Analysts at New York-based CreditSights Inc. predict housing won't rebound until ``2009, at best.'' Moody's Economy.com Inc., the economic forecasting unit of Moody's Corp. in New York, says home sales will hit bottom next year, declining 40 percent from their peak.The peak for existing home sales was 7.076 million in 2005. So 40% off the peak would be 4.246 million units next year.

And from AP: Fannie CEO: housing trouble until 2009

Fannie Mae's CEO [Daniel Mudd] told shareholders Friday he does not expect a housing market recovery until late 2009, "at the earliest" ...OK, not a specific 2008 forecast, but still interesting.

Here are a few other forecasts:

NAR, Dec 2007:

Existing-home sales are likely to total 5.67 million this year, the fifth highest on record, rising to 5.70 million in 2008, in contrast with 6.48 million in 2006.From AP:

Patrick Newport, an economist at Global Insight, forecasts that home sales will drop from 5.66 million this year to 4.7 million in 2008Back in August, Goldman Sachs forecast existing home sales would fall to 4.9 million in 2008. However, since then, Goldman has becoming even more bearish on housing.

To put these numbers in perspective:

Click on graph for larger image.

Click on graph for larger image.This graph shows sales as a percent of total owner occupied units. This is a measure of turnover of existing homes.

It appears sales in 2007 will come in at about 7.5% of owner occupied units, well above the long term median of 6%. If sales fall back to the median level, sales will be around 4.5 million in 2008. Note also that usually sales fall below the median level during a housing slowdown.

Here is a table of a few existing home sales forecasts:

| Forecaster | Units | Percent of Owner Occupied Units |

| National Association of Realtors | 5.7 million | 7.5% |

| Goldman Sachs (August) | 4.9 million | 6.5% |

| Global Insights | 4.7 million | 6.2% |

| Moody's Economy.com | 4.25 million | 5.6% |

Krugman: After the Money's Gone

by Calculated Risk on 12/14/2007 11:49:00 AM

Update: Also see Krugman's blog: Why negative equity matters

[T]he problem with the markets isn’t just a lack of liquidity — there’s also a fundamental problem of solvency.Paul Krugman writes in the NY Times: After the Money's Gone

Paul Krugman, NY Times, Dec 14, 2007

First, we had an enormous housing bubble in the middle of this decade. To restore a historically normal ratio of housing prices to rents or incomes, average home prices would have to fall about 30 percent from their current levels.The WSJ recently had a series of graphs titled: Genesis of a Crisis. Here is the chart of the Price to Rent ratio.

Click on graph for larger image.

Click on graph for larger image.This graph is based on a ratio of the OFHEO house price index to personal consumptions on rent. Note: Later today I'll post a graph based on the Case-Shiller index.

As Krugman notes, house prices would have to fall about 30% to bring the Price to Rent ratio back to a more normal ratio.

Krugman:

Second, there was a tremendous amount of borrowing into the bubble, as new home buyers purchased houses with little or no money down, and as people who already owned houses refinanced their mortgages as a way of converting rising home prices into cash.The Fed recently released the Q3 Flow of Funds report. The report showed that household percent equity was at an all time low of 50.4%.

This graph shows homeowner percent equity since 1954. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity withdrawal 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

This graph shows homeowner percent equity since 1954. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity withdrawal 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.Also note that this percent equity includes all homeowners. Based on the methodology in this post, aggregate percent equity for households with a mortgage has fallen to 33% from 36% at the end of 2006.

Krugman:

As home prices come back down to earth, many of these borrowers will find themselves with negative equity — owing more than their houses are worth. Negative equity, in turn, often leads to foreclosures and big losses for lenders.From the post Professor Krugman mentions: Homeowners With Negative Equity

And the numbers are huge. The financial blog Calculated Risk, using data from First American CoreLogic, estimates that if home prices fall 20 percent there will be 13.7 million homeowners with negative equity. If prices fall 30 percent, that number would rise to more than 20 million.

That translates into a lot of losses, and explains why liquidity has dried up. What’s going on in the markets isn’t an irrational panic. It’s a wholly rational panic ...

The following graph shows the number of homeowners with no or negative equity, using the most recent First American data, with several different price declines.

At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).

At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).By the end of 2007, the number will have risen to about 5.6 million.

If prices decline an additional 10% in 2008, the number of homeowners with no equity will rise to 10.7 million.

The last two categories are based on a 20%, and 30%, peak to trough declines. The 20% decline was suggested by MarketWatch chief economist Irwin Kellner (See How low must housing prices go?) and 30% was suggested by Paul Krugman (see What it takes).

As Krugman notes: The current crisis is not a liquidity problem, it is a solvency problem.

Put These People on the RepoBus

by Anonymous on 12/14/2007 10:50:00 AM

BusinessWeek sums it up: "Dog Days at Cerberus."

Here's one for the Things You Have To Read A Couple of Times At Least To Assure Yourself That It's Not Just You File:

Now, say sources close to Cerberus, the $26 billion firm has slowed its pace of dealmaking with the credit crunch in full force. It's also focusing more rigorously on the troubled holdings in its portfolio—some of which may have blindsided the firm. The situation has prompted concern that Cerberus' returns may suffer. This comes at a time when all players are under pressure. "Industry returns have been extraordinary, 20% to 30% a year," says Katharina Lichtner, managing director of the private equity advisory firm Capital Dynamics. "Returns will come down, revert to a more normal 16%."And what kind of socially redeeming value will Cerberus be adding to the mortgage biz for that perfectly normal 16%?

It's unclear just how much work it will take to fix GMAC, the financing arm of General Motors (GM). A Cerberus-led group paid $14 billion for a 51% stake in September, 2006. Cerberus wasn't exactly an industry newcomer. It had a front row seat at the subprime show with Aegis Mortgage, a lender it took control of in 1996. Yet Cerberus jumped into GMAC at exactly the wrong moment. Price defends the move: "There was one time to buy GMAC. We wanted it and took action."Cut back office at a mortgage servicer. Put people who can service car loans in charge of mortgage loans. That's exactly what we need right now. Dog days at Cerberus, or just doghouse for the rest of us?

The short story? Aegis filed for bankruptcy in August, and GMAC's mortgage group ResCap has been bleeding red ink. Cerberus watched GMAC continue to make subprime loans in the first quarter but has since reined it in. It wasn't fast enough to prevent the pain. ResCap has lost $3.4 billion so far this year, forcing GMAC to pump $2 billion into the business to help it survive the mortgage mess. And Lehman Brothers analyst Brian Johnson forecasts an additional $1.3 billion hit this quarter and $600 million in 2008. "I don't think anyone is panicked," says one Cerberus insider. But "we sure as hell didn't expect GMAC to be what it turned out to be."

Those problems may put a kink in the firm's strategy. Cerberus, which also owns 80.1% of struggling automaker Chrysler, wants to merge the lending operations of both companies. By doing so, it could reap massive savings on back office and loan processing operations, boosting returns at both GMAC and Chrysler.

Let me just observe that GMAC's mortgage servicing unit was already pretty "stripped down" in its heyday. That was its business model: cheap servicing. I can't wait to see what happens when you make it cheaper.

As Opposed to the RepoChopper

by Anonymous on 12/14/2007 09:50:00 AM

In case you were paying attention to big news yesterday (yeah, we're lookin' at you, Citi) and missed the RepoBus, don't miss the RepoBus. Tragedy as farce. It always gets there in the end.

I forgot who sent me the link to that article yesterday. So I'll just hat tip everybody, the innocent as well as the guilty. It ought to be a fun day.

Thursday, December 13, 2007

WSJ: Citi to Move SIVs to Balance Sheet

by Calculated Risk on 12/13/2007 06:48:00 PM

From the WSJ: Citigroup to Bring $49 Billion From SIVs Onto Its Balance Sheet

Citigroup ..., is bailing out seven struggling investment entities, bringing $49 billion onto its beleaguered balance sheet and further denting its depleted capital base.

...

The move could be the death knell for an industry-wide effort to create a rescue fund for the SIVs. ...

The move underscores how quickly Vikram Pandit, who was named Citi's new chief executive on Tuesday, is moving to tackle the myriad problems facing Citigroup. Just two days into his tenure, Mr. Pandit decided to bring the SIV assets onto the bank's balance sheet ...

...

By bringing the SIV assets on its balance sheet, Citigroup's already-depleted capital levels will come under further stress.

...

A Citigroup spokeswoman declined to comment on possible dividend cuts or capital-raising plans.

Consumers Use the 401(k) ATM

by Calculated Risk on 12/13/2007 04:33:00 PM

From CFO.com: Employees Raiding 401(k)s, CFOs Say (hat tip Lyle)

The latest Duke University/CFO Magazine Global Business Outlook Survey, which polls 573 finance chiefs in the U.S. and 1,275 globally, finds that year-end employee bonuses will fall by 10 percent this year compared to 2006. That decline could be especially painful at a time when more employees are dipping into their retirement accounts in order to pay bills.This article is from last week. With home equity extraction slowing, consumers are turning to other sources for cash, like credit cards and 401(k) withdrawals. Whatever the source, it appears - at least in November - that they are still spending.

The survey finds that nearly 20 percent of companies have seen increased hardship withdrawals from 401(k) accounts, often to cover mortgage payments or to avoid personal bankruptcy.

"In the last four or five months we have seen an absolute onslaught of people trying to do hardship withdrawals and loans out of 401(k)s," Mark Anderson, CFO of Granite City Electric, told CFO magazine in October. "What has happened with housing and the economy has really blown up for people at the lower end of the spectrum."

CFOs attribute the 401(k) withdrawals to the effects of the shaken credit markets and higher costs of living, among other reasons. Those concerns have affected companies from top to bottom. Nearly a third of CFOs polled in the survey said their firms have been directly hurt by credit conditions.

Discount Rate Spread Increases

by Calculated Risk on 12/13/2007 12:31:00 PM

From the Fed weekly report on commercial paper this morning, here is the discount rate spread: Click on graph for larger image.

Click on graph for larger image.

Worse than August.

Worse than 9/11.

UPDATE: A simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. Correction: This doesn't include the Asset Backed CP - that is another category and is even at a higher rate (see commercial paper table).

The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now the spread is indicating that "fear" is very high. It is actually very rare for CP defaults, but they do happen (see table 5 in the above Fed link).