by Calculated Risk on 12/17/2007 01:11:00 PM

Monday, December 17, 2007

NAHB: Builder Confidence Unchanged at Record Low

| Click on graph for larger image. The NAHB reports that builder confidence was unchanged at a record low 19 in December. |  |

Builder confidence in the market for new single-family homes remained unchanged for a third consecutive month in December as problems in the mortgage market and excess inventory issues continued, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI held even at 19 this month, its lowest reading since the series began in January 1985.

“Builders continue to look for signs of improvement in the ongoing mortgage market crisis that is weighing on housing and the overall economy,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif. ...

“Today’s report shows that builders’ views of housing market conditions haven’t changed in the past several months, and there clearly are signs of stabilization in the HMI,” noted NAHB Chief Economist David Seiders. “At this point, many builders are bracing themselves for the winter months when home buying traditionally slows, scaling down their inventories and repositioning themselves for the time when market conditions can support an upswing in building activity – most likely by the second half of 2008.”

...

In December, the index gauging current sales conditions for single-family homes improved by a single point, to 19, and the index gauging sales expectations for the next six months rose two points to 26. Meanwhile, the index gauging traffic of prospective buyers declined three points to 14.

Regionally, the HMI results were mixed in December. The Midwest and South each posted two-point gains in their HMI readings, to 15 and 21, respectively. The West held even at 18, and the Northeast, which experienced wetter weather conditions than normal in the survey period, posted a seven-point decline to 19. All regions were down on a year-over-year basis.

National City Corp. Warns

by Calculated Risk on 12/17/2007 12:30:00 PM

From the WSJ: National City Warns of Loan Losses

National City Corp. expects to set aside about $700 million to cover loan losses in the fourth quarter and said it incurred mortgage-related charges of about $200 million in October and November.Here is the National City SEC filing.

"The mortgage business continues to be under stress," the financial-services company said in a Securities and Exchange Commission filing....

Click on graph for larger image.

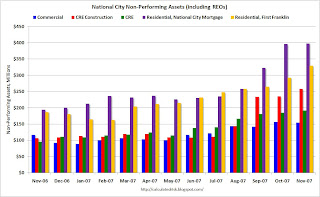

Click on graph for larger image.This graph shows the key nonperforming assets of National City Corp. Residential REO's are including in National City mortgage and First Franklin nonperforming assets.

According to the SEC filing:

Credit quality in the commercial and core consumer portfolios, including direct home equity lending, remains satisfactory. The areas of elevated risk continue to be in the run-off portfolios of First Franklin non-prime mortgages, especially seconds; broker-originated home equity loans and lines of credit associated with the former National Home Equity business; and certain sectors of investment real estate and residential construction. In particular, indirect home equity loans and lines that were transferred to portfolio in the third quarter have shown further deterioration beyond that which was anticipated at the time the September 30 loan loss allowance was established.Look at the graph. Most of the problems are in residential, but the nonperforming CRE (green) and nonperforming CRE construction (red) are definitely climbing.

emphasis added

Moody's Warnings on Monoline Guarantors Impacts $1.2 Trillion Debt

by Calculated Risk on 12/17/2007 10:05:00 AM

From Bloomberg: Moody's Warnings on FGIC, MBIA Cast Doubt on $1.2 Trillion Debt

Moody's Investors Service's warning that the top credit ratings of FGIC Corp. and three other bond insurers may be cut casts doubt on $1.2 trillion of municipal, corporate and asset-backed securities.Does everyone understand the systemic risk? I'm not so sure. This warning puts 89,709 public finance issues on negative watch and probably impacts most communities in the U.S..

...

``Everyone understands the systemic risk if even one of these companies is downgraded,'' said Peter Plaut, an analyst at hedge fund manager Sanno Point Capital Management in New York.

CRE: Centro Properties "struggling to refinance debt"

by Calculated Risk on 12/17/2007 09:38:00 AM

From Bloomberg: Centro Slumps 76% on Struggles to Refinance Debt (hat tip CG and Brian)

Centro Properties Group, the owner of 700 U.S. shopping malls ... say[s] it's struggling to refinance debt ...No one could have known.

Melbourne-based Centro suspended dividends and said in a statement that it may have to sell assets, after lenders set a Feb. 15 deadline to negotiate maturing debt. Traditional sources of funding are ``shut for business,'' Chairman Brian Healey said in the statement.

...

``We never expected nor could reasonably anticipate that the sources of funding that have historically been available to us and many other companies would shut for business,'' Centro's Healey said in the statement.

UPDATE: Last week I mentioned MBS (apartments) in Texas was delinquent on many loans. The WSJ had a story on Saturday: In Texas, MBS apartment Titan Battles Defaults

Massive Texas apartment-complex owner and operator MBS Cos. is in danger of defaulting on nearly $400 million in loans and has sought bankruptcy-law protection for many of its properties to stave off foreclosure.

Sunday, December 16, 2007

CDOs: Here Come the Lawyers

by Calculated Risk on 12/16/2007 09:45:00 PM

Here are a couple of different stories about CDOs and lawsuits. The first story concerns Wall Street selling CDOs to municipalities who now are claiming they were unaware of the risks.

From the Finanical Times: Lehman faces legal threat over CDO deals (hat tip Viv)

Lehman Brothers faces the threat of legal action by municipal councils in Australia over the sale of high-risk collateralised debt obligations by the Wall Street bank's local subsidiary, Grange Securities.The second story concerns sophisticated investors wrestling over the scraps, from the WSJ: CDO Battles: Royal Pain Over Who Gets What

At least two councils in New South Wales and a third in Western Australia are considering litigation against Grange ...

The Lehman-originated Federation CDO, exposed to the US subprime mortgage market, was last month marked down to just 16 cents in the dollar by the bank, leaving councils nursing paper losses of 84 per cent.

The sale by Grange and others of many hundreds of millions of dollars worth of CDOs to Australian councils, some of which had 70 per cent or more of their total investment devoted entirely to CDOs, has sparked an investigation by the state government of New South Wales.

A recent filing in New York state court provides a window into the legal battles likely to ensue from battered investments. Big players, including Deutsche Bank AG, bond insurer MBIA Inc., Wachovia Corp. and UBS AG are tangled together over a mortgage investment vehicle named Sagittarius.The lawyers will definitely be busy.

...

On Nov. 6, Sagittarius triggered "an event of default." This prompted MBIA to claim it should get all the remaining payments. That put it into potential conflict with Deutsche, the CDO's trustee, and UBS, an investor with fewer rights in the event of default.

Sorting out how to value the assets, who gets paid and whether to pull the plug on struggling CDOs is complicated business. Often little is known about who holds what. "If there's one safe prediction for 2008, it is that legal teams will be busy," wrote J.P. Morgan Chase in a recent report led by analyst Chris Flanagan.

NY Times: Are We in a Recession?

by Calculated Risk on 12/16/2007 12:02:00 PM

It is always difficult to tell - in real time - if the economy has slipped into a recession. Dr. Jim Hamilton at Econbrowser (and extended by Chauvet - see below) has developed a model that seems to do a pretty good job. From Chauvet:

"According to the model, the probability that the American economy was in a recession in October, the last month for which we have data, was only 16.5 percent. This is high enough to make us nervous about the future, but it is low enough that we can be fairly sure that if a recession is going to be visible in the data, it did not begin until November at the earliest."The next few months will be an interesting test of the Hamilton / Chauvet models.

Here are six views on the recession question from the NY Times:

You Can Almost Hear It Pop, by Stephen S. Roach

The Facts Say No, by Marcelle Chauvet and Kevin Hassett

Bet the House on It, by Laura Tyson

Not if Exports Save Us, by Jason Furman

Nobody Knows, by James Grant

Wait Till Next Year, by Martin Feldstein

"My judgment is that when we look back at December with the data released in 2008 we will conclude that the economy is not in recession now.Feldstein's view is especially important since he is the current President of the National Bureau of Economic Research (NBER) the organization that calls recession in the U.S..

There is no doubt, however, that the economy is slowing. There is a substantial risk of a recession in 2008."

And for fun, here are some Greenspan quotes from the '90/'91 recession: (bear in mind that the recession started in July, 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].” Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.” Greenspan, August 1990

“... the economy has not yet slipped into recession.” Greenspan, October 1990Source (pdf): "Booms, Busts, and the Role of the Federal Reserve" by Dr. David Altig.

Saturday, December 15, 2007

CRE Outlook Dims

by Calculated Risk on 12/15/2007 04:56:00 PM

From the Chicago Tribune: Commercial sales outlook turns darker

... since the summer, sales in the commercial real estate market have slowed radically as financial institutions and debt markets reel from the fallout of years of ill-advised financing."Reckless" lenders, slowing demand and more supply coming; those are key CRE fundamentals.

... as the economy slows, real estate fundamentals such as rents and vacancies seem destined to weaken, and some wonder if the frenzied commercial property deals of the recent past were wise.

Lenders competing for ever-larger shares of commercial property loans offered low- or no-interest financing for 90 percent or more of the asset value to buyers who might have rushed through their due diligence and bid up prices extravagantly, said Arthur Oduma, a senior analyst for Morningstar Inc.

"Lenders were almost reckless," he said.

Mark "Sam" Davis, senior managing director of real estate for Allstate Insurance, a commercial property lender and a unit of Northbrook-based Allstate Corp., agrees.

"In hindsight, some of these deals don't look so good and are unlikely to perform as the economy weakens," Davis said.

...

The Chicago office market could be further weakened because 6 million square feet of new office space is in development, with 3.6 million square feet of that scheduled for completion in 2009.

...

"With so much space rolling over, and tenants having more options, that makes investors back away," said Oduma.

One Good Bongwater Deserves Another

by Anonymous on 12/15/2007 04:06:00 PM

For those of you who might be new to this website, "drinking the bongwater" has been one of our favorite, er, "colorful" metaphors for the utter abandonment of sane underwriting standards during the great mortgage bubble. Not that anyone around here knows what a bong is or why it has water or what would happen if you drank it. It's undoubtedly something our children picked up in daycare.

As usual, though, we find that reality has a way of seeing you one and raising you one. Via Atrios, we learn about the bongwater housing economy:

Sheriff's Office narcotics detectives reported raiding three houses where hundreds of marijuana plants were being grown. . . .I'm guessing they went "stated income."

The investigation, which started 18 months ago, has led to a total of six raids at five addresses -- including the houses searched Thursday -- Carney said. Detectives have confiscated almost 2,000 plants, worth $2.4 million to $3.6 million on the street. The other houses are in South County and one has been busted twice by drug officers, Carney said.

The same group of people bought all the houses in 2005 and allegedly set up the grows, according to detectives. Investigators think the owners were using the marijuana grows to pay the mortgages on the homes.

"It appears they've been financing the houses with the cultivation and sales of marijuana," Carney said.

Moody's Lowers Bond Insurers Outlook

by Calculated Risk on 12/15/2007 12:17:00 AM

From Bloomberg: Moody's May Lower FGIC, XL Ratings; MBIA Outlook

FGIC Corp. and XL Capital Assurance Inc., two bond insurers, may lose their Aaa credit ratings at Moody's Investors Service after a slump in the value of the debt they guarantee.Just another Friday night ...

MBIA Inc., the largest bond insurer, and CIFG Guaranty had their outlooks lowered to ``negative'' by the New York-based ratings company today. The Aaa rankings of Ambac Financial Group Inc., Assured Guaranty Corp., and Financial Security Assurance Inc. were all affirmed, signaling no plans to change them, Moody's said. Radian Group Inc. was also affirmed.

Friday, December 14, 2007

Condo Conversions

by Calculated Risk on 12/14/2007 08:13:00 PM

The following story concerns how poorly the conversion from condos to apartments was apparently handled by a developer in D.C. From the WaPo: Condo Crunch

... Senate Square, was converting condos to apartment rentals. The Web site for the project confirmed the news with a new advertising pitch for "luxury apartments."More interesting - at least to me - is this story fits with my analysis of the rental market. (See Housing Inventory and Rental Units)

Since Q2 2004, there have been 2.6 million rental units added to the U.S. inventory according to the Census Bureau, but only 773 thousand units completed as 'built for rent' since Q2 2004.

The other 1.8+ million rental units added must be older out-of-service units being brought back to the rental market, condo "reconversions", flippers becoming landlords, or homeowners renting their previous homes instead of selling. As I noted in the earlier post, this shows the substantial excess inventory in 2004 and 2005 that didn't show up in the new home or existing home inventory numbers at the time (although many of us thought correctly that there was a huge unaccounted for inventory).

The 2nd part of the WaPo story is grim:

Danah Leeson, a registered nurse, agreed to pay $615,000 for a two-bedroom condo at the Phoenix in Arlington in July 2005. She put down a deposit of about $31,000. But this summer, when she tried to secure a loan to complete the purchase, the lender told her she would have to come up with an extra $100,000 to make up the difference between the purchase price and the current value of the unit. "The lender won't give us more than the appraised value," she said.Can you imagine a lender not wanting to loan more than the appraised value? How traditional. But Danah's choices aren't find $100K or lose her deposit. Her choices are renegotiate with the builder or walk away.

Her choice? Find $100,000 or lose her $31,000 deposit.