by Calculated Risk on 1/01/2008 03:19:00 PM

Tuesday, January 01, 2008

A Sacramento Housing Ad

Click on photo for larger image.

Click on photo for larger image.

This is a photo taken at the Sacramento Airport by Itamar

We wouldn't want anyone thinking "housing bubble", would we?

Best to all.

Mortgage "Implosion" Scuttles PHH Deal

by Calculated Risk on 1/01/2008 12:11:00 PM

From the WSJ: PHH Ends Agreement With Blackstone, GE Unit (hat tip Terry)

PHH Corp. said Tuesday it terminated its planned deal with private-equity firm Blackstone Group and a unit of General Electric Co. amid problems with the availability of debt financing needed to fund part of the transaction.Tanta is right: "We're All Subprime Now."

...

The ... company's industry has been hit hard by the implosion of the mortgage business at large. ... PHH says it is one of the top originators of residential mortgages in the U.S. ... Most are "prime" loans ...

Monday, December 31, 2007

Housing Summary

by Calculated Risk on 12/31/2007 08:54:00 PM

| What is that pig? It's from Tanta's Excel Art. A Mortgage Pig™ exclusive. Raindrops Keep Falling on My Pig Warning: this is a large (2 MB) Excel File. And yes, the Mortgage Pig™ is wearing lipstick. |

Happy New Year to All!

The following are some excerpts (with graphs) from a few housing posts in December. Follow the link for the entire post.

From Homeowners With Negative Equity

The following graph shows the number of homeowners with no or negative equity, using the most recent First American data, with several different price declines.

Click on graph for larger image.

Click on graph for larger image.At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).

By the end of 2007, the number will have risen to about 5.6 million.

If prices decline an additional 10% in 2008, the number of homeowners with no equity will rise to 10.7 million.

The last two categories are based on a 20%, and 30%, peak to trough declines.

From: Home Builders and Homeownership Rates

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year.

The graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.The reasons for the change in homeownership rate will be discussed [see here], but here are two key points: 1) The change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the rate (red arrow is trend) appears to be heading down.

From: MBA Mortgage Delinquency Graph

Here is a graph of the MBA mortgage delinquency rate since 1979.

Here is a graph of the MBA mortgage delinquency rate since 1979.This is the overall delinquency rate, and it is at the highest rates since 1986. As noted earlier this morning, delinquencies are getting worse in every category - including prime fixed rate mortgages - and getting worse at a faster rate in every category.

NOTE on 12/31/2007: See: Defaults on Insured Mortgages Reach Record

From: Housing Inventory and Rental Units

Renting is a substitute for owning, and to understand the current excess housing inventory, we also need to consider rental units.

Renting is a substitute for owning, and to understand the current excess housing inventory, we also need to consider rental units.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

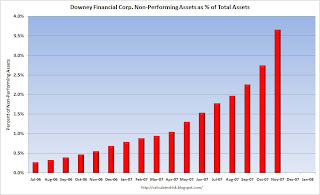

From: Downey Financial Non-Performing Assets

From the Downey Financial 8-K released on Dec 14th.

From the Downey Financial 8-K released on Dec 14th.This would be a nice looking chart, except those are the percent non-performing assets by month.

From: NAHB: Builder Confidence Unchanged at Record Low

The NAHB reports that builder confidence was unchanged at a record low 19 in December.

The NAHB reports that builder confidence was unchanged at a record low 19 in December.NAHB: Builder Confidence Remains Unchanged For Third Consecutive Month

Builder confidence in the market for new single-family homes remained unchanged for a third consecutive month in December as problems in the mortgage market and excess inventory issues continued, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI held even at 19 this month, its lowest reading since the series began in January 1985.

From: Single Family Starts Fall to Lowest Level Since April 1991

Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.Look at what is about to happen to completions: Completions were at a 1,344 million rate in November, but are about to follow starts to below the 1.2 million level. I'd expect completions to fall rapidly over the next few months, impacting residential construction employment.

From: November New Home Sales

According to the Census Bureau report, New Home Sales in November were at a seasonally adjusted annual rate of 647 thousand. Sales for October were revised down to 711 thousand, from 728 thousand. Numbers for August and September were also revised down.

From: More on New Home Sales

This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001.

This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This is what we call Cliff Diving!

And this shows why so many economists are concerned about a possible consumer led recession - possibly starting right now.

From: November Existing Home Sales

The graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, November sales were slightly below October.

The graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, November sales were slightly below October.The impact of the credit crunch is obvious as sales in September, October and November declined sharply from earlier in the year.

For existing homes, sales are reported at the close of escrow. So November sales were for contracts signed in September and October.

From: More on November Existing Home Sales

Click on graph for larger image.

Click on graph for larger image. This graph shows the seasonally adjusted annual rate of reported new and existing home sales since 1994. Since sales peaked in the summer of 2005, both new and existing home sales have fallen sharply.

Ignoring the occasional month to month increases, it is clear that sales of both new and existing homes are in free fall.

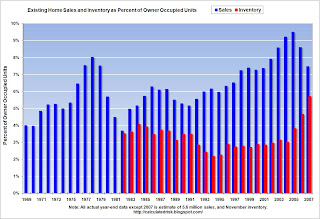

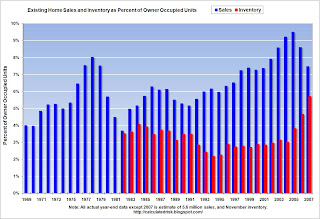

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - November sales were at a 5.0 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests sales will fall much further in 2008.

Happy New Year to All! Best Wishes from CR and Tanta.

Delong: Three cures for three crises

by Calculated Risk on 12/31/2007 03:52:00 PM

From Project Syndicate, Professor DeLong writes: Three cures for three crises

A full-scale financial crisis is triggered by a sharp fall in the prices of a large set of assets that banks and other financial institutions own, or that make up their borrowers' financial reserves. The cure depends on which of three modes define the fall in asset prices.DeLong discusses what he sees as the three crisis modes: a liquidity crisis, a minor solvency crisis, and a major solvency crisis. DeLong notes:

At the start, the Fed assumed that it was facing a first-mode crisis -- a mere liquidity crisis -- and that the principal cure would be to ensure the liquidity of fundamentally solvent institutions.Clearly this is a solvency crisis, not just a liquidity crisis. Professor Thoma notes:

But the Fed has shifted over the past two months toward policies aimed at a second-mode crisis -- more significant monetary loosening, despite the risks of higher inflation, extra moral hazard and unjust redistribution.

And, as if on cue, from the WSJ Economics blog:So now, in Dr. DeLong's view, the question is: Is this a minor solvency crisis or a major solvency crisis? Much depends on how far housing prices fall. A 30% price decline would reduce household real estate asset by about $6 trillion and cause significant losses for lender and investors. That would probably be DeLong's major solvency crisis. His solution:Liquidity Threat Eases; Solvency Threat Still Looms, WSJ Economics Blog: As 2007 winds down, the much-feared year-end liquidity crisis appears to have been averted thanks to aggressive action by central banks. ... [A]s 2008 begins, it's solvency, not liquidity, that threatens the economy and the financial system. And at the root of the solvency threat is a likely decline in housing prices that will further undermine credit quality. Making banks more confident of their own ability to raise funds is not going to resolve a generalized shrinkage of lending driven by declining collateral values. ...

The third mode is like the second: A bursting bubble or bad news about future productivity or interest rates drives the fall in asset prices. But the fall is larger. Easing monetary policy won't solve this kind of crisis, because even moderately lower interest rates cannot boost asset prices enough to restore the financial system to solvency.I don't think it's quite that bad. Even if the losses for investors and lenders reach $1 trillion (a possibility), I think the financial system can absorb those losses. Sure, some players might disappear, and others might have to sell significant assets (or dilute their shareholders), but I don't think the choice is between serious inflation and depression.

When this happens, governments have two options. First, they can simply nationalize the broken financial system and have the Treasury sort things out -- and reprivatize the functioning and solvent parts as rapidly as possible. Government is not the best form of organization of a financial system in the long term, and even in the short term it is not very good. It is merely the best organization available.

The second option is simply inflation. Yes, the financial system is insolvent, but it has nominal liabilities and either it or its borrowers have some real assets. Print enough money and boost the price level enough, and the insolvency problem goes away without the risks entailed by putting the government in the investment and commercial banking business.

The inflation may be severe, implying massive unjust redistributions and at least a temporary grave degradation in the price system's capacity to guide resource allocation. But even this is almost surely better than a depression.

Still, I think the "Yikes" tag fits.

Mortgage Crisis Leading to Government Budget Cuts

by Calculated Risk on 12/31/2007 02:23:00 PM

From Stephanie Simon at the LA Times: Mortgage crisis takes a bite out of states and cities First, kudos to Ms. Simon for calling it a "mortgage crisis" and not falling into the subprime reporting trap!

Dozens of states, counties and cities across the nation will enter the new year facing deep and unexpected budget holes as the widening mortgage crisis cuts sharply into tax revenue.There are many details in the article. And imagine what will happen if the economy slides into recession?

...

The mortgage crisis cuts into tax revenue in several ways.

The most obvious victim is property tax collection. Homeowners in foreclosure don't pay taxes on time. And as foreclosures spread, property values drop -- dragging down assessments and collections.

...

Even more distressing to budget planners is the decline in sales tax revenue. If people aren't buying homes, they're not buying refrigerators and washing machines to furnish them.

Also, the LA Times has an article on a mortgage fraud ring in Los Angeles hat apparently obtained $142 million in fraudulent loans: How a bank fell victim to loan fraud. An amazing story.

More on November Existing Home Sales

by Calculated Risk on 12/31/2007 12:52:00 PM

For more existing home sales graphs, please see the earlier post: November Existing Home Sales

Occasionally during the housing bust, we have seen months with flat or even rising sales compared to the previous month. This brings out the bottom callers. As an example, from NAR today:

Lawrence Yun, NAR chief economist, said the market appears to be stabilizing. “Near term, existing-home sales should continue to hover in a narrow range, just as they have since September, and that’s good news because it’ll be a further sign that the housing market is stabilizing.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the seasonally adjusted annual rate of reported new and existing home sales since 1994. Since sales peaked in the summer of 2005, both new and existing home sales have fallen sharply.

Ignoring the occasional month to month increases, it is clear that sales of both new and existing homes are in free fall.

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - November sales were at a 5.0 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests sales will fall much further in 2008.

On inventory: the normal seasonal pattern is for inventory of existing homes to peak in the summer, remain fairly flat through the Fall, and then decline significantly (usually around 15%) in December. Many potential home sellers take their homes off the market during the holidays.

Then usually inventory starts increasing again in the new year. If inventory follows the normal pattern, we will probably see a decline to 3.7 million units or so in December (from 4.273 million units in November). This will bring out even more bottom callers, but it is just the normal seasonal pattern.

November Existing Home Sales

by Calculated Risk on 12/31/2007 10:00:00 AM

The NAR reports that Existing Home sales were at 5 million (SAAR) unit rate in November.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 0.4 percent to a seasonally adjusted annual rate1 of 5.00 million units in November from an upwardly revised pace of 4.98 million in October, but are 20.0 percent below the 6.25 million-unit level in November 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, November sales were slightly below October.

The impact of the credit crunch is obvious as sales in September, October and November declined sharply from earlier in the year.

For existing homes, sales are reported at the close of escrow. So November sales were for contracts signed in September and October.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 4.273 million homes for sale in November.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 4.273 million homes for sale in November. Total housing inventory declined 3.6 percent at the end of November to 4.27 million existing homes available for sale, which represents a 10.3-month supply at the current sales pace, down from a 10.7-month supply in October.This is a slight decrease in the inventory level from the last few months, and the months of supply also decreased slightly to 10.3.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

The third graph shows the 'months of supply' metric for the last six years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of December 2000.

This shows sales have now fallen to the level of December 2000. More later today on existing home sales.

Gambling? In A Casino?

by Anonymous on 12/31/2007 07:01:00 AM

It's shocking. Via naked capitalism, this jewel from the WSJ on subprime lender-sponsored lobbying efforts against predatory lending regulation:

Washington lobbyist Wright Andrews and his wife, Lisa, coordinated much of the industry's lobbying. Mr. Andrews's firm, Butera & Andrews, collected at least $4 million in fees from the subprime industry from 2002 through 2006, congressional lobbying reports indicate. Mr. Andrews didn't represent Ameriquest directly. He ran three different subprime-industry trade groups: the National Home Equity Mortgage Association, of which Ameriquest was a member; the Coalition for Fair and Affordable Lending, which spent $6.3 million lobbying against state laws before it dissolved earlier this year, according to federal filings; and the Responsible Mortgage Lending Coalition.Here's a hint, Mr. Andrews. When a regulation is proposed that says lenders should adopt a certain underwriting standard, and the industry responds by saying "we already do it that way," and then pays you $4 million to stop that regulation from being enacted, you actually have some reason to believe they're pulling your leg. No, really.

In 2003, Lisa Andrews was appointed senior vice president for government affairs at Ameriquest. Her public-relations firm, Washington Communications Group Inc., claims credit on its Web site for coordinating the industry's victory in New Jersey, as well as its overall strategy at the state level. Ms. Andrews left Ameriquest in 2005 and returned to her firm. . . .

In the wake of the collapse of the subprime market, Mr. Andrews's subprime lobbying business has withered. The three trade groups he ran are gone, and most of his subprime clients have stopped lobbying.

"I certainly was not aware of the degree to which many in the industry clearly failed to follow proper underwriting standards -- the standards which they represented they were following to those of us who were lobbying," Mr. Andrews says.

Sunday, December 30, 2007

Shiller: America could plunge into recession

by Calculated Risk on 12/30/2007 08:13:00 PM

From The Times: Top economist says America could plunge into recession

Robert Shiller, Professor of Economics at Yale University, predicted that there was a very real possibility that the US would be plunged into a Japan-style slump, with house prices declining for years.We have to distinguish between various measures of house prices. Shiller is using the Case-Shiller National index to derive the $1 trillion in lost real estate values. Total household real estate assets were over $20 trillion at the peak, so a decline of $1 trillion is about 5%. (The S&P Case-Shiller national index showed a decline of 5% from the peak through Q3).

Professor Shiller, co-founder of the respected S&P Case/Shiller house-price index, said: “American real estate values have already lost around $1 trillion [£503 billion]. That could easily increase threefold over the next few years. This is a much bigger issue than sub-prime. We are talking trillions of dollars’ worth of losses.”

Click on graph for larger image.

Click on graph for larger image.This graph, from an earlier post, compares the S&P/Case-Shiller index with the OFHEO index.

The Fed Flow of Funds report is more closely tied to the OFHEO index. The most recent Fed report showed a decline of $67.2B in existing household real estate assets in Q3.

We also have to distinguish between lender / investor mortgage related losses (see the previous post on Merrill) and household real estate value losses. The former impacts the credit crunch directly, the later will probably impact consumer spending and the ability of homeowners to withdraw equity from their homes.

As Shiller notes, we could easily be talking about several trillion in lost real estate values. A 15% average decline in prices, would mean $3 trillion in losses. A 30% price decline would mean a decline of around $6 trillion in U.S. household real estate assets.

Report: Merrill Seeks More Money

by Calculated Risk on 12/30/2007 08:08:00 PM

From the Observer: Merrill seeks more funds to avoid crisis (hat tip AllenM)

John Thain, the new chief executive of Merrill Lynch, is this weekend in talks with Chinese and Middle Eastern sovereign wealth funds that could lead to the sale of another big stake in the US bank in a desperate bid to raise capital, according to sources in London and New York.Just a rumor at this point ...

...

Sources close to Merrill Lynch say that Thain has cancelled New Year leave among his top lieutenants and that his team is working around the clock on various 'scenarios' that could be employed to save the bank if problems related to the credit crunch continue to worsen.

...

Fears are mounting that Merrill Lynch will be forced to write down between $10bn and $15bn worth of assets related to CDOs ... when it reports financial results next month.