by Calculated Risk on 1/04/2008 12:24:00 PM

Friday, January 04, 2008

S&P may cut $6.42 Billion in CDOs

From Reuters: S&P may cut $6.42 bln CDOs affecting 149 tranches

Standard & Poor's may cut the rating on $6.42 billion of collateralized debt obligations (CDOs) following downgrades to billions of dollars worth of second-lien residential mortgage-backed securities last month.

S&P said the action affects 149 tranches from 43 U.S. cash flow and hybrid CDOs of asset-backed securities.

December Employment Report

by Calculated Risk on 1/04/2008 08:31:00 AM

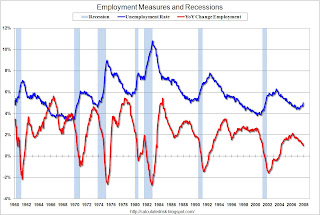

Update: This graph shows the unemployment rate and the year-over-year change in employment vs. recessions. Click on graph for larger image.

Click on graph for larger image.

The rise in unemployment, from a cycle low of 4.4% to 5.0% will set off alarm bells.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Employment numbers can be heavily revised, but this report will definitely get attention.

Original Post: From the BLS: Employment Situation Summary

The unemployment rate rose to 5.0 percent in December, while nonfarm payroll employment was essentially unchanged (+18,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Job growth in several service-providing industries, including professional and technical services, health care, and food services, was largely offset by job losses in construction and manufacturing. Average hourly earnings rose by 7 cents, or 0.4 percent.

Click on graph for larger image.

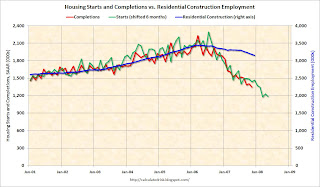

Click on graph for larger image.Residential construction employment declined 28,500 in December, and including downward revisions to previous months, is down 293.1 thousand, or about 8.5%, from the peak in March 2006. (compared to housing starts off almost 50%).

Note the scale doesn't start from zero: this is to better show the change in employment.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.This suggests residential construction employment could fall significantly from current levels.

Overall this is a very weak report, and the unemployment rate rising to 5% will set off recession arguments.

Thursday, January 03, 2008

Analysts: Corporate Defaults to Rise "Drastically"

by Calculated Risk on 1/03/2008 05:51:00 PM

From the WSJ Deal Journal: Citi and J.P. Morgan Predict a Buffet of Defaults (hat tip James)

With credit flowing to practically any company in need of cash in recent years, the rate of defaults for U.S. high-yield companies fell to just 0.34% in December, according to a J.P. Morgan Chase analysis. The J.P. Morgan analyst, Peter Acciavatti, predicts that is about to rise drastically, to 4% by the end of 2009 ... Citigroup expects the default rate to surge to 5.5% ...And from Bloomberg: Buffets Misses Coupon Payment; Bonds Fall to New Low

Buffets Inc., the largest operator of buffet-style restaurants in the U.S., failed to make a coupon payment on $293 million of debt, sending the bond prices plunging to a record low.

...

The missed payment sparked concerns that corporate defaults are starting to escalate as the worst home sales market since 1981 slows the economy. Tousa Inc., the Florida homebuilder that lost 99 percent of its market value in the past year, also missed interest obligations on $485 million in debt, the company said in a regulatory filing yesterday.

Consumer Delinquency Rate Highest Since Last Recession

by Calculated Risk on 1/03/2008 01:48:00 PM

From Reuters: Consumers late payers on most loans since recession (hat tip Mike_in_Fl)

Americans are falling further behind on consumer loans, with late payments rising to the highest level since the nation's last recession in 2001, data released Thursday show.A nice follow up to my earlier post on auto sales.

In its quarterly study of consumer borrowing, the American Bankers Association said the percentage of loans at least 30 days past due rose to 2.44 percent in the July-to-September period from 2.27 percent in the previous quarter.

The delinquency rate, which covers eight loan categories, was the highest since a 2.51 percent rate in the second quarter of 2001. Late payments on some types of loans rose to levels not seen since the 1990s.

...

Meanwhile, late payments on "indirect" auto loans, which are made through dealerships, totaled 2.86 percent in the third quarter, a 16-year high.

Credit-card delinquencies fell to 4.18 percent from 4.39 percent in the second quarter.

Foreclosure Fraud

by Anonymous on 1/03/2008 01:00:00 PM

To summarize: if you're in the situation you're in with an unaffordable mortgage because some fast-talking guy in a suit asked you to sign a bunch of papers you didn't understand, you are not going to be in a better situation because some other fast-talking guy in a suit asked you to sign a bunch more papers you don't understand.

Ford: Auto Sales Declined 9.2% in December

by Calculated Risk on 1/03/2008 12:30:00 PM

From Bloomberg: Ford Motor's December U.S. Auto Sales Declined 9.2%

Ford Motor Co. said its December U.S. auto sales fell 9.2 percent ... sales dropped to 212,094 vehicles from 233,621 a year earlier ....Most of the automakers will report today. It looks like December was awful across the board, and most forecasts are for another decline in 2008.

Americans bought about 16.1 million cars and light trucks in 2007, the least since 1998 ... The company's full-year sales slid 12 percent.

And as difficult as 2007 was (and 2008 will probably be), the automakers are building a time bomb with debt. From the LA Times: New cars that are fully loaded — with debt

Gone are the days of the three-year car loan. The length of the average automobile loan hit five years, four months in October, up more than six months from 2002, according to the Federal Reserve. And nearly 45% of loans written today are for longer than six years. Even some staid lenders owned by the carmakers, such as Toyota Financial Services and Ford Credit, are offering seven-year financing. And a few credit unions, particularly in the West, are tinkering with the eight-year note.There is a basic guideline when financing a purchase - match the length of the financing to the life of the asset. Thirty years for a house, maybe 5 years for a car. Then, when the asset becomes worthless, you are no longer paying for it and you can afford to replace the asset. That is the general idea.

Of course money is fungible, and this is just a guideline, but the buyers in the LA Times story are violating this guideline - they are still paying for the automobile after they sell it (by rolling the debt into their new car), and eventually this will lead to more consumer loan delinquencies and probably fewer car sales.

Discount Rate Spread Narrows, Asset Backed CP Increases

by Calculated Risk on 1/03/2008 10:58:00 AM

From the Fed weekly report on commercial paper this morning, here is the discount rate spread: Click on graph for larger image.

Click on graph for larger image.

According to the Fed, the discount rate spread narrowed to 58 bps. This graph was released this morning.

Also, asset backed commercial paper (CP) increased $26.3 billion to $773.8 billion. This is the first increase since August.

This is preliminary evidence that the liquidity crisis is easing. But the solvency crisis remains. From the WSJ Economics Blog a couple of day ago: Liquidity Threat Eases; Solvency Threat Still Looms:

As 2007 winds down, the much-feared year-end liquidity crisis appears to have been averted thanks to aggressive action by central banks. ... [A]s 2008 begins, it's solvency, not liquidity, that threatens the economy and the financial system. And at the root of the solvency threat is a likely decline in housing prices that will further undermine credit quality. Making banks more confident of their own ability to raise funds is not going to resolve a generalized shrinkage of lending driven by declining collateral values. ...

CRE: O.C. Office Vacancies Rise

by Calculated Risk on 1/03/2008 10:22:00 AM

From Jon Lansner at the O.C. Register: Vacancies up, rates flat for O.C. offices

The county’s vacancy rate ended 2007 at 12.43%, up from 10.53% in Q3 2007 and 7.91% a year earlier.O.C. office space has been especially hard hit because many subprime lenders were located here. Still, not a good trend.

...

However, the vacancy rate doesn’t include sublease space — when a company has more room than it needs and is trying to find a tenant to take the extra. Vacancy and sublease space together totaled 17.07% at the end of last year, up from 15.11% in Q3 and 11.50% at the end of 2006.

The Un-re-dis-inter-mediation Blues

by Anonymous on 1/03/2008 08:06:00 AM

We all knew that technology would solve our productivity problems, and National Mortgage News has the proof:

One question some of you might be asking is this: if subprime volumes have screeched to a halt, what are all those traders on Wall Street doing? Good question. We're told that come January there will be a wholesale shakeup at several firms. Sources tell us that Deutsche Bank, Lehman Brothers and Merrill Lynch all are conducting reviews (or soon will) of their entire mortgage operations. As for where the most drastic changes might occur, Merrill Lynch might be a good bet. An account executive there told us recently about conditions at Merrill's First Franklin Financial Corp. He said many offices are not funding loans while awaiting training for Fannie Mae products. "So far, there's been no training," he told us. The AE, requesting his name not be used, painted a bleak picture, saying business is so slow that employees pass the day playing Scrabble and PlayStation on the conference room projector screen. He said FFFC AEs and executives keep asking Merrill why they can't just originate loans and put them on the balance sheet of Merrill's FDIC-insured bank. "We're not getting any answers," he said.Aside from the idea of loan officers having sufficient spelling skills to play Scrabble, which is new to me, here we have the two same old dumb ideas that emerge in any mortgage downturn, with a delicious twist that it's Wall Street getting it instead of Main Street.

First, there's the old "let's retrain a bunch of subprime loan officers to be prime GSE loan officers." You civilians might think this should be fairly easy, but the fact is that training a lot of these people to be prime loan officers basically means training them to be loan officers. If they had any basic depth of understanding of the business they're in, they could move to prime origination by just reading that other rate sheet. The reality is that they've been doing no-doc no-down no-sweat stuff for so long--some of them have never done anything but--that they're sitting around with the PlayStation waiting for someone to tell them how a 30-year fixed rate loan with a down payment and verified income actually works. Which is to say, their bosses are sitting around in the busier conference rooms trying to figure out if it's possibly worth the time and money to turn these people into mortgage experts instead of corner-cutting order-takers.

Item the second causes a deep belly laugh in anyone who ever worked for a depository in a mortgage downcycle: "Why can't we just put the loans on the balance sheet?" I know it makes me a bad person, but the thought of Merrill getting this one from its mortgage people is floating me heavenward on a warm tide of schadenfreude. I suspect that it may well be tickling the folks at National City, insofar as they have anything to laugh about these days. In case you don't remember, Merrill bought First Franklin from National City just over a year ago--but apparently nobody explained to the First Franklin folks that they no longer had a parent with a big fat hold-to-maturity portfolio with which loan originators can be subsidized in a low-volume period.

That is--or once was--an old strategy for depositories: when you can't sell your loans, hunker down, stuff 'em on the books and wait for the tide to turn. We are seeing depository after depository shutting down its wholesale and correspondent lending divisions, meaning it will, as always, only allocate those portfolio dollars to keeping an expensive but much safer retail operation alive. If you're a mortgage broker right now, you are staring in the face of hunger.

But Merrill really really wanted to be a retail originator in its own right. Welcome to the other side of the mortgage world, Mother Merrill, and try turning in some tiles. Maybe you'll get a vowel.

Newsletter Update

by Calculated Risk on 1/03/2008 01:30:00 AM

Tanta and I are working towards having the first issue of the newsletter out this weekend (hopefully). Here is the sign up page ($60 annual subscription).

This is an adventure for us, and I expect the content will evolve as we receive feedback from all of you.

Also, I will post the first issue next week as a sample. Thanks to all that have subscribed.