by Calculated Risk on 1/09/2008 02:43:00 PM

Wednesday, January 09, 2008

Goldman Predicts Recession

From the WSJ: Goldman Sees Recession This Year

“Over the past few months, we have become increasingly concerned that the U.S. housing and credit market downturn would trigger not just a growth slowdown and substantial Fed easing — our long-standing view — but also an outright recession. The latest data suggest that recession has now arrived, or will very shortly,” Goldman said in a research note. The bank also expects a decline in consumer spending, which didn’t happen during the 2001 recession, amid spillover from the housing market.

Countrywide: Foreclosures, Overdue Loans Rise

by Calculated Risk on 1/09/2008 11:18:00 AM

From Bloomberg: Countrywide Says Foreclosures, Overdue Loans Rise

Foreclosures doubled to 1.44 percent of unpaid principal in December from 0.7 percent a year earlier at the company's unit that handles billing and processing, Countrywide said in a statement today. Late payments advanced to 7.2 percent of unpaid balances from 4.6 percent.And a few other tidbits:

...

``It appears that the housing trends in 2008 will look a lot like 2007, so Countrywide will remain under a lot of stress,'' said Tom Atteberry, a money manager in Los Angeles at First Pacific Advisors LLC, in an interview yesterday. ``What they are left with is a pretty low-margin business.''

...

Mortgages funded rose 1 percent from November, and fell 45 percent from year-earlier levels, according to the Countrywide statement. New loans in December totaled $24 billion.

Countrywide made $6 million in subprime loans in December, down from $3.7 billion a year earlier ...From $3.7 billion to $6 million (with an m) - that is quite a decline in subprime loan originations. I wonder why it isn't zero?

Countrywide's bank attracted a net $2.3 billion in deposits in December, ending the year at $61 billion. The bank is boosting interest rates to help attract deposits, while borrowing more than $50 billion from the Federal Home Loan Bank system.As I noted yesterday, Countrywide is paying 5.45% APY on 6 month CDs. This is attracting deposits, but squeezing their net interest margins (NIMs).

MBIA to Raise Funds, Cut Dividend

by Calculated Risk on 1/09/2008 10:35:00 AM

From the WSJ: MBIA to Raise Funds, Cut Dividend

MBIA ... said it will raise $1 billion in new capital, cut its annual dividend by about 62%, to 52 cents a share...

The dividend cut announced today will save the company an estimated $80 million a year. The $1 billion in new capital will be raised by issuing a kind of debt known as surplus notes.

In its announcement, MBIA said, "Upon successful completion of its capital management plan, the Company expects to meet or exceed the rating agencies' current capital requirements for MBIA to retain its Triple-A ratings."

Foreclosure Investigator

by Anonymous on 1/09/2008 09:45:00 AM

Elizabeth Warren at Credit Slips has an interesting post up inviting reader comments. I thought our readers might have some ideas about this.

Because subprime lending was not evenly spread around the country (or even around a state or city), individual neighborhoods are bearing the brunt of the meltdown. When several homes in one community go into foreclosure, a neighborhood can rapidly shift from a safe, comfortable area with well-tended lawns to a place where no one wants to live. Mayors are on the front lines in dealing with the fallout.I confess to wondering why homeowners would have to contact this Foreclosure Investigator in the first place. The first step of any foreclosure is to file a Notice of Default or Lis Pendens (or whatever the jurisdiction/foreclosure type requires) in the land records of the county (or city or town, depending). Homeowners can actually miss these things if they no longer occupy or for some other reason don't get served. The recorder's office doesn't miss them.

Like most academics, we at Credit Slips tend to talk about what the federal government could do to deal with the subprime crisis. The feds have the power, if not the will, to make some big changes. But what about mayors? Can anything be done at the city level? This isn't an academic question, so put on your thinking caps and volunteer some ideas. Here's mine:

A mayor could appoint a Foreclosure Investigator. Announce that any person anywhere in the city who has received a notice of foreclosure or similar document should immediately call the city officer who will investigate all the paperwork to make certain that every aspect of the mortgage and the mortgage foreclosure comply with the law--at no expense to the homeowner.

This would be a powerful tool for three reasons: 1) Many of the worst mortgages have bad documentation, illegal provisions, etc. But if homeowners don't know that, and if they don't go to very good lawyers, the mortgage companies will foreclose and the homeowner's rights will be lost. 2) Even if the mortgage paperwork is in order, any push back from a homeowner makes is more likely that a deal can be negotiated to keep the homeowner in the house (if the homeowner really can afford it). A Foreclosure Investigator can inform the homeowner about a range of options. 3) If one city has the reputation as a lousy place to bring a foreclosure action, mortgage companies have lots to do right now, and they may put that city's foreclosures lower on their to-do lists. I realize the last point simply externalizes the problem, but for a mayor working hard to save neighborhoods in his or her city, that may be an issue for another day.

What are your ideas? What other tools are available? If a highly motivated mayor asked you what to do, what would you suggest?

The legal issue, I assume, is giving the Foreclosure Investigator the right to demand documents or information from the lender/servicer/investor, either on behalf of the homeowner or in its own right. I have no idea how that would work technically.

I'm not sure I'd push for having a Foreclosure Investigator being charged with things like "informing the borrower about options." If these municipalities need legal aid services or homeowner counseling services, models for such things already exist and should be funded. It seems to me the point of the proposal is to have a party who represents the interests, first of all, of the city (or whatever jurisdiction this is), not the lender or the homeowner. In other words, it is precisely formalizing the "externalized" interest.

After all, while it's obvious to me (at least) that cities might have interests that don't exactly align with big national servicers and mortgage investors, it also seems obvious that they might have interests that don't always align with individual homeowners, either. At some level this proposal may well be a recognition of the socially crucial function of judicial foreclosures, which are rarer and rarer in many states as lenders elect "power of sale" or trustee sale foreclosures (because they're faster and cheaper to the lender). The judicial foreclosure is slow and expensive, but it gives the borrower "a day in court" and it tries, at least, to make sure that the state's interest in the process is protected.

Even in states where judicial foreclosures are still the only way to foreclose--like Ohio--we're seeing huge court backlogs. We've all heard about the uproar the Federal District judges have been creating with their attempts to make sure the lenders' paperwork is straight. Warren's proposal for a Foreclosure Investigator sounds a bit to me like a kind of officer of those foreclosure courts. In states where lenders can elect non-judicial foreclosure, it would insert the level of scrutiny of the loan paperwork back into the process.

I would guess that the loudest and first complaint will be about "spending taxpayer money" on cleaning up the mortgage mess. That's why I'd be inclined to think that any such Foreclosure Investigator needs to represent the city, not the individual or the lender, and that it needs to be quite explicit whose interests are being protected and why. It's probably easy enough for foreclosure-ridden cities to cost-justify the expense versus the gain to the taxpayers of preventing neighborhood foreclosure crises.

But it isn't going to be just subprime, and it isn't going to be just old core neighborhoods teetering on the brink for long. It's going to be fancy new half-built half-sold suburban developments full of "prime" mortgages and half-built schools and streets too far from core-city employment centers and the lovely politics of development. I envision the Foreclosure Investigator running up against not just "business environment" types who don't want Our Fair City to see "lender flight," but against those back-room deals with the developers and builders for tax abatements and permits and what have you, and suddenly the Foreclosure Investigator is drawn into the muck of whether some of these new neighborhoods are worth finishing, not "saving." That could be ugly.

Not that that's an argument against doing it, mind you. Ugly is going to arrive whether we fund an Investigator or not.

Tuesday, January 08, 2008

Falling House Prices: Videos

by Calculated Risk on 1/08/2008 07:53:00 PM

The first video is from Bakersfield (2 minutes):

Remember the guy who predicted house prices would be up 10% this year? Here he is explaining his view today (1 minute 16 seconds):

Sample Newsletter

by Calculated Risk on 1/08/2008 04:49:00 PM

Here is the January Newsletter (858KB PDF) for everyone as a sample.

Enjoy.

For current subscribers, your 12 month period starts with the February issue (first week in February). If you didn't receive an earlier email - and signed up before last Friday - please send me an email to verify your email address - please specify how you paid (letter or PayPal). I think I have everything sorted out.

If you'd like to subscribe, here is the sign up page ($60 annual fee).

Just to be clear: the blog will stay the same, and much of the newsletter material is from the blog. Best Wishes to All.

AT&T Sees Softness in Consumer Business

by Calculated Risk on 1/08/2008 03:55:00 PM

Click on picture for larger image.

Click on picture for larger image.

Headlines via Brian.

"Hoping we can manage through this downcycle"

'softness' in consumer business.

Not feeling economic effect in corporate sales.

UPDATE: AP story: AT&T CEO Sees Slowdown in Consumer Side

CD Rates and NIMs

by Calculated Risk on 1/08/2008 01:44:00 PM

The WSJ had an interesting article this morning on the margin squeeze at many banks. From the WSJ: Banks' Narrowing Margins

Many banks ... are likely to report narrowing in net interest margins -- a key measure of industry profitability -- already at the lowest level since 1991.Check out the CD rates at CountryWide and IndyMac.

Much of the pinch is being attributed to a scramble for deposits. Even though the Federal Reserve has been cutting interest rates, many banks are still offering attractive rates for deposits. A quarterly survey released last week by Citigroup Inc. found that "the competition to raise new deposits" via certificates of deposit and money-market funds "remains intense."

...

While banks are now collecting less interest on loans because of the Fed's rate reductions, they are still making the same interest payments to depositors.

CountryWide is offering a 6 month CD with an APY of 5.45%.

IndyMac is offering a 3 months CD with an APY of 5.4%.

Click on graph for larger image.

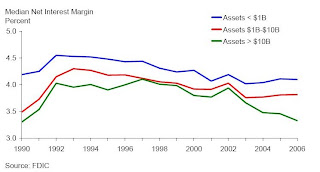

Click on graph for larger image.Here is a graph from the FDIC (through 2006) of Net Interest Margins (NIMs) by bank size. Even though the larger banks have seen more of a NIM squeeze, the smaller banks make more of their income from NIMs.

Another concern is that banks have been growing their asset portfolios to lessen the impact of falling NIMs. From the FDIC last year:

To offset the effects of lower margins, institutions have been growing their asset portfolios. ... Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs, they have achieved this success in part by assuming higher levels of credit risk.I eagerly await the next Emerging Risks report from the FDIC.

Countrywide Bankruptcy Rumor and Denial

by Calculated Risk on 1/08/2008 01:33:00 PM

From Bloomberg: Countrywide Loses Most Since 1987 on Bankruptcy Bets

Countrywide Financial Corp. dropped the most in two decades on the New York Stock Exchange amid speculation the largest U.S. mortgage lender will file for bankruptcy.From Reuters: Countrywide Financial denies bankruptcy rumors

...

``There's some sort of rumor that they would go under, but it's purely a rumor,'' said Thomas Garcia, head of trading at Thornburg Investment Management, which oversees about $50 billion in Santa Fe, New Mexico.

"There is no substance to the rumor that Countrywide is planning to file for bankruptcy, and we are not aware of any basis for the rumor that any of the major rating agencies are contemplating negative action relative to the company," Countrywide said in a statement.Just another false CFC bankruptcy rumor.

Moody's Cuts Ratings On 46 Tranches Of Bear Deals

by Calculated Risk on 1/08/2008 12:16:00 PM

From Dow Jones (no link yet): Moody's Cuts Ratings On 46 Tranches Of Bear Deals (hat tip BR)

Moody's Investors Service downgraded the ratings of 46 tranches and placed under review for possible downgrade the ratings of 11 tranches from eight Alt-A deals issued by Bear Stearns Cos. (BSC) in 2007. ...More junk.

The collateral backing these tranches consists of primarily first lien, fixed and adjustable-rate, Alt-A mortgage loans. ...