by Calculated Risk on 1/15/2008 12:00:00 PM

Tuesday, January 15, 2008

Citi Dividend, Future Prospects and Credit Cards

There comments are very telling about the future return on capital, and possible additional shocks. (all emphasis added). Also see the comments on tightening credit card standards, evaluating current customers and the trade-offs between HELOCs and credit cards.

From the Citi conference call:

“The dividend reduction reflects the approximate sizing of our dividend relative to our growth opportunities and the volatility of each of our businesses. After a careful analysis of our businesses, given the normal risk that we have on an ongoing basis, we were faced with two choices -- either increase the excess capital that we carried permanently to reflect the ongoing exposures of the Company or better align our payout ratio so as to be able to restore our targeted capital ratios in a reasonable timeframe after a capital-reducing event. We recommended a dividend policy change to the Board alongside the capital raise and they approved this change yesterday. When the Company returns to a more normalized level of earnings generation and capital ratios, we have the flexibility to supplement the dividend with share repurchases.”And from the Q&A:

Richard Bove, Punk Ziegel:And the following exchange on consumer credit cards:

The second question would relate to the cash flow indication that you just mentioned and that is, to my knowledge, the $26 billion that has been taken either in write-downs or in loan loss provision are all non-cash charges. I think I heard it said that the equity raises will put the relevant ratios above what they were targeted to be let's say three months ago. Given the fact that there is no significant cash charge here, given the fact that the Company is going to wind up with perhaps some excess capital, I find it difficult to understand why you would cut the dividend. In addition, since by cutting the dividend, you have knocked, at least today, $5 billion off the value of the stock, I am wondering where do the shareholders show up in this whole calculation? You've lost 40% of his dividend, his stock price is down $5 billion in value, and from what I think I heard you say, if there is no prospect of the dividend going back up again, there is going to be share repurchases as opposed to replacing the dividend. So how does the stockholder benefit by this?

Gary Crittenden, Citi CFO:

Let me talk first of all, Dick, about the way we have thought about the dividend and just give you a little bit more color around that. So if you took the kind of a normalized situation -- so if you go back over the last few years and we have had say a $20 billion earnings level and you assumed a 55% payout ratio or something like that, that gave you 45% of that capital essentially to allow the business to grow and to take care of any shocks that might happen in the system assuming that we ran the Company right at the kind of targeted ratios that we have, right at 6.5% in TCE and 7.5% in terms of our tier one ratio. That is basically the assumption that you made. That essentially, even under that scenario, gives you relatively little capital to rebuild your capital in the event of a shock scenario and obviously one of the things that I have to, as part of my job, think about all the time is what is the implications of the Company of having a shock scenario happen and we have just experienced one of those. We have just been through that and we have obviously taken the charge associated with that in this quarter. And that kind of an event could happen at some point down the road. If it did happen at some point down the road, the proper way I think to manage this would be to do one of two things -- either to hold significant additional excess capital -- so even in the event of a shock, you are able to recover relatively quickly -- or alternatively, to reduce the payout ratio that would reflect what you believe the growth prospects of the business and the inherent exposures of the Company to be. Those are kind of the opposing trade-offs that we have as an organization and having thought through very carefully the amount of excess capital that we would need to hold the return on capital implications associated with that and looked at the trade-off of that relative to the payout ratio given the businesses that we are in and the inherent volatility that we think exists in those businesses, we tried to make the right long-term decision. So this was not a -- this decision was not made for the next quarter or the quarter after that. It was a recommendation that we made looking forward overtime, trying to consider the growth prospects of the Company and as I say, the inherent exposures that the Company has and with an eye towards trying to maximize the return on equity that we can provide back to our shareholders. And all of that kind of taken together really reinforced the decision that we made around the dividend. Now there is no doubt that this is a short-term difficult decision for us, but we felt, in the context of the uncertainty that exists in the environment, as well as the growth opportunities that exist in front of us, that both the capital raise made a lot of sense for us, as well as a dividend policy that positions us appropriately to rebound in the event of an exposure event down the road.

Bove:

A final thought on that and that is that I think I heard a number of times said that the dividend was being sized relative to the growth prospects of the Company. So if I assume a 40% payout ratio and a dividend of about 28, presumably the Company is setting out a 320 if you will, ability to show earnings over some timeframe, which would be substantially lower than let's say the $1.25 inherent in the second-quarter numbers. So is the Company, in fact, saying that it's earning capacity is substantially less and because it's earning capacity at substantially less, shareholders should take a $5 billion one-day hit in their holdings and a 40% reduction in their dividends?

Crittenden:

Dick, obviously, we don't give forecasts for where we think the future is going to go. We also carefully did not talk about a payout ratio here. We didn't think about it necessarily in terms of a specific payout ratio. We thought about it in terms of the capital formation and our ability to respond relatively quickly to a stress scenario in the environment. And it doesn't -- I mean it mathematically calculates into a payout ratio, but that is not the way we derived it.

Mike Mayo, Deutsche Bank:

Good morning. Can you talk some about the trade-off between pursuing growth and managing risk and as you pointed out, the credit card losses are up over 100 basis points in three months with unemployment only at 5% and mortgages getting worse. At the same time, short-term funding costs are higher over the last three months. So does that encourage you to pull back growth at all? ... specifically, as it relates to US credit cards, the margin was down linked quarter. Is that an area where you might want to pull back or increase pricing or neither?

Cittenden:

Actually all of the above is happening, Mike. So we are tightening underwriting standards as you might guess. We are evaluating the open lines of credit that exist with current customers. We are doing cross reference work between customers where we have the mortgage position and where we hold the credit card and obviously, we are off of promotional balances essentially as we go through this fourth quarter. So this is a time -- as you no doubt have read -- there was a good article in the New York Times a couple of days ago about this. This is no doubt a time where, in the credit card business, you could make some substantial missteps if you weren't careful in watching the credit because there is some natural growth in outstandings that will take place. There's a bit of a substitution effect between home-equity loans and credit card loans and we are very aware of what those trade-offs are. This falls into the second category that Vikram just talked about. There is some growth that's good growth and there is other growth, which can be dangerous if it is done without the proper kind of risk parameters around it. But I think our team is very focused on these issues right now in the card business. Obviously, we have taken a bit of a reserve increase in the card business in this quarter, but we are very focused on what the risks are around the inherent or natural growth that is going to happen in that business over the next year.

Mortgage Broker Spam

by Anonymous on 1/15/2008 11:34:00 AM

This showed up in my email yesterday:

Is your current mortgage turning out to be too good to be true? Financing your current mortgage into an FHA loan can help save your home. New legislation will allow homeowners in danger of foreclosure to refinance into a low, fixed rate FHA mortgage. To learn more about this new program, give me a call today.So what? So this was the subject line of the email:

Respectfully,

Toby Spangler

TJS Financial LLC

407-733-8962

www.homestarfla.com

Skip your mortgage payment for 3 monthsI hereby invite any reader of Calculated Risk, including of course any of you who happen to work for HUD and have enforcement authority, to correspond with Mr. Spangler and explain to him the meaning of the following:

The FHASecure initiative for refinancing borrowers harmed by non-FHA ARMs that have recently reset is not to be used to solicit homeowners to cease making timely mortgage payments; FHA reserves the right to reject for insurance those mortgage applications where it appears that a loan officer or other mortgagee employee suggested that the homeowners could stop making their payments, refinance into a FHA insured mortgage, and keep, as cash, the amount of payments not made on time.I would of course be happy to forward the original message to anyone with a .gov email address; just drop me a line.

If you, a Calculated Risk reader, do not feel particularly motivated to correspond with Mr. Spangler, perhaps you could give some thought to corresponding with your members of Congress on the subject of "modernizing" FHA to allow more "streamlined" participation by mortgage brokers.

If you happen to be an idiot mortgage broker cruising sites like this one to find email addresses to add your sleazy spam lists, why go right ahead. Add me to your list. I'm here to help you get the recognition you deserve.

From the Citi Conference Call

by Calculated Risk on 1/15/2008 09:36:00 AM

Here are some excerpts from the Citi conference call (hat tip Brian), and a couple of graphs from the Citi presentation. emphasis added

Re: charges to consumer credit portfolio:

Consumer lending net credit losses were higher by $396 million over last year, primarily driven by losses in the consumer mortgage portfolio. In US cards, net credit losses were up by $156 million, reflecting higher write-offs, lower recoveries and higher average yield balances. While delinquency levels remain relatively stable, the increase in write-offs reflect higher bankruptcy filings and the impact of customers that are delinquent in advancing to write-offs at a higher rate.

Within our bank cards portfolio, approximately two-thirds of the losses occurred in five states -- California , Florida , Illinois , Arizona and Michigan . And the loss rates on customers with mortgages in those states increased by fourfold versus the loss rates in the rest of the country .... Loss rates in the branch-originated mortgage business remained relatively stable, where face-to-face interaction with customers and long-standing relationships have historically resulted in lower losses. The CitiFinancial real estate mortgage portfolio, for example, is comprised primarily of full documentation, fixed-rate loans with low loan to values.Consumer reserve build:

Second, the loan-loss reserve build of $3.8 billion was primarily driven by the US consumer reserve build of $3.3 billion. Approximately 73% or $2.4 billion of the US consumer build was in the consumer lending group, reflecting continued weakness in the mortgage portfolio and a higher expectation for losses in the auto portfolio. The auto portfolio is primarily subprime with loans sourced directly through dealers. I will discuss the mortgage portfolio in more detail in just a minute. Approximately 15% of the US consumer build or $493 million was in US cards. While US cards delinquencies remain relatively stable, the build reflects recently observed trends, which point to an expectation of higher losses in the near term. As I mentioned, the rate at which delinquent customers advance to write-offs has increased. This is especially true in certain geographic areas where the impact of events in the housing market has been greatest driving higher loss rates. Bankruptcy filings have increased from historically low levels. These trends and other portfolio indicators led to a build in reserves for US cards in the quarter. …..This increase in net credit losses included $[535] million related to loans with subprime mortgage collateral included in the $18.1 billion figure that I previously mentioned. Credit costs also include a $284 million net charge to increase loan-loss reserves reflecting a slight weakening in overall portfolio credit quality. They also include loan-loss reserves set aside for specific counterparties, including $169 million related to our direct subprime exposures, which is also included in the $18.1 billion figure.Delinquency specifics in mortgages:

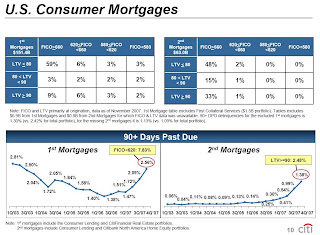

On slide 10, the two grides, which show the FICO and LTV distribution for the US consumer mortgage portfolio, are listed. The two graphs at the bottom show the 90 plus day delinquencies in each of the first and second mortgage portfolios. In the grids on the top half of the slide, there are two segments which have demonstrated the greatest weaknesses. In first mortgages, we are experiencing higher losses from the loans which have FICO scores less than 620. This comprises roughly 15% or $23 billion of the first mortgage portfolio. In second mortgages, we are experiencing higher losses from loans with origination loan to value that are greater or equal to 90%, which comprise 34% or $20 billion of the second mortgage portfolio. We consider these two segments the higher risk segments of the portfolio. The bottom graph shows that delinquencies have increased substantially, particularly since the beginning of September. The first mortgage delinquency trend shows that current delinquency levels are almost at their early 2003 peak. A further breakout of the below 620 segment in the yellow box indicates that delinquencies in this segment are three times higher than the overall first mortgage portfolio. By contrast, delinquency rates in our second mortgage portfolio are at historically high levels, particularly in the 90% LTV segment -- 90% and higher LTV segment as shown in the yellow box. This segment has a delinquency rate twice as high as the rate for the overall second mortgage portfolio. In general, first mortgages have higher delinquencies than second mortgages. This is driven by the fact that first mortgages include government guaranteed loans such as those to low and middle income families, which have sharply higher delinquencies due to the guarantee future. There is no equivalent product in the second mortgage portfolio. On the other hand, second mortgages are much more likely to go directly from delinquency to charge-off without going into foreclosure, which explains why the loss deterioration in second mortgages has been more significant than for first mortgages.

FED: Just Another Quadrupling of Reserves

by Anonymous on 1/15/2008 09:33:00 AM

SANTA MONICA, Calif., Jan 15, 2008 (BUSINESS WIRE) -- FirstFed Financial Corp., parent company of First Federal Bank of California, today announced that, due to rising single family loan delinquencies, the provision for loan losses for the current quarter is expected to be between $20 million and $23 million, compared with $4.5 million that was recorded for the third quarter of 2007.Who coodanode?

Non-accrual single family loans at December 31, 2007 rose to approximately $180 million, from $83 million at September 30, 2007, while single family loans thirty to eighty-nine days delinquent rose to approximately $237 million, from $72 million at September 30, 2007. Adjustable rate mortgages that have reached their maximum allowable negative amortization, which now require an increased payment, are a contributing factor in the higher level of delinquent loans.

Retail Sales Decrease 0.4% in December

by Calculated Risk on 1/15/2008 08:59:00 AM

From the Census Bureau: Advance Monthly Sales for Retail Trade and Food Services

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $382.9 billion, a decrease of 0.4 percent (±0.7%)* from the previous month, but 4.1 percent (±0.7%) above December 2006.Another indication that the recession probably started in December 2007.

Citigroup: $17.4 Billion in Write-Downs, Cuts Dividend

by Calculated Risk on 1/15/2008 08:51:00 AM

From the WSJ: Citigroup Swings to a Loss, Cuts Quarterly Dividend

Citigroup Inc. posted a huge fourth-quarter net loss, hit by $17.4 billion in subprime-related write-downs.Hey, they beat the whisper number!

The bank announced plans to sell another $14.5 billion in preferred stock and said it will cut its dividend 41%....

Here is the Citi presentation.

Monday, January 14, 2008

Fed Funds Rate Cut: 50bps or 75bps?

by Calculated Risk on 1/14/2008 07:52:00 PM

Click on graph for larger image.

Click on graph for larger image.

Source: Cleveland Fed, Fed Funds Rate Predictions

It's now a tossup, based on market expectations, between a 50 bps rate cut and a 75 bps rate cut, on January 30th.

Just a couple of days ago, I heard a couple of analysts say that the Fed wouldn't cut 75 bps because that would give the appearance that the Fed is panicking.

Wall Street is apparently saying "Bring on the panic".

WSJ: Citigroup to Cut Dividend, Write-Down $20 Billion

by Calculated Risk on 1/14/2008 05:51:00 PM

From WSJ: Citigroup Aims to Stabilize Finances

Citigroup ... is expected to announce a sizable dividend cut, cash infusion of at least $10 billion and write-down of as much as $20 billion ...

Vikram Pandit, Citigroup's new chief executive, also is expected to unveil Tuesday a cost-cutting plan that will likely include substantial job cuts...

Whitney reasoned that given the current economy, the bank didn't have the means to boost its capital ratios through organic growth. She argued that cutting the dividend or selling assets was the only quick way to raise cash. She predicts that "in six to 18 months, Citi will look nothing like it does now. Citi's position is precarious, and I don't use that word lightly," she says. "It has real capital issues."If anything, Meredith was too optimistic.

OFHEO: Implications of Increasing the Conforming Loan Limit

by Calculated Risk on 1/14/2008 02:02:00 PM

OFHEO has released a preliminary analysis of the Potential Implications of Increasing the Conforming Loan Limit in High-Cost Areas.

The conforming loan limit is the maximum loan that Fannie and Freddie can buy. An overview:

For mortgages that finance one-unit properties, [the conforming loan] limit is $417,000 in 2008, as it was in 2006 and 2007. Higher limits apply to loans that finance properties with two to four units. The limits for properties of all sizes are 50 percent higher in Alaska, Hawaii, Guam, and the U.S. Virgin Islands. The limits are adjusted each year to reflect the change in the national average purchase price for all conventionally financed single-family homes, as measured by the Federal Housing Finance Board’s (FHFB’s) Monthly Interest Rate Survey (MIRS). Conventional single-family loans with original balances above the conforming loan limit are generally known as jumbo mortgages.And here is some interesting data on the Jumbo Market:

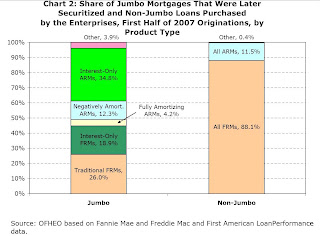

Click on graph for larger image.

Click on graph for larger image.According to Inside Mortgage Finance Publications, originations of jumbo mortgages have ranged from 15 percent to 21 percent of the total single-family market from 2000 through the first half of 2007.Jumbo loans are not only larger, and geographically concentrated (almost 50% are in California!), but they also have many risky features:

...

The jumbo market is much more geographically concentrated than the conventional mortgage market as a whole. Data from First American LoanPerformance suggest that California accounted for 49 percent of the dollar volume of first lien jumbo mortgages originated in the first half of 2007 and later securitized (Chart 1). In a comparable sample of conventional loans purchased by the Enterprises, the California market share was 14 percent.

First American LoanPerformance data also suggest that interest-only (IO) loans and negatively-amortizing adjustable-rate mortgages (ARMs) comprised nearly two-thirds of the dollar volume of first lien jumbo loans originated in the first half of 2007 and later securitized, whereas traditional (fully amortizing) fixed-rate mortgages (FRMs) comprised only a quarter of those loans (Chart 2). In contrast, FRMs comprised over 88 percent of non-jumbo conventional loans originated in the first half of 2007 and purchased by Fannie Mae and Freddie Mac.With falling prices, many of these jumbo loans with IO or neg-Am features will probably be underwater soon. This will probably be a huge story in '08 and '09. (Note: There is much more in the OFHEO report).

Sovereign Bancorp $1.58 billion in Charges

by Calculated Risk on 1/14/2008 12:10:00 PM

From Bloomberg: Sovereign Posts Charge on Loans, Independence Results

Sovereign Bancorp ... said a pullout from auto lending in some regions and the 2006 purchase of Independence Community Bank Corp. led to $1.58 billion in fourth-quarter pretax charges.Just another $1.5 billion.

The company stopped making auto loans in the Southeast and Southwest and bolstered its provision for bad loans of all kinds ... The bank also reduced the value of its consumer and New York regional units, with Brooklyn-based Independence producing less revenue and deposit growth than expected.