by Calculated Risk on 1/16/2008 12:55:00 PM

Wednesday, January 16, 2008

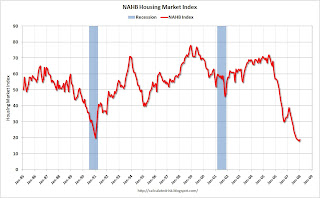

NAHB: Builder Confidence Still at Record Lows

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in January, up from a revised 18 in December. Confidence in January would have been at a record low without the revision to December. |  |

NAHB: Builder Confidence Virtually Unchanged In January

Builder confidence in the market for new single-family homes was virtually unchanged for a fourth consecutive month in January as mortgage-market problems and inventory issues continued to pose challenges, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI rose a single point to 19 this month following a downwardly revised 18 reading in December and 19 readings in both October and November of 2007.

...

“The HMI has held within a narrow two-point range for the past five months, indicating that builder views of housing market conditions essentially haven’t changed over that time,” said NAHB Chief Economist David Seiders. ...

In January, the index gauging current sales conditions for single-family homes remained unchanged at 19, while the index gauging sales expectations for the next six months rose two points to 28. Meanwhile, the index gauging traffic of prospective buyers rose one point to 14.

Regionally, the HMI results were mixed in January. The Northeast posted no change at 20, while the Midwest reported a two-point gain to 17 and the South registered a three-point gain to 23. The West posted a five-point decline to an HMI reading of 13.

Downey Financial Non-Performing Assets (update)

by Calculated Risk on 1/16/2008 11:30:00 AM

Tanta previously noted that Downey announced they were restating their Non-Performing Assets (NPAs). Here is the graph of the new percentages from the Downey Financial 8-K released yesterday. (Credit Bubble Stocks has been on top of this story).

The Economics of Second Liens

by Anonymous on 1/16/2008 11:25:00 AM

From the Wall Street Journal:

In some cases, servicers are telling borrowers they will take 10 cents on the dollar to settle their claim, says Micheal Thompson, director of the Iowa Mediation Service, which runs a hotline for homeowners in financial distress. In other cases, they are selling these loans at large discounts to third parties, says Kathleen Tillwitz, a senior vice president at DBRS, a ratings agency.Scenario A: Expenses $0, Recoveries $0. Scenario B: Expenses $2,000, Recoveries $2,000. Amazingly enough, they're going for A.

Coming up with a plan that will get borrowers back on track is easiest if both the mortgage and home-equity loan are held by the same party. Countrywide will sometimes "whittle down" the payment on the second mortgage to come up with an amount that the borrower can afford to pay for both mortgages, or even eliminate that payment, Mr. Bailey says. The company doesn't publicize such efforts, he adds, because that might encourage "people not to make their payment and see what happens." In either case, "the borrower still owes the principal," Mr. Bailey says.

Solutions can be harder to come by when the two loans were made by different lenders and are held by different parties. "The people in the first position will say, 'Until you get a deal with the second, why should I make a deal with you?'" says Iowa's Mr. Thompson. Second-mortgage holders are often reluctant to approve a short sale or deed in lieu of foreclosure that could wipe out their claims, he adds.

FirstFed says it encourages borrowers in financial distress to contact the owner of their home-equity loan and sometimes offers to buy out a home-equity loan with no current value for a small sum -- $2,000, for example -- so that the entire mortgage can be restructured.

But the company says such offers are often rejected. "It's not worth their while to take the $2,000" because of the costs associated with evaluating the offer and releasing the borrower from the lien, says Ms. Heimbuch, the company's CEO. "The second forces you into foreclosure."

Of course, eventually they'll be able to make it up on volume . . .

JP Morgan: Home Equity Delinquencies Higher than Expected "even at the peak of the cycle"

by Calculated Risk on 1/16/2008 09:52:00 AM

Quote of the day:

“For all consumer credit and I think we've pointed out consistently that we see in auto, home equity, subprime, credit card, that where home prices are down, delinquencies, charge-offs are going up, and so we've kind of been preparing for that, thinking about that and trying to build that into some of our models and that's what you see in home equity and I hope we get near the end of this but this was certainly higher than we would expect it even at the peak of a cycle.”And on credit cards:

CEO Jamie Dimon, J.P. Morgan Chase, Jan 16, 2008

“So remember, credit card was always kind of abnormally low , so part of what you're seeing we think is the catch up to getting back to a more normal, forget everything else. The second effect is that in HPA's, where prices are down, think of California, Arizona, Miami, Michigan, Ohio, we have seen the credit card delinquency losses simply going up, so where we have real visibility, we know it's going to hit 4.5% or thereabout in the first and Second Quarter, we're obviously a little less certainly about the Second Quarter. What I'm saying is I believe that home prices are worse than people think. That's my own personal belief. Just looking at numbers and thinking at lags and what goes into those things and therefore, if you kind of roll that through, while there's nothing in the current data that shows it, I think that more likely than not it will be 5% [delinquency] by the end of the year and that's barring a real recession. Remember, in the credit card and the consumer business, on top of all of this other stuff we talk about which is normally driven credit losses, real cyclical credit losses is unemployment. I think that will still be a factor if you see unemployment going up on top of this other stuff.”With a recession, and rising unemployment, it could really get ugly.

Added (hat tip Brian):

James Dimon:The broker model is broken.

This is a lesson that's been learned over and over about broker originations, they perform much worse than our own originations, and if you separate home equity into we call it kind of good bank, bad bank, and broker so I would say it's less than 20%, but a lot of the losses are coming from that 20%, which is high LTV, broker originated businesses. High LTV business is also bad in its own.

Analyst:

And the 20% you referred to a minute ago in round numbers is the sort of specifically high LTV and originated away [by brokers] is that right?

James Dimon:

It's been very consistent In both our own originated and broker originated, high LTV, stated income is bad. It is three times worse in broker than it is in our own.

Analyst:

Wow.

Ambac Cuts Dividend, Takes $5.4 billion pre-tax mark-to-market loss

by Calculated Risk on 1/16/2008 08:27:00 AM

PR from Ambac: Ambac Announces Capital Enhancement Plan to Raise in Excess of $1 Billion

Ambac Financial Group ... today announced ... the issuance of at least $1 billion of equity and equity-linked securities. ... By raising at least $1 billion in capital, Ambac is expected to meet or exceed Fitch Ratings’ current triple-A capital requirements for the Company. ... As part of its capital initiative, Ambac also said that it will reduce the quarterly dividend on its common stock from $0.21 per share to $0.07 per share.

...

Ambac’s estimate of the fair value or “mark-to-market” adjustment for its credit derivative portfolio for the quarter ended December 31, 2007 amounted to an estimated loss of $5.4 billion, pre-tax, $3.5 billion, after tax.

JP Morgan: $1.3 billion in Write-Downs

by Calculated Risk on 1/16/2008 08:22:00 AM

From the WSJ: J.P. Morgan Posts 34% Fall in Net On Subprime-Related Write-Downs

J.P. Morgan Chase & Co.'s fourth-quarter net income fell 34% as the company recorded $1.3 billion in markdowns on subprime positions and saw sharply higher credit costs.A billion here, a billion there ... even these small write-downs are adding up.

...

"We remain extremely cautious as we enter 2008," [Chairman and Chief Executive Jamie Dimon] said. "If the economy weakens substantially from here - for which, as a company, we need to be prepared - it will negatively affect business volumes and drive credit costs higher."

Tuesday, January 15, 2008

Housing Wire: S&P Revises RMBS Ratings Assumptions (Again)

by Calculated Risk on 1/15/2008 11:51:00 PM

From Housing Wire: Get Ready For More Downgrades: S&P Revises RMBS Ratings Assumptions (Again)

S&P said it has revised the assumptions it uses for the surveillance of U.S. residential mortgage-backed securities (RMBS) — chief among them, the rating agency said it has bumped up expected lifetime losses for the 2006 subprime vintage to 19 percent. The agency had previously forecast losses at 14 percent.And Housing Wire concludes:

Beyond the 2006 vintage, S&P also said it will “recalculate lifetime loss expectations for all vintages of U.S. RMBS” — that means not just subprime, and not just 2006.

There’s also some very serious discussion about the fact that cumulative losses thus far have been far below expectations, while foreclosure volume is strongly outstripping projections — which means there is a whole lot of REO out there that isn’t getting sold. Losses don’t get recorded until they’re actually losses, meaning the REO inventory is sold off and losses start to get real.

Standard & Poor’s last put its RMBS criteria through a major revision in July 2007 (see HW’s coverage here), which lead to wide-scale downgrades of numerous subprime RMBS. I’d expect to see more in the wake of today’s announcement.

Brown: Northern Rock may be Nationalized

by Calculated Risk on 1/15/2008 11:32:00 PM

From Bloomberg: Brown Says U.K. May Take Over Northern Rock, Resell

Prime Minister Gordon Brown, in his clearest indication yet that Northern Rock Plc may be nationalized, said the U.K. is considering acquiring the mortgage-lender and reselling it when market conditions recover.And here are the betting lines from MarketWatch (everything in England seems to have betting lines):

``Because stability is the issue, we will look at every option and that includes taking the company into public ownership and then moving it later back into the private sector,'' Brown said in an interview with ITN's News at Ten program last night. ``So that is, yes, one of the options that has got to be considered.''

The U.K. Treasury said it may nationalize the bank in order to recover more than 25 billion pounds ($49 billion) in loans it made to Northern Rock and to protect depositors.

Spread-betting firm Cantor Index is offering odds of 5-to-1 on Virgin winning and 7-to-2 on Olivant. Nationalization of the bank, however, is the clear favorite with Cantor at odds of 1-to-8.The bettors clearly think that Northern Rock will be nationalized. Heck, the New England Patriots are overwhelming favorites to win the Superbowl, and the odds are only 2-to-7.

IndyMac CEO: "Conditions have gotten worse", Cuts 2,403 jobs

by Calculated Risk on 1/15/2008 06:18:00 PM

From Reuters: IndyMac slashes 2,403 jobs

IndyMac ... said on Tuesday it is eliminating 2,403 jobs, or 24 percent of its workforceThanks to all for sending me the early reports. The job cuts were even worse than expected.

...

"The reality is that since October 12 conditions have gotten worse," Perry wrote.

From Mathew Padilla at the O.C. Register, here is Perry’s email.

DataQuick: SoCal Record Low December Sales, Prices off 15.8% From Peak

by Calculated Risk on 1/15/2008 01:24:00 PM

From DataQuick: Continued nose-dive for Southland home sales

A total of 13,240 new and resale houses and condos were sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in December. That was up 0.5 percent from 13,173 for the previous month, and down 45.3 percent from 24,209 for December last year, according to DataQuick Information Systems.I'd call that Cliff Diving!

Last month's sales were by far the lowest for any December in DataQuick's statistics, which go back to 1988. The sales count was 23.5 percent below the previous December low of 17,272 in 1990. The average December over the past 20 years is 25,543, the all-time peak for the month was reached in 2003 when 36,865 homes were sold.

The median price paid for a Southland home was $425,000 last month, the lowest since $420,000 in February 2005. Last month's median was down 2.4 percent from November's $435,000, and 13.3 percent below $490,000 for December 2006.UPDATE: Mathew Padilla at the O.C. Register has the foreclosure activity for Orange County: O.C. foreclosures approach record high. Data for all of California will probably be released next week.

Last month's median was 15.8 percent below the $505,000 peak reached last spring and summer. While the steep decline in median sales price does reflect a drop in prices, it also reflects significant shifts in the types of homes selling. Particularly noticeable is a drop-off in sales of more expensive homes financed with "jumbo" mortgages.

...

Foreclosure activity is at record levels ...