by Calculated Risk on 1/17/2008 09:49:00 AM

Thursday, January 17, 2008

Ambac Comments on Recent Moody’s Report

Ambac Financial Group, Inc. (NYSE: ABK) (“Ambac”), the parent company of Ambac Assurance Corporation, today commented on a January 16, 2008 announcement by Moody’s Investors Service that it has placed Ambac Assurance Corporation’s ‘Aaa’ insurance financial strength rating on review for possible downgrade.Translation: You thought 14% was a steep yield for MBIA to pay on the surplus notes (See: "How many other AAA rated companies are raising money at 14%?"). With this possible downgrade, we might not be able to raise capital even at 20%!

In view of the uncertainty generated by Moody’s surprising announcement, Ambac is assessing the impact of this action on the Company’s previously announced capital plan.

Also note, from Merrill this morning, the $3.1B credit valuation adjustments related to hedges with financial guarantors (ACA financial). There is no party in counterparty. (thanks to BR!)

Merrill: $16.7 Billion in Write-Downs

by Calculated Risk on 1/17/2008 09:32:00 AM

From the WSJ: Merrill Lynch Swings to Loss Amid Deep Write-Downs

Lynch & Co. matched Citigroup Inc.'s massive fourth-quarter net loss, as the company recorded a total of $16.7 billion in losses related to subprime mortgages and complex debt instruments ...From the conference call (Brian's notes):

The losses include, among others, a $9.9 billion write-down on collateralized debt obligations, or CDOs, a $1.6 billion write-down in subprime, and a $3.1 billion write-down related to exposure to shaky bond insurers.

$11.5B write down related to ABS CDOs and sub-prime residential mortgage mortgages

$3.1B credit valuation adjustments related to hedges with financial guarantors (only ACA – 100% reserved vs ACA exposure)

Net exposure to US ABS CDO totaled $4.8B, down from $15.8B q/q reflecting $9.9B of writedowns and $1.1B of other changes – majority of writedowns were related to high-grade, super senior ABS exposures primarily with 2006 collateral. They are assuming 16-21% cumulative loss assumptions on the underlying loans. Made a comment that a number of the CDOs values were approaching IO value. On average mezz CDOs valued in the mid 20 cents on the dollar vs low 60s at 9/30.

Remaining US ABS CDO Net Exposure:

Super Senior:

High Grade $4.4B

Mezz $2.2B

CDO^2 $271MM

Less:

Secondary Mkt Hedges $(2.0)

Total Net exposure $4.8B

Their gross supersenior long exposure to CDOs (ex hedges) is $30B

They have $13B of notional credit default swaps with AAA (for now) rated Financial Guarantors – there is a chart which lays out adjustments that I don’t understand. There is a foot not that says they have bought $2B of CDS on the Financial Guarantors themselves.

Residential mortgage exposures (excluding securities):

Subprime $2.7B

Alt –A $2.7B after $400M write downs vs 9/30 value of $3.0B – a 13% haircut on the mortgages themselves!

Prime $28B

Int’l $9.6B after $500M write down vs 11.8B value at 9/30

Mortgage Securities Portfolio (including assets in conduits that are not on balance sheet – so these will not foot with totals)

Subprime MBS $4.1B

Alt-A MBS $7.1B

CMBS $5.8B

Prime MBS $4.2B

$18B CRE net exposures, $230MM writedowns this quarter – Thain said they were “very comfortable” with the portfolio

$18B leveraged finance commitments vs $31B at 9/30. Writedowns of $126MM this Q. Thain said the leveraged loan portfolio was one of the positive surprises since he came on board.

Thain says it is “not likely” that ABS CDO values are likely to recover.

Housing Starts: Lowest Since 1991

by Calculated Risk on 1/17/2008 09:19:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,068,000. This is 8.1 percent (±1.7%) below the revised November rate of 1,162,000 and is 34.4 percent (±2.2%) below the revised December 2006 estimate of 1,628,000.Starts fell sharply, with starts for all units and single family units at the lowest level since 1991:

Single-family authorizations in December were at a rate of 692,000; this is 10.1 percent (±1.6%) below the November figure of 770,000. Authorizations of units in buildings with five units or more were at a rate of 322,000 in December.

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,006,000. This is 14.2 percent (±8.3%) below the revised November estimate of 1,173,000 and is 38.2 percent (±4.9%) below the revised December 2006 rate of 1,629,000.And Completions declined sharply:

Single-family housing starts in December were at a rate of 794,000; this is 2.9 percent (±8.7)* below the November figure of 818,000. The December rate for units in buildings with five units or more was 196,000.

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 1,302,000. This is 7.7 percent (±10.3%)* below the revised November estimate of 1,411,000 and is 31.0 percent (±5.8%) below the revised December 2006 rate of 1,887,000.

Single-family housing completions in December were at a rate of 1,009,000; this is 12.0 percent (±10.5%) below the November figure of 1,146,000. The December rate for units in buildings with five units or more was 278,000.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

Look at what is about to happen to completions: Completions were at a 1,302 million rate in December, but are about to follow starts to below the 1.1 million level. I'd expect completions to fall rapidly over the next few months, impacting residential construction employment.

Even with single family starts at the lowest level since the '91 recession, when you look at inventories and new home sales, the builders are still starting too many homes ... but they are getting there. I'll take a look at how much further starts will probably fall soon.

Wednesday, January 16, 2008

CRE Credit Crunch

by Calculated Risk on 1/16/2008 11:16:00 PM

From the WSJ: Las Vegas Default Highlights Commercial-Property Crunch

The credit crunch ... is starting to bite commercial projects, too.At this point in the investment cycle, a CRE slump would be expected. For more see Investment Patterns. The final graph in the referenced post shows the typical relationship between Residential and non-residential investment:

Yesterday ... the developer of a twin-tower casino resort in the heart of Las Vegas, defaulted on a $760 million loan from Deutsche Bank AG ... Moody's Investors Service warned last week that the corporate default rate for the construction and building industry could reach 12% this year and predicted a 6% default rate in the hotel, gaming and leisure industries.

...

Around April of last year, commercial lenders started to get nervous about the lax underwriting standards that developed during the property boom. Bankers began to raise interest rates and required borrowers to put in more of their own money into deals.

Click on graph for larger image.

Click on graph for larger image.This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to have turned negative now.

The strong investment in non-residential structures has been one of the keys to avoiding recession through Q3 2007. Now that commercial real estate appears to be slumping, it looks like non-residential investment will slump too - putting the economy into recession.

Moody's: Ambac Under Review for Possible Downgrade

by Calculated Risk on 1/16/2008 11:05:00 PM

From Moody's (no link): Moody's has placed the ratings of Ambac Assurance Corp. and Ambac Assurance UK on review for possible downgrade. Moody's has also placed the ratings of Ambac Financial Group, Inc. (the holding company) and related trusts on review for possible downgrade. Also under review for possible downgrade are Moody's-rated securities that are guaranteed by Ambac.

S&P: Bond Insurer Review to be Completed Next Week

by Calculated Risk on 1/16/2008 05:42:00 PM

From Bloomberg: S&P Will Review Bond Insurers With New Assumptions

Standard & Poor's will re-examine the AAA credit ratings of bond insurers including MBIA Inc. and Ambac Financial Group Inc. after deciding that the housing slump will cause bigger losses from subprime mortgages than anticipated.I'm not sure if the current review will also include downgrades to the CDOs based on the new assumptions; if it doesn't, then the insurers will probably be reviewed again in a couple of months.

S&P, which completed a review of the bond insurers in December, will rerun a stress test ... The test will be completed within a week ... The ratings company is now assuming losses on 2006 subprime mortgages will reach 19 percent, up from 14 percent ... That may make S&P more likely to downgrade mortgage-backed securities guaranteed by the bond insurers.

Auto Loans: Lax Lending Standards?

by Calculated Risk on 1/16/2008 04:07:00 PM

Remember when the credit problems were contained to subprime mortgages? From Greg Ip in July 2007:

"Despite fears in the markets and press that subprime problems would trigger broader contagion, the Federal Reserve has repeatedly predicted that what started in subprime would stay in subprime. Chairman Ben Bernanke largely echoed that sentiment in congressional testimony today ..."Now from the WSJ: Lax Lending Standards Could End Up Fueling Sudden Acceleration in Auto-Loan Delinquencies

It is becoming clear that several auto lenders let lending standards slip substantially in 2006-07. ... There is also some evidence that credit-card companies made the same mistake.For both "prime and subprime loans". Just six months ago the Fed thought the problems were contained to subprime mortgages. Well, we're all subprime now.

"The problem of lax loan-underwriting standards was not just concentrated in the mortgage sector; it's looking like it took place across the consumer-finance sector, from credit-card loans to auto loans to motorcycle loans," says William Ryan, consumer-finance analyst at Portales Partners, a research firm.

... Certain classes of loans made in 2006-07 are reporting some of weakest early credit performances in recent memory.

For instance, 2.06% of prime auto loans made in 2006 were more than 30 days past due in November, according to a Standard & Poor's Corp. survey. That past-due number for loans in their first year exceeds the historical high rate recorded in 2001 -- and it is well up from the 1.75% for prime auto loans made in 2005, S&P says.

The past-due numbers for loans made in 2007 are even worse than the 2006 credits -- a trend that exists for both prime and subprime loans, according to S&P.

MBIA's Surplus Notes Plunge

by Calculated Risk on 1/16/2008 02:56:00 PM

Remember those surplus notes that MBIA sold yielding 14%? See: "How many other AAA rated companies are raising money at 14%?"

I guess a 14% yield isn't enough anymore, from Reuters: MBIA's Surplus Notes Plunge to 89.50 Cents - Investor

MBIA Insurance Corp's recently issued $1 billion of surplus notes plunged on Wednesday to about 89.50 cents on the dollar from 95 cents on the previous day, according to a portfolio manager.Nice haircut.

NY Times: The Education of Ben Bernanke

by Calculated Risk on 1/16/2008 02:19:00 PM

I recommend this article from the Sunday New York Times magazine The Education of Ben Bernanke, by Roger Lowenstein. It is long, but well worth reading.

“I think Bernanke is in a very difficult situation. Too many bubbles have been going on for too long. The Fed is not really in control of the situation.”While on the subject of Paul Volcker, here is a speech he gave in February 2005.

Former Fed Chairman Paul Volcker (Chairman from 1979 to 1987) to Roger Lowenstein.

| Click image for video. |

Volcker always talks about fiscal discipline, and that bring us back to the Lowenstein piece:

Bernanke updates Bush and Vice President Cheney several times a year, but he prizes his political independence. Unlike Greenspan, he has avoided taking positions on economic issues that do not relate to the Fed’s mission. (An exception is his affirmation that he “believes in the laws of arithmetic,” a none-too-subtle rejection of the Bush ideology that championed deficit-spawning tax cuts.)I couldn't have said it better.

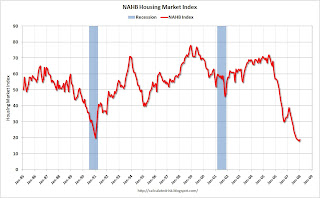

NAHB: Builder Confidence Still at Record Lows

by Calculated Risk on 1/16/2008 12:55:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in January, up from a revised 18 in December. Confidence in January would have been at a record low without the revision to December. |  |

NAHB: Builder Confidence Virtually Unchanged In January

Builder confidence in the market for new single-family homes was virtually unchanged for a fourth consecutive month in January as mortgage-market problems and inventory issues continued to pose challenges, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI rose a single point to 19 this month following a downwardly revised 18 reading in December and 19 readings in both October and November of 2007.

...

“The HMI has held within a narrow two-point range for the past five months, indicating that builder views of housing market conditions essentially haven’t changed over that time,” said NAHB Chief Economist David Seiders. ...

In January, the index gauging current sales conditions for single-family homes remained unchanged at 19, while the index gauging sales expectations for the next six months rose two points to 28. Meanwhile, the index gauging traffic of prospective buyers rose one point to 14.

Regionally, the HMI results were mixed in January. The Northeast posted no change at 20, while the Midwest reported a two-point gain to 17 and the South registered a three-point gain to 23. The West posted a five-point decline to an HMI reading of 13.